Last updated: March 6th, 2020 4:08 PM

Last updated: March 6th, 2020 4:08 PM

Maharashtra Solvency Certificate

Solvency refers to the ability of an individual or an entity to pay its expenses or liabilities. In other words, solvency denotes that the assets exceed the liabilities. Solvency certificate acts as a proof of finances and is issued by either a Government body or any financial liquidators like banks. In this article, the process of obtaining the Maharashtra Solvency Certificate issued by the Government is described in detail. To know more about Solvency Certificate, click here.Purpose of the Certificate

Solvency certification on behalf of a corporation or a person serves various purposes, some of which are below.- The financial stability of the company is based on its solvency. Therefore, a firm has to submit a solvency certificate while offering against a bid as evidence of its financial status.

- Various Government and semi-Government organizations require a solvency certificate as a document of surety.

- Solvency certificate is an essential document while considering the applications for contracts, tenders.

- Solvency certificate is necessary when participating in an auction.

- Solvency certificate is an important document for students pursuing their higher studies abroad. The universities abroad require this document as proof of finances. Moreover, this certificate is also necessary while seeking admission in Government medical and engineering colleges in the country.

- It is also required in court matters like obtaining bails.

Documents Required for Maharashtra Solvency Certificate

The following documents are required to be attached along with application form to obtain a solvency certificate.- Proof of Identity (Aadhaar Card, Voter ID card, Passport)

- Proof of Residence (Ration Card, Driving License, Electricity Bill)

- Notarized affidavit or Self-Declaration

- Copy of 7/12, a Tax receipt (Details of Property on which grant solvency certificate applied.)

- Valuation report from Government approved valuer

- Society No Objection Certificate (NOC)

- Copy of society share certificate

- Copy of registered sale agreement

- Copies of last three-year income tax returns.

Concerned Authority

The Revenue Department is the concerned department for the issuance of the solvency certificate. The applicant requesting for the solvency certificate should apply to the concerned authorities of their respective District depending on the amount or value of the property for which the solvency certificate is requested.| Value | Designated Officer | First Appellate Officer | Second Appellate Officer |

| Up to Rs. 2 Lakhs | Nayab Tehsildar | Tehsildar |

Sub-Divisional Officer |

| Rs. 2,00,001 to 8 Lakhs | Tehsildar | Sub-Divisional Officer | Additional Collector |

| Rs. 8,00,001 to 40 Lakhs | Sub-Divisional Officer | Additional Collector | Collector |

| Above 40 Lakhs | Collector | Additional Commissioner | Divisional Commissioner |

Validity

The Solvency Certificate issued in Maharashtra is valid for one month from the date of issue. Solvency certificate older than one month will not be accepted.Fees

A court fee stamp of Rs.5/- should be affixed on the application if applying offline.Processing Time

The concerned authority processes and issues the certificate on being satisfied within 21 days from the date of application. In other cases, the certificate would be rejected. The reasons for rejection will be specified and communicated to the applicant.Application Procedure for Maharashtra Solvency Certificate

The entity can apply for the solvency certificate in either online or offline mode. The procedure for the issuance of a solvency certificate requires the property (land, gold) to be evaluated by any government body or any property agent.Offline application process

The applicant requesting for the solvency certificate should visit the nearby Tehsildar office in their concerned District. The application form should be collected and filed properly providing all necessary details. Once filled, the application form with a court fee stamp of Rs. 5/- should be submitted to the Chief Officer in Charge of Revenue Administration of the concerned District, Sub-division/Tehsil or the Additional District Magistrate / Additional Tehsildar along with the mentioned documents. The copy of the request form for the solvency certificate is provided below.Online Application Process

The Government of Maharashtra offers online services through its official website' aaple sarkar'. To apply online for Maharashtra Solvency Certificate, follow the given steps. Step 1: Visit the official website of aaple sarkar to apply for Maharashtra Solvency Certificate. User Registration To apply to this portal, the citizen should be a registered user. Step 2: Click 'Register Here' on the login page to register. [caption id="attachment_60178" align="aligncenter" width="1310"] Maharashtra-Solvency-Certificate-Services

Note: For Marathi keyboard press Ctrl + Y.

Step 3: It displays two options for registration. Select anyone from the given options.

Maharashtra-Solvency-Certificate-Services

Note: For Marathi keyboard press Ctrl + Y.

Step 3: It displays two options for registration. Select anyone from the given options.

- Registration Using UID Number:

Maharashtra-Solvency-Certificate-UID-Number

2.Self-registration:

The citizen should self-complete providing details to create their user profile using OTP verification on the registered mobile number.

[caption id="attachment_60180" align="aligncenter" width="871"]

Maharashtra-Solvency-Certificate-UID-Number

2.Self-registration:

The citizen should self-complete providing details to create their user profile using OTP verification on the registered mobile number.

[caption id="attachment_60180" align="aligncenter" width="871"] Maharashtra-Solvency-Certificate-Self-Registration

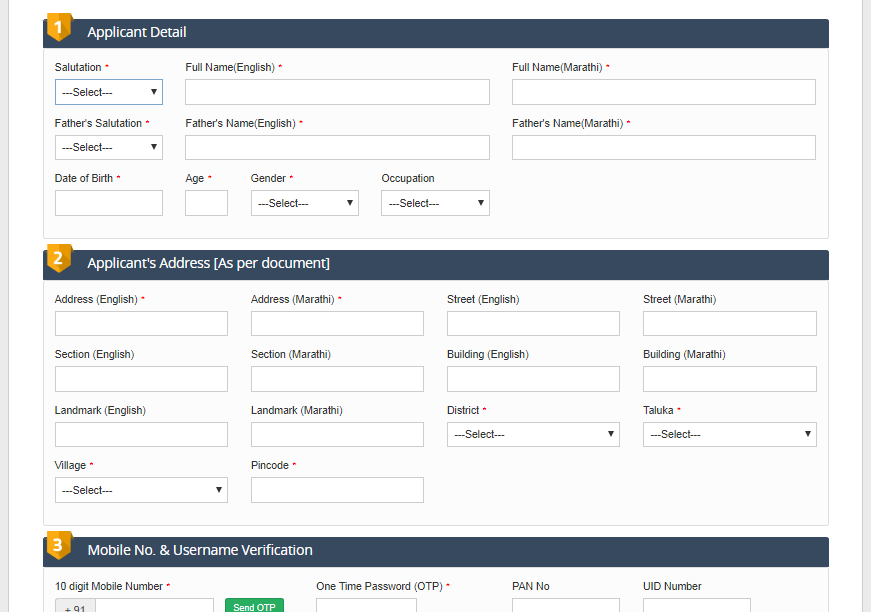

Step 4: On selecting self-registration, the registration form appears. Fill out the necessary details that include the following.

Maharashtra-Solvency-Certificate-Self-Registration

Step 4: On selecting self-registration, the registration form appears. Fill out the necessary details that include the following.

- Applicant Detail

- Applicant's Address [As per document]

- Mobile No. & Username Verification

- Upload Photograph

Track Application Status

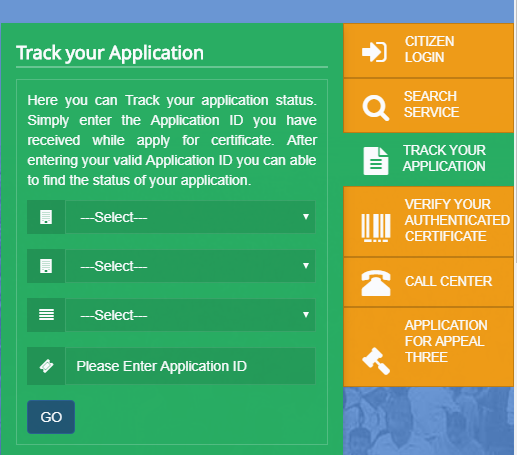

[caption id="attachment_60183" align="aligncenter" width="517"] Maharashtra-Solvency-Certificate-Track-Application

Select Revenue Department from the drop-down list.

Select Revenue Services from the drop-down list.

Select Solvency Certificate from the drop-down list.

Track the application status by entering the Application ID while applying for the certificate. After entering the valid Application ID, you can find the status of your application.

Maharashtra-Solvency-Certificate-Track-Application

Select Revenue Department from the drop-down list.

Select Revenue Services from the drop-down list.

Select Solvency Certificate from the drop-down list.

Track the application status by entering the Application ID while applying for the certificate. After entering the valid Application ID, you can find the status of your application.

Verify Certificate

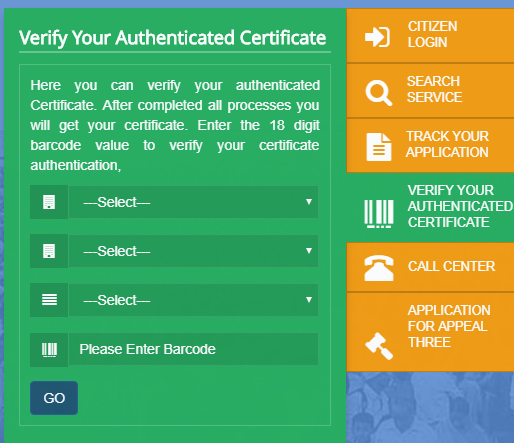

[caption id="attachment_60184" align="aligncenter" width="514"] Maharashtra-Solvency-Certificate-Verify-Certificate

After the completion of all application processes, the digitally signed certificate will be released.

Select Revenue Department from the drop-down list.

Select Revenue Services from the drop-down list.

Select Solvency Certificate from the drop-down list.

Enter the 18-digit barcode value to verify your certificate authentication.

Once verifying, download the certificate and print for necessary purposes.

Maharashtra-Solvency-Certificate-Verify-Certificate

After the completion of all application processes, the digitally signed certificate will be released.

Select Revenue Department from the drop-down list.

Select Revenue Services from the drop-down list.

Select Solvency Certificate from the drop-down list.

Enter the 18-digit barcode value to verify your certificate authentication.

Once verifying, download the certificate and print for necessary purposes.

Application for Appeal Three

As per the Right to Service Act, citizens can file the first appeal and the second appeal with senior officers within the department and third and final appeal can be filed before this commission in case of a delay in providing the services or denial of the services without adequate justification.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...