Last updated: December 17th, 2024 5:39 PM

Last updated: December 17th, 2024 5:39 PM

Procedure for Making GST Payment - Electronic Cash Ledger

The GST platform created by the Government has three ledgers for managing GST payment, liability, input credit, interest due, penalty due, late fee or any other amount - namely GST Electronic Liability Ledger, GST Electronic Credit Ledger, and GST Electronic Cash Ledger. The taxpayer shall use these three ledgers to balance the GST liability, credit, and payments pertaining to each of the GST taxpayers. In this article, let us look at the procedure for making GST payment and the Electronic Cash Ledger in detail.GST Electronic Cash Ledger

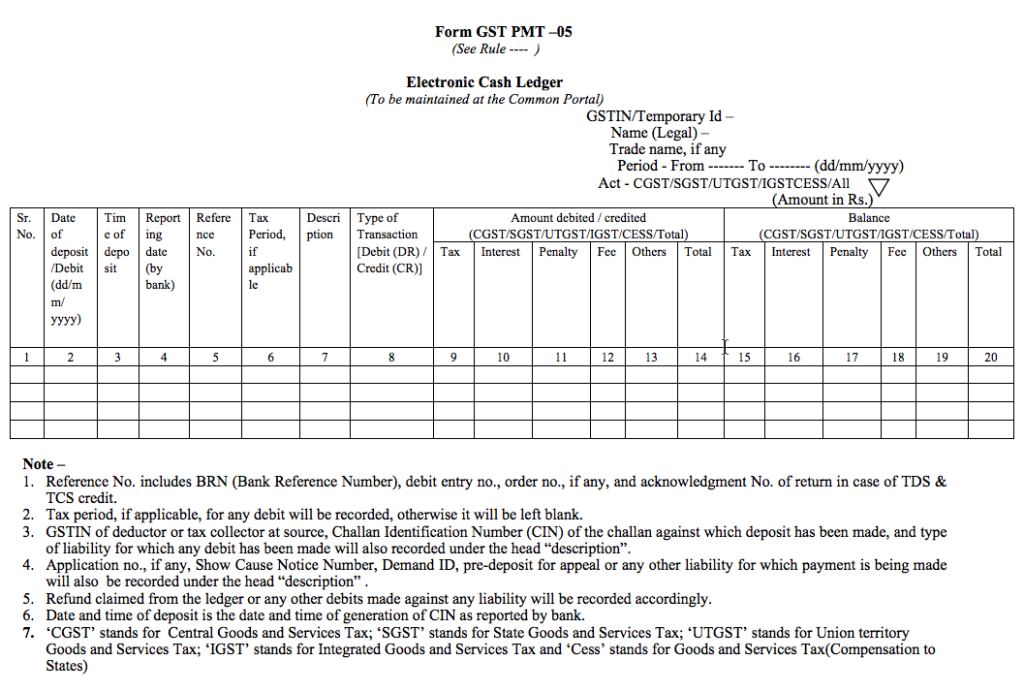

The GST electronic cash ledger is maintained in Form GST PMT-05 for each of the GST taxpayers. The GST Electronic Cash Ledger contains credit entries for amounts deposited towards GST liability and debit entries for the payments like GST tax, interest, penalty, fee, or any other amount. The following details the format for the GST Electronic Cash Ledger or GST Form PMT-05: [caption id="attachment_30921" align="aligncenter" width="730"] GST Electronic Cash Ledger

GST Electronic Cash Ledger

Procedure for Depositing GST Payment

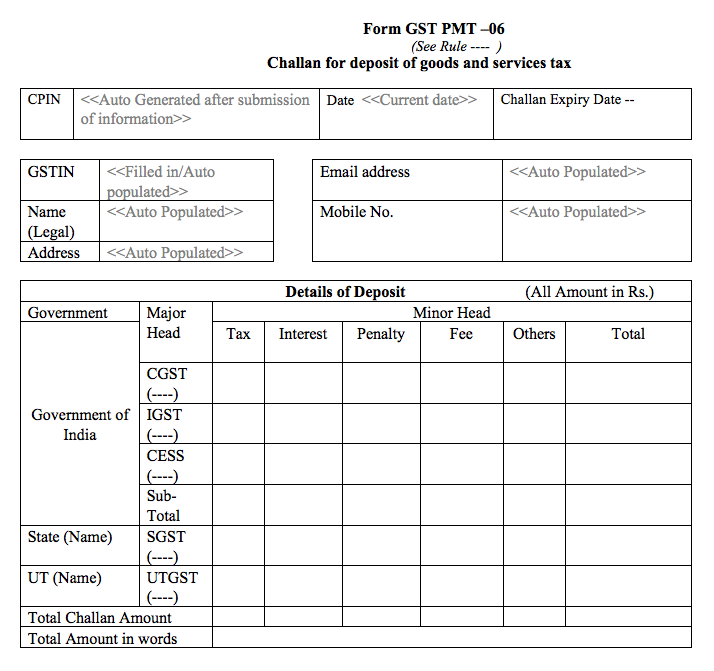

To deposit a GST payment or to debit the GST electronic cash ledger account, the taxpayer or any person on the taxpayers' behalf can generate a challan in Form GST PMT-06 on the GST Common Portal. Based on the GSTIN of the taxpayer, details such as name and address of the taxpayer, email address, and mobile number on the account would be auto-populated. The taxpayer must then enter the GST payment details such as major heads of accounts (CGST, IGST, Cess, Sub-total, SGST, and UTGST) and minor heads of accounts (Tax, Interest, Penalty, Fee, Others and Total). [caption id="attachment_30924" align="aligncenter" width="714"] GST Form PMT-06 - Part A

[caption id="attachment_30925" align="aligncenter" width="705"]

GST Form PMT-06 - Part A

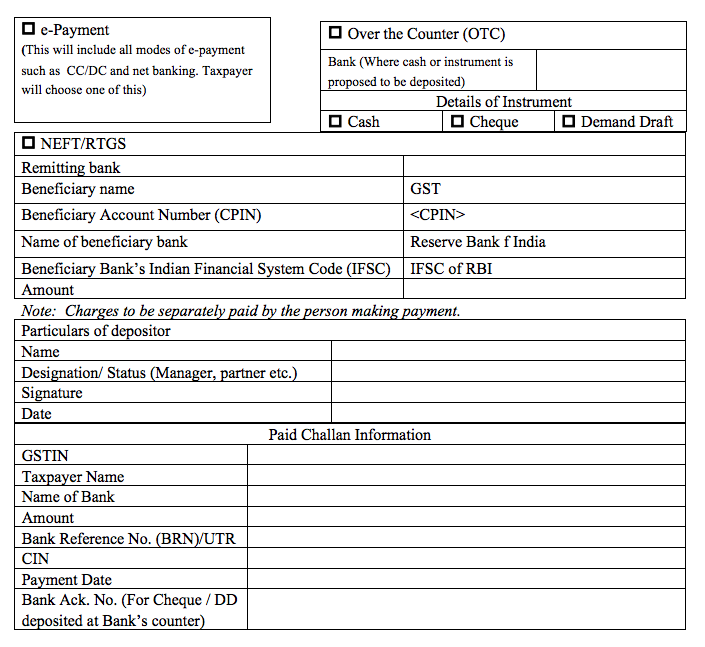

[caption id="attachment_30925" align="aligncenter" width="705"] GST Form PMT-05 - Part B

After providing the information of the payment, the taxpayer shall enter the mode of payment along with the information of the payment depositor such as Name, Designation, Signature, and Date. The portal generates FORM GST PMT-06 at the Common Portal. The validity of the Form extends for a period of fifteen days.

GST Form PMT-05 - Part B

After providing the information of the payment, the taxpayer shall enter the mode of payment along with the information of the payment depositor such as Name, Designation, Signature, and Date. The portal generates FORM GST PMT-06 at the Common Portal. The validity of the Form extends for a period of fifteen days.

Modes of Making GST Payment

The taxpayer shall use the following modes for GST payment:- Internet Banking through authorized banks;

- Credit card or Debit card through the authorized bank;

- National Electronic Fund Transfer (NEFT) or Real Time Gross Settlement (RTGS) from any bank;

- Over the Counter payment (OTC) through authorized banks for deposits up to ten thousand rupees per challan per tax period, by cash, cheque or demand draft

- The restriction for deposit of up to ten thousand rupees per challan in case of an Over the Counter (OTC) payment is not applicable to the deposits made by Government Departments or any other officer authorized to recover outstanding dues from any person, whether registered or not, including recovery made through attachment or sale of movable or immovable properties;

CIN Generation on Successful Payment

Upon a successful transfer of the GST payment to the concerned government account, the collecting bank generates a Challan Identification Number (CIN). The CIN shall reflect in the challan. The electronic cash ledger receives the GST payment amount after obtaining the CIN from the collecting bank. The taxpayer can download the receipt from the GST Common Portal for the amount deposited in the collecting bank.CIN Not Generated After Making Payment

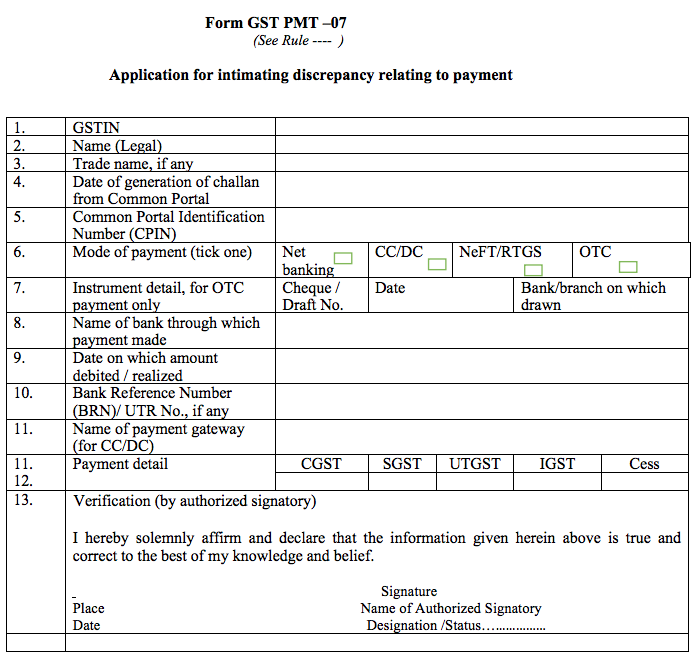

If the bank account of a person making GST payment is debited, but no Challan Identification Number (CIN) is generated or communicated, the taxpayer can make a representation using FORM GST PMT-07 through the Common Portal to the bank or electronic gateway through which the deposit was initiated for assistance. [caption id="attachment_30922" align="aligncenter" width="695"] GST Form PMT-07

GST Form PMT-07

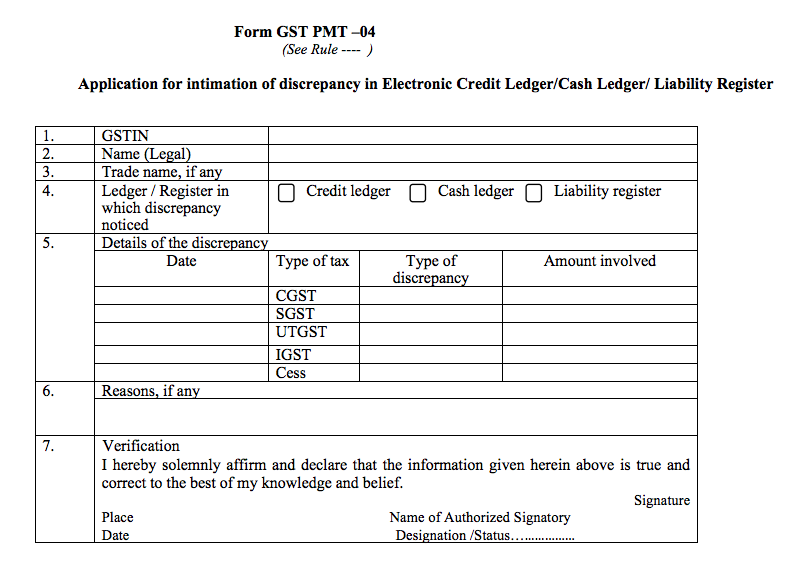

Discrepancy in Electronic Cash Ledger

In case a CIN is generated after making payment, but there is a discrepancy with the Electronic Cash Ledger or the Electronic Credit Ledger or Electronic Liability Ledger, FORM GST PMT-04 can be used for communicating the discrepancy and obtaining assistance. [caption id="attachment_30923" align="aligncenter" width="797"] GST Form PMT-04

GST Form PMT-04

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...