Last updated: December 17th, 2019 6:07 PM

Last updated: December 17th, 2019 6:07 PM

Manipur Property Registration

Manipur property registration procedure is governed by the Section 17 of Indian Registration Act, I908. Any transactions that involve the sale of the immovable property should be registered to ensure clear transfer of title to the property owner. Once the registration of transaction of immovable property has been done, it becomes a permanent public record. Manipur property registration process involves the preparation of documents, paying the applicable stamp duty and registration charges for the deed to be legally recorded at the Sub-Registrar’s office. The Revenue department manages the registration or transfer of property in Manipur. In this article, we look at the process for Manipur property registration in detail.Indian Registration Act, I908

Indian Registration Act provides details regarding the method of registering documents, information regarding legal rights and obligations affecting the particulars of immovable property. According to this Act, immovable property includes land, buildings, rights to ways, lights or fisheries.Section 17 of Indian Registration Act – Compulsory Registration

Section 17 of the Indian Registration Act governs the different categories of the deed for which registration is compulsory. The deed relating to the following transactions of immovable properties is required to be compulsorily registered;- Instruments of the gift of immovable property

- Instruments which extinguish or create any right or title to or in a property of a value of above one hundred rupees.

- Lease of property for any term exceeding twelve months or from year to year

Section 18 of Indian Registration Act - Registration Optional

Section 18 of the Registration act governs the deed of which registration is optional, that is given below:- Instruments (other than instruments of wills and gifts) relating to the transfer of immovable property, the value of which is less than Rs.100.

- Instruments acknowledging the receipt or payment of any consideration.

- Lease of immovable property for a term less than one year.

- Instruments are transferring any decree or order of a court where the subject matter of such decree or order is immovable property, the value of which is less than one hundred rupees.

Purpose of Property Registration (Deed Registration)

Manipur property registration of immovable property furnishes the following benefits:- According to the Manipur Transfer of Property Act right, title or interest can be acquired only if the deed is registered.

- The document of transfer of immovable property will be a permanent public record once it’s registered with the concerned office of Sub-Registrar.

- Anyone and the copy of the document can inspect the public record of the transfer of property can be obtained from the Sub –Registrar office.

- Registration of wealth is giving the information to the general public that the owner has transferred to the buyer by the owner.

- It enables the public to verify whether the property has been previously encumbered during transfer of ownership.

- If a person intends to buy a property, he/she can easily verify the record-index available in the sub-Registrar office. Such a person can ascertain in whose name the last transfer deed has been registered.

Documents Required Manipur Property Registration

Documents required for applying for various types of property deeds are explained in detail here.Documents Required for Gift Deed

- Records of Right

- Circle Rate

- Agriculturist certificate of the buyer or Permission under section 118 of HPTRA whichever is applicable

- Affidavit or Self Declaration of buyer and seller regarding the distance of land from the road

- ID proof of buyer and seller

- PAN card of buyer and seller

- Valuation of built-up structure from register valuator in case gift includes built-up area

- Copy of approved map if the built-up area is within municipal limits

- Copy of Tatima (If Tatima registry)

Documents Required for Lease Deed

Along with above mentioned supporting documents, few of other papers need to be furnished for registering lease deed.- Lease sanctions letter – If the leased land is Government land

- Agriculturist Certificate of the Mortgagee – If Mortgage is with possession

- ID proof of Mortgagor and Mortgagee

Documents required for Sale Deed

For registering sale deed a copy of Tatima (If Tatima registry) can be submitted with documents mentioned under Gift Deed.Stamp Duty for Manipur Property Registration

Stamp duty is one of the legal tax payable as proof for any transaction involves the immovable property. Registration fees Rates of stamp duty and for purchases in Manipur are given here:The Rate of Stamp Duty

The proportions of the Stamp duty in respect of Gift, Sale and Mortgage deed with possession are 7% of the market value of a property or consideration amount, whichever is higher.Rates of Registration Fee

The rates of Registration fees are 3% of the above amount subject to the minimum of Rs. 5 and a maximum limit of the Registration Fees has been fixed as Rs. 25000.Prescribed Authority

The deed has to be presented for registration at the office of the Sub-Registrar within whose sub-district the whole portion of the property to which such report relates is situated.Prepare a Deed

Before applying for property registration, the document needs to be prepared. Deed preparation for certification can be done personally written by the executants or through Deed writers by paying the applicable fee. Fee for document writers is based on the value of the property specified in a document. The language of a deed presented for registration should be in an expression commonly used in the district existing in the State. Note: The SRO empowered to refuse to register the deed if the language prescribed in the deed is not commonly used in the district unless an accurate translation accompanies the report into the language widely used in the region and also by a true copy.Procedure for Registering Deed through SRO

Process for registering deed through Sub-Registrar office centre is explained in detail below.Approach Sub Registrar Office

Step 1: Duly filled application of required deed and all other supporting documents need to be submitted at SRO. We have herewith enclosed the format of Deed.Get Acknowledgement Slip

Step 2: On submission of application will be processed and get an acknowledgement slip. This slip will contain a unique number and slot date for visiting SRO office for verification. Visit the Sub Registrar Office on the important date and time with original documents.Verification by SRO

Step 3: Sub registering officer will verify the following details.- Documents verification

- Oral confirmation of Transaction

- Checking of entries made by the clerk

- Examination of proper stamp duty

Recording Photo and Bio-Metrics

Step 5: Once the Sub-Registrar marked the deed, it will be fetched into the revenue records and deed data and Photograph of the buyer, seller, witnesses and identifiers will be recorded. Note: Any person, above 18 years of age and not a party to the document may sign as a witness. Step 6: SRO officer will regularise the party details form by obtaining the sign and Biometrics of the buyer & seller.Pay applicable Duty

Step 7: Pay applicable duty for registration, the officer will generate fee receipt. After creating the receipt, deed number can be obtained. Note: Kindly note it for future referenceGet Registered Deed

Step 8: After verification SRO will register the property and update details in online land records. The registered deed can be obtained from the concerned Registrar’s office.Online Application for Certified or True copy of Registered Deed

E-Form for certificate of the certified or exact copy of Registered Deed can be filled Online as well as Offline. The procedure for completing Manipur Property registration is described in step by step procedure. The applicant has to be a registered user of the official website of Manipur Governmentto access the E-form.User Registration

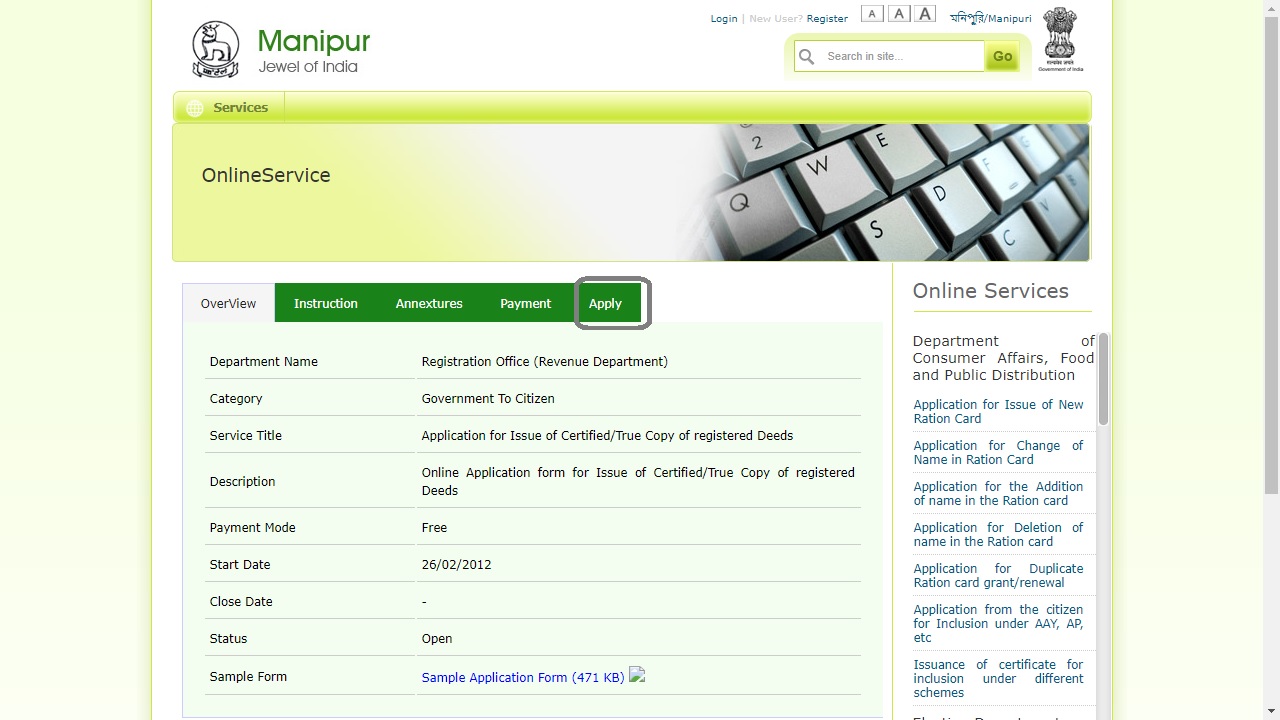

Step 1: Access official website of Manipur Government and click on How to apply option from home page. Image 1 Manipur Deed Registration

Step 2: If the applicant is a new user for this portal, click on New User link, it will redirect to the new page.

Image 1 Manipur Deed Registration

Step 2: If the applicant is a new user for this portal, click on New User link, it will redirect to the new page.

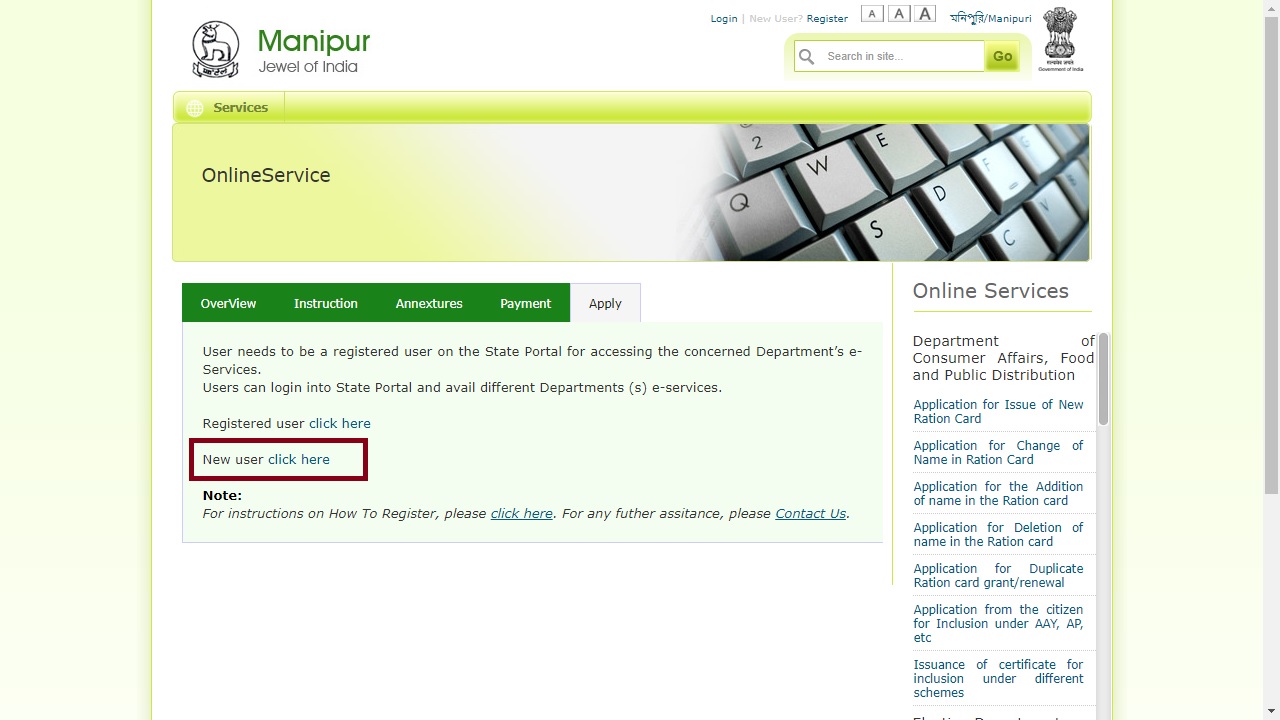

Image 2 Manipur Deed Registration

Step 3: Provide mandatory details such as Login details, Residential details, and security question. Provide the captcha and click on submit button. With the registered username and password proceed with the application for deed.

Image 2 Manipur Deed Registration

Step 3: Provide mandatory details such as Login details, Residential details, and security question. Provide the captcha and click on submit button. With the registered username and password proceed with the application for deed.

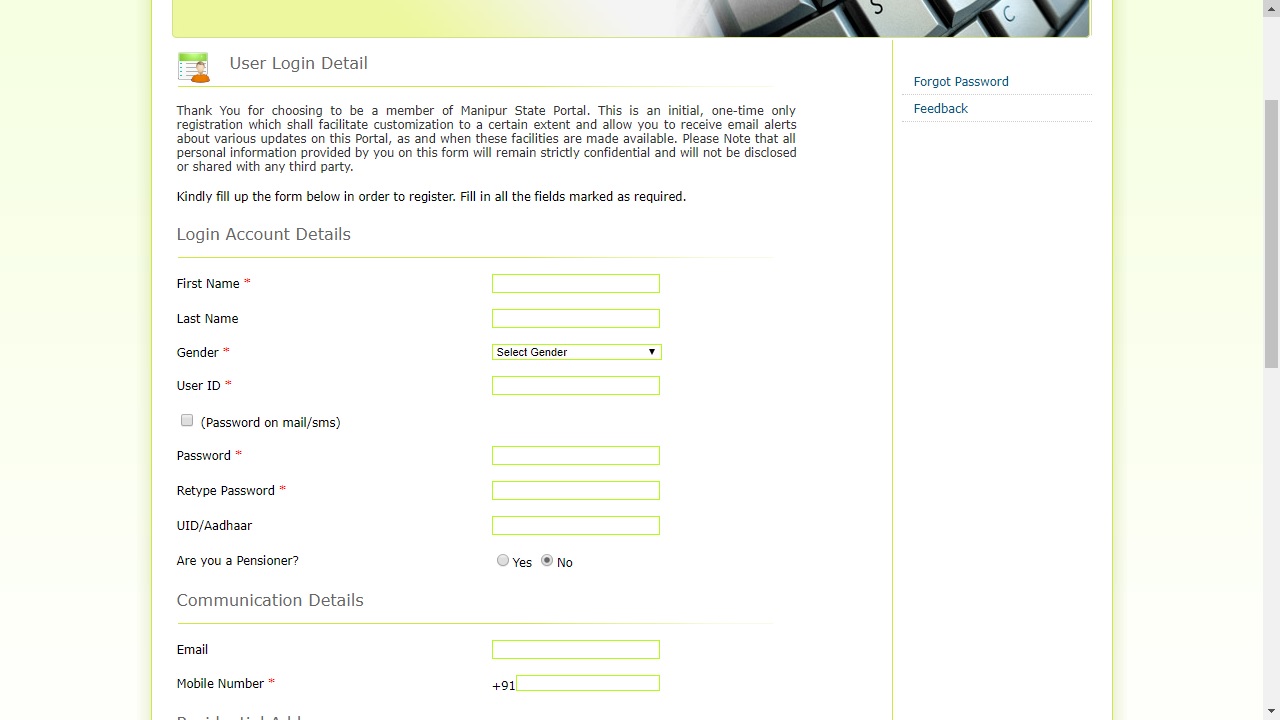

Image 3 Manipur Deed Registration

Image 3 Manipur Deed Registration

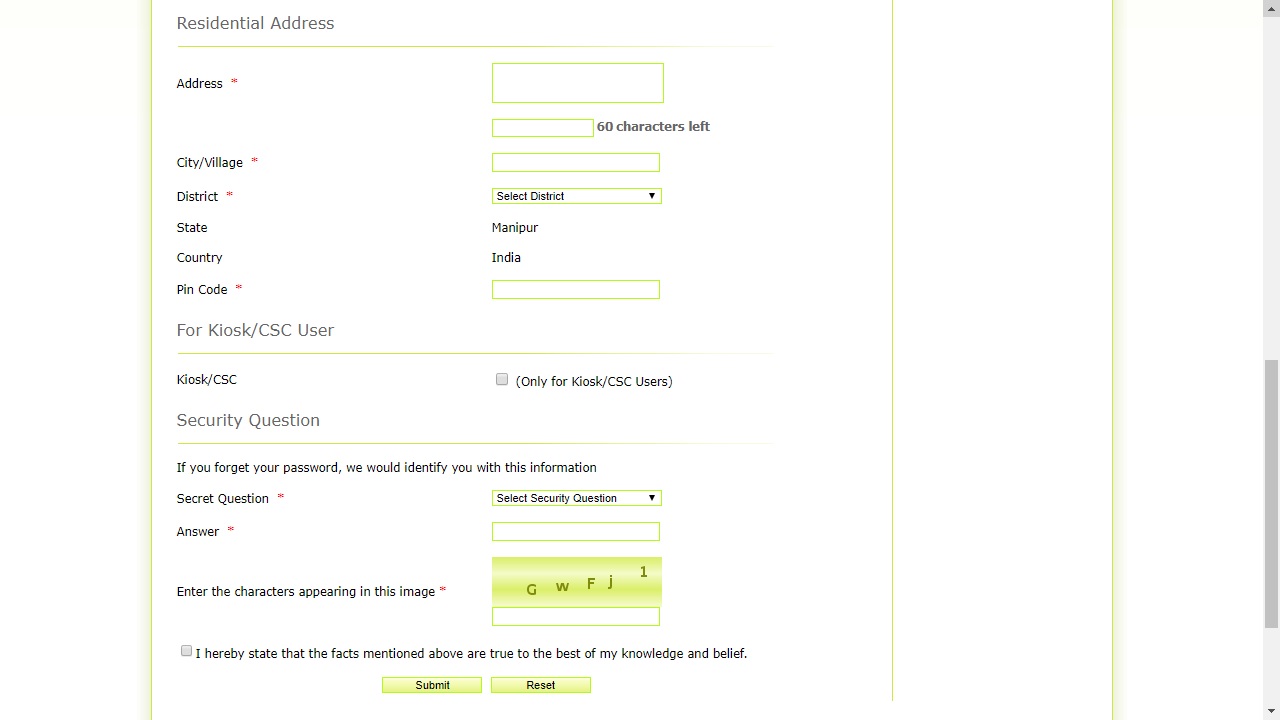

Image 4 Manipur Deed Registration

Image 4 Manipur Deed Registration

Login to Portal

Step 4: Registered user can click on the ‘Registered User’ option. The login page will appear, Provide the username and password. The page will redirect to the application page. Image 5 Manipur Deed Registration

Step 5: You have to click on “Submit Online” button for filing the e- form Online or Click on “Submit Offline” button for filling the Offline e-form.

Image 5 Manipur Deed Registration

Step 5: You have to click on “Submit Online” button for filing the e- form Online or Click on “Submit Offline” button for filling the Offline e-form.

Offline e-form

In the offline mode, the applicant can able to save the details and fetch the data whenever required. The applicant can also assign a security key to secure the details entered. Step 6: For completing property deed registration offline mode, a zip file can be downloaded to the computer by clicking on the submit offline button. Step 7: You have to unzip the file, and then provide the details in the application. The format of application form is attached here: Note: Double-clicking on form.html file, the application form will be opened. Step 8: Offline type forms can be submitted only when the applicant comes to online, and the internet is accessible. After checking the details, the applicant needs to visit the official website and log in to the portal user ID and password for submitting the form.Online e-form

This form allows the applicant to fill out the form online at once and submit the form after validating it. Step 6: By clicking on submitting the online option, you can provide details for e-form. Select the district where you want application form to be processed. Provide all necessary documents in the application.Attach Documents

Step 9: Upload deed and all required documents for completing Manipur property registration. Note: Attachments or Enclosures uploaded by you with the e-form should not exceed a file size of 2 MB.Time Slot Booking

The applicant need select the appropriate time for visiting SRO office.Transaction ID Generation

Step 10: After providing all details and uploading supporting documents in the e-form in either mode, a transaction ID will be generated. This can be used for future references. Note: For future communication with Department Authorities regarding the e-form requires this transaction id.Status of Application

Status of Manipur property registration application will be updated in any of the following ways:- The applicant will be intimated of the status change in their inbox available in the state portal.

- The applicant will get SMS notification on Status change.

- The applicant can also inquire about status at the department with the transaction id.

Collect the Certified or True copy of Registered Deed

On the requested date, submit the deed along with all supporting documentation to concerned Sub-registrar office. After verification SRO will register the property and update details in online land records and photographs of buyer, seller, witnesses and identifiers will be recorded. The registered deed can be obtained from the concerned Sub Registrar’s office. Note: Applicant can also apply for certified or true copy of registered deed through CSC centre.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...