Last updated: December 31st, 2021 3:19 PM

Last updated: December 31st, 2021 3:19 PM

MCA Filing Due Date Extension

AOC 4 Form files the company’s statement for every financial year with the Registrar of Companies. The financial statements are the source based on which the Board of Directors and shareholders evaluate the company. The company is responsible for duly furnishing the form within 30 days of conducting the Annual General meeting. MCA has recently updated the due date to file. MCA return must be filed by all companies registered in India. While filing the MCA Annual Return, the company must submit its Audited Financial Statement and Board Reports. MCA has recently extended the due date for filing FY2020-21 annual return to 15th February 2022.Latest Update

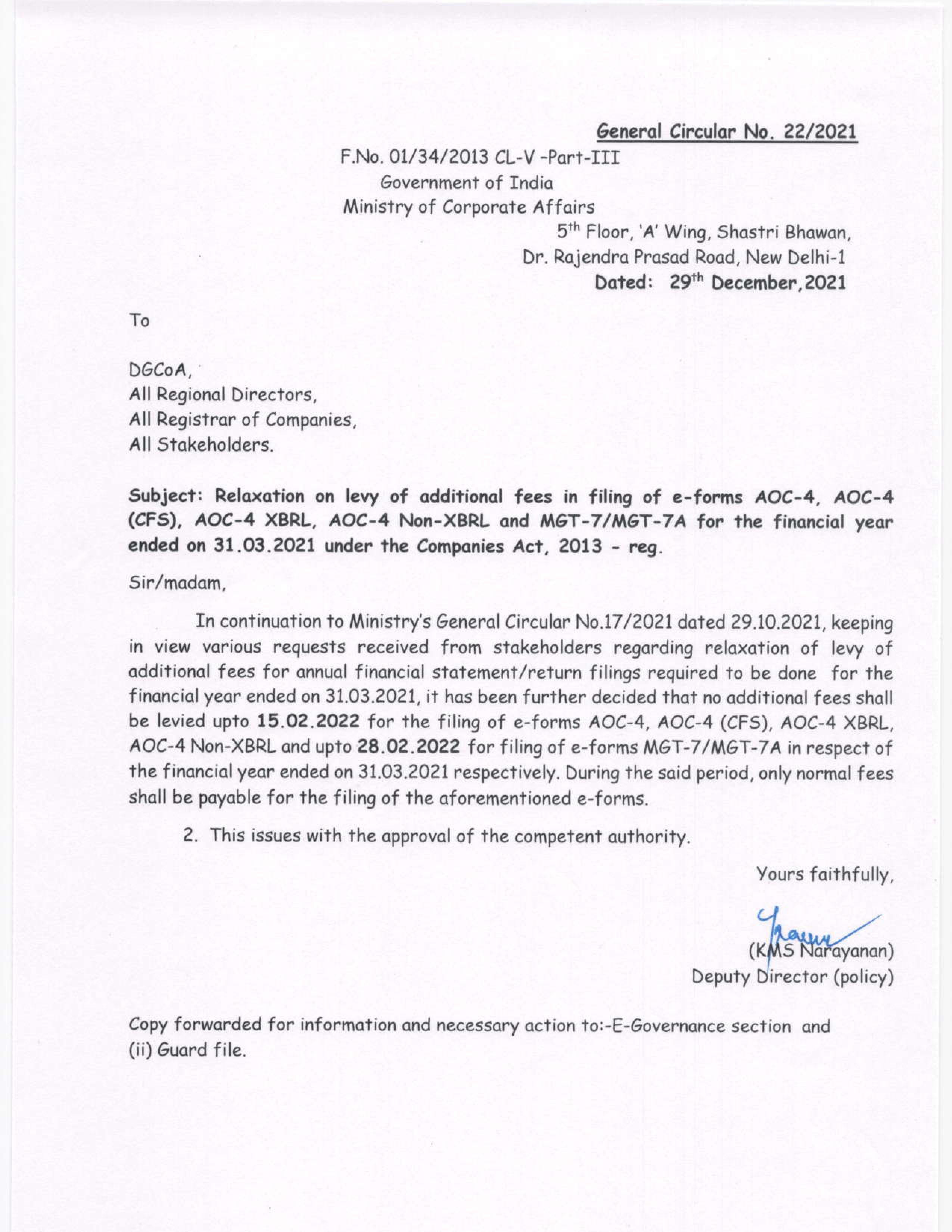

29th December 2021: The Ministry of Corporate Affairs released a circular number 22/2021 that notifies an extension regarding the due date for filing the annual returns in AOC 4, AOC 4 (CFS), AOC 4 XBRL, AOC-4 for the financial year ending on 31.03.2021 till 15th of February 2022. Read hereWhat documents are to be submitted?

- Balance sheet

- Profit and loss Statements

- Cash Flow statements

- Statement of change in equity

- Reports from the Auditor

- Reports from the Board

- CSR or corporate social responsibility if there is any

- Other relevant documents if required

Guidelines to be followed while filing

- The company has to appoint and authorize the auditors for auditing the financial statements.

- According to Company Act 2013, the Directors with the help of other officials need to draft a board report.

- The financial statements and the Board report need to be approved in the approved.

- The financial statements shall be framed once the Annual General meeting is concluded. The shareholder’s approval is an ultimate requirement for accepting the financial statements.

Related Approval and Certification

The data in the form needs to be approved by the Directors, Manager, CFO, and CEO. A practicing CA or CS needs to confirm the authenticity of the information. Considering various requests received from stakeholders regarding the relaxation of levy of the additional fees for the annual financial statement/ return filings required for the financial year ending on 31.03.2021 is further extended to 15.02.2022.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...