Last updated: March 29th, 2024 10:45 AM

Last updated: March 29th, 2024 10:45 AM

MCA Form CSR-2 - Report on the Corporate Social Responsibility

The Ministry of Corporate Affairs (MCA) vides a Notification dated February 11, 2022, has issued Companies (Accounts) Amendment Rules, 2022 to further amend the Companies (Accounts) Rules, 2014. As per amended rules, every company covered under Section 135 of the Companies Act, 2013 shall furnish a report on Corporate Social Responsibility in E-Form CSR-2 to the Registrar for the preceding financial year (2020-2021) and onwards. The new rule shall come into force from February 11, 2022. Know more about the Companies (CSR Policy) Amendment Rules, 2021Latest Due Date Update - 2024

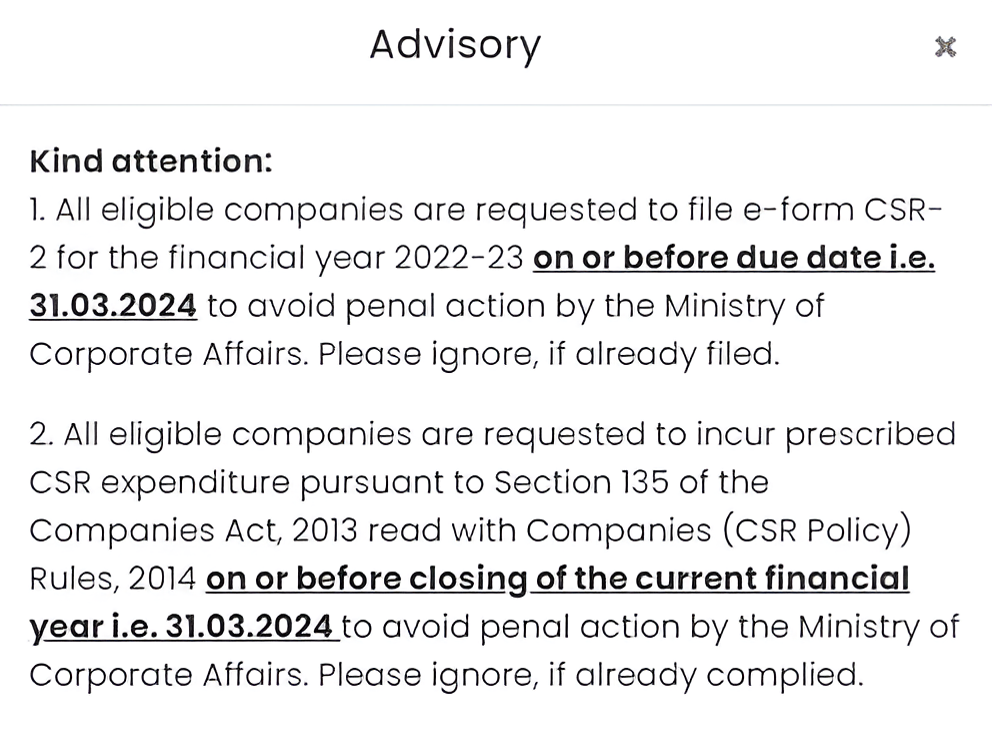

MCA announced that all eligible companies must file e-form CSR-2 for the financial year 2022-23 on or before the due date of 31.03.2024 to avoid penal action.

Synopsis of Companies (Accounts) Amendment Rules, 2022

The synopsis of the Companies (Accounts) Amendment Rules, 2022 is given here:- MCA has inserted a new-sub rule 1A in Rule 12 in Companies (Accounts) Rules, 2014 vide the Companies (Accounts) Amendment Rules, 2022

- As mentioned above, Through this amendment MCA has inserted a new Form CSR-2 (Report on the Corporate Social Responsibility)

Section 135 of the Companies Act, 2013

The Corporate Social Responsibility concept in India is governed by Section 135 of the Companies Act, 2013 wherein the criteria has been provided for assessing the CSR eligibility of a company, Implementation, and Reporting of their CSR Policies. According to the Companies Act 2013, certain classes of profitable organizations have to shell out at least 2 percent of the three-year annual net profit towards Corporate Social Responsibility (CSR) activities in a particular financial year. The companies having the following net-worth during the immediately preceding financial year can make CSR expenditure under Section 135 of the Companies Act, 2013- The net worth of Rs. 500 Crore or more

- Turnover of Rs. 1000 crore or more

- Net Profit of Rs. 5 crores or more

Subrule 1A in Rule 12 of Companies (Accounts) Amendment Rules

According to Sub-rule 1A in Rule 12 of Companies (Accounts) Amendment Rules, Every company covered under the provisions of sub-section (1) of section 135 of the Companies Act, 2013, shall furnish a report on Corporate Social Responsibility in Form CSR-2 to the Registrar for the preceding financial year (2020-2021) and onwards as an addendum to Form AOC-4 or AOC-4 XBRL or AOC-4 NBFC (Ind AS).MCA Form CSR-2

As a part of the good corporate governance practice, MCA on 11th Feb 2022 notified Form CSR-2. Now corporate must furnish the details of the CSR spent to the Ministry through this form. Companies falling under section 135 are required to spend a certain % of their profits on CSR as specified in the section.Applicability of Form CSR-2

The newly introduced form CSR-2 (report on Corporate Social Responsibility) is required to be filed by those entities which fall under the provisions of Section 135 of the Companies Act, 2013, i.e., the companies which are required to comply with the provisions of Corporate Social Responsibility (CSR). [pdf-embedder url="https://www.indiafilings.com/learn/wp-content/uploads/2022/02/form-csr-2-1.pdf" title="form-csr-2"]Report on the Corporate Social Responsibility

Earlier there was no form prescribed to furnish a report on CSR. Section 135 of the act only mandates to annex the details of CSR to its Board Report and also disclose on the website of the Company, if any. Now through this notification ministry introduced the Form CSR-2. The form is to be filed in addition to Form AOC-4 for filing the company's financial statement with the Registrar of Companies. In this new 11-page form notified by the MCA on February 11, companies will have to provide the following:- The details of the CSR amount spent in the three preceding financial years and details of all ongoing projects.

- Details of CSR Committee

- Details of CSR disclosed on the website of the company in pursuance of Rule 9 of Companies (CSR Policy) Rules, 2014

- Net Profit & other details of the company for the preceding financial years

- If any capital assets have been created or acquired through CSR spending, companies will have to provide details, including the address, location, pin code of the property, along with the amount spent and its registered owner.

The Due Date for filing CSR-2

MCA vide its notification dated 11th February 11 announced that Form CSR-2 shall be filed separately on or before 31st March 2022 for the preceding financial year (2020-2021) after filing Form AOC-4 or AOC-4 XBRL or AOC-4 NBFC (Ind AS). From the above, we can interpret that the due date of CSR-form 2 is:- For the financial year 2020-21, the Form CSR-2 is to be filed separately on or before 31st March 2022

- For the financial year 2021-22 onwards, the Form CSR-2 is to be filed as an addendum to form AOC-4 (due date of AOC-4)

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...