Last updated: February 2nd, 2023 7:29 PM

Last updated: February 2nd, 2023 7:29 PM

Mukhyamantri Krishi Udyog Yojana (MKUY) Application

Agriculture and Farmers Empowerment Department, Government of Odisha has launched Mukhyamantri Krishi Udyog Yojana in the year 2018. Under this scheme, the Government provides financial assistance in the form of Capital Investment Subsidy on loan to entrepreneurs for setting up new agro-industries in the state of Odisha. Krishi Udyog Yojana encourages young entrepreneurs to set up a new business and increases the production of agriculture sectors. In this article, we look at Mukhyamantri Krishi Udyog Yojana in detail.Objective of Krishi Udyog Yojana

The key objective of this scheme is to increase the income of the farmer by creating new employment opportunities in agro-industries.Eligible Projects

The entrepreneurs will receive a Capital Investment Subsidy for setting up new agro-enterprises like:- Agriculture units

- Horticulture

- Fisheries

- Dairy farming

- Animal resource development

- Food processing sector

- Agro service centre

- Veterinary clinic

- Biofertilizer production and marketing

- Tissue culture laboratory

- Vermiculture

- Poultry hatchery and breeders farm

- Bakery and confectionary

- Commercial duck farming

Krishi Udyog Yojana Beneficiaries

The eligible beneficiaries under Mukhyamantri Krishi Udyog Yojana are:- An individual

- Partnership enterprise

- Body of individuals

- Registered NGOs, SHGs

- Private limited companies

- Group of Individuals like registered FPOs, FPCs, NGOs, SHGs, PACs and LAMPs

- Women, SC, ST Graduates in Agriculture and allied discipline

Subsidy for Commercial Agri-Enterprises (CAE)

Capital Investment Subsidy for Commercial Agri- enterprises is 40% of the fixed capital subject to a limit of 50 lakh (this does not include the cost of the land) and 50% limited to 50 lakh for SC, ST, Women, Graduates of Agriculture and Allied Disciplines in Odisha. Self-financed Commercial Agri-Enterprises (CAE) will be allowed up to project of Rs.10 lakhs. For a project costing more than 10 lakh, bank financing will be mandatory for not less than 10% of the project cost as a term loan. The subsidy for layer production has been increased from Rs.50 lakh to Rs.75 lakh.Eligibility Criteria

Eligibility criteria to obtain MKUY benefits are:- Permanent resident of Odisha only can apply for MKUY subsidy loan

- An entrepreneur or group of entrepreneurs can avail benefits for any numbers of projects. The entrepreneur should receive a net income of 10% of the project cost minimum to Rs.2.00 lakh per annum.

- If an entrepreneur once availed CIS (Capital Investment Subsidy) for an Agri-enterprise, he will be eligible to apply for another new project only after 5 years.

Documents Required

Following documents need to be submitted for Mukhyamantri Krishi Udyog Yojana CSI.- Land record

- Lease document

- Aadhaar Card

- Caste certificate (mandatory for SC or ST applicant)

- Graduation certificate in Agriculture and allied discipline

- Identity proof – Voter ID

- Passport size photograph

- Project Report summary

- Bank Consent Letter

Apply for MKUY in APICOL

Step 1: Go to Agricultural Promotion & Investment Corporation of Odisha Limited, (APICOL) official website. List of Agri Enterprise Mukhyamantri Krishi Udyog Yojana

Step 2: Select registration option under Application master menu.

List of Agri Enterprise Mukhyamantri Krishi Udyog Yojana

Step 2: Select registration option under Application master menu.

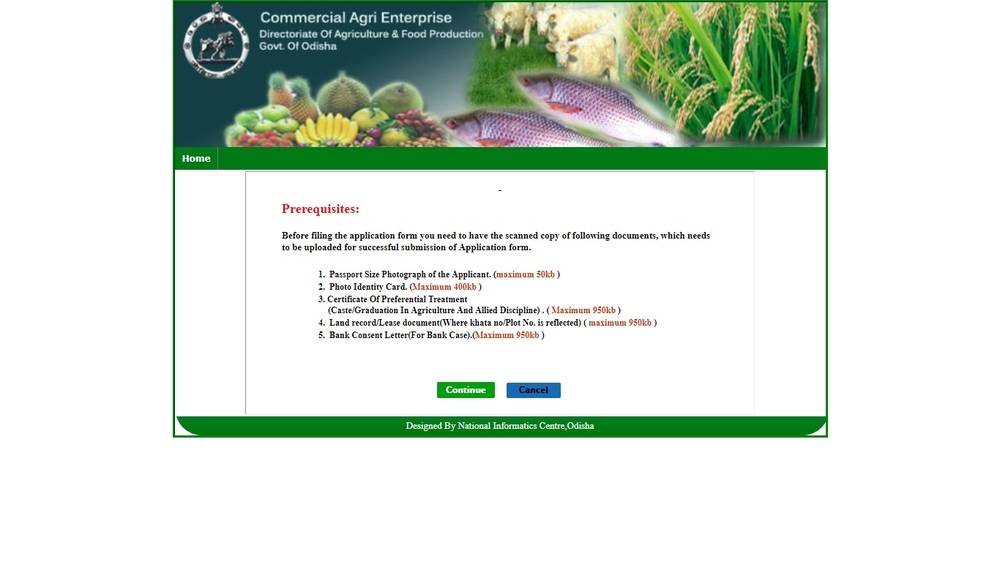

Prerequisites Mukhyamantri Krishi Udyog Yojana

Prerequisites Mukhyamantri Krishi Udyog Yojana

Fill the application Form

Step 3: Entrepreneur needs to fill an application in the prescribed form.Pay Security Deposit

Step 4: Security deposit of Rs.10,000 need to be paid online. Note: The security money will be refunded at the time of disbursal of subsidy or amount will be forfeited in case of non-establishment of the unit without valid reasons after the issue of Go-Ahead letter. In the case of bank finance, if the loan is not sanctioned, then the security amount will be refunded.Submit Application

Step 5: Apply along with all the details of capital investment in the Project Report summary format to the Block Level Officer (BLO).BLO Visit to Farm Site

Step 6: The concerned Block Level Officer will view the online application. BLO will visit the farm site, verify the relevant land records, take a GPS photograph of the site in a mobile app and upload same in the web portal. Step 7: BLO will upload and submit the feasibility report in the web portal within 15 days.Verification by DNO

Step 8: Concerned District Nodal Officer (DNO) will process and review the proposal along with the feasibility report and project report and retrieve the land records from Bhulekh. The DNO will carry out on-spot verification of the proposal. After satisfaction, the DNO will upload his recommendation.Get Go-Ahead Letter

Step 9: Go-ahead letter will be uploaded in the website with a seal and full signature of the DNO. The applicant can get Go-Ahead within 60 days from the date of online application. In the case of rejected proposals, the applicant will receive an SMS to the registered mobile number with the reason for rejection. There will be a refund in the security deposit automatically through the payment gateway with a message to APICOL portal.Scheduled Date for Completion

The scheduled date for completion of the Agri - projects will be 2 years from the date of issue of the go-ahead letter. In case of delay in completion of the agro- project within scheduled period mentioned in the Go-Ahead Letter, 20% of the CIS will be deducted from the eligible subsidy amount in case of completion delayed by 6 months and 50% will be deducted from eligible CIS in case of delay in completion from 6 months to one year. The applicant will not receive the subsidy if there is a delay in the completion of the project.Sanction of Capital Investment Subsidy

After completion of the agro-project, the applicant needs to submit an application for Capital investment subsidy in the prescribed format along with bill and vouchers of following to District Nodal Officer and Lending Bank.- Electrification

- Water supply

- Equipment and machinery

- Civil construction report prepared by one assistant engineer

Disbursement of Capital Investment Subsidy

After the completion of the project, the Government will disburse the CIS. In the case of manufacturing units, trial production will be made. In case of a project financed by the lending bank, CIS will be disbursed to the bank. For all other cases, the Government disburses the subsidy to the Bank Account directly.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...