Last updated: March 10th, 2020 10:50 AM

Last updated: March 10th, 2020 10:50 AM

Mumbai Property Tax

Property tax is a source of revenue collected from the residents of a particular city or town for development of the locality in terms of maintenance of roads and the facilitation of essential civic amenities. It must be remitted to the local municipal corporation on an annual or half-annual basis. In this article, we look at the procedure for making Mumbai property tax payment in detail. Also, know how to register the property in Mumbai.Methodology of Payment

The Government of Maharastra and the municipal corporations have introduced an online portal (including a calculator) through which the payments can be remitted. The residents of Mumbai can calculate and settle their property tax dues by visiting the portal of Brihamumbai Municipal Corporation (explained further).Calculation of Dues

Property tax in the City of Mumbai was earlier calculated on the rate-based value system in which the changes were determined based on the sum of rent collected from a particular property in a year. But losses resulting from artificially low property taxes issued by the Rent Control Board prompted the MBC to adopt a capital value-based property assessment and tax calculation system. This system is based on the stamp duty ready-reckoner rate issued by the government for estimating the value of the property by considering various parameters. This rate is revised every year so that a realistic value can be identified. Calculation of Property tax using the formula are as follows: Property tax = Tax rate* Total carpet area/area of land if the land is vacant * Type of Building * age factor * usage factor * floor factor. In the above formula, capital value is the rate of base value*Total carpet area/area of land in case of vacant land*building type*usage factor*floor factor. Computation of property tax is through the BMC website by specifying the particular ward, zone, locality, area, occupancy type, total carpet area, year of construction, floor type, etc.Capital Value Calculation

Calculation of Capital value is as follows: Capital value = Market Value of the property * total carpet area * weight of construction type * weight for age of the Building.Market Value

Determination of Market value is based on the Ready Reckoner, which is fixed by the state government.Weights for Construction Type

The following are the weights for ‘construction type’, in units:- Bungalows and RCC construction - 1 unit.

- Other than RCC (semi-permanent/chawls) - 0.60 units.

- Under-construction/vacant land – 0.50 units.

Weights for the age of Building

The following are the weights for the ‘age of building’, in units:- Properties constructed before 1945 – 0.80 units.

- Properties constructed before the years of 1945 and 1985 – 0.90 units.

- Properties constructed after 1985 – 1 unit.

Payment Procedure

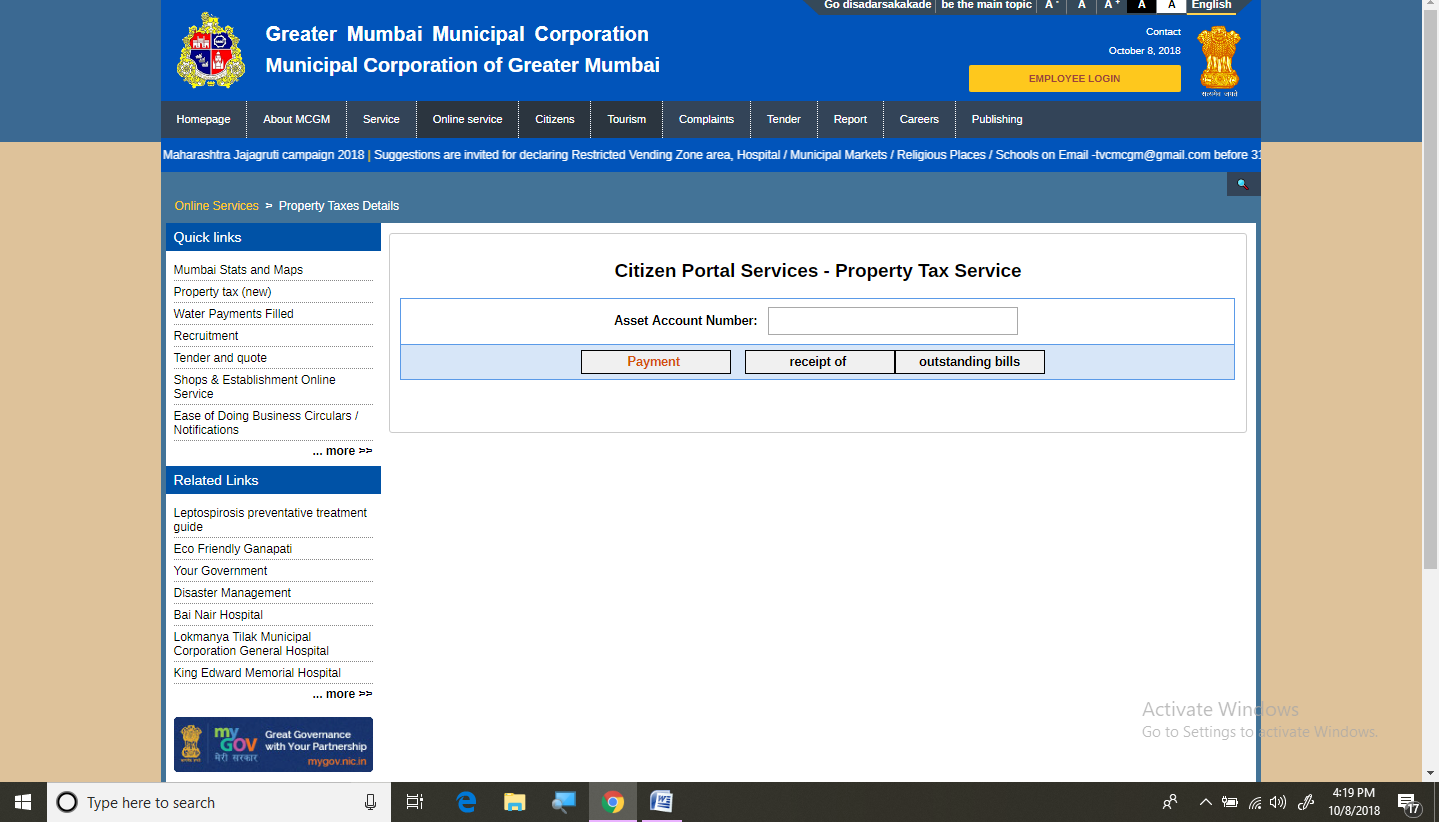

Residents can make payment either through an online or offline method. Applicants pursuing the latter can remit their dues by visiting the respective assistant revenue office or through the facilitation centres of the ward offices. The digital means of remitting payment are as follows: Step 1:- Official Website The user may initiate the process by visiting the official portal of BMC, which facilitates the residents to make payments. [caption id="attachment_61197" align="aligncenter" width="1417"] Mumbai-Property-Tax-Home-Page

Step 2:- Payment Link

In the home page, choose the option ‘pay property tax’ from the ‘online services’ drop-down menu.

Step 3: Enter Details

As a part of the requisites of the login procedure, the property account number must be entered. In the same page, the user will have to choose any of the following options:

Mumbai-Property-Tax-Home-Page

Step 2:- Payment Link

In the home page, choose the option ‘pay property tax’ from the ‘online services’ drop-down menu.

Step 3: Enter Details

As a part of the requisites of the login procedure, the property account number must be entered. In the same page, the user will have to choose any of the following options:

- Outstanding bills

- Receipt

- Make payment

Mumbai-Property-Tax-Portal-Services

If the taxpayer is unaware of the property account number, he/she may choose the option ‘Search’ instead of login, in which case the property account number appears along with the ward, name, and the address of the particular Building.

Step 4: Post Login Procedure

After logging in to the portal, the taxpayer needs to verify the details of the property depicted in the screen and confirm the acceptance.

Step 5: Total Outstanding

The succeeding page will depict the year-wise outstanding.

Step 6: Specification of Amount

The user must now specify the amount which he/she desires to pay and click on ‘online payment.’

Payment adjustment is based on FIFO.

Step 7: Payment Gateway

The processing of payment is through net-banking by choosing the name of the bank. Click ‘pay now’ to complete the payment.

Now, print the receipt of payment for future references. Further, the applicant can view the receipt anytime by visiting the BMC online portal and by opting for ‘receipts’ under ‘online services.’

The property payment procedure for Navi Mumbai is almost similar, except for the postal address. Residents of Navi Mumbi require to remit their dues by visiting the NMMC portal.

[caption id="attachment_61207" align="aligncenter" width="1418"]

Mumbai-Property-Tax-Portal-Services

If the taxpayer is unaware of the property account number, he/she may choose the option ‘Search’ instead of login, in which case the property account number appears along with the ward, name, and the address of the particular Building.

Step 4: Post Login Procedure

After logging in to the portal, the taxpayer needs to verify the details of the property depicted in the screen and confirm the acceptance.

Step 5: Total Outstanding

The succeeding page will depict the year-wise outstanding.

Step 6: Specification of Amount

The user must now specify the amount which he/she desires to pay and click on ‘online payment.’

Payment adjustment is based on FIFO.

Step 7: Payment Gateway

The processing of payment is through net-banking by choosing the name of the bank. Click ‘pay now’ to complete the payment.

Now, print the receipt of payment for future references. Further, the applicant can view the receipt anytime by visiting the BMC online portal and by opting for ‘receipts’ under ‘online services.’

The property payment procedure for Navi Mumbai is almost similar, except for the postal address. Residents of Navi Mumbi require to remit their dues by visiting the NMMC portal.

[caption id="attachment_61207" align="aligncenter" width="1418"] Mumbai-Property-Tax-Online-Payment

Mumbai-Property-Tax-Online-Payment

Property Tax Exemptions

The following properties are exempted from property tax:- Property utilized for public worship/charitable purpose.

- Properties designated by the Government for Diplomatic or Consular Mission of a foreign State.

- Houses/flats of less than 500 square feet.

Personalized Billing System

Earlier this year, the BMC came up with a resolution of issuing property tax bills to individual flat owners in future building projects, against the system of issuing common bills to a housing society. This option can avail to those who clear arrears. For this purpose, flat owners require to produce a No Objection Certificate (NOC) from society.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...