Updated on: June 9th, 2023 7:54 PM

Updated on: June 9th, 2023 7:54 PM

Mutation of Property in Telangana

The mutation is a process of transferring of title ownership name in records of the revenue department for a property. Mutation (transfer of title) is to be done when the property is transferred from one owner to another. By mutating the particular property, the new owner can get the property records on his name. This article demonstrates the Telangana Property Mutation procedure in detail.Importance of Property Mutation

Property mutation is a mandatory process in all legal transactions involving the property. As stated above, by mutating the property, the new owner gets the revenue records on his name. Once the property is mutated, such details will be updated in the revenue records maintained by civic bodies like Municipalities, Panchayat or Municipal Corporations. In Telangana, Greater Hyderabad Municipal Corporation (GHMC) is doing the process of mutation.- Mutation document is necessary for fixing the property tax payment liabilities

- Mutation property is necessary to prove the ownership of a particular land

- For selling a property, the landowner has to submit mutation certificate to the buyer for verification

Documents Required

Documents required for Property Mutation in Telangana are below:- Notice of transfer under Section 208 of GHMC Act, duly signed by both the Vendor and Vendee

- Attested copies of property documents and link documents

- Encumbrance Certificate (Latest document to be furnished)

- Non-Judicial Stamp paper for Rs.20 for each copy of the document

- Undertaking on Notarized Affidavit cum indemnity bond on Rs.50 stamp paper

- Tax Payment receipt

In the case of Will

In addition to all the above documents, the following documents are also necessary for land mutation:- Death Certificate

- Succession Certificate

- Legal Heir Certificate

Mutation Fee

Mutation fee is to be paid at the time of property registration. Concerned Sub-Registrars of Registration & Stamps Department will collect this fee and share this transaction details to the respective Municipalities or Municipal Corporations (ULBs). Rates of mutation fees to be paid at the time of the registration are given here. The Mutation fee is to be paid through Demand Draft (DD) in favor of the Commissioner, GHMC.Market Value of Land

Mutation fee to be calculated based on the market value of land in Telangana. The must submit the mutation fee in the form of DD in the concerned Sub Registrar office. The applicant can check the market value of land by visiting the Telangana Registration and Stamps Department. Step 1: Select the option non-agriculture rates or Agriculture rates. Unit rates Mutation of Property in Telangana

Step 2: Select district name from the drop-down menu. The applicant must select the Mandal and village name for getting the market value of land in Telangana.

Unit rates Mutation of Property in Telangana

Step 2: Select district name from the drop-down menu. The applicant must select the Mandal and village name for getting the market value of land in Telangana.

Unit rates locality wise Mutation of Property in Telangana

Step 3: Click on the submit button to get details.

Unit rates locality wise Mutation of Property in Telangana

Step 3: Click on the submit button to get details.

Time Frame

- In the case where both buyer and seller made an application for mutation, it will be done within 14 days

- If the seller or buyer applied for mutation certificate, it would take 45 days to complete the process of mutation

Telangana Property Registration Process

Process of mutation and procedure for obtaining mutation certificate in Telangana are below in a step by step procedure: Step 1: At the time of property registration, submit an application for mutation along with the relevant document to the concerned Registration & Stamps Department. Step 2: As mentioned above a Demand Draft for mutation fee to be submitted at the time of property registration. Step 3: During the property registration process, the Registration Department will collect all property related data and the transaction details for mutation. Step 4: Property and transaction details will be shared with respective GHMC circle office through online. Step 5: The applicant will receive an SMS with a mutation application number when the mutation request is processed. Step 6: The unique mutation number also has another purpose like tracking application status and downloading the certificate. Step 7: The concerned Revenue officer of the ULB will initiate the process of mutation as per rules and procedure.- Verification of the premises before a change of name physically

- Verification of existing property tax as per Bench Mark rate. In case of any under-assessment, there will be a revision of the property tax as per rules.

Check Status of Application

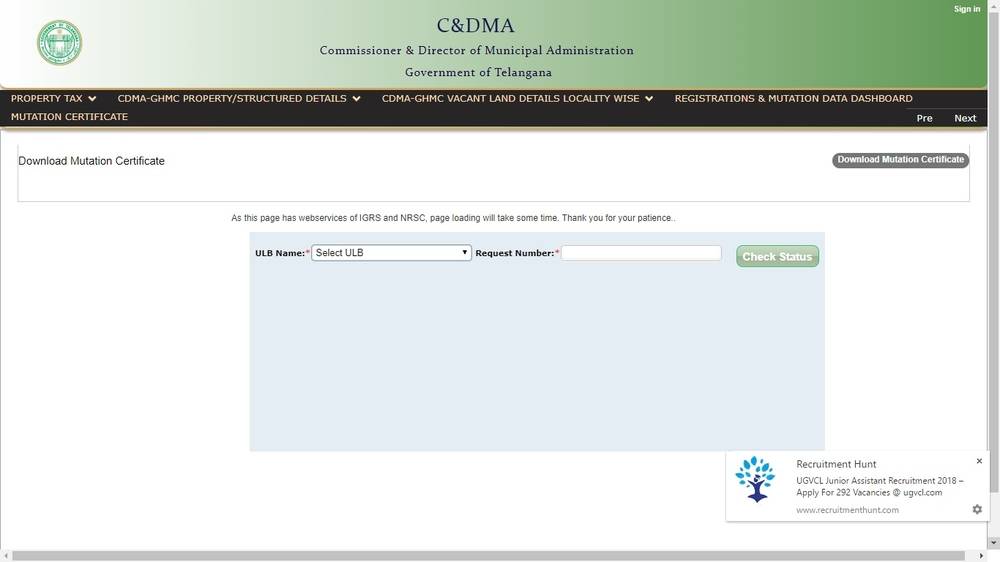

Procedure to check mutation application: Step 1: Go to Commissioner & Director of Municipal Administration (C&DMA) web portal. Download mutation certificate Mutation of Property in Telangana

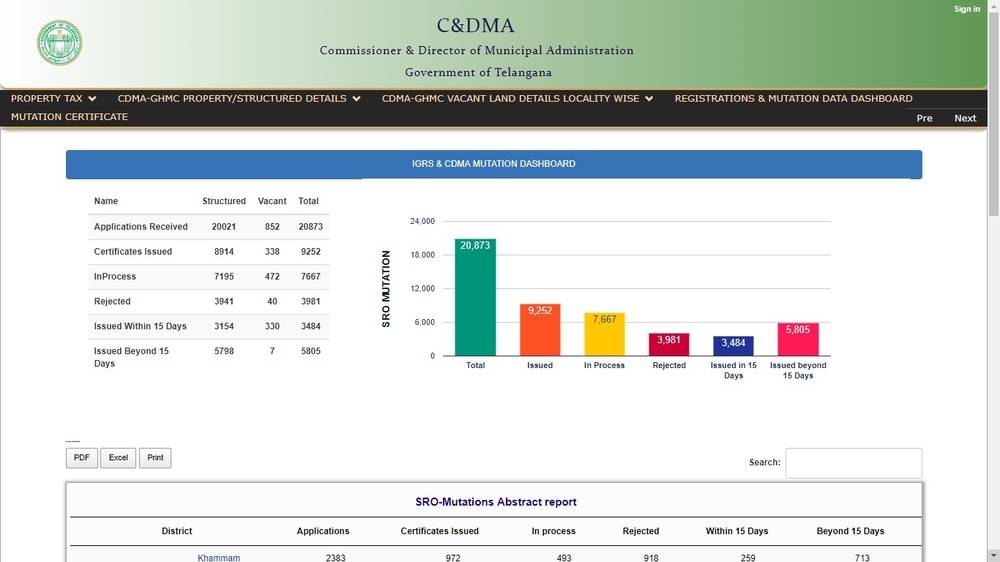

Step 2: Select Registration and Mutation data dashboard option from the menu. SRO Mutations Abstract report will appear.

Download mutation certificate Mutation of Property in Telangana

Step 2: Select Registration and Mutation data dashboard option from the menu. SRO Mutations Abstract report will appear.

Abstract report Mutation of Property in Telangana

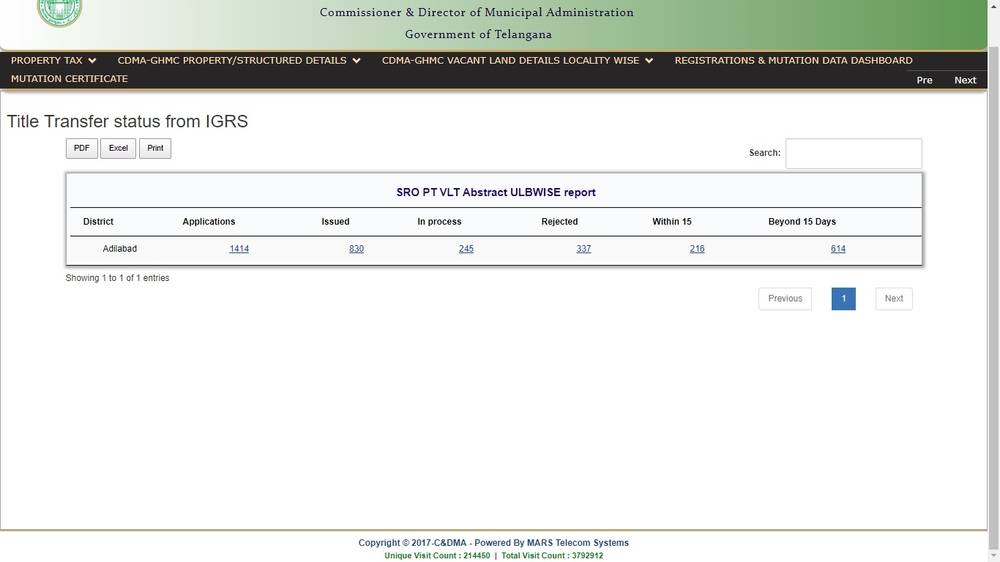

Step 3: Click on district name. SRO PT VLT Abstract ULB wise report will appear.

Abstract report Mutation of Property in Telangana

Step 3: Click on district name. SRO PT VLT Abstract ULB wise report will appear.

Abstract ULB Mutation of Property in Telangana

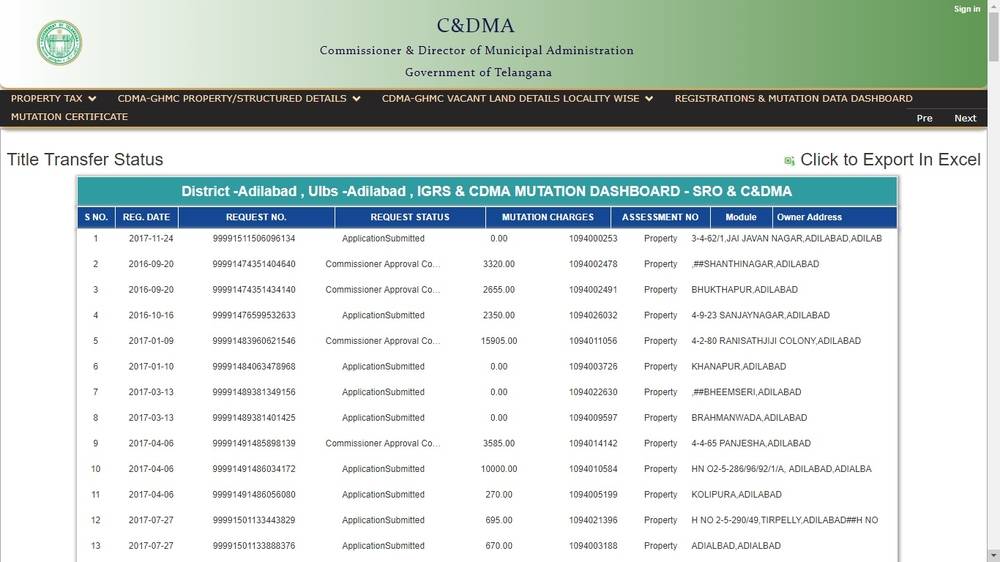

Step 4: The applicant can check the status of the application by selecting any one of the options such as application number, issued, in process, rejected within 15 days.

Abstract ULB Mutation of Property in Telangana

Step 4: The applicant can check the status of the application by selecting any one of the options such as application number, issued, in process, rejected within 15 days.

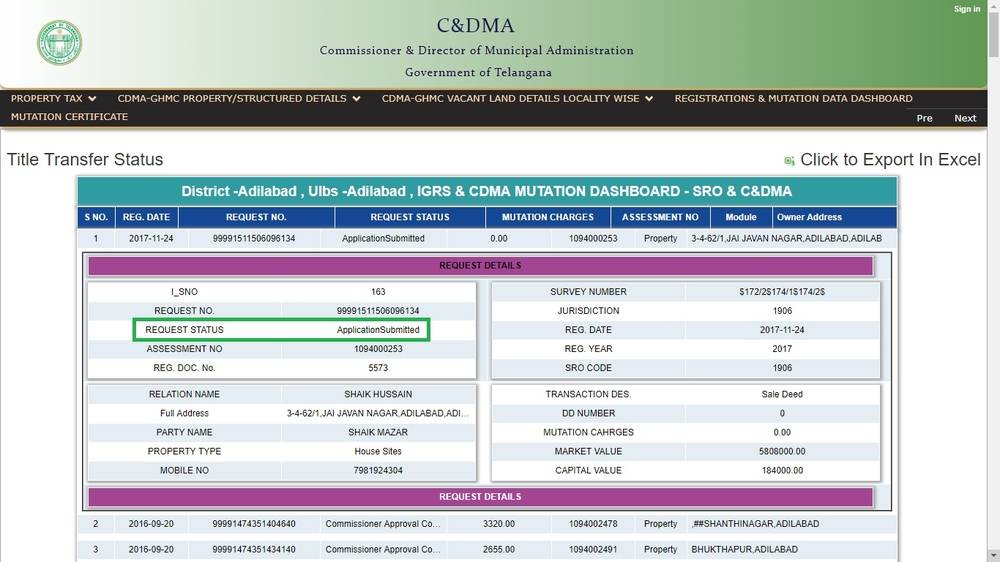

Check status Mutation of Property in Telangana

Step 5: Select the request number from the list; the applicant can view the status along with all information related to a particular property.

Check status Mutation of Property in Telangana

Step 5: Select the request number from the list; the applicant can view the status along with all information related to a particular property.

Request number Mutation of Property in Telangana

Status, along with all other details, is here:

Request number Mutation of Property in Telangana

Status, along with all other details, is here:

Application status Mutation of Property in Telangana

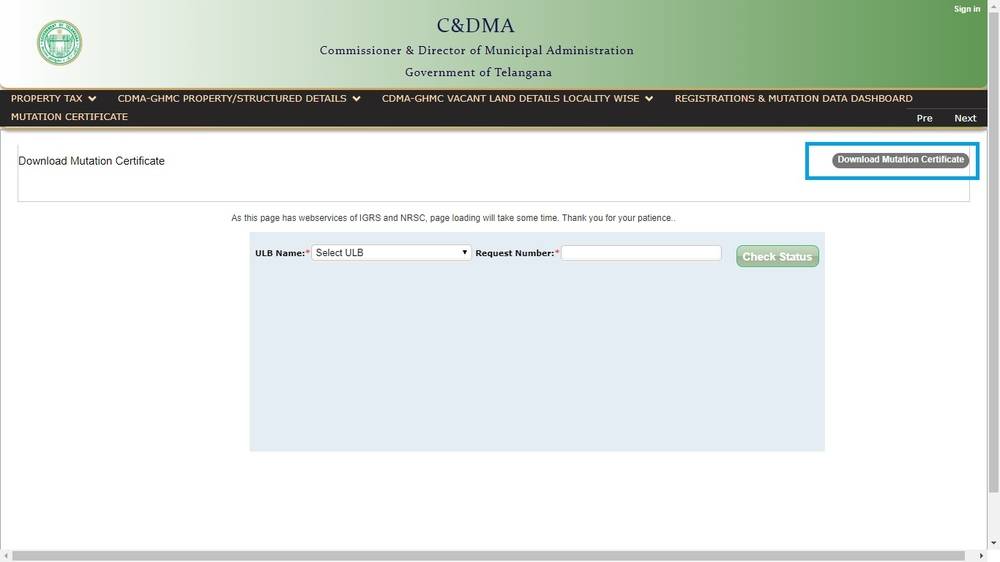

Step 6: The applicant can also search for the status by selecting the ULB name from the drop-down menu and enter the request number. Click on check status button.

Application status Mutation of Property in Telangana

Step 6: The applicant can also search for the status by selecting the ULB name from the drop-down menu and enter the request number. Click on check status button.

Download Mutation Certificate

The applicant can download the Mutation Certificate through CDMA Web Portal using the Unique Mutation Application request number. Download mutation certificate Mutation of Property in Telangana

Select ULB name from the drop-down menu and enter request number. Click on download mutation certificate. The applicant can get the certificate. After mutation, the new owner of the property has to pay all taxes in his name at the respective village office Commissioner & Director of Municipal Administration. Using assessment Number (10 Digit PTI Number), the new owner can pay property tax online in Telangana.

Download mutation certificate Mutation of Property in Telangana

Select ULB name from the drop-down menu and enter request number. Click on download mutation certificate. The applicant can get the certificate. After mutation, the new owner of the property has to pay all taxes in his name at the respective village office Commissioner & Director of Municipal Administration. Using assessment Number (10 Digit PTI Number), the new owner can pay property tax online in Telangana.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...