Last updated: April 25th, 2019 2:05 AM

Last updated: April 25th, 2019 2:05 AM

Nari Arthik Sashaktikaran Yojana

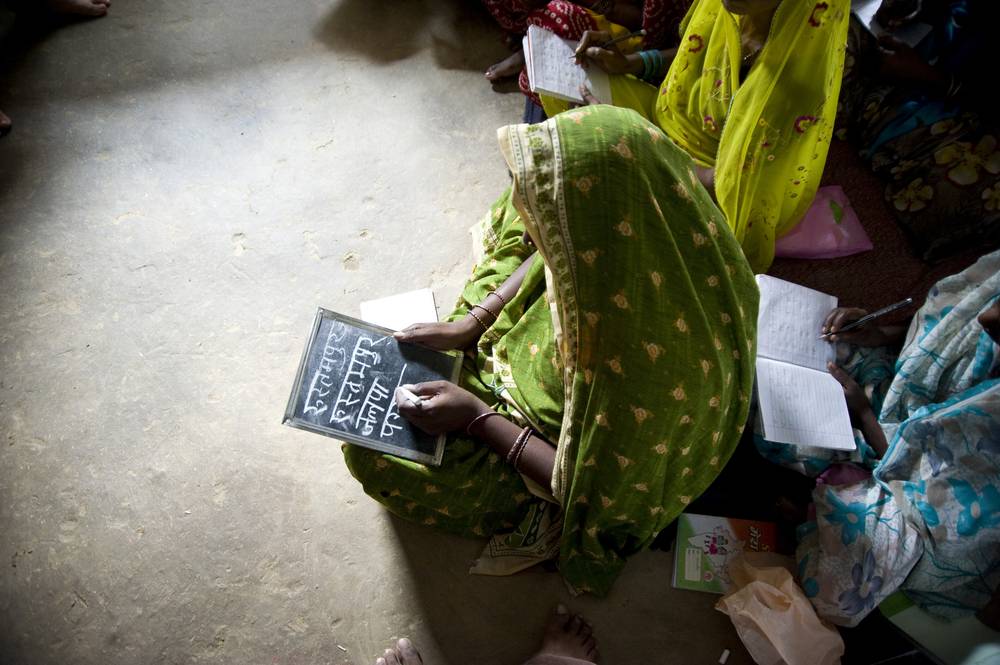

National Scheduled Castes Finance and Development Corporation (NSFDC) has initiated the Nari Arthik Sashaktikaran Yojana to support the Single Women or Divorcee who take up income generating activity. It aims to finance for the economic empowerment of persons belonging to the Scheduled Castes (SC) families those who are living below the poverty line and also ensures their skill upgradation. In this article, we look at the Nari Arthik Sashaktikaran Yojana in detail.Eligibility Criteria

The eligibility criteria for coverage of beneficiaries under the Nari Arthik Sashaktikaran Yojana shall be as follows:- The applicant must be belonging to the Scheduled Castes.

- The annual income of the family must be below the poverty line limit as prescribed timely. In rural areas, the income limit should be up to Rs. 98,000/- and in urban areas, it is limited to 1,20,000/-

- The applicant must be either Widow, Divorcee, Single Mother, or Single Women aged above 35 years

- The age of the applicant must be between 25-50 years to apply for this loan

- All women registered under Widow Pension Scheme who must meet the conditions as per above-given conditions that would also be eligible for loans under the Scheme.

Unit Cost

The applicants who are eligible can avail the financial assistance under any of NSFDC’s Schemes as per unit cost prescribed for the Schemes.Quantum of Assistance

NSFDC aims to provide loans only to economically poor sections of Scheduled Castes to promote and improve the economic development activities. The beneficiary of the scheme, selected for Financial Assistance under the NSFDC receives the subsidiary under the National Loan Scheme of NSFDC Loan Policy. The margin money will be provided by the SCAs and subsidy provided only to the Below Poverty Line (BPL) beneficiaries those who are under the Central Sector Scheme of Special Central Assistance to the Special Component Plans for Rs.10,000 or 50% of the unit cost, whichever is less. The selected beneficiaries under this Scheme can also be considered for assistance under NSFDC’s Skill Training Programme to undergo various vocational and entrepreneur development training in reputed institutions.Loan Amount

- The SCA will be providing 2% of the loan amount for the beneficiaries as a grant for the purpose of taking out ‘handholding activity’ covered under the Scheme and this subject to a maximum of amount of Rs. 4000 per unit.

- The beneficiaries those who are covered under the Scheme would be eligible to avail the further assistance given for the expansion of business after 2 years of availing the first loan provided only if the repayment is regular.

Interest Rates

The NSFDC may charge a moderate interest from the applicants under Nari Arthik Sashaktikaran Yojana (NASY) at 1% per annum. The SCAs, which in turn, will charge 4% per annum from the beneficiaries.Repayment Period

The loan under the NASY must be repaid in quarterly instalments by the applicants, within a maximum of 10 years period including moratorium period. The Moratorium Period will be from 3 months to 24 months depending upon the nature of the scheme.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...