Updated on: February 17th, 2020 12:20 PM

Updated on: February 17th, 2020 12:20 PM

Income Certificate in Kerala

Income certificate document serves as a proof of annual income of a person or family. Income certificate is issued by Village or Taluk Officer in Kerala. Income certificate can be used for availing subsidies provided by the Kerala Government. In this article, we look at the procedure for obtaining an income certificate in Kerala.Importance of Income Certificate

The following are some of the important reasons for obtaining income certificate:- Income certificate needs to be produced to avail tax relaxation at the time of property purchase

- To avail fee concession in an education institution, income certificate need to be furnished

- Income certificate is an important document to obtain a loan from banks and financial organization in Kerala

- Income certificate is mandatory to get some types of pensions in India

- Income certificate may be necessary at the time of admission in school

- For securing seats in the quota reserved in educational institutions, income certificate has to be submitted

- Income certificate is mandatory to avail subsidies and scheme introduced by the Government

Calculate Income for Income Certificate

Before applying for income certificate, the applicant must calculate the income of a family, i.e. the income earned by the family members. The income of the family is a sum of income from the applicant, spouse, father, mother and unmarried family members. To calculate income, the total income from the following sources are necessary:- Income from Land

- Salary of the family member

- Pension amount

- Income from business

- Income from labour

- The income of NRI Member

- Rental income

- The income of widow daughter or sister

- Family pension

- Surrender leave salary

- Festival allowance

- Terminal benefits

Documents Required

Following documents are necessary to apply for income certificate in Kerala:- Ration Card

- Proof of Identify

- Proof of Income

- Land Tax

- Salary Certificate

- Basic Tax Payment Receipt

Processing Time

Time Frame to issue the income certificate is 7 days from the date of application.Validity

Kerala income certificate is valid for 1 year from the date of issue.Applicable Fee

The fee structure for obtaining income certificate in Kerala is below:Akshaya Fee for Income certificate

In case of income certificate application through Akshaya Centre, a fee of Rs. 28 have to be paid. (Akshaya service charge is Rs.18, Government service charge is Rs. 7 and per page for scanning or printing is Rs.3). For SC or ST families the fee is only 12 rupees. For getting income certificate, Below Poverty Line (BPL) family members need to pay Rupees 20 for the certificate.Fee for Online Application

To apply income certificates online through the e-District portal, an amount of Rs.15 to be paid.Applying through Akshaya Centers

Procedure to apply for income certificate through Akshaya Centers in Kerala are below with explanation: Step 1: Visit the nearest Akshaya Service Centre. Step 2: The applicant needs to put in the application request for the income certificate online at the Akshaya Service Centre. Step 3: Submit all necessary documents (as mentioned above) to the Akshaya service person. The request for income certificate will be forwarded to the Departmental backend application. Note: Applicant will get application number through SMS to registered mobile number and also get SMS regarding the progress of the application. Step 4: The Department will process the income certificate request, and after successful verification, the authorized Government Officer will issue the Income Certificate by digitally signing it. Step 5: After the reading of the applicant's income certificate, an SMS will be sent. Revisit any Akshaya centre. Step 6: Provide the application number to service centre person, he or she will provide the income certificate from the application repository. Step 7: Applicant can get a printed copy of the electronic Income certificate. It can be used for all purposes.Apply for Income Certificate Online

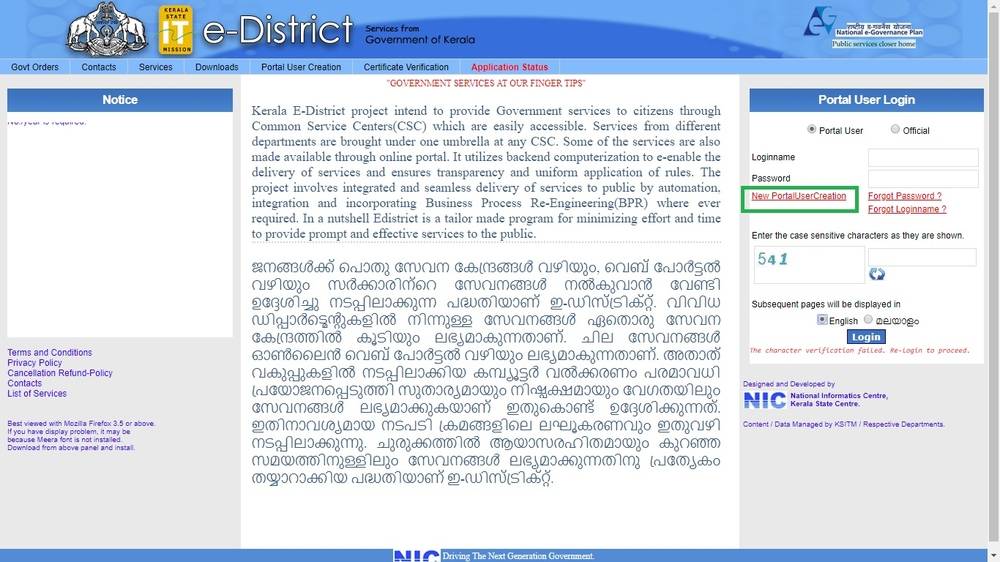

Follow the below-mentioned step by step guidelines to obtain income certificate online in Kerala: Step 1: Applicant needs to visit the main page of the e-District portal.e-District Registration

Note: To avail online certificate services, applicants have to register in the e-district web portal. Step 2: To register online in e-District click on Portal user registration link from home page. The page will redirect to next page. Image 1 Income Certificate Kerala

Step 3: Provide personal details and Select login name and password. Applicants need to select password recovery question and fill the answer.

Image 1 Income Certificate Kerala

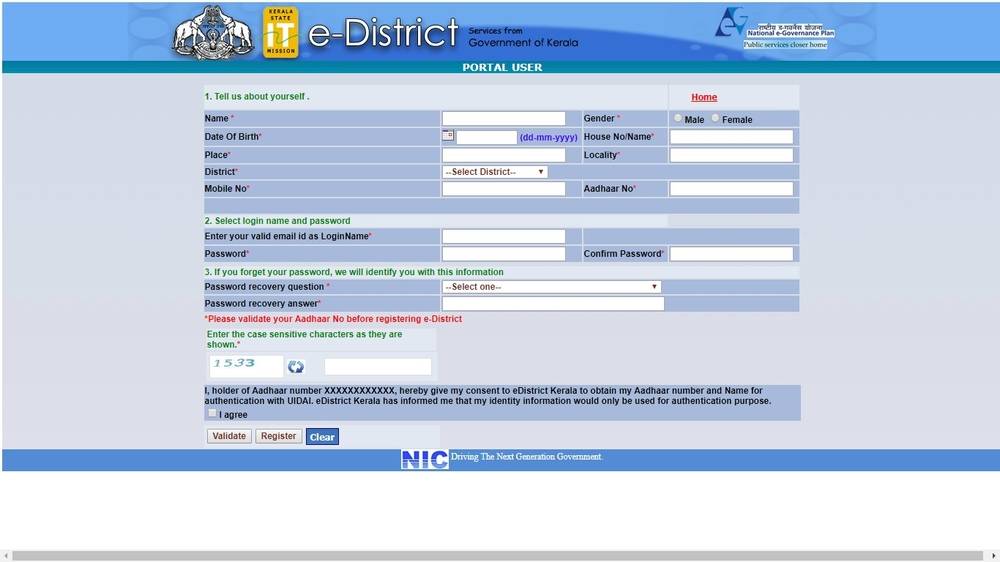

Step 3: Provide personal details and Select login name and password. Applicants need to select password recovery question and fill the answer. Image 2 Income Certificate Kerala

Step 4: Next step is to enter the shown case sensitive characters and declare the statement.

Step 5: Click on validate and further to register. Now the applicant can log in into the e-district portal using the username and password.

Image 2 Income Certificate Kerala

Step 4: Next step is to enter the shown case sensitive characters and declare the statement.

Step 5: Click on validate and further to register. Now the applicant can log in into the e-district portal using the username and password.

One Time Registration

The applicant has to do a onetime registration to avail income certificate services in e-District Kerala. Step 6: Click on the onetime registration button. Fill all mandatory details and click on the duplicate button. Note: This process will find out if the applicant has already registered through any Akshaya Centers or so and enable the applicant to pick all details. Step 7: After the successful duplicate check, the submit button will be enabled. Click on submit button to register. Note: The applicant can edit the registered details later by clicking 'Edit Registration'. Step 8: Applicant has to click on Applicant registration; the link will direct to the next page. Step 9: In this page click on the duplicate, the system will automatically check the duplicate application Step 10: After successful duplicate verification, Click on Submit. Step 11: To precede application, click on apply for the certificate and then click on get started. Submitting Income certificate application online through e-District is a 3 stage process:- Application details section

- Upload supporting documents

- Make payment and generate acknowledgement (Receipt)

Application Detail Section

Step 12: At first, the applicant needs to enter the e-District register number and select the certificate type as Income certificate and then select the certificate purpose. Step 13: Enter name and Select self for the relationship from the drop-down menu. Step 14: By clicking on save. The applicant will be redirected to the document uploading section.Upload Documents

Step 15: Upload all documents as mentioned above, such as Ration card, Voter ID, Income tax receipts and income proof documents. Note: The applicant can attach only PDF files. Maximum size of PDF is 100KB per page. Step 16: Once all the documents uploaded, make payment. Check entered details such as registration number, certificate type and all other information.Payment and Receipt Generation

After uploading documents, the fee for income certificate will be shown on the screen. Step 17: By any of the following methods, the applicant can pay the fee:- Net banking

- Debit card payment

- Credit Card Payment

- Cash-card prepaid

- Wallets

- IMPS

Download Income Certificate

Status of application will be displayed on the transaction history tab in the e-District portal. The applicant will also receive SMS regarding the status of the application. Step 19: After receiving the certificate issued SMS on the registered mobile number login into eDistrict. Download the digitally signed income certificate and take a print out.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...