Last updated: May 24th, 2024 1:18 PM

Last updated: May 24th, 2024 1:18 PM

Odisha Partnership Firm Registration

Partnership firm is a type of business entity in which two or more persons agree with a deed of partnership to share their profits as well as liabilities of the firm in a predetermined ratio. In Odisha, as per section 71 of the Indian Partnership Act, 1932 partnership firm can be registered with Registrar of Firms. In this article, we look at the procedure for registering a partnership firm in Odisha. If you need any assistance for registering a partnership firm registration in Odisha, get in touch with an India filings Advisor at sales@indiafilings.comAdvantages of Partnership Firm Registration

Easy to start: Compared to LLP (Limited Liability Partnership), partnership firms can be registered easy, as there is no need for obtaining DIN, DSC, and Name Approval. LLP registration falls into Central Government (Ministry of Corporate Affairs) laws while State Governments laws comprise Partnership registration. Know more about LLP Vs Partnership firm Business Name: As the name of a Partnership firm is not registered, a Partnership firm can choose to have any name as it does not violate the terms subject to trademark registration. However, in case of not registering the name, any other person can also use the same business name unless trademark registration is obtained. Know more about online trademark registration Annual Filing NOT Required: A Partnership firm is not required to file its annual accounts with the Registrar each year, unlike a Limited Liability Partnership or Company. Limited Liability Partnership's and companies are required to file their annual accounts with Registrar of Companies each year. Know more about company annual return filingChoosing the Partnership Name

The partners can easily choose any name as they require for their partnership firm subject to the following rules:- The names must not be too identical or similar to the name of another existing firm doing related business to avoid duplication in the firm names.

- The name must not include words like Crown, Emperor, Empress, Empire or the words indicating the sanction, approval of Government except when the State Government signifies its consent in writing to the use of such words as part of the firm name.

Drafting Partnership Deed

A Partnership Deed is an agreement in which the respective terms and conditions of the members of a partnership are stated. The Partnership deed consists of following characteristics they are mentioned below:- Both Partners and Firm name as well as address.

- Business nature to be carried on by partners

- Date of business commencement

- The term of Partnership (whether for a fixed period/project)

- Capital contribution from each partner

- Profit sharing ratio among the partners

- Interest on Partner's Capital, Partners' Loan, and Interest, if any, to be charged on drawings.

- Salaries, Commissions etc., if any, payable to partners

- Method of preparing accounts and arrangement for audit

- Division of task and responsibility, i.e. the duties, powers and obligations of all the partners of the firm.

- Terms and conditions to be followed in case of retirement, death and admission of a partner.

Documents Required

- The required documents are to be submitted while submitting the application form.

- Form No. 1 (Application for registration under Partnership Act)

- Original copy of Partnership Deed, signed by all partners.

- Affidavit declaring the intention to become the partner

- Rental or lease agreement of the property/campus on which the business is set.

- Self-attested proof of Identity of the partners.

- All related documents as per the proposed business activity of the firm.

- Self-addressed stamped envelope required for sending the certificate and objections if any.

- Partnership deed affixed with Non-Judicial stamp duty of Rs.200/- and registered by concerned sub-Registrar or notarized by any notary public.

- Treasury challan of Rs.2 towards application fee.

- Treasury challan of Rs.3 towards registration fee.

Partnership Firm Registration Application

The application form for the partnership firm registration in Odisha is displayed below for quick reference. The Copy of application Form No.1 under the Indian Partnership Act, 1932 to be submitted along with details of Partners of the firm (Name, Age, and Address) along with all other prescribed documents to the office of the Registrar of Firms (ICR, Odisha, Cuttack). Upon submission, the applicant will be provided with an acknowledgement of registration of firm.Online Partnership Firm Registration

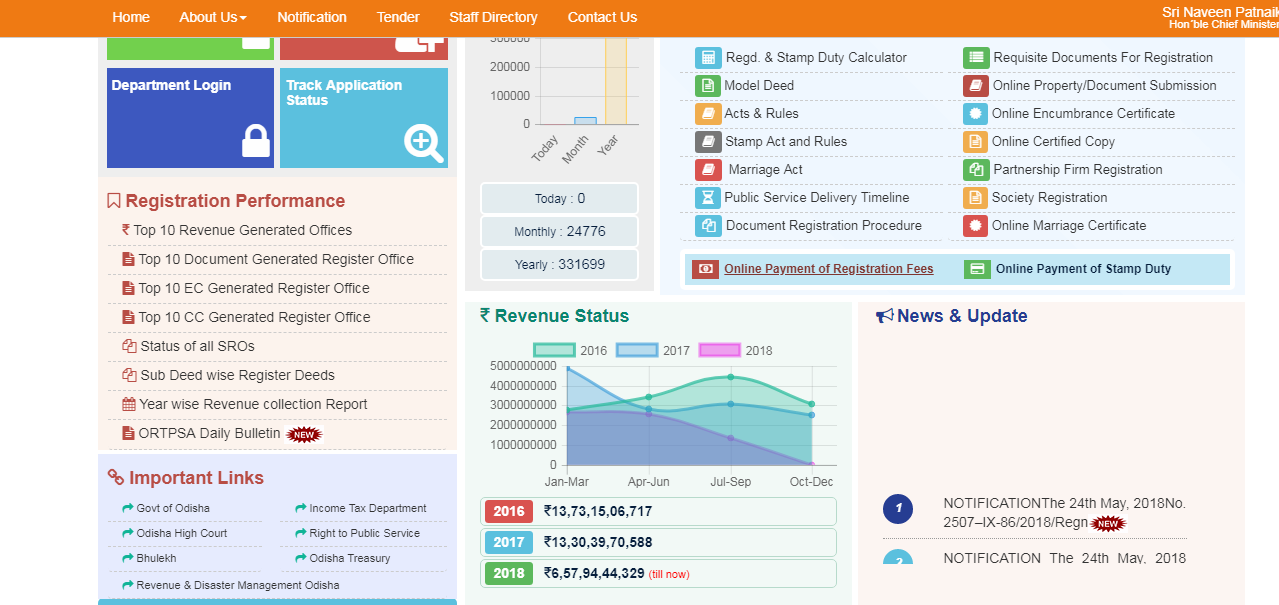

To register for partnership firm registration in Odisha, follow the steps mentioned here: Step 1: The applicant has to visit the official website of Odisha Government. Step 2: Click on "Partnership Firm Registration" which is displayed on the home page of the web portal. [caption id="attachment_56655" align="aligncenter" width="604"] Step 2 Odisha Partnership Firm Registration

Step 3: Now, the user needs to enter the required details for user login.

[caption id="attachment_56656" align="aligncenter" width="563"]

Step 2 Odisha Partnership Firm Registration

Step 3: Now, the user needs to enter the required details for user login.

[caption id="attachment_56656" align="aligncenter" width="563"] Step 3 Odisha Partnership Firm Registration

Step 4: After entering the details and then click on "Submit" button.

Step 5: The application form will open on the next screen for registration of partnership firm.

Step 6: Fill up the application form with the prescribed information regarding the firm and partners of the firm and attach the required documents along with the application.

Step 7: After applying, the applicant can proceed with online payment for the successful registration.

Step 8: Then the application will be forwarded to the Registrar officer for verification.

Step 9: Once verified the application status would be updated to the applicant through SMS or mail.

Step 10: Finally, the applicant can download the digitally signed document of partnership firm through online.

Step 3 Odisha Partnership Firm Registration

Step 4: After entering the details and then click on "Submit" button.

Step 5: The application form will open on the next screen for registration of partnership firm.

Step 6: Fill up the application form with the prescribed information regarding the firm and partners of the firm and attach the required documents along with the application.

Step 7: After applying, the applicant can proceed with online payment for the successful registration.

Step 8: Then the application will be forwarded to the Registrar officer for verification.

Step 9: Once verified the application status would be updated to the applicant through SMS or mail.

Step 10: Finally, the applicant can download the digitally signed document of partnership firm through online.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...