Updated on: December 17th, 2019 6:03 PM

Updated on: December 17th, 2019 6:03 PM

Odisha Solvency Certificate

Odisha solvency certificate is proof of solvency which means that the person’s assets are more than his liabilities. Solvency certificate certifies an individual’s creditworthiness. The Government of Odisha issues solvency certificate to verify the solvency of a person who undertakes certain works or functions. In this article, we will look at the procedure to obtain an Odisha solvency certificate in detail.Legal Framework

In Odisha, solvency certificate is issued by Odisha Miscellaneous Certificate Rules, 1984 under the Department of Revenue & Disaster Management, Government of Odisha.Benefits of Odisha Solvency Certificate

Odisha solvency certificate can be used in many places; some of the essential uses of solvency certificate are given here:- Odisha solvency certificate proves the financial stability of an individual or entity

- This certificate indicates one’s history which he has earned with his previous dealings with other financial institutions from where he had earlier availed of loans.

- This certificate helps to get financial support by way of loans from banks or other financial institutions

- The Odisha solvency certificate authenticates that a person is not a declared insolvent.

- Solvency certificate is usually used to prove financial strength while applying for a visa interview

- Solvency certificate is an essential document for Government departments or other organisations for applying for tenders or similar purposes

- Many companies require solvency certificate for auditing purpose

- This is particularly very useful for students who wish to pursue higher education abroad as most universities need this certificate

- Solvency certificate is mandatory for seeking admission in Government medical or engineering colleges

- This certificate plays a crucial role in court matters like obtaining bails.

- Solvency certificate is needed for submitting to the property sales tax in Odisha

Attributes in Odisha Solvency Certificate

Solvency certificate contains the detailed particulars of property (movable or immovable property) in addition to this the amount for which the person’s solvent and the assets considered for computing the solvency will be mentioned in Odisha solvency certificate.Assets Considered

The below-mentioned details will be considered in an Odisha solvency certificate:- Aspects of District, Taluk and Village of the property

- Old survey and Subdivision number of the property

- Information regarding the re-survey block

- Resurvey, and subdivision number will be considered for computing the solvency

- Land mutation number

- Class and Extent of land in Hector

- Market value and Fair Value of the property

- Details of Liability Amount

Eligibility Criteria

The eligibility criteria to obtain Odisha solvency certificate is given here:- Permanent residence of Odisha can apply for solvency certificate in the respective Tahasil

- The person having his or her landed property in Odisha is entitled to obtain Solvency Certificate

Time Frame

Odisha solvency certificate will be issued within 30 days from the date of application.The validity of Solvency Certificate

Odisha solvency certificate is valid for one year from date of issuing.Applicable Fee

The fee structure for obtaining Kerala solvency certificate is explained in details below.| S.No | Services | Amount |

| 1 | Service Charges of the kiosk Operator | Rs.8 |

| 2 | Printing Charges | Rs.10 |

| 3 | Scanning Charges | Rs.5 |

| 4 | Certificate Output Charges | Rs.10 |

| 5 | DeGS charges | Rs.2 |

| 6 | The Government fees and User costs | Rs.30 |

Prescribed Authority

Revenue and Disaster Management, Government of Odisha, is the concerned department for the issuance of Odisha solvency certificate. The applicant requesting for the solvency certificate should apply to the Tahsildar of the concerned Tahasil which is the competent authority. The following officer will process the Odisha solvency certificate:- Chief Officer in Charge of Revenue Administration of the concerned & District, Sub-division/Tahasil

- Additional District Magistrate

- Additional Tahasildar

Documents Required

Below-mentioned documents must be furnished to apply for Odisha solvency certificate.- Ration Card

- Proof of Identify – Voter ID

- Proof of Address – Aadhaar Card

- Proof of ownership of property

- Land Tax

- Extract of Records of Rights

- Encumbrance certificate (This document is evidence that the property in question is free from any monetary and legal liabilities)

- Proof for Income Sources – Income certificate

Applying through District Revenue Office

Guidelines for applying Odisha solvency certificate through District Revenue Office in is described in detail here.Approach District Revenue Office

Step 1: Applicant needs to visit the District Revenue Office to apply for solvency certificate through offline mode.Submit an Application

Step 2: Applicant has to submit an application in the prescribed format for the Odisha solvency certificate. Get the solvency certificate application form from office and fill duly according to the norms. Submit all other required documents to the concerned office along with application form.Get Acknowledgement Receipt

Step 4: Obtain an acknowledgement slip with the unique application number for solvency certificate application. Keep it safe for future reference. Step 5: Once the application for Odisha solvency certificate has been submitted; the concerned authority will process the solvency application.Local Enquiry by the Revenue officer

Step 6: A local enquiry will be conducted for verifying the applicant’s immovable properties, the income and sourcesObtain Odisha Solvency Certificate

After local investigation and the request for solvency certificate has been approved, the concerned revenue officer will issue a solvency certificate. Revisit the office and provide the unique application number. You can collect the Odisha solvency certificate, and it can be used for the purpose mentioned above.Applying for Odisha solvency certificate through CSC centre

Procedure to get Odisha solvency certificate through CSC centre is explained in detail below.Approach CSC centre

Step 1: Applicant needs to approach the nearest CSC centre for obtaining a solvency certificate.Submit an Application

Step 2: The applicant has to apply in the prescribed format for obtaining Odisha solvency certificate at the CSC centre. The application form for getting the Odisha solvency certificate is enclosed here. Provide the following details in the application form:- Personal information Parents Details

- Spouse Details

- Contact Details

- Permanent address

- Details of submitter

- Purpose of obtaining solvency certificate

- Land Record Details

- Plot Details

- Solvency Certificate for the amount (in Rs.)

Application Processing

Step 4: The concerned authority, Tahasildhar will process the solvency certificate request. Step 5: After downloading all verification and proceeding documents, Tahasildhar will take action for issuing an Odisha solvency certificate.Application Status

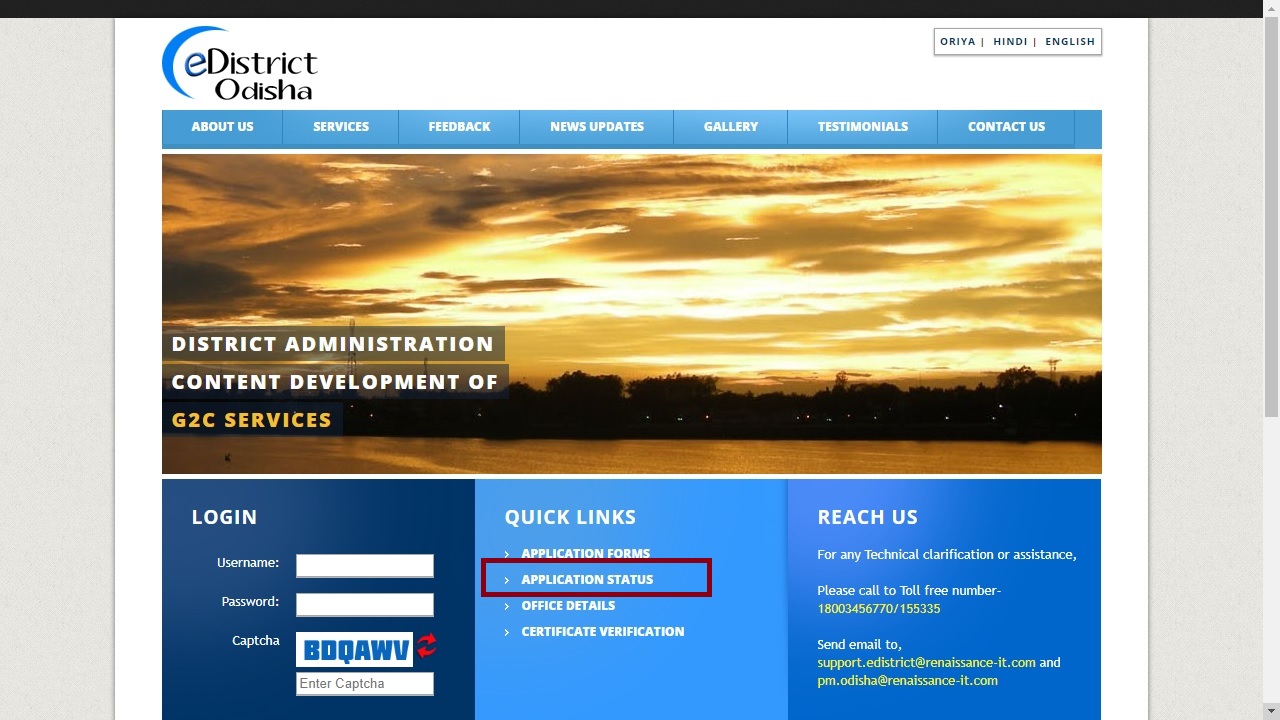

Odisha solvency certificate application status will be updated through SMS. The applicant can also track application status from the Odisha e-District portal home page. Image 1 Odisha Solvency Certificate

Enter your solvency application number and click on search button, solvency certificate application status will be displayed.

Image 1 Odisha Solvency Certificate

Enter your solvency application number and click on search button, solvency certificate application status will be displayed.

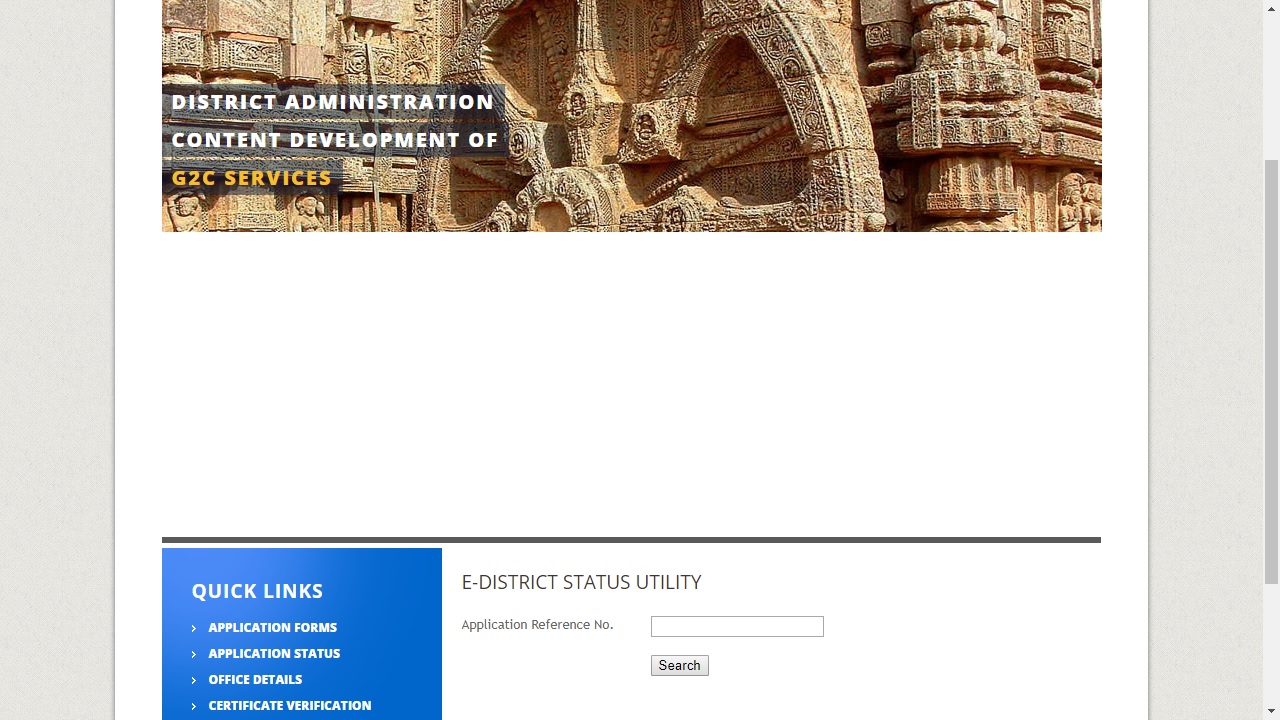

Image 2 Odisha Solvency Certificate

Image 2 Odisha Solvency Certificate

Verify the Solvency Certificate

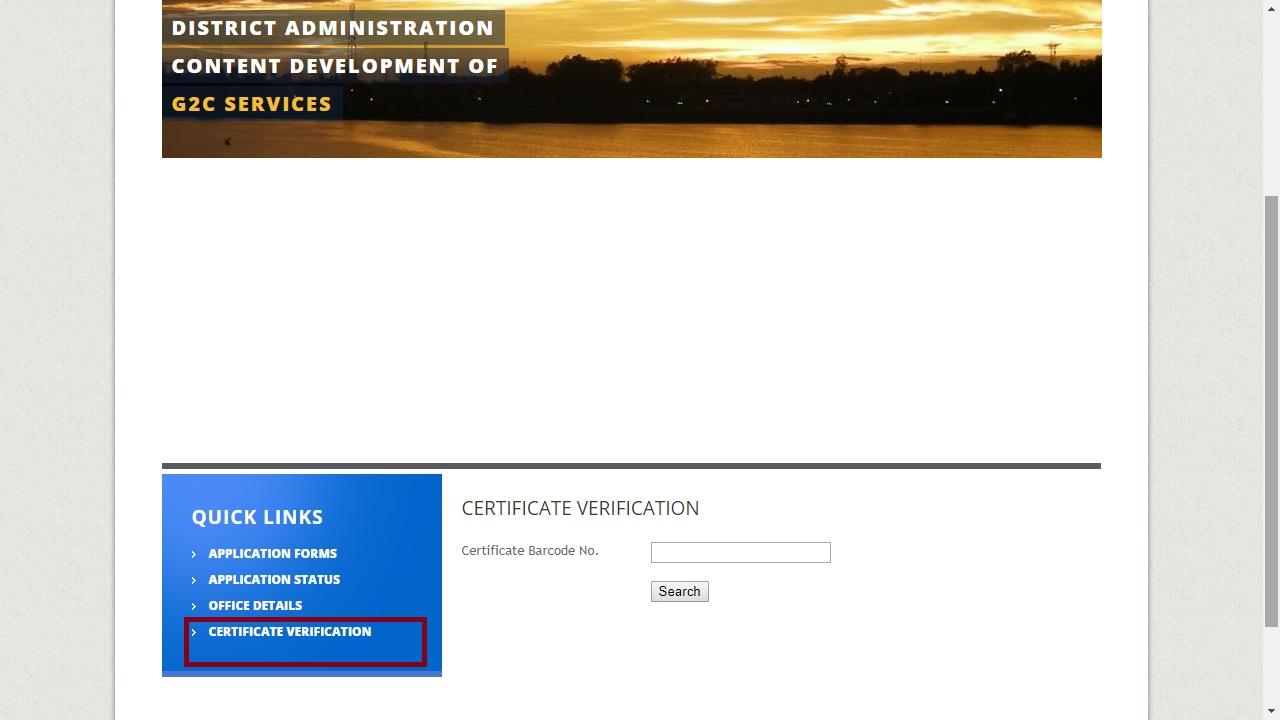

Once the applicant’s solvency certificate request is accepted, an SMS will be sent to registered mobile number as the application has been approved. Image 3 Odisha Solvency Certificate

Verify the Odisha solvency certificate details in the Odisha e-District portal by entering application number.

Image 3 Odisha Solvency Certificate

Verify the Odisha solvency certificate details in the Odisha e-District portal by entering application number.

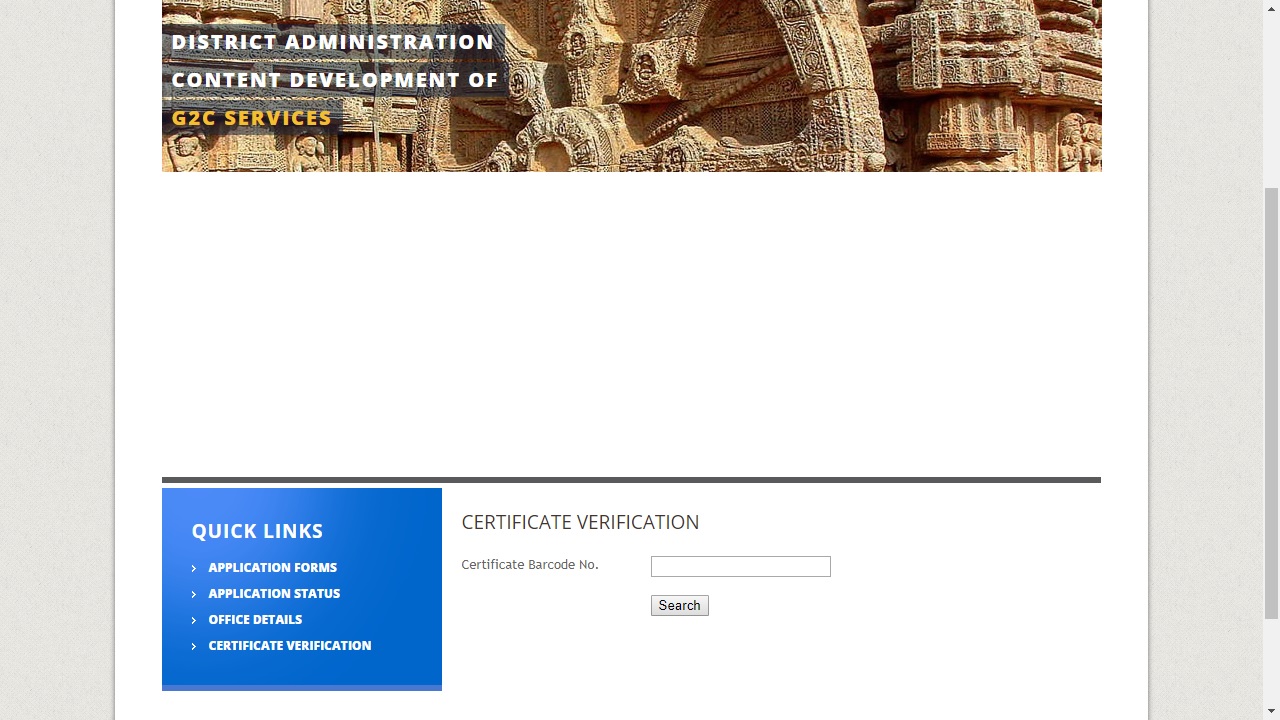

Image 4 Odisha Solvency Certificate

Image 4 Odisha Solvency Certificate

Get Odisha Solvency Certificate

After verification, if Revenue officer (Tahasildhar) approves the request for solvency certificate, Odisha solvency certificate can be downloaded. Revisit CSC centre and provide the application number. CSC centre person will provide the digitally signed Odisha Solvency Certificate. It can be used for all purposes as mentioned above.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...