Updated on: June 9th, 2023 8:11 PM

Updated on: June 9th, 2023 8:11 PM

Odisha Vehicle Tax

Odisha vehicle tax is levied as excise duty on every motor vehicle used or kept for use in Odisha at the rates specified by the State Government for each type of vehicle. The Government of Odisha has conferred the power of levying vehicle tax under the Odisha Motor Vehicle Taxation (Amendment) Act, 2017. According to this Act, the registered owner or any person having possession control of a motor vehicle has to pay Odisha Vehicle Tax. On payment of Odisha Vehicle Tax, State Transport Authority of Odisha issues a license to the registered owner. In this article, we will look at Odisha Vehicle Tax in detail.Odisha Motor Vehicle Taxation Act

Odisha Motor Vehicle Taxation (Amendment) Act, 2017 consolidates the laws relating to the levy of tax on motor vehicles, passengers and goods carried by such vehicles in Odisha. According to this OMVT act, no vehicle tax will be levied on the motor vehicles kept by a dealer or a manufacturer for trade and used under the authorization of a trade certificate granted by the registering authority. Know more about the Input Tax Credit on Motor VehicleOdisha Vehicle Tax – Applicability

According to Vehicle Taxation Act, the person who has transferred the ownership or has halted to be in possession or control of the following vehicle has to pay Odisha Vehicle Tax- Motor Cycle

- Jeeps

- Maxi cabs

- Motor Cars

- Omnibuses (not exceeding 2286 kgs in ULW) used personally or kept for personal use

- Private service vehicle

- Educational Institution buses

Odisha Vehicle Tax – Exemption

Below-mentioned vehicle owners are exempted from the payment of Odisha Vehicle Tax:- The vehicles used only for agricultural purposes are exempted from the payment of Odisha vehicle tax.

- The vehicles owned by disabled persons used solely for the conveyance of those persons can claim exempt from the amount of vehicle tax.

Odisha Vehicle Tax Schedule (Rate)

Odisha Government will specify the rate of the vehicle tax rate for each type of vehicle. The Odisha State Government has the powers to increase the rate of vehicle tax from time to time.Additional Tax

According to the provision of Odisha Motor Vehicle Taxation Act, an additional tax will be levied on every public service vehicles and goods carriage used or kept of use within Odisha. You can refer the below-mentioned document to refer to the rate of Additional Tax. You can get up to date Odisha Vehicle Tax rate details from the official website of Odisha Motor Vehicle Department. You can refer the Additional tax current rate from the document enclosed here.One-Time Tax

One time tax needs to be paid at the time of its first registration. Omnibus and Motor Cab need to pay a one-time tax at the rate equal to a standard rate as specified in schedule or five per centum of the cost of the vehicle whichever is higher. The rate of one-time tax will be calculated based on the cost of such vehicle prevalent on the date of its first registration. The cost of the vehicle will include taxes and duties charged by the Dealer. The levy and payment of one-time tax will be for the lifetime of the vehicle in respect of tax is paid.- The levy and payment of one-time tax will be compulsory in respect of vehicles registered on or after the appointed date. Its optional in respect of the vehicles registered before that date.

One Time Tax for New Motor Vehicle

The rate of one-time tax for New Motor Cycle with or without attachment is tabulated here:| Sl.No | Cost of Motor Cycle | Rate of Tax |

| 1 | Not exceeding five lakh rupees | 6 % of the cost of Motor Cycle |

| 2 | Exceeding five lakhs but not exceeding ten lakh rupees | 8% of the cost of Motor Cycle |

| 3 | Exceeding ten lakhs but not exceeding twenty lakh rupees | 10% of the cost of Motor Cycle |

| 4 | Exceeding twenty lakhs but not exceeding forty lakh rupees | 12% of the cost of Motor Cycle |

| 5 | Exceeding forty lakh rupees | 20% of the cost of Motor Cycle |

One Time Tax for New Vehicles

The rate of onetime tax for Motorcar, Jeep, Private Service vehicle and Educational Bus which is constructed to carry not more than twelve persons excluding Driver, Omnibuses, motor cab and the taxi cab is tabulated here:|

Sl.No |

Cost of Motor Vehicle |

Rate of Tax |

| 1 | Not exceeding five lakh rupees | 6 % of the cost of Motor Vehicle |

| 2 | Exceeding five lakhs but not exceeding ten lakh rupees | 8% of the cost of Motor Vehicle |

| 3 | Exceeding ten lakhs but not exceeding twenty lakh rupees | 10% of the cost of Motor Vehicle |

| 4 | Exceeding twenty lakhs but not exceeding forty lakh rupees | 12% of the cost of Motor Vehicle |

| 5 | Exceeding forty lakh rupees | 20% of the cost of Motor Vehicle |

Differential Tax

If any motor vehicle tax for any period has been paid and is altered during such period the registered owner or the person having possession or control of the vehicle, will have to pay differential tax. The rate of differential tax is equal to the difference between the tax already paid and the tax need to be paid in respect of the vehicle for the period for which the higher rate of tax is payable in consequence of the alteration or proposed user Note: In determining the differential tax, any broken period in a month will be considered as a full month.Green Tax

The purpose of the implementation of various measures to control air pollution, the Government of Odisha has levied and collected an additional tax called a green tax. The Rate of green tax follows:- Transport vehicle, which has completed fifteen years from the date of its registration need to pay green tax at a rate of four thousand rupees, at the time of renewal of fitness certificate

- Vehicles other than a transport vehicle, which has completed fifteen years from the date of its registration need to pay green tax at a rate of one thousand rupees, at the time of renewal of renewal of a certificate of registration.

Prescribed Period for Tax Payment

The tax levied under OMVT act will have to be paid by the registered owner or by any other person having control or possession of the motor vehicle, at his/her choice, either half-yearly, quarterly or annually, on a license to be taken out by him/her for that quarter, half-year or year. The tax due under this OMVT act will have to be paid within the prescribed period, not being less than is seven days or more than forty-five days from the commencement of the quarter, half-year.Payment of Odisha Vehicle Tax – Offline Method

Odisha Vehicle Tax payment procedure is explained in step-step by procedure here: Step 1: The registered vehicle owner or the person having possession or control of the vehicle will have to be paid the Odisha vehicle tax in the office of the Taxation officer. Note: The place for payment of Odisha vehicle tax will be specified by Government of Odisha, from time to time and different office locations may be specified for the different class of vehicles. Step 2: The Odisha vehicle tax can be paid to the Taxation officer in cash. The payment made on cash will be deposited into an Odisha Government Treasury. Step 3: Along with the Odisha vehicle tax amount, the owner liable for vehicle tax need to submit a declaration form in a prescribed format to the Taxation officer. Note: The declaration form can be sent by registered post or by a duly authorised agent or can be presented in person to the Taxation officer. The declaration form can be obtained from any Taxation office, Secretary or any Secretary, Regional Transport officer.Payment of Odisha Vehicle Tax – Online Method

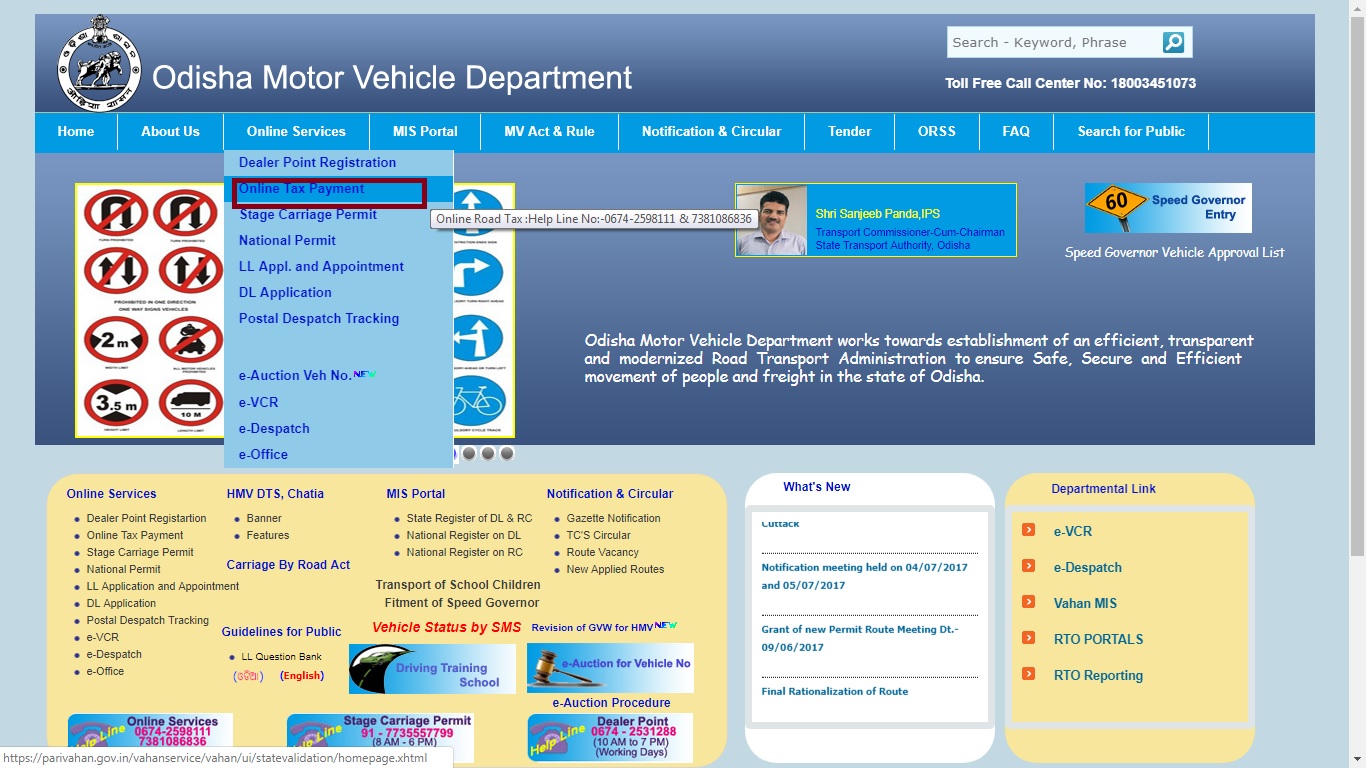

To pay Odisha vehicle tax online, you can follow the procedure as explained below: Step 1: Access the official website of Odisha Motor Vehicle Department. From the home page, select the Online Services option. Image 1 Odisha Vehicle Tax

Step 2: From the list of Online Services option, click on Online Tax payment. By clicking on this, you will be redirected to VAHAN Citizen Service portal.

Image 1 Odisha Vehicle Tax

Step 2: From the list of Online Services option, click on Online Tax payment. By clicking on this, you will be redirected to VAHAN Citizen Service portal.

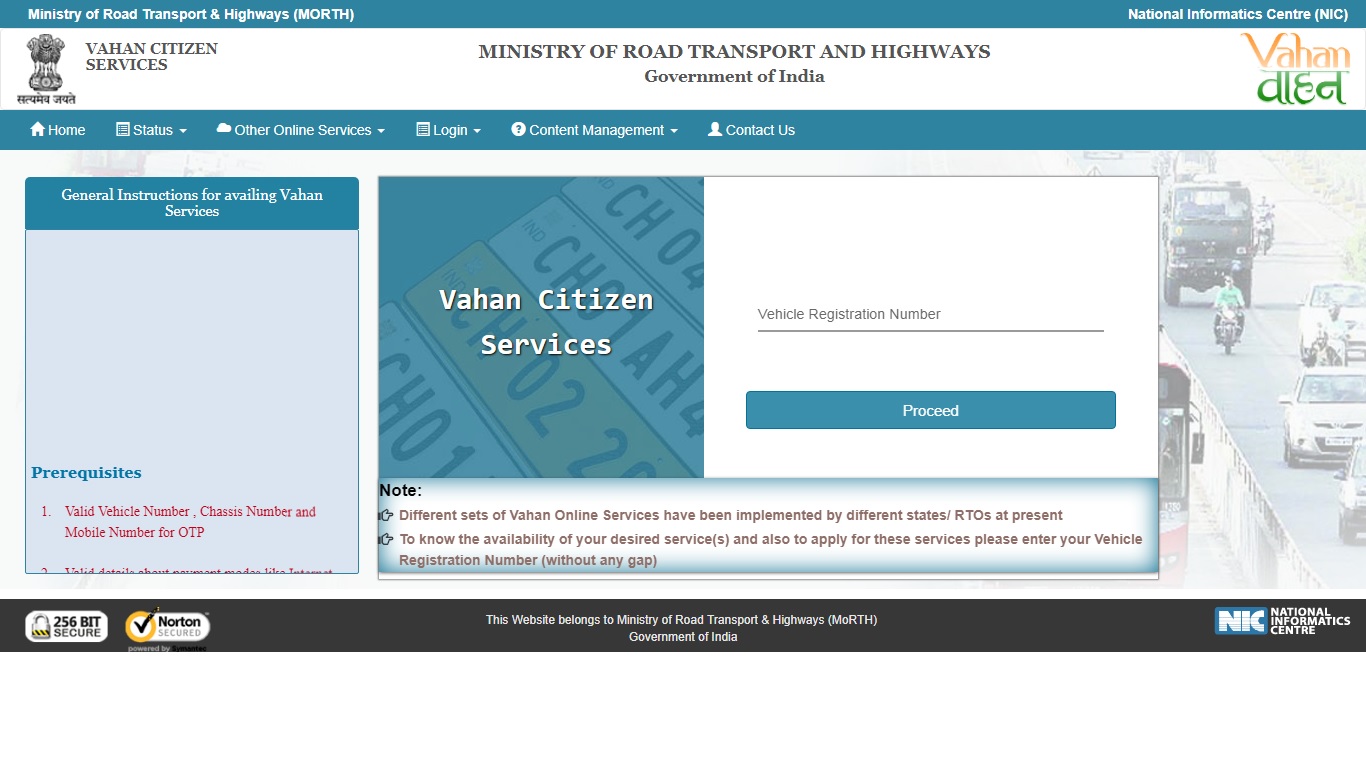

Image 2 Odisha Vehicle Tax

Step 3: In this page, enter Valid Vehicle Registration Number and click on Proceed.

Image 2 Odisha Vehicle Tax

Step 3: In this page, enter Valid Vehicle Registration Number and click on Proceed.

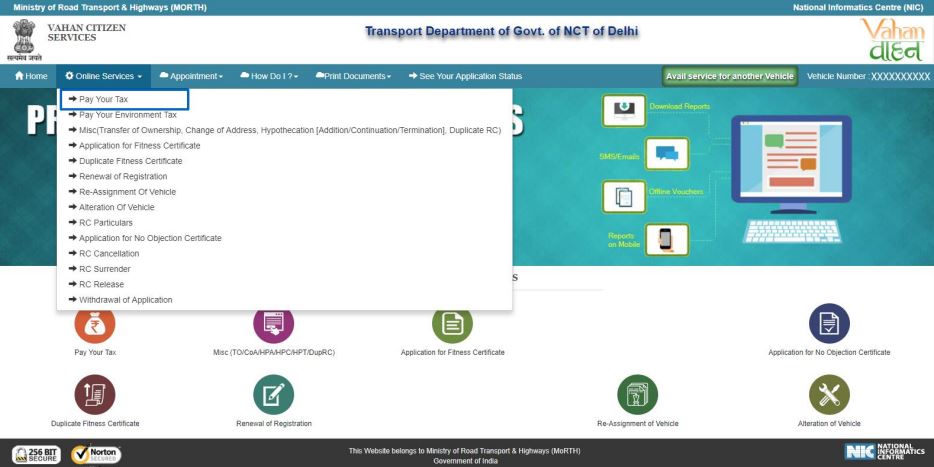

Image 3 Odisha Vehicle Tax

Step 4: You need to select the Pay Your Tax service from the drop-down Online Services menu.

Image 3 Odisha Vehicle Tax

Step 4: You need to select the Pay Your Tax service from the drop-down Online Services menu.

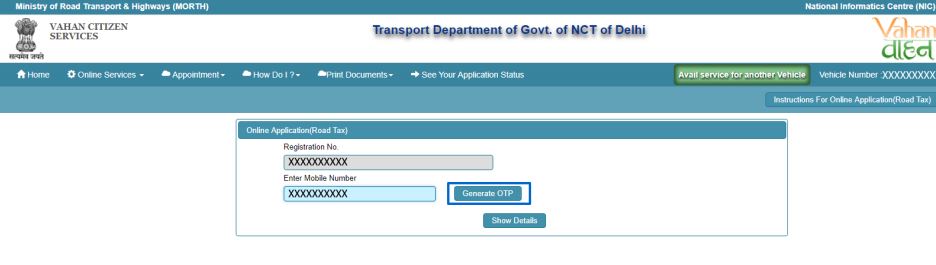

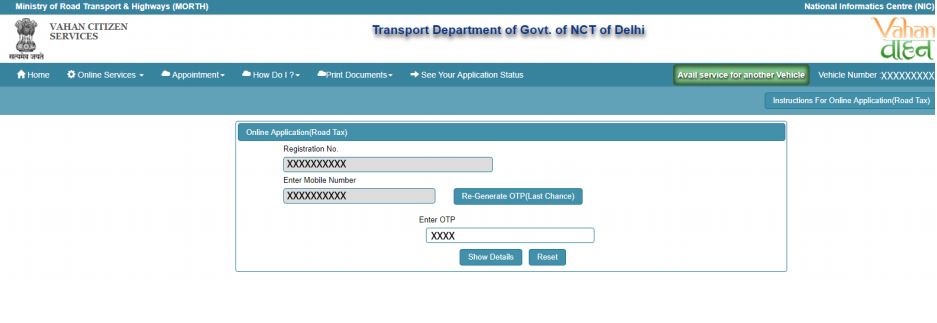

Image 4 Odisha Vehicle Tax

Step 5: Provide your mobile number and click on Generate OTP option. An OTP will be sent to the registered mobile number.

Image 4 Odisha Vehicle Tax

Step 5: Provide your mobile number and click on Generate OTP option. An OTP will be sent to the registered mobile number.

Image 5 Odisha Vehicle Tax

Step 6: You have to provide the received OTP in the box as depicted in the image.

Image 5 Odisha Vehicle Tax

Step 6: You have to provide the received OTP in the box as depicted in the image.

Image 6 Odisha Vehicle Tax

Step 7: Click on the show details button to proceed further with the application.

Step 8: Select tax mode from the drop-down menu and provide details. Once the details are provided, you can make payment by clicking on Payment option.

Image 6 Odisha Vehicle Tax

Step 7: Click on the show details button to proceed further with the application.

Step 8: Select tax mode from the drop-down menu and provide details. Once the details are provided, you can make payment by clicking on Payment option.

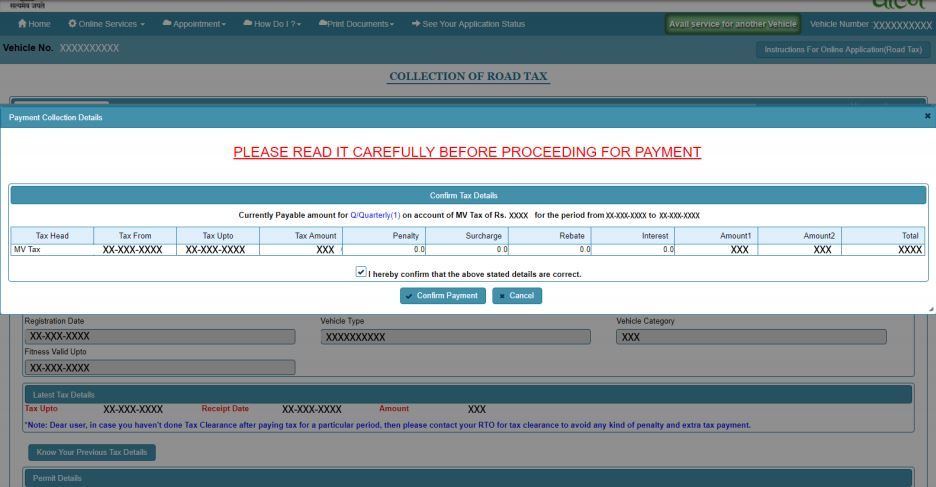

Image 7 Odisha Vehicle Tax

Step 9: Confirmation box will be shown. Confirm the details and proceed further to make payment.

Image 7 Odisha Vehicle Tax

Step 9: Confirmation box will be shown. Confirm the details and proceed further to make payment.

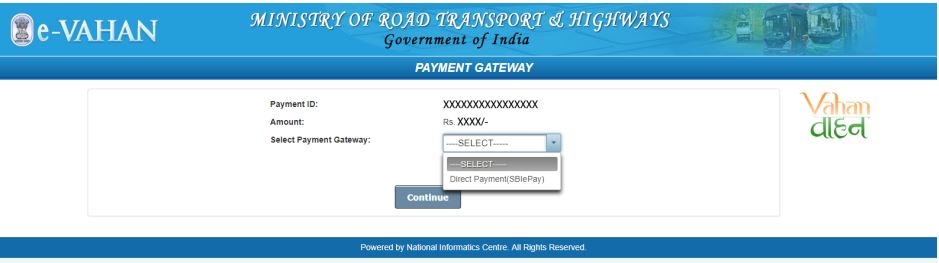

Image 8 Odisha Vehicle Tax

Step 10: Make a payment button will allow you to select the payment gateway. Select the Direct Payment (SBIePAY) payment gateway for the e-payment.

Image 8 Odisha Vehicle Tax

Step 10: Make a payment button will allow you to select the payment gateway. Select the Direct Payment (SBIePAY) payment gateway for the e-payment.

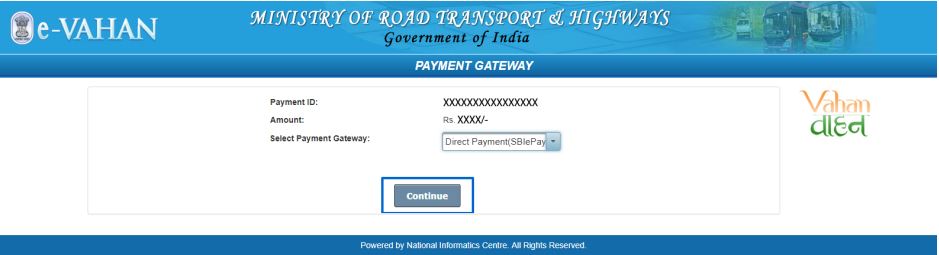

Image 9 Odisha Vehicle Tax

Step 11: Select the concerned bank and then click on the Continue option.

Image 9 Odisha Vehicle Tax

Step 11: Select the concerned bank and then click on the Continue option.

Image 10 Odisha Vehicle Tax

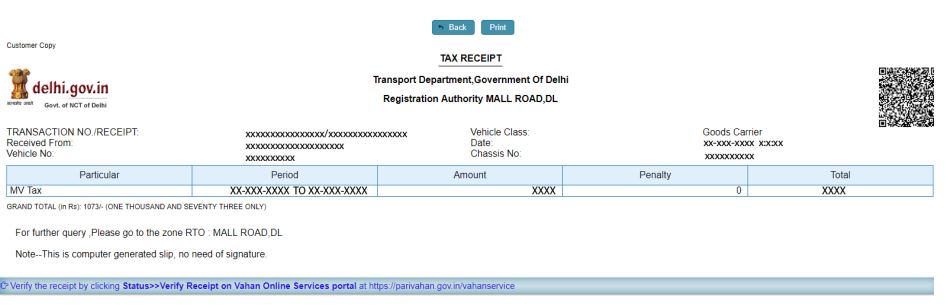

Step 12: On successful payment of Odisha Vehicle Tax, fee receipt will be generated. You can take print out of the receipt for future reference.

Image 10 Odisha Vehicle Tax

Step 12: On successful payment of Odisha Vehicle Tax, fee receipt will be generated. You can take print out of the receipt for future reference.

Image 11 Odisha Vehicle Tax

Image 11 Odisha Vehicle Tax

Issue of Token

After the payment of Odisha vehicle tax and all the supporting documents have been found in order, a token in the prescribed format will be provided to the registered owner or person having possession. The token contains the following information:- The amount paid

- The registration number of the vehicle

- The period for which the Odisha vehicle tax has been paid

Endorsement on Registration Certificates

The amount of penalty imposed under this OMVT act has been recovered along with the arrears of Odisha vehicle tax an endorsement in respect of such a recovery will be made on the certificate of registration.Payment of Vehicle Tax for Vehicles Registered in Other State

Payment of every tax due in respect of the transport vehicles of any other States used or kept for use in the public places in Odisha will be paid either by money order or by the bank draft for the value for which payment is required. The Odisha vehicle tax needs to be paid to the Secretary, Odisha Transport Officer.Display of Token

- The token issued will have to be displayed prominently on the motor vehicles at all times whether kept in any public place, or it is in use in a below-mentioned manner:

- In the case of motorcycles, motor tricycle, motorcycles with sidecars or the motor scooters in a visible place on the left side of the vehicle

- For other motor vehicles, a token needs to be affixed to the bottom left-hand corner of the windscreen facing forward

- In case the motor vehicle is not fitted with the windscreen, the toke need to be placed on some other visible place on the left-hand side of the vehicle

- The token need to be placed on the motor vehicle as to visible at all time by daylight to a person standing the left side of such motor vehicle whether such a vehicle is stationary or moving

- On expiry of the validity of the token, it must be removed on the expiry of the period

Issue of Duplicate Token

If the Odisha vehicle tax token is lost or destroyed, the fact needs to be reported to the Taxation officer. After verification, the Taxation officer will issue a duplicate token prominently marked as 'Duplicate'. To get the duplicate token, the owner needs to pay a fee of Rs. Two.Refund of Vehicle Tax

If a vehicle owner has paid excess tax in respect of a motor vehicle, he/she will be entitled to a refund:- In case of excess tax has been paid for any period due to over assessment by the Taxing Officer

- After payment of tax in respect of a vehicle, it is found that the vehicle is not subject to tax, such tax amount will be released refunded.

The Penalty for Failure to Pay Tax

If the Odisha vehicle tax due of any motor vehicle has not been paid, the registered owner or the person having possession will be liable to pay the penalty which may extend to twice the vehicle tax due in respect of that vehicle.Rebate on Payment of Annual Tax in Advance

A rebate of five per cent the amount of annual tax payable in respect of a motor vehicle will be allowed if such annual tax is paid in advance.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...