Last updated: August 23rd, 2024 5:57 PM

Last updated: August 23rd, 2024 5:57 PM

Online E-Tariff Rate Quota System for Imports

As part of the IT Revamp, the DGFT has introduced the Online E-Tariff Rate Quota System for Imports vide a Trade notification dated 4th February 2021. All applicants seeking Tariff Rate Quota (TRQ) for imports must apply online under “e-Tariff Rate Quota” in the Import Management System through the DGFT Website. The current article briefs the Online E-Tariff Rate Quota System for Imports.The Gist of DGFT Trade Notice

The Direct General of Foreign Trade has announced the following information to importers.- With effect from 8th February 2021 onwards, all applicants seeking Tariff Rate Quota (TRQ) for imports need to apply online under “e-Tariff Rate Quota” in the Import Management System through the importer’s dashboard on the DGFT Web portal.

- TRQ applications that have already been submitted for Financial Year 2021-2022 and are yet to be processed will be migrated to the new system.

- Any request for amendment of the TRQ licenses, issued on or after 8th February 2021, must be submitted electronically only through the thee-TRQ system.

- Further, licenses for all TRQs would be issued electronically, and TRQ License data would be transmitted electronically to the Customs Authorities.

- DGFT will issue no paper copies of the TRQ Import license from 8th February 2021.

Tariff Rate Quota

The Tariff Rate Quota is a mechanism that allows a set quantity of specific products to be imported. These specific items are as per the particular custom notification associated with them. Tariff quotas are used on a wide range of products, but most are in agriculture.- As mentioned above, the TRQ is allotted to the importer by the Directorate General of Foreign Trade, following paragraph 2.62 of the Handbook of Procedures, 2015-2020.

- The TRQ authorization shall contain the name and address of the importer, IEC code, Customs notification No., sub-heading or tariff item as applicable, quantity, and validity period of the certificate.

- The TRQ authorization shall be issued electronically by the Directorate General of Foreign Trade and transmitted to the ICES system.

- Imports made against the TRQ shall be allowed only upon debiting the TRQ quantity electronically in the ICES system.

Applicability of TRQ

The following persons will get benefit from the Tariff Rate Quota scheme:- Manufacturer exporters, with or without supporting manufacturer

- Merchant exporters tied to supporting manufacturers

- Service provider

Prerequisites for applying for TRQ Authorization

To apply for Tariff Rate Quota, the following are the prerequisites required:- The DGFT user profile must be linked with an importer-exporter Code

- A valid DSC must be registered in the system

- GSTN details corresponding to the branches of the IEC

The Applicable fee for TRQ Application

A registration fee of Rs. 1 per thousand subjects to a minimum of Rs. 500 and a maximum of Rs. 1 Lakh on CIF amount of the authorization will need to be paid through electronic mode in the online system for each application for issuance of the authorization.TRQ Authorization Validity

TRQ authorization will be valid for imports for one year from the date of issuance of the authorizationDocuments Required

There are no mandatory attachments; however, the applicant can attach the Pre-purchase agreement.Application Procedure for Tariff Rate Quota (TRQ)

The application procedure for applying the e-Tariff Rate Quota in the Import Management System through the importer’s dashboard on the DGFT Website is as follows:New User Registration

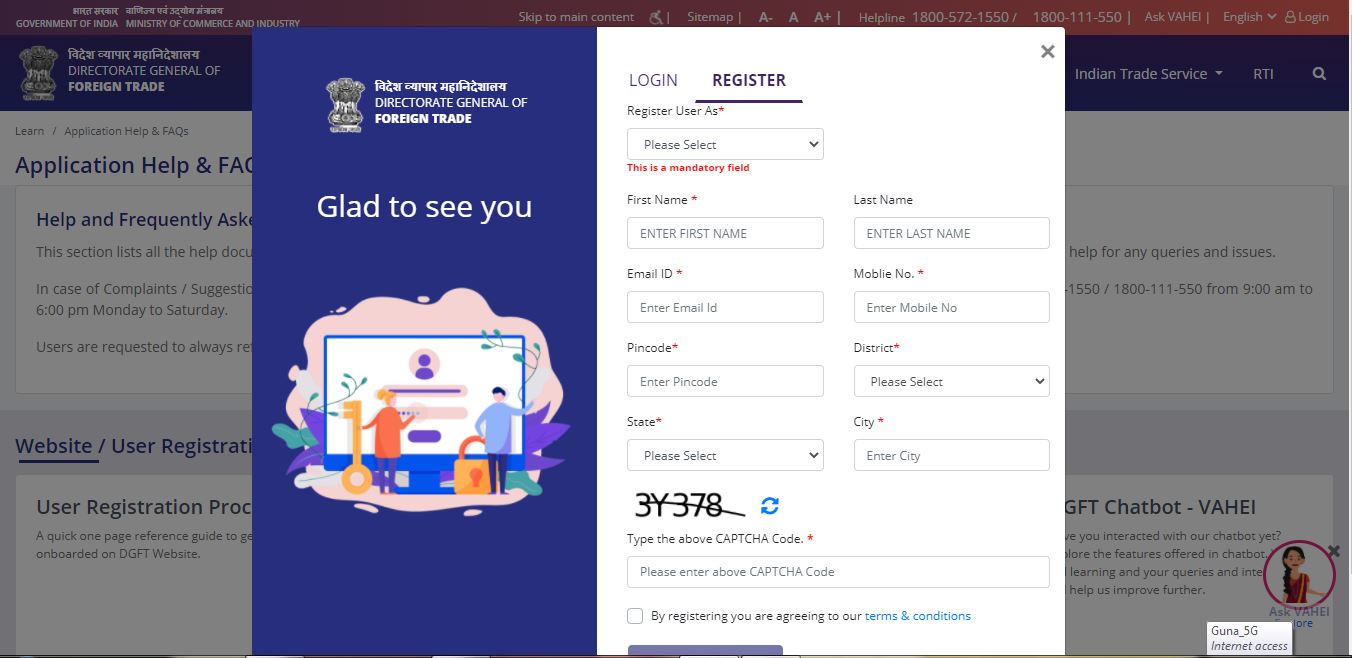

- Access the DGFT website and proceed with the registration process. Provide the Registration Details and Select Register User as “Importer/Exporter.”

Online E-Tariff Rate Quota System for Imports - DGFT Homepage

Online E-Tariff Rate Quota System for Imports - DGFT Homepage

- Furnish the OTPs received on email and mobile number, Upon Successful validation of the OTP, you can receive a notification containing the temporary password, which you need to change upon the first login.

Online E-Tariff Rate Quota System for Imports - DGFT User Registration

Online E-Tariff Rate Quota System for Imports - DGFT User Registration

Apply for TRQ Application

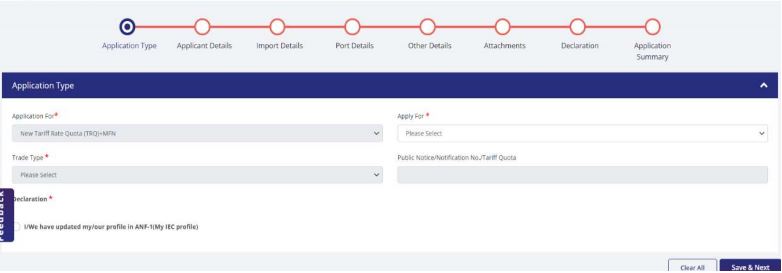

- After logging in to the DGFT web portal, navigate to Services, select Import Management system, and click on the TRQ option.

Online E-Tariff Rate Quota System for Imports - TRQ Application

Online E-Tariff Rate Quota System for Imports - TRQ Application

- On Apply for TRQ tile, the user must click on the “Explore” link.

- On the “Application Type” screen, provide the values on the screen and click on the “Save and Next” option.

- On the “Firm’s details” screen, provide all the required input values and click on the “Save and Next” button.

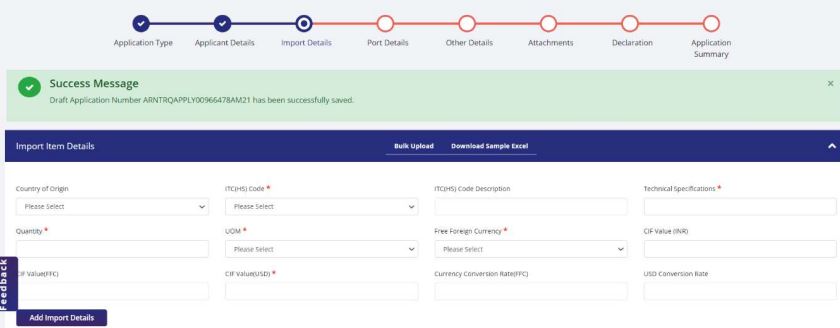

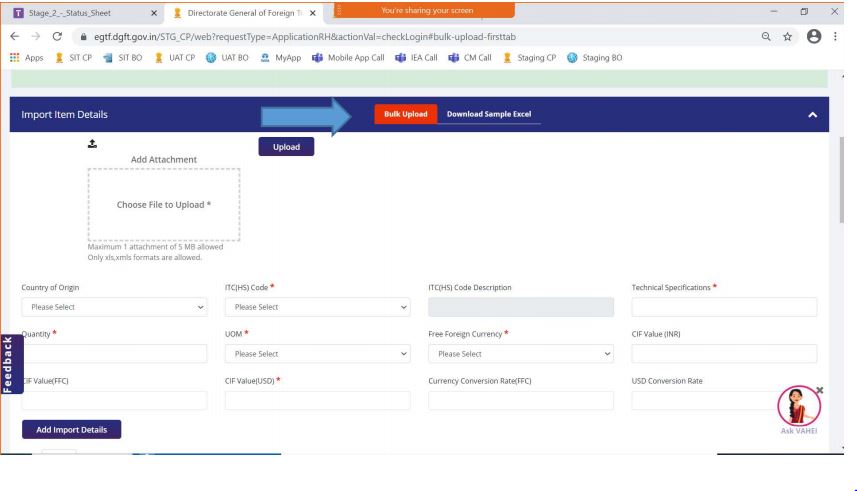

- On the “Import Details” screen, furnish the necessary input values in “Import Item Details,” Details Of Imports” and click on the “Save and Next” button

- Users can add multiple items and licenses and bulk upload items if needed, as shown below:

Online E-Tariff Rate Quota System for Imports - TRQ Application2

Online E-Tariff Rate Quota System for Imports - TRQ Application2

- After entering details on the Import Details tab and Save and Next button, the user will be redirected to the “Port details tab.

- Based on the value selected from the Purpose of Import dropdown on the “Port Details” screen, the ribbon will be displayed on the “Other Details” screen. The user must fill in the input values on the “Other Details” screen and click on the “Save and Next” button.

Upload Documents

Uploading attachment is not mandatory; users can upload and click on the “Save and Next” button if they need to upload any requirement. Online E-Tariff Rate Quota System for Imports - TRQ Upload

Online E-Tariff Rate Quota System for Imports - TRQ Upload

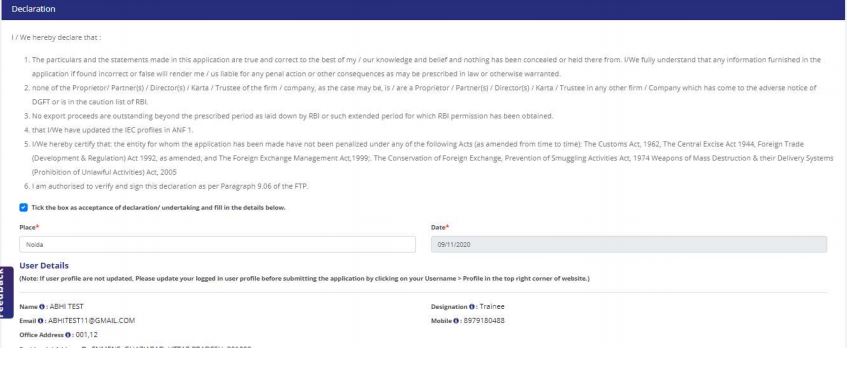

Declaration Section

- On the “Declaration” tab, the user needs to accept the terms and conditions by clicking on the checkbox. Provide all required details and click the “Save and Next” button.

Online E-Tariff Rate Quota System for Imports - TRQ Declaration

Online E-Tariff Rate Quota System for Imports - TRQ Declaration

- On the “Application Summary” screen, select the acceptance of declaration check box and click on the Sign button to sign the application using a digital token.

Payment Section

- By clicking the “Sign” button, the “Payment for Apply for TRQ” button will be displayed.

- Confirm and proceed to make the payment against the application. The system calculates the application payment value automatically.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...