Last updated: January 30th, 2020 10:03 AM

Last updated: January 30th, 2020 10:03 AM

Online Income Tax Payment Challans

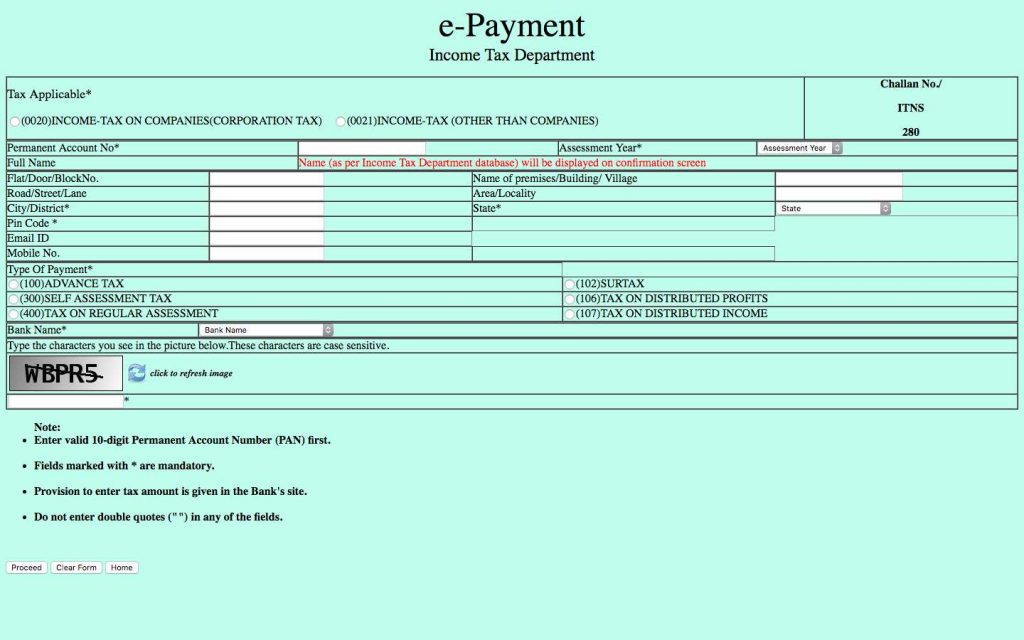

Income tax can be paid online or manually. Payment of tax is facilitated through designated banks by furnishing a hardcopy of the challan. Currently, online income tax payment has been mandated for various taxpayers. Also, more and more assesses are paying taxes online. In this article, we look at the various types of online income tax payment challans. The uses applicable to each challan have also been discussed.Income Tax Challan 280

This challan should be used for making payment of Income-tax, including Corporate tax. While completing Challan 280, the taxpayer should make a correct selection of the type of tax which is applicable to the assessee. Also, the correct code of the tax-payment should be mentioned. In Challan 280, Code 0020 is for income-tax paid by companies. Code 0021 is for income tax paid by non-corporate taxpayers. Further, the taxpayer should make the correct selection of an applicable type of payment along with the correct code of the respective type of payment. The following list enables an assessee to ascertain the correct code which should be applied:|

S. No. |

Code Number |

Purpose of the Field |

| 1 | 100 | Payment of advance tax |

| 2 | 300 | Payment of self-assessment tax |

| 3 | 400 | Tax on regular assessment |

| 4 | 106 | Dividend distribution tax |

| 5 | 107 | Tax on distributed income to unitholders |

| 6 | 102 | Surcharge tax |

Income Tax Challan 280

Income Tax Challan 280

Income Tax Challan 281

This challan should be used for making payment of TDS/TCS by corporate and non-corporate deductors/collectors. In challan 281, Code 200 is used for TDS/TCS payable by taxpayer and Code 400 is for TDS/TCS to be paid on regular assessment.

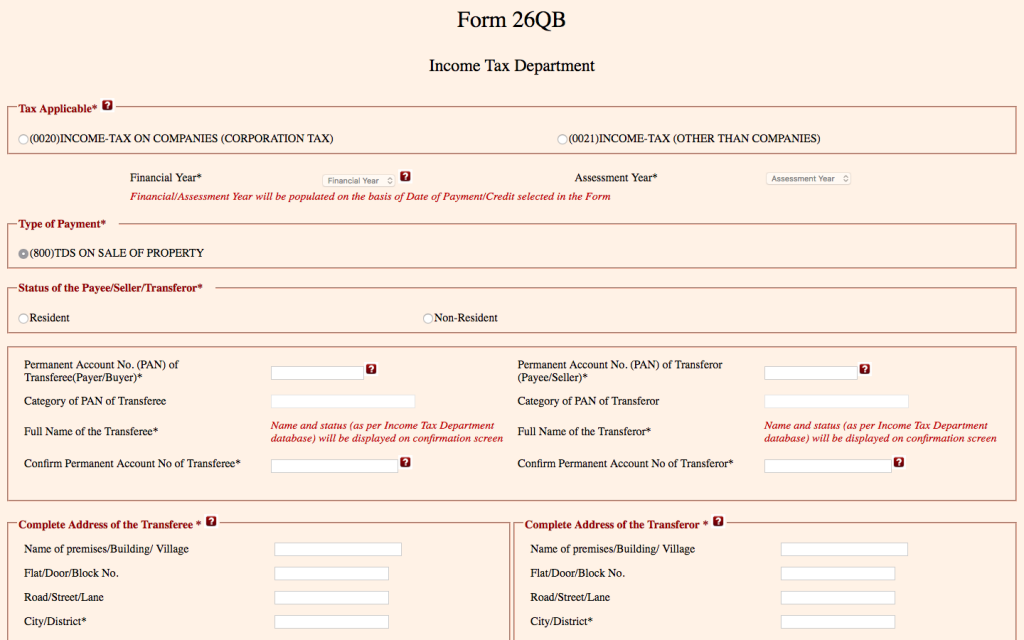

Form 26QB

This form should be used for making payment of tax deducted at source from consideration paid for the purchase of immovable property. It can be used by a corporate as well as non-corporate deductor. Details required for Form 26QB shall be the following:- Category of the PAN of the transferee and transferor (will be automatically selected)

- Full name of the transferee and transferor

- Address of the transferee and transferor

- Selection for more than one transferee/buyer

- Selection for more than one transferor/seller

- Details of the property transferred along with the complete address

- Date of agreement/booking, sale consideration and type of payment (i.e., lump sum or on instalment)

- Amount paid/credited (to be selected from the drop-down provided)

- Amount of TDS and other details like rate of TDS, interest, fees, etc.

- Selection of mode of payment (i.e., payment through net banking or e-payment by visiting any of the bank branches).

- Date of payment/credit and date of deduction of tax at source.

Form 26QB

Form 26QB

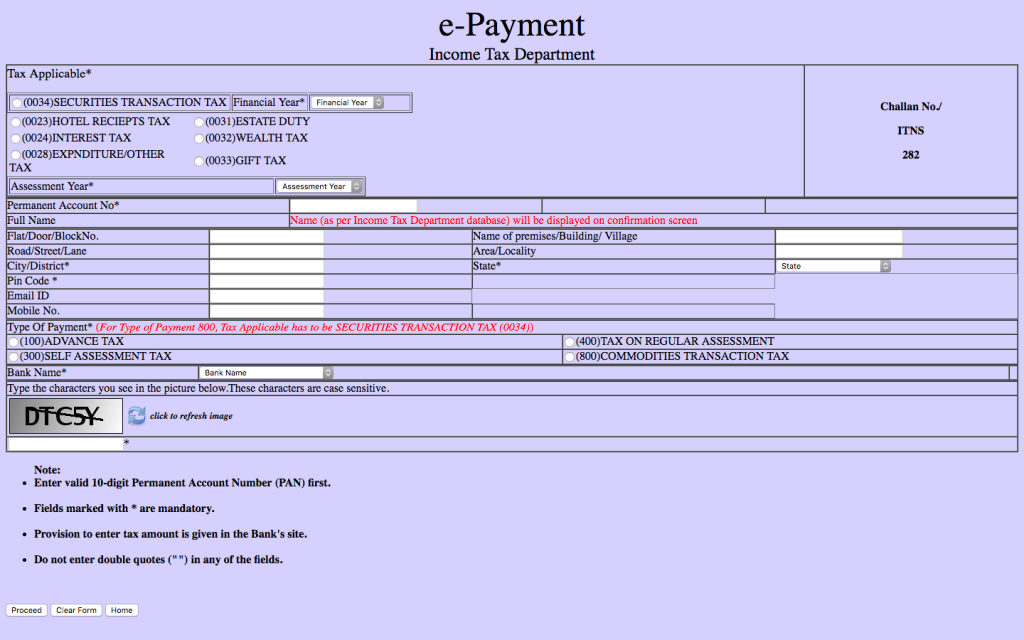

Income Tax Challan 282

This challan is used for payment of security transaction tax, hotel receipts tax, estate duty, interest tax, wealth tax, expenditure tax, other direct taxes and gift tax.

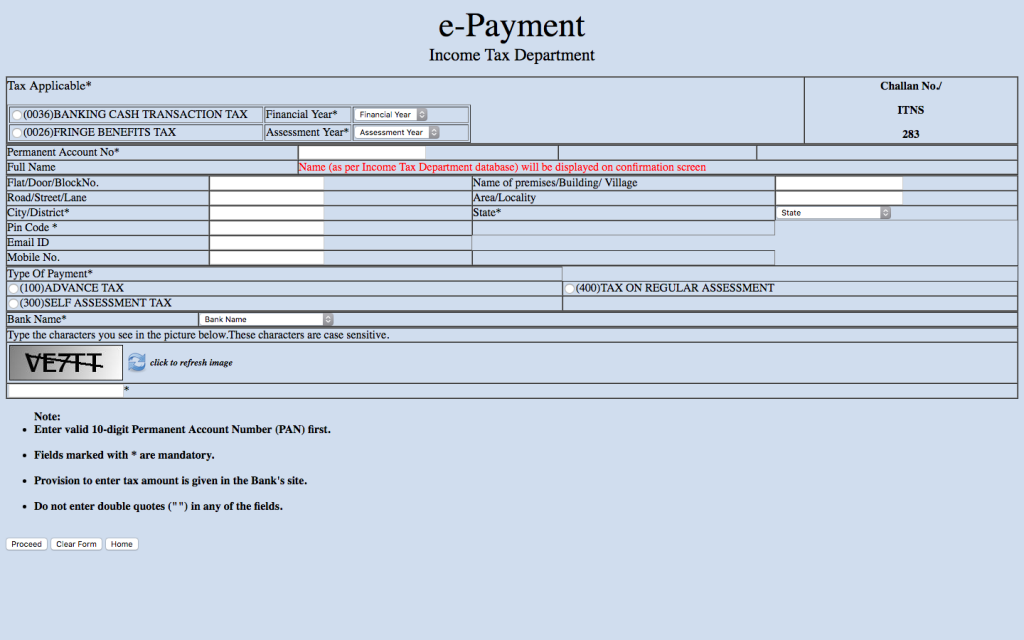

Income Tax Challan 283

This challan is used for payment of banking cash transaction tax and fringe benefits tax.

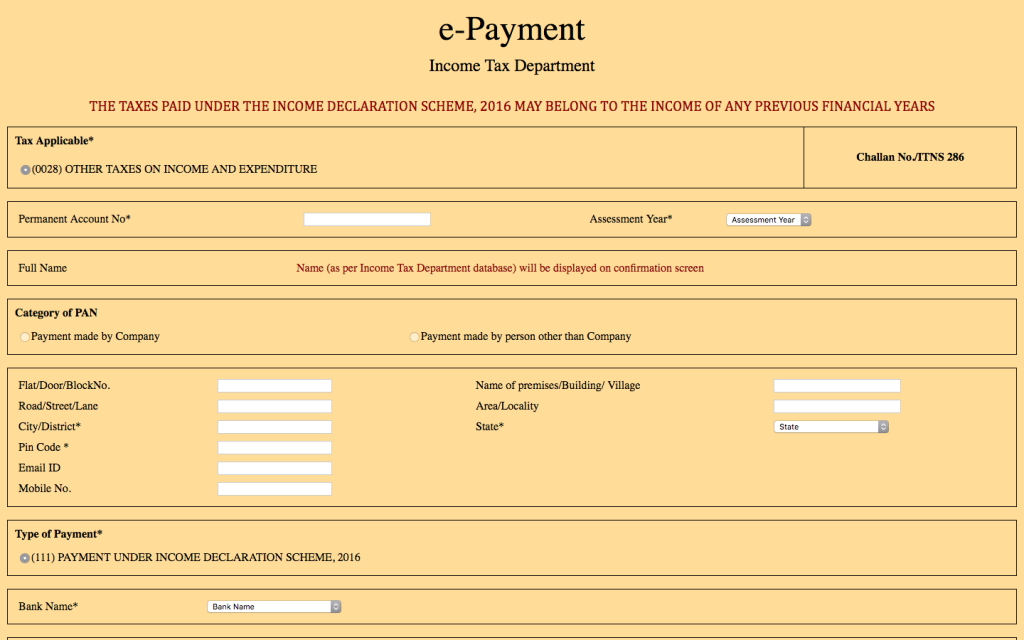

Income Tax Challan 286

Income tax challan 286 can be used by those paying online tax under the Income Declaration Scheme 2016. The Income Declaration Scheme was introduced by the Government of India (GoI) in 2016. The objective of the scheme is to allow taxpayers to declare previously undisclosed income. The scheme allows all domestic taxpayers to pay income tax at an effective rate of 45%. Also, there is a requirement to pay a penalty.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...