Last updated: May 4th, 2024 9:39 AM

Last updated: May 4th, 2024 9:39 AM

PAN Card Cancellation Online

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse, could even be jailed. Since the Government of India has made it mandatory to link one's Aadhaar with their PAN card, every individual and business entity with more than one PAN issued in their name have been compelled to cancel or surrender their addition PAN cards. PF claim tracking is the process of monitoring the status of your submitted claim for Provident Fund (PF) amount. This article talks about PAN Card Cancellation online with respect to individuals and entities who have more than a one Permanent Account Number (PAN).Consequences of Additional PAN

When an individual is in possession of more than one PAN card, they may be penalised as per the law set by the Government of India. According to Section 139A of the Income Tax Act of 1961, an individual is only permitted to hold one single PAN card. This section of the Act talks about the eligibility for obtaining a PAN card. Therefore, an Income Tax Officer has the power to impose a penalty of INR 10,000 on any individual who has more than one PAN card as per Section 272B of the Income Tax Act. However, individuals have been given the opportunity to cancel/ surrender the additional PAN cards by merely visiting the NSDL online portal and complete the PAN card cancellation Form for PAN corrections. The individual would receive a notification once the Form and payment have been successfully processed. Additionally, one may even surrender/ cancel their additional PAN card by submitting the PAN Correction Form at their nearest NSDL Collection Centre. Once the PAN card cancellation Form is duly completed, the same may be sent and paid for to the Assessing Officer of the respective jurisdiction.How to Cancel PAN Card Online?

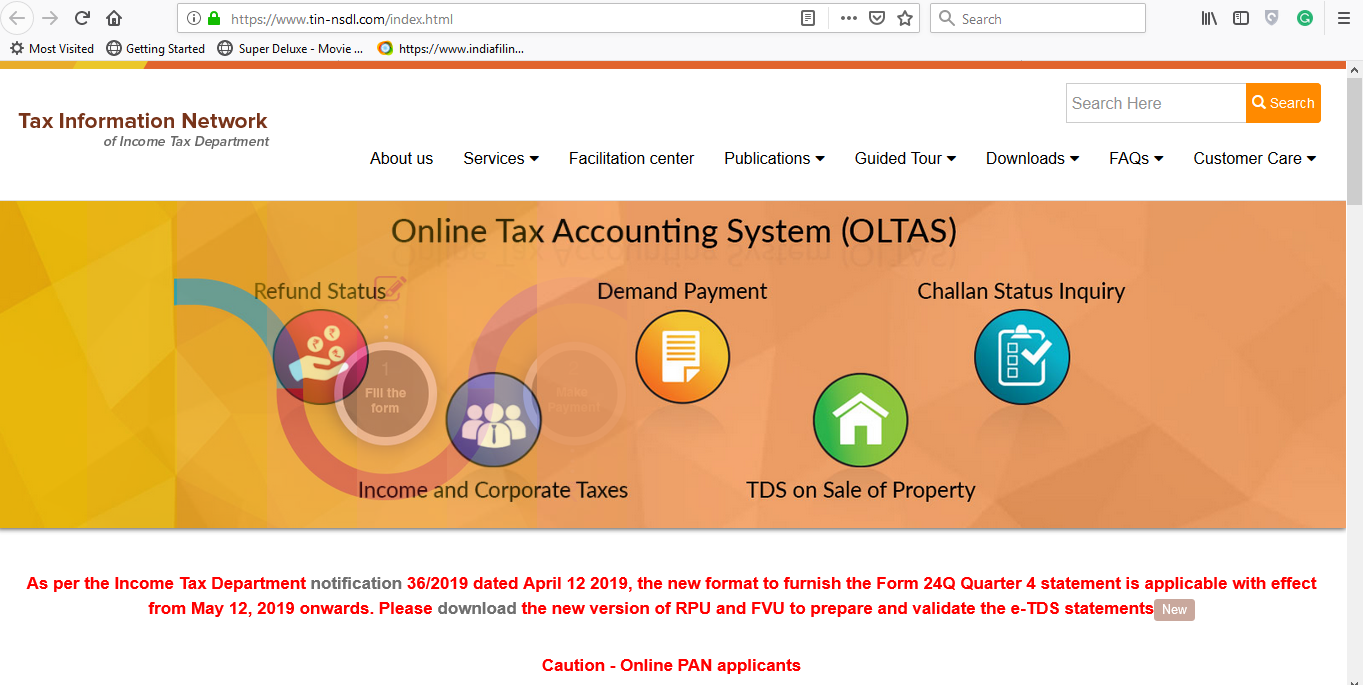

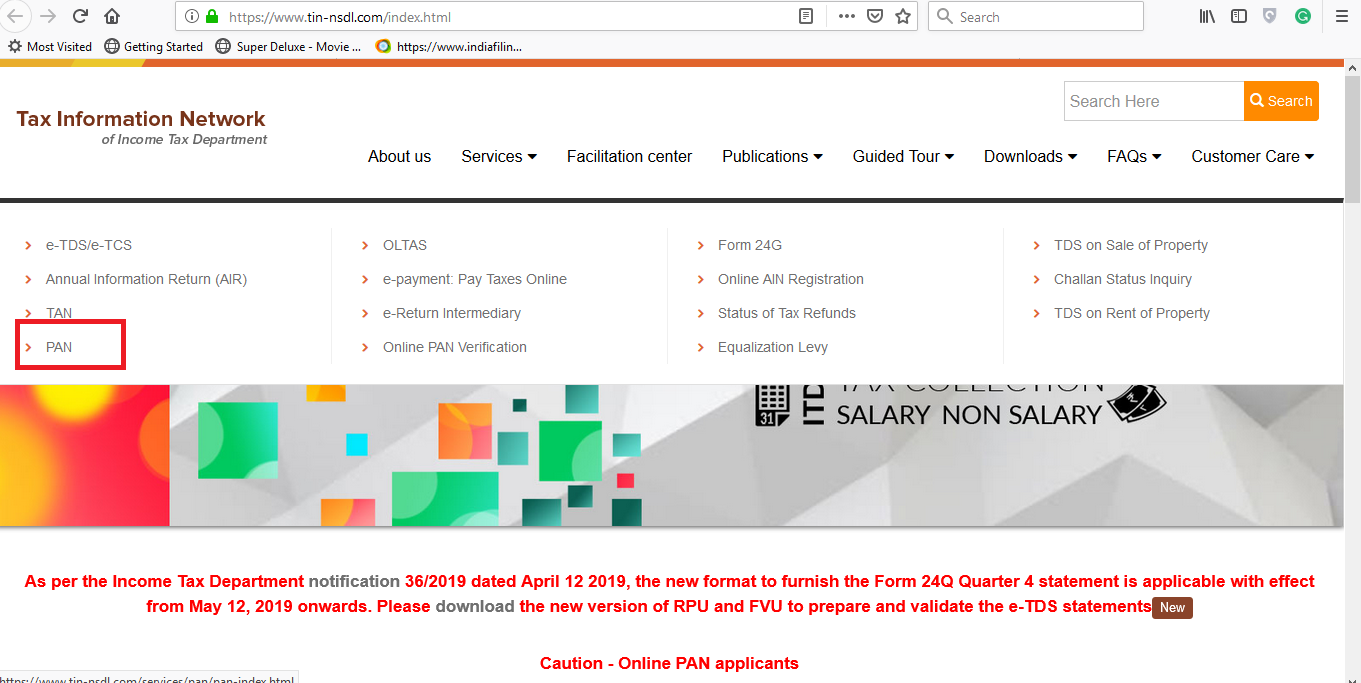

The procedure mentioned below has to be followed on how to cancel PAN card online. Step 1: Visit the official NSDL web portal. Step 2: Click on the Services tab and select the option of PAN.

Step 2: Click on the Services tab and select the option of PAN.

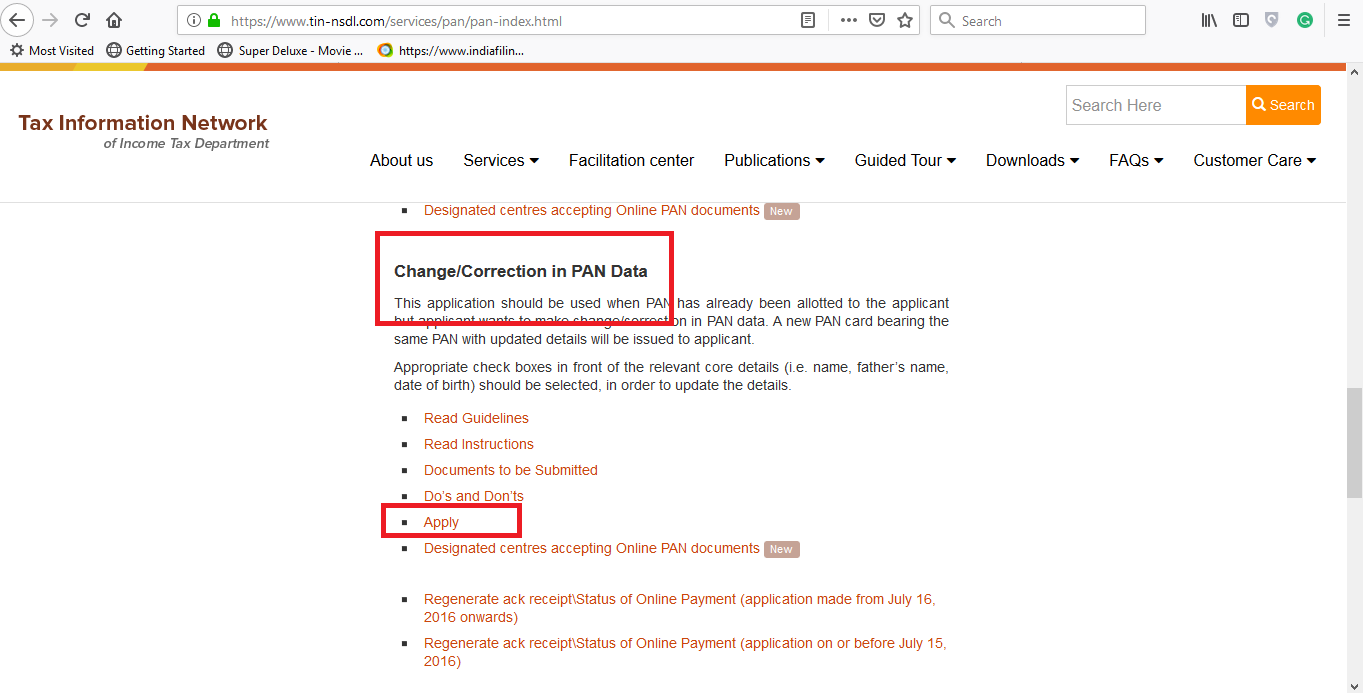

Step 3: Under the Change/ Correction in PAN data, click on the option to Apply.

Step 3: Under the Change/ Correction in PAN data, click on the option to Apply.

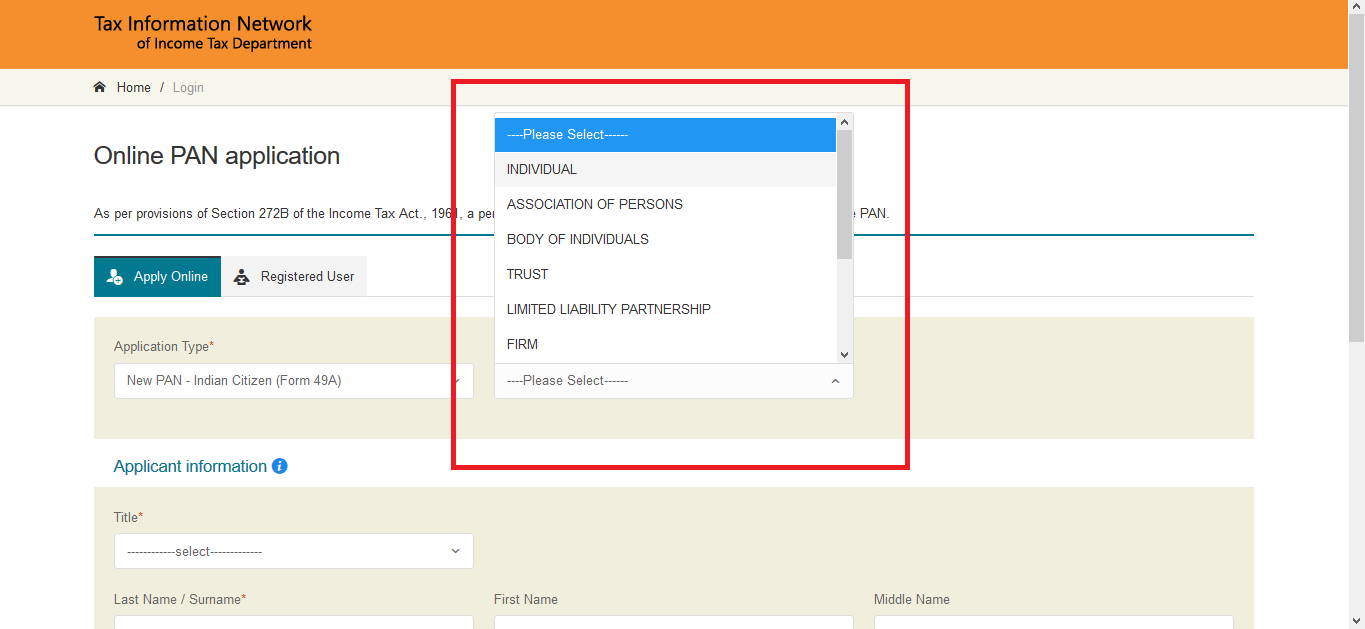

Step 4: Click on Application Type. From the drop-down menu, click on the Changes or Correction in existing PAN Data/ Reprint of PAN Card (No changes in existing PAN Data) option.

Step 5: From the Category drop-down menu, click on Individual.

Step 4: Click on Application Type. From the drop-down menu, click on the Changes or Correction in existing PAN Data/ Reprint of PAN Card (No changes in existing PAN Data) option.

Step 5: From the Category drop-down menu, click on Individual.

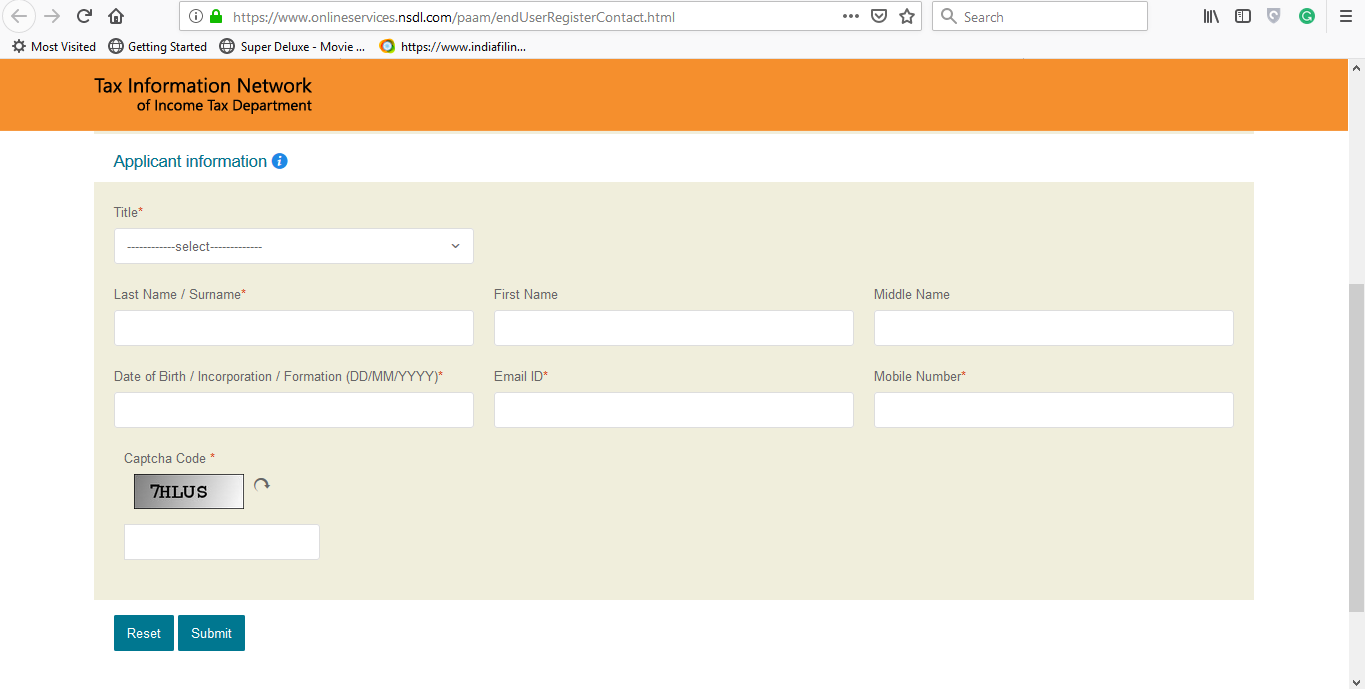

Step 6: Fill the given Form with appropriate details and click on the Submit icon. After the Form has been submitted successfully, the request will be registered, and a token number would be generated. This token number would be sent on the Email Address that was provided in the application.

Step 6: Fill the given Form with appropriate details and click on the Submit icon. After the Form has been submitted successfully, the request will be registered, and a token number would be generated. This token number would be sent on the Email Address that was provided in the application.

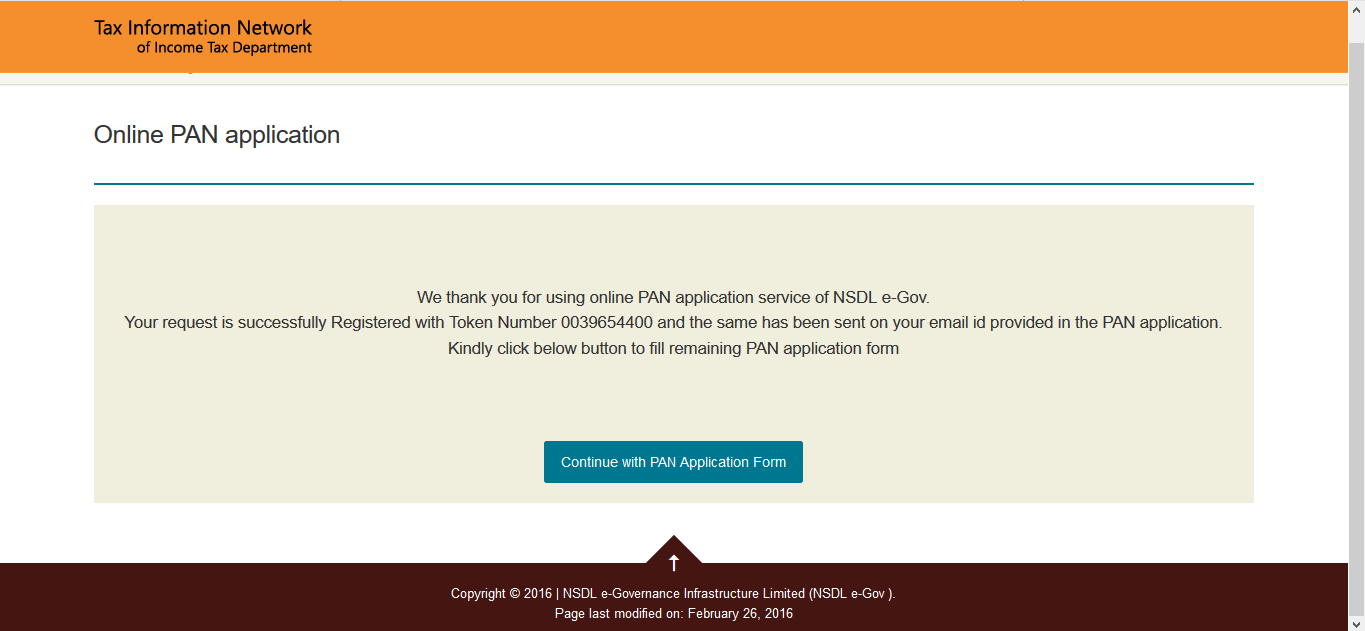

Step 7: It is recommended to take a note of the token number for future references. Continue further by clicking on the Continue with PAN Application Form icon given below the page.

Step 7: It is recommended to take a note of the token number for future references. Continue further by clicking on the Continue with PAN Application Form icon given below the page.

Step 8: The user would be re-directed to a new webpage. On the top of the displayed page, click on the Submit scanned images through e-Sign option.

Step 8: The user would be re-directed to a new webpage. On the top of the displayed page, click on the Submit scanned images through e-Sign option.

Step 9: On the bottom left corner of the page, the user will be required to mention the PAN number that they want to retain.

Step 10: Then, the user has to fill the Form with personal details including their contact number.

Step 11: Below the next page, the user would be required to mention the additional PAN cards and the details that they want to surrender PAN card. After doing so, click on the Next icon.

Step 12: On the next page, select the appropriate Proof of Identity along with Residence Address and Date of Birth as required.

Step 13: The user would then be required to upload scanned images of their photograph along with authorising signatures and relevant documents. The individual must sign the acknowledgement receipt or must be approved by authorised signatories in order to request for surrender PAN card. For example, a Director is an authorised signatory in the case of surrender of PAN by a Company. On the other hand, for a Partnership Firm/ LLP, an authorised signatory would be a partner.

Step 14: The user will be able to preview their application form once they have submitted their details successfully. The user is required to verify the details and make corrections, if necessary, and proceed to make the payment.

Step 15: The user has to make the necessary payment via Debit Card, Credit Card, Internet Banking or Demand Draft.

Step 16: Once the payment has been successful, the user will be able to download a soft copy of the payment acknowledgement. This payment receipt has to be saved and printed for future references and also, stands as a proof of payment.

Step 17: The user has to send a printed copy of the acknowledgement to the National Securities Depository Limited eGovernment along with two attached photographs of the user.

Step 18: Before the receipt is sent out; the envelope has to be labelled under Application for PAN Cancellation along with the Acknowledgment Number.

Step 19: Post the signed acknowledgement (along with the Demand Draft if that payment option was chosen) to the address below.

NSDL e-Gov at 'Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016

Step 9: On the bottom left corner of the page, the user will be required to mention the PAN number that they want to retain.

Step 10: Then, the user has to fill the Form with personal details including their contact number.

Step 11: Below the next page, the user would be required to mention the additional PAN cards and the details that they want to surrender PAN card. After doing so, click on the Next icon.

Step 12: On the next page, select the appropriate Proof of Identity along with Residence Address and Date of Birth as required.

Step 13: The user would then be required to upload scanned images of their photograph along with authorising signatures and relevant documents. The individual must sign the acknowledgement receipt or must be approved by authorised signatories in order to request for surrender PAN card. For example, a Director is an authorised signatory in the case of surrender of PAN by a Company. On the other hand, for a Partnership Firm/ LLP, an authorised signatory would be a partner.

Step 14: The user will be able to preview their application form once they have submitted their details successfully. The user is required to verify the details and make corrections, if necessary, and proceed to make the payment.

Step 15: The user has to make the necessary payment via Debit Card, Credit Card, Internet Banking or Demand Draft.

Step 16: Once the payment has been successful, the user will be able to download a soft copy of the payment acknowledgement. This payment receipt has to be saved and printed for future references and also, stands as a proof of payment.

Step 17: The user has to send a printed copy of the acknowledgement to the National Securities Depository Limited eGovernment along with two attached photographs of the user.

Step 18: Before the receipt is sent out; the envelope has to be labelled under Application for PAN Cancellation along with the Acknowledgment Number.

Step 19: Post the signed acknowledgement (along with the Demand Draft if that payment option was chosen) to the address below.

NSDL e-Gov at 'Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016

Surrendering PAN of Deceased

Once a PAN card holder passes away, the relatives of the deceased individual are required to write a letter to the Income Tax Officer who presides over the respective jurisdiction. The letter must comprise of the reason for surrender (here, it is the death of the PAN card holder) and the death certificate of the deceased. Other vital information such as the Name, PAN Card Number, Date of Birth and so on are to be mentioned in the letter. The same process of surrendering PAN card is applicable in the case of the demise of Non-Indian Residents and Foreign Nationals as well.Surrendering PAN of Company/ Firm/ Partnership

The procedure mentioned below has to be followed in order to cancel your duplicate PAN cards online. The PAN card may be surrendered online by visiting the National Securities Depository Limited Tax Information Network (TIN) portal and filling out form 49A. If a Company/ Firm/ Partnership is being shut down or dissolved, the PAN issued in the name of the entity has to be surrendered to the concerned authorities. Step 1: Visit the official NSDL web portal. Step 2: Click on Application Type. From the drop-down menu, click on the Changes or Correction in existing PAN Data/ Reprint of PAN Card (No changes in existing PAN Data) option. Step 3: For Category, select the option of Company, Firm or Partnership and proceed with filling the Form online. Step 4: In Form 49A, enter the PAN that has to be cancelled in Item 11 of the Form. Step 5: Submit the completed Form and print out the acknowledgement. The user is required to send the same along with the necessary documents to the NSDL Office Address mentioned on the Form. Step 6: Once the request has been processed, the user would receive a notification indicating the same.Surrendering Current PAN

It is always recommended that an Indian citizen not to surrender or cancel their PAN card as it serves as a valid identity proof. However, in the case of Foreign National who are leaving the country and who would not be paying any taxes to the Indian Government, the PAN card would not be of any use. Such individuals may write an application to the Income Tax Assessing Officer of their respective jurisdiction in order to surrender their PAN card. They would be required to mention the reason for the surrender in the application. This would lead to the cancellation of the relevant PAN card. After this, the same could be surrendered to the tax officer by the respective PAN card holder.Cancellation of PAN Card FAQs

Can one cancel their existing PAN Card?

In what circumstances is it possible to cancel one's PAN card?

How to apply for PAN cancellation?

What is an ‘Assessing Officer Code’ and how to find it?

What is the procedure for cancelling a PAN card?

Is it possible to cancel a PAN Card application and reapply for one?

Is it necessary for a person to cancel their PAN Card and apply for a new one if they relocate within India?

What happens if the Income Tax Department accidentally issues two PAN Cards to the same person?

What happens if the IRS issues two PAN Cards to the same person by accident?

Should an Indian working in another country cancel his or her PAN?

Is having a PAN card required for NRIs?

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...