Last updated: March 9th, 2023 1:57 PM

Last updated: March 9th, 2023 1:57 PM

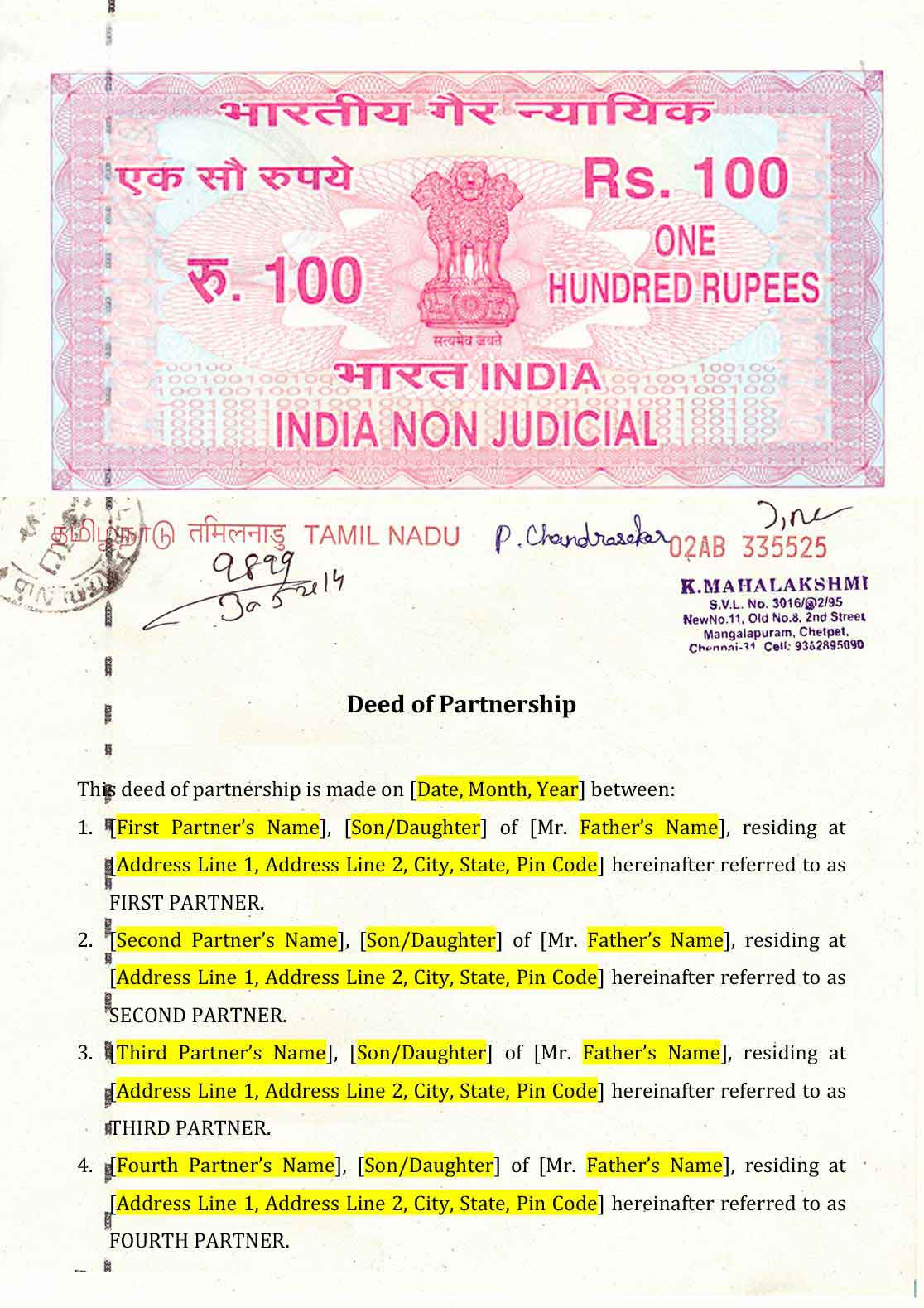

Partnership Deed Format

What is a Partnership Deed?

A partnership deed is a written legal document signed by two individuals coming together, who decide to run a business, regardless of the profits or losses that have incurred. A partnership deed documents help to ensure that both parties do not disagree, conflict over the partnership norms. It is also known as a partnership agreement, the partnership added is registered under the Partnership Act, 1932. The partners can make changes in the terms of the Partnership deed format if they wish to.Why is a Partnership Deed needed?

A partnership deed format briefs the legal possibilities of the partners of the firm. Here we have listed down the importance of a partnership deed:- It regulates the rights, duties, and liabilities of each of the partners.

- Very helpful to avoid misunderstandings between the partners as all of the terms and the conditions of the partnerships are specified in the deed.

- In case of any dispute amongst the partners, it will be settled easily as the partnership deed will be readily referred to.

- The confusion between the partners concerning the compensation of the profits and loss sharing with the partners.

- Mentions the role of each individual partner

- The partnership deed will also contain the clauses that clarify what should be the remuneration that is to be paid.

- Also, registration of a Partnership will make the firm eligible for obtaining PAN, applying for a bank loan, opening a bank account in Partnership Firm name, obtaining GST registration or IE Code or FSSAI license in partnership firm name, and more.

Download Partnership Deed Format

Executing a Partnership Deed

Sample-Partnership-Agreement

Sample-Partnership-Agreement

Partnership deed form FAQs

What are the types of partnership deeds?

- General Partnership Deed: This legal document outlines the terms and conditions of a general partnership, where all partners share equal responsibility for the management of the business and are jointly liable for any debts or obligations.

- Limited Partnership Deed: This is a legal document that establishes a limited partnership, where there are both general partners and limited partners. The general partners have unlimited liability for the debts and obligations of the partnership, while the limited partners have limited liability and do not participate in the management of the business.

- Limited Liability Partnership Deed: This is a legal document that establishes a type of partnership where all partners have limited liability for the debts and obligations of the business, as well as limited responsibility for the actions of other partners. LLPs are often used by professionals such as lawyers and accountants.

Is it mandatory to form a partnership deed?

Is an unregistered partnership deed valid?

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...