Last updated: November 15th, 2024 3:21 PM

Last updated: November 15th, 2024 3:21 PM

Patta Chitta

Patta and Chitta are land revenue records maintained by the Tamil Nadu Government. Patta and Chitta documents play an important role in all property-related transactions in Tamil Nadu like property transfer, property pledge, property legal opinion, etc. In this article, we look at Patta Chitta in detail. To obtain Patta Chitta for your property or please get in touch with an IndiaFilings Advisor at sales@indiafilings.comWhat is Patta?

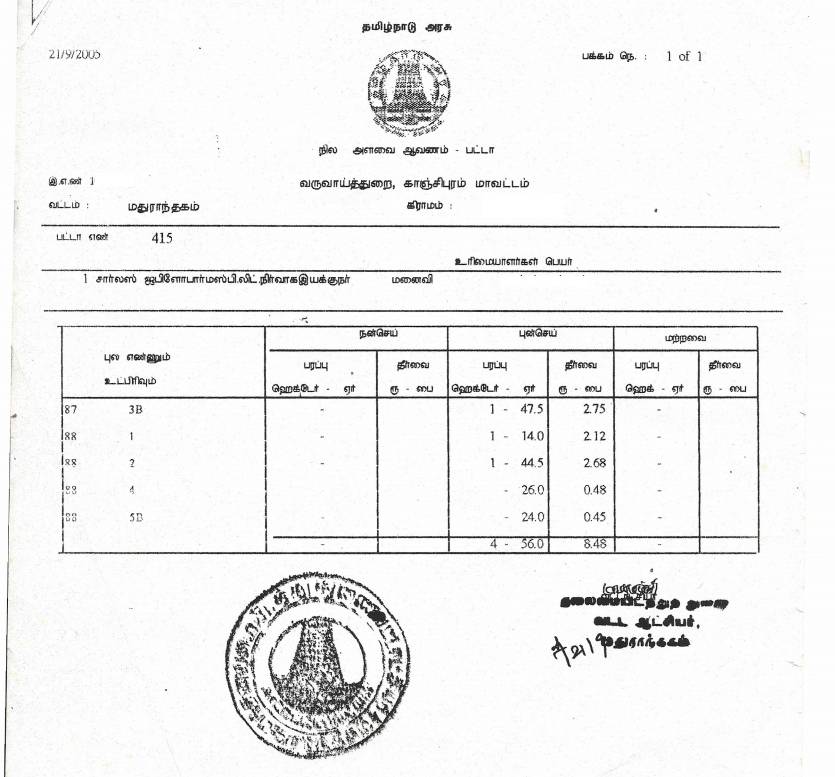

Patta is a government record containing the details of land ownership, area of land, location with survey details. While purchasing a property, verifying the patta documents will ensure that the property is being purchased from the rightful owner as per the Government record. For a clear property title, the seller must have a valid patta for the land that he/she is selling. After the purchase of land, the buyer must apply to the concerned Taluka office for the transfer of patta to the buyer's name to maintain a clear title. A sample patta document is provided below for reference: Patta Sample

Patta Sample

What is Chitta?

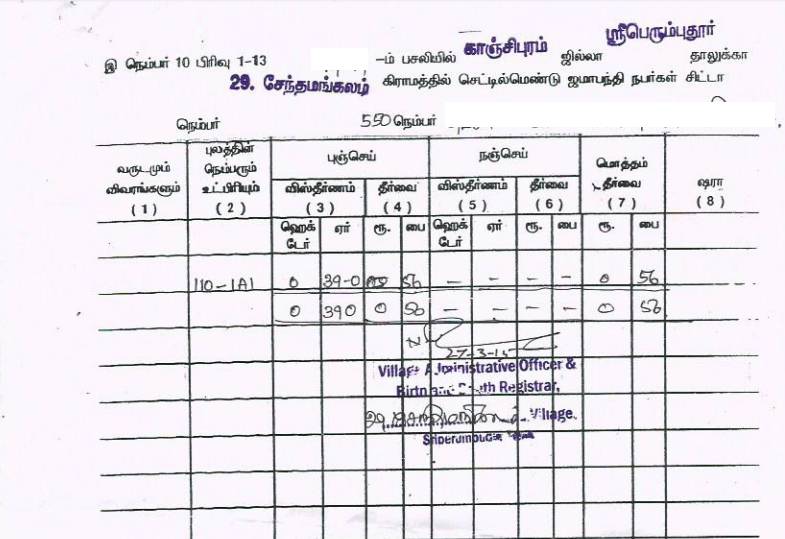

Chitta is a government document pertaining to immovable property that is maintained by the concerned Village Administrative Officer (VAO) and Taluka office. In the Chitta, the classification of the land between nanjai and Punjai is provided along with the details of the owner of the property. Nanjai refers to land with plenty of water, usually with water bodies like rivers, canals, ponds, etc. Punjai refers to land with fewer water bodies and with facilities such as bore-wells. Chitta Sample

Chitta Sample

How to Get Patta Chitta?

The Government of Tamil Nadu has computerized records of Patta Chitta and made the same available online. You can access Patta Chitta online or by approaching the concerned Taluka office. The following is the procedure for obtaining Patta Chitta online.Step 1: Go to Patta Chitta Website

The Tamil Nadu Patta Chitta website is available in two languages - English & Tamil.Step 2: Select View Patta and FMB, Chitta or TSLR Extract

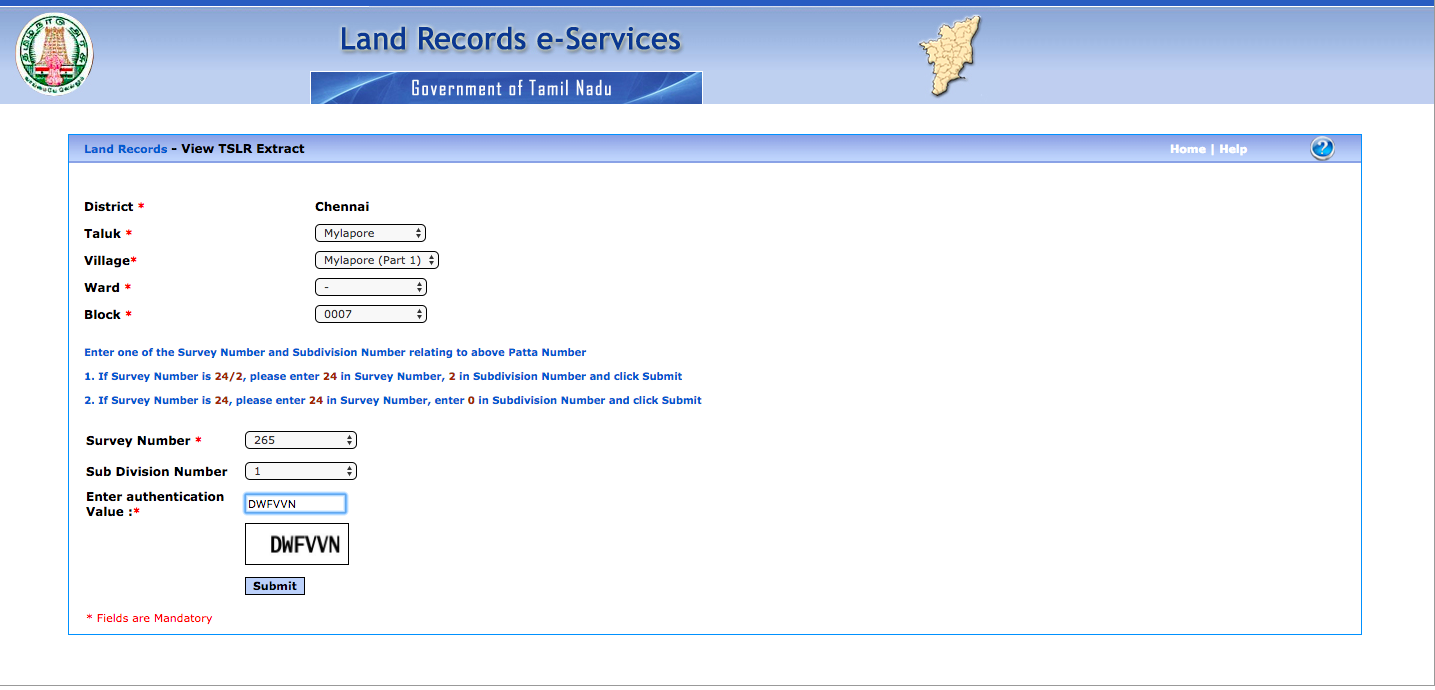

Select the Patta and FMB, Chitta, or TSLR Extract and choose the district in which the property is located.Step 3: Details of Property

The Patta Chitta requires details like Taluk, Village, Ward, and Block along with the Survey Number and Sub Division Number. The following image shows the details of the property.

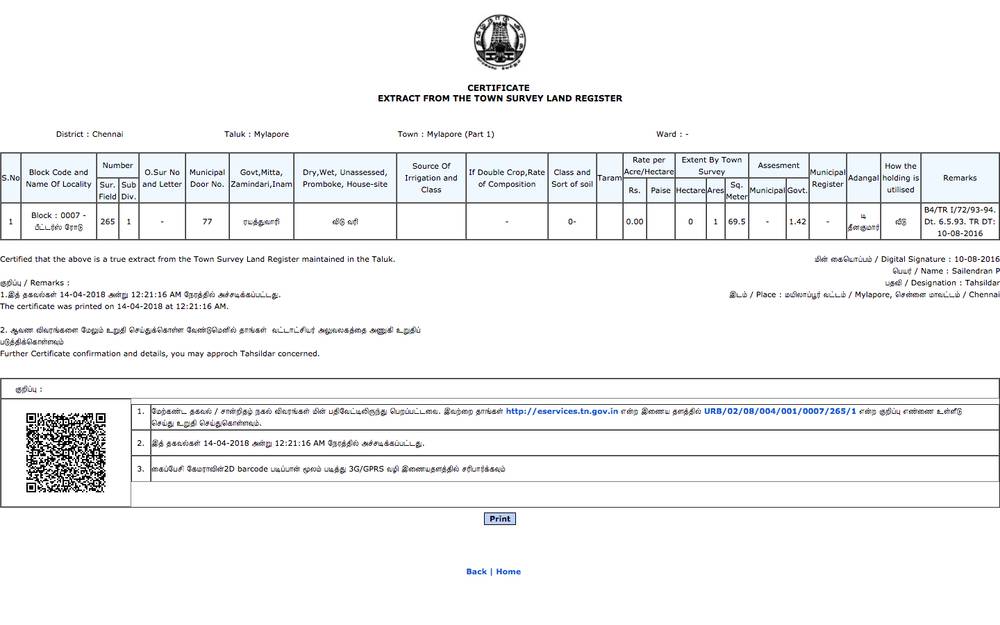

Step 4: Patta Chitta from Town Survey Land Register

On submission of the property details, the following Certificate from the Town Survey Land Register would be issued online with details of the property. The Certificate would contain details like type of construction on the property, municipal door number, locality, type of land, etc., The issued Certificate's validity can be checked online here.

Transfer of Patta Chitta

Patta Chitta verified by the concerned taluka office as show under Patta and Chitta may be requested by a prospective buyer or banker sometimes. In such cases, the property owner can approach the concerned taluka office or village administrative officer for the same. The transfer of Patta Chitta on account of property transfer requires an application in the application form shown below:[maxbutton id="13" url="https://www.indiafilings.com/learn/wp-content/uploads/2018/04/Patta-Application.pdf" text="Download Patta Transfer Application Form" ]

Documents Required for Patta Transfer

Along with the patta transfer application, the following documents must be submitted for patta transfer:- Signed patta transfer application

- Copy of sale deed. Verification requires original documents.

- Proof of possession like EB bill or property tax receipt

- Encumbrance certificate

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...