Last updated: July 23rd, 2021 6:41 PM

Last updated: July 23rd, 2021 6:41 PM

Pokkuvaravu or Mutation of Property

The mutation is the process of changing of title ownership of a property from one person to another when the property is transferred. By mutating the property, the new owner can get the property record on his or her name in the land revenue department. While selling a property, one should submit a copy of the latest mutation to the buyer. In this article, we will look at the importance of the mutation document and process of applying mutation document in Kerala.Pokkuvaravu or Mutation

Pokkuvaravu or mutation is an essential process in all legal transactions involving land. By mutating a property, the new owner gets the property recorded on his name; property details will be updated in the revenue records maintained by civic bodies like Municipalities, Panchayat or Municipal Corporations.- Mutation document is essential to fix the property tax payment liabilities

- Mutation of property is an essential proof of ownership

Documents Required for Mutation

In case of sale of a property

The following documents need to be furnished in the Village office for mutating a property:- Application for mutation with a stamp affixed

- Registration deeds (Both current and previous)

- Sale deeds

- Affidavit on stamp paper of requisite value

- Receipt of up-to-date property tax payment

- Address proof - Ration Card

- Identity Proof - Aadhaar Card

In the case of Will

- Death certificate

- Copy of Succession Certificate

- Affidavit on stamp paper

- Receipt of up-to-date property tax payment In case of Power of Attorney:

- Copy of Power of Attorney

- Application for mutation with a stamp affixed

- Registration deeds (Both current and previous)

- Sale deeds

- Affidavit on stamp paper of requisite value

- Receipt of up-to-date property tax payment

- Address proof - Ration Card

- Identity Proof - Aadhaar Card

Fees for Mutation in Kerala

The fee structure for mutating a property in Kerala is tabulated here.|

Property |

Fee |

|

Up to 5 acres of property |

25 |

|

5 acres to 20 acres |

50 |

|

20 acres to 40 acres |

100 |

| 40 acres to 2 hectares |

200 |

| Over 2 hectares |

500 |

Process for doing Pokkuvaravu or Land Mutation in Kerala

Process of doing Pokkuvaravu is explained in step by step: Step 1: Complete the registration process of the property and get the sale deed from the sub-registrar office. Step 2: Fill the application form and submit to the village office along with the documents mentioned above. The following details to be entered in the application.- Name and Address of seller

- District

- Taluk

- Village

- Survey number of the property (Both old and new to be mentioned)

- Name of buyer

- Other details related to property registration

ReLIS

ReLIS - Revenue Land Information System is an online portal of the Revenue Department of Kerala. ReLIS portal helps the user to verify the Pokkuvaravu details and E-payment for Land tax. ReLIS portal is developed to achieve the objectives of NLRMP (National Land Records Modernisation Programme ).NLRMP - National Land Records Modernisation Programme

NLRMP aims to minimize the scope of land or property disputes, enhance transparency in the land records maintenance system and facilitate moving eventually towards guaranteed conclusive titles to immovable properties in the countryVerify the Pokkuvaru Online in ReLIS

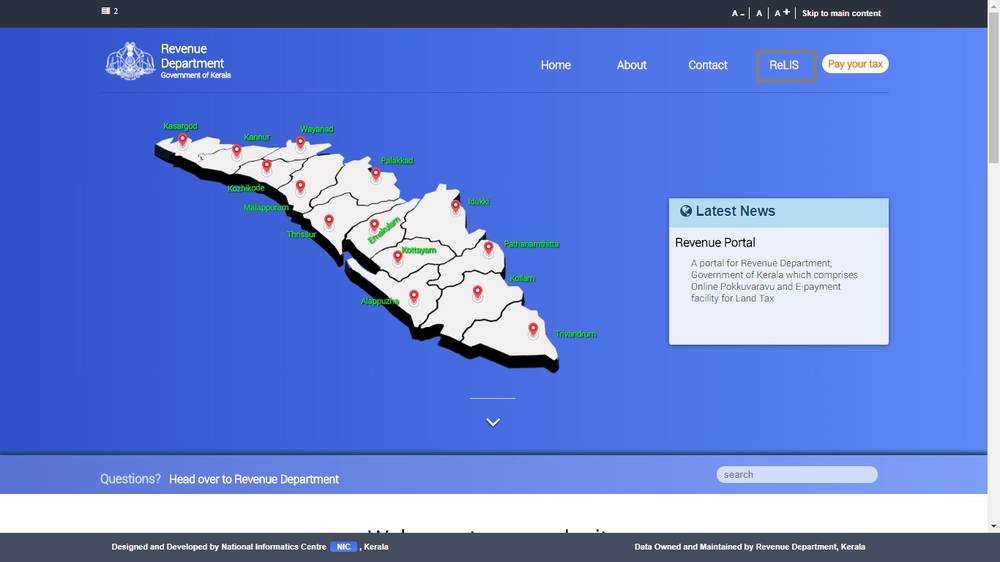

The following steps will help the applicant to verify the mutation details Online in ReLIS. Step 1: Visit home page of Revenue department of Kerala. Step 2: Click on ReLIS option from the menu bar. The page will be redirected to ReLIS webpage. Note: Kindly use Mozilla browser for a better experience of ReLIS Image 1 Mutation of Property in Kerala

Step 3: In this page, select verify option to get the mutation or Pokkuvaravu details.

Image 1 Mutation of Property in Kerala

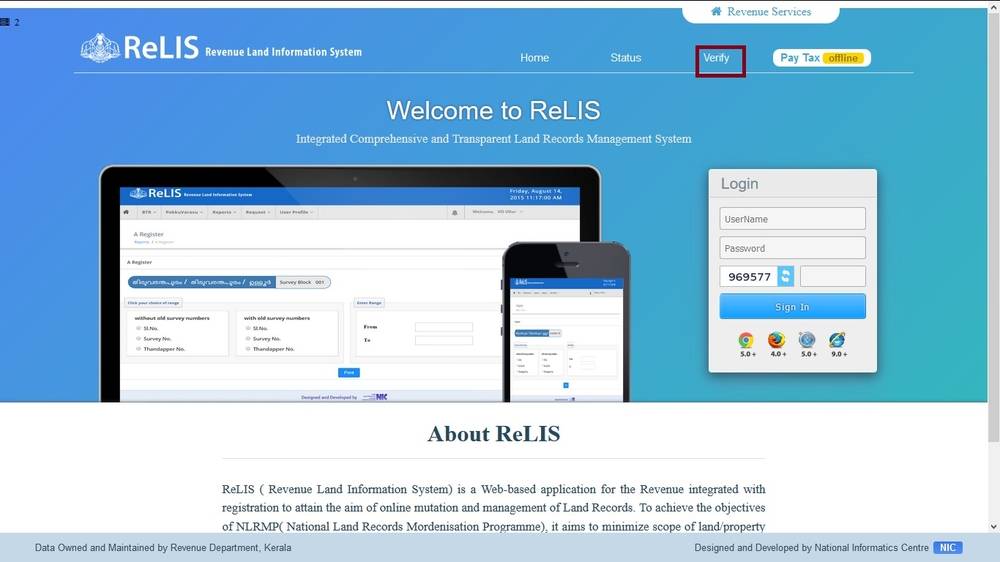

Step 3: In this page, select verify option to get the mutation or Pokkuvaravu details.

Image 2 Mutation of Property in Kerala

Step 4: Select the district (where the property located) from the drop-down menu.

Step 5: The applicant has to select the Sub-Register Office.

Step 6: Select the year when the property registered.

Note : Details from 2015 – 2018 is available.

Image 2 Mutation of Property in Kerala

Step 4: Select the district (where the property located) from the drop-down menu.

Step 5: The applicant has to select the Sub-Register Office.

Step 6: Select the year when the property registered.

Note : Details from 2015 – 2018 is available.

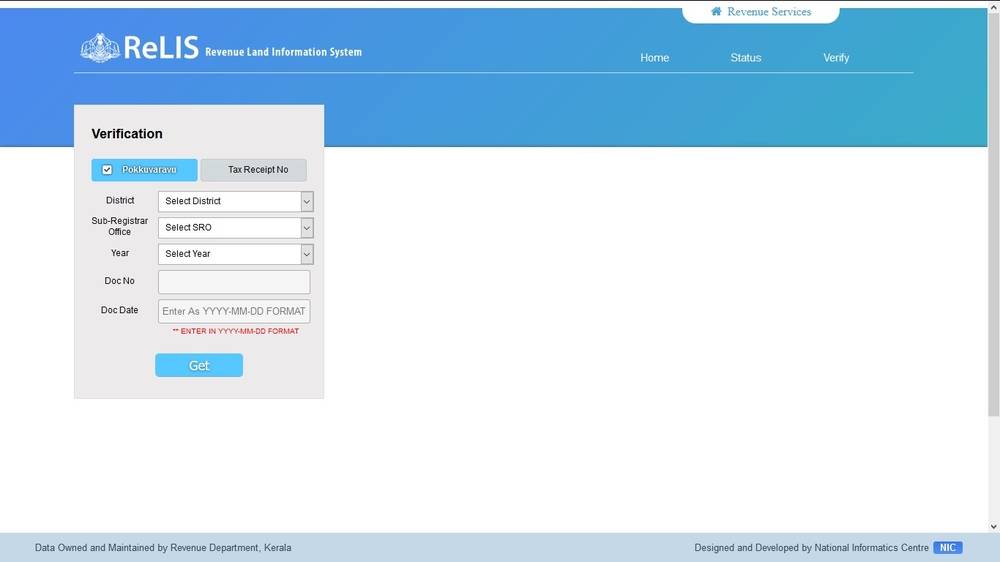

Image 3 Mutation of Property in Kerala

Step 7: Enter the document number and date.

Step 8: Click on ‘Get’ to verify the Pokkuvaravu details. The details of Pokkuvaravu will be displayed.

Image 3 Mutation of Property in Kerala

Step 7: Enter the document number and date.

Step 8: Click on ‘Get’ to verify the Pokkuvaravu details. The details of Pokkuvaravu will be displayed.

Pay Land Tax online through ReLIS

To pay tax online through ReLIS the applicant has registered in this portal. Follow the below steps to pay the tax online.Register in ReLiS for E-Payment

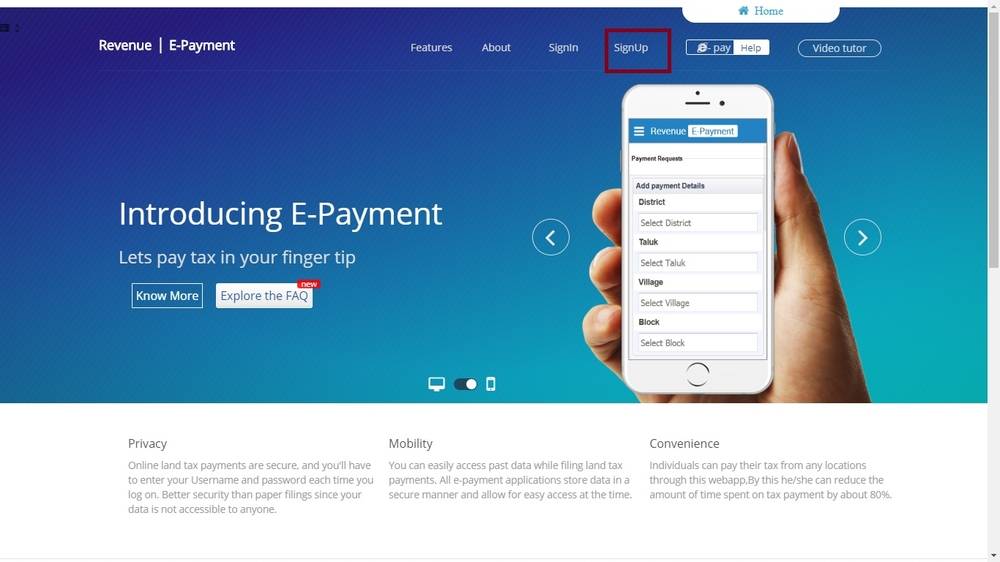

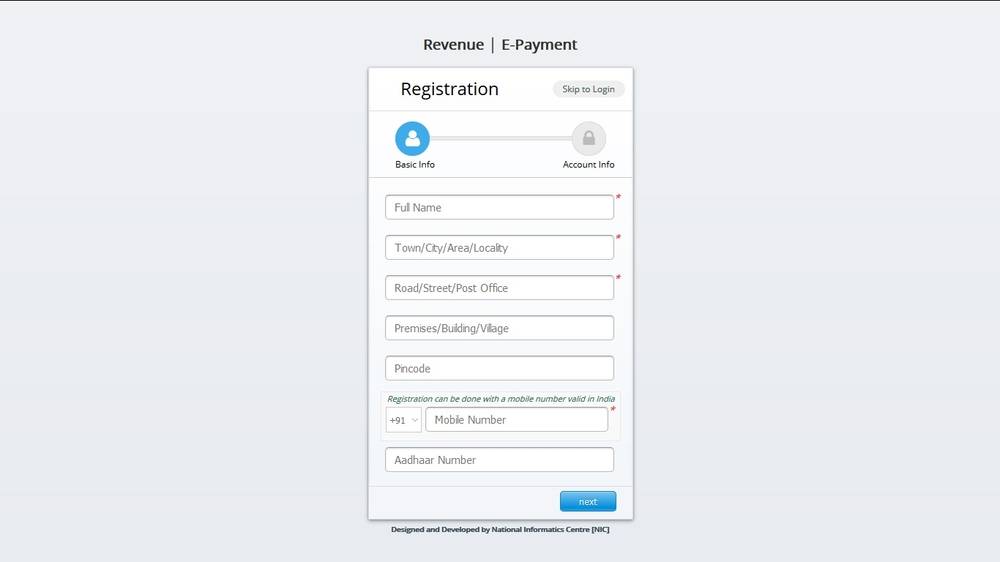

Step 1: Go to the home page of the Revenue department of Kerala. Step 2: Click on Pay the tax option from the menu. This will take the applicant to E-payment page. Image 4 Mutation of Property in Kerala

Step 3: Click on the sign-up option. Enter the name, address, mobile number and Aadhaar number.

Image 4 Mutation of Property in Kerala

Step 3: Click on the sign-up option. Enter the name, address, mobile number and Aadhaar number.

Image 5 Mutation of Property in Kerala

Step 4: Click on next button to enter account information.

Step 5: After entering the user name for the account and password, click on submit for registration.

Image 5 Mutation of Property in Kerala

Step 4: Click on next button to enter account information.

Step 5: After entering the user name for the account and password, click on submit for registration.

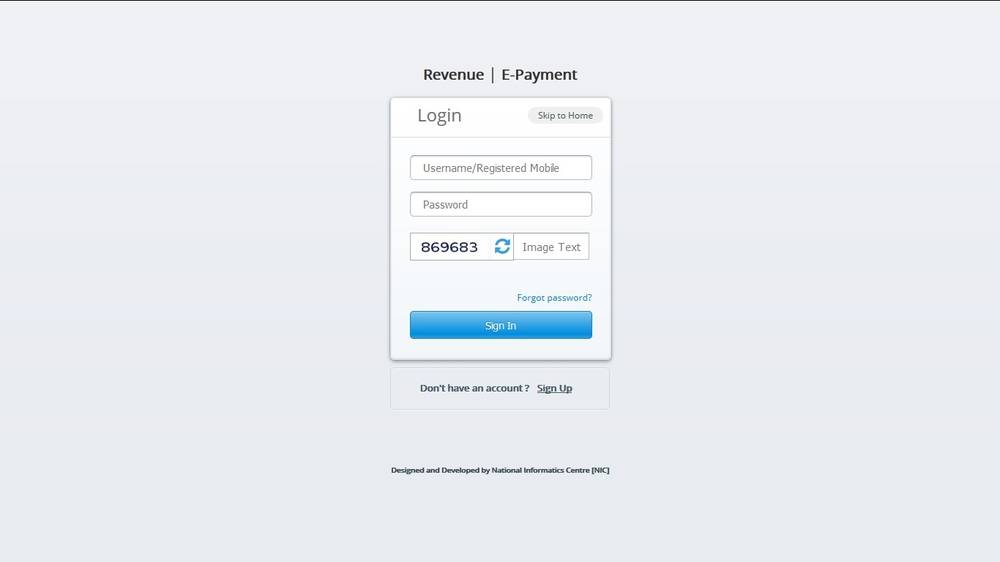

Image 6 Mutation of Property in Kerala

Image 6 Mutation of Property in Kerala

Make E-payment through ReLis

Step 6: Login into the portal by entering the user name and password. Step 7: Go to the menu and select New request option. Step 8: Select the district, Taluk, Village from the drop-down menu. Step 9: Enter Thandapper Number survey or subdivision number. Follow the below steps. Step 10: If ReLIS found the area, the applicant can make payment. Make individual landholders details; the tax amount is available on this page. Click Pay tax for payment. In the case of the area not found ‘If the area not seen, the applicant needs to add the area details by following these steps. Step 10a: Add Land Holder details. Step 10b: Enter Tax amount, date, receipt number of last tax paid and remarks. Step 10c: Click Submit for approval from the village officer. Note: After approval by the village officer, the applicant will receive an SMS indicating Village officer approval and amount of tax to be paid. Step 11: Log in to the ReLIS E-payment page Step 12: Click on My request option. Step 13: To pay Online click on the Pay now button.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...