Last updated: April 3rd, 2024 10:01 AM

Last updated: April 3rd, 2024 10:01 AM

Power of Attorney Format

Power of Attorney is a legal document executed by one or more persons giving authority to one or more persons to act on his or her behalf. Power of Attorney is governed by the Powers of Attorney Act of 1888. The person giving authority is called the attorney of the party giving the authority. The person receiving powers is called a Power of Attorney holder. Normally, there is no requirement for registration of Power-of-Attorney. However, if the Power of Attorney creates an interest in any immovable property, then the Power of Attorney must be registered. In this article, we delve into the intricacies of Power of Attorney, offering a comprehensive exploration and providing downloadable POA templates in both Word and PDF formats for your convenience.Power of Attorney Form

A Power of Attorney form is a legal document that allows an individual (the "Principal") to designate another person (the "Agent" or "Attorney-in-Fact") to act on their behalf in specified matters or all aspects of their life. Depending on the type of POA, these matters can range from financial and legal affairs to medical decisions.Importance of Power of Attorney

A power of attorney (POA) is an essential legal tool, especially when the Principal cannot manage their affairs due to illness, disability, or absence during critical legal transactions.Types of Power of Attorney Forms

There are several types of Power of Attorney, each serving different purposes:- General Power of Attorney: This grants the Agent broad powers to handle a wide range of the Principal's affairs. The authority under a General POA typically includes buying or selling property, managing business transactions, and handling banking matters. However, this type of POA becomes invalid if the Principal becomes incapacitated.

- Durable Power of Attorney: Similar to a General POA, it allows the Agent to manage the Principal's affairs, but it remains in effect even if the Principal becomes incapacitated. This feature makes it particularly important for long-term planning.

- Special or Limited Power of Attorney: This grants the Agent authority to conduct specific acts or make decisions in specific situations, such as selling a property, managing certain financial transactions, or handling legal claims. It does not grant broad authority across all areas of the Principal's life.

- Medical Power of Attorney: A Healthcare Proxy authorizes the Agent to make medical decisions on the Principal's behalf if they cannot do so themselves. A living often accompanies it will that outlines the Principal's wishes regarding life-sustaining treatment.

- Springing Power of Attorney: This POA "springs" into effect under specific conditions, typically when the Principal becomes incapacitated. It allows the Principal to retain control over their affairs until a certain event triggers the transfer of authority to the Agent.

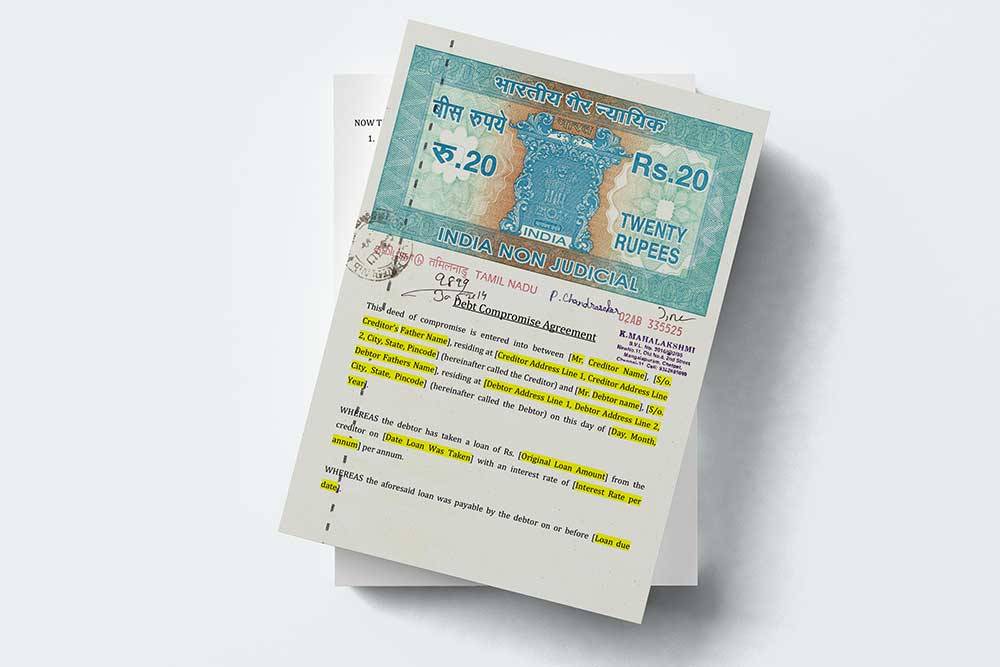

Stamp Duty for Power of Attorney

If a General Power of Attorney is conferred to father, mother, brother, sister, wife, husband, son, daughter, grandson, granddaughter or any near relative, without any consideration, then Stamp Duty of Rs. 500/- is only applicable for registration. In case General Power of Attorney is conferred to someone other than a close relative and/or for consideration. Stamp duty is payable as per the property's market value or the consideration, whichever is higher. In addition to the stamp duty, a registration fee of Rs.100 is applicable if the Power of Attorney is conferred without consideration in the name of the father, mother, brother, sister, wife, husband, son, daughter, grandson granddaughter or a near relative. In any other case, a registration fee is payable at Rs.10/- per Rs. 1000/- with a minimum of Rs. 100/- and a maximum fee of Rs. 30,000/- on the market value of property or consideration, whichever is higher. Stamp Duty payable for Special Power of Attorney is Rs. 100/-. Note: The stamp duty on a power of attorney will vary depending on the State and the powers conferred in the Power of Attorney. Hence, it's best to consult a Lawyer while executing a Power of Attorney.Authentication Process for Power of Attorney Documents

Power of Attorney can be authenticated before a Registrar or Sub-Registrar within whose district or sub-district the principal resides, and in case a Power of Attorney is executed outside of India, it can be authenticated by a Notary Public or any Court, Judge, Magistrate, Indian Counsel or via Counsel or a representative of the Central Government.General Power of Attorney vs Special Power of Attorney

This versatile document can be tailored to meet various needs. It offers two primary types: the "General" Power of Attorney, which grants broad authority across a wide range of matters, and the "Special" or "Limited" Power of Attorney, designed for specific tasks or decisions. When managing legal and financial affairs, it's crucial to understand the differences between a General Power of Attorney (POA) and a Special (or Limited) Power of Attorney. Each serves unique purposes and grants varying levels of authority to the appointed agent.General Power of Attorney

A General Power of Attorney provides broad powers to the agent or attorney-in-fact to manage a wide array of the principal's affairs. This type of POA is comprehensive and allows the agent to make decisions and perform actions as if they were the principals themselves. The authority typically includes handling financial transactions, buying or selling real estate, managing business dealings, and dealing with legal claims and litigation.Key aspects of a General Power of Attorney include:

- Broad Authority: The agent can perform almost any act the principal could, from managing finances to handling business transactions.

- Convenience: Ideal for individuals who need someone to manage all their affairs due to absence or incapacity.

- Termination: Generally ceases if the principal becomes incapacitated unless it's specified as "durable."

Special Power of Attorney

In contrast, a Special (or Limited) Power of Attorney grants the agent authority to act on the principal's behalf in specific matters or events. This type of POA is used for particular tasks, such as selling a property, managing a specific legal action, or handling financial transactions in a certain account. The document clearly outlines the agent's powers, limiting their authority to those actions.Key aspects of a Special Power of Attorney include:

- Limited Scope: The agent's powers are narrowly defined and restricted to specific tasks.

- Precision: This POA is useful for principals who need an agent to handle specific duties without granting broad access to all affairs.

- Flexibility: Can be tailored to suit the principal's precise needs for a particular transaction or period.

Key Differences

- Scope of Authority: General POA offers wide-ranging powers, while Special POA is limited to specific tasks.

- Purpose: A General POA is suitable for the comprehensive management of one's affairs, whereas a Special POA is ideal for particular transactions or events.

- Duration and Revocation: Both types can be revoked by the principal at any time, but the General POA often ceases if the principal becomes incapacitated, unlike the Special POA, which is typically task or time-bound.

Choosing Between General and Special POA

The choice between a General and a Special Power of Attorney depends on the principal's needs. If comprehensive management of affairs is needed, particularly in anticipation of potential incapacity, a General POA (preferably durable) might be appropriate. A Special POA is more suitable for specific transactions or limited purposes, providing precision and limiting the agent's authority to the principal's desired scope.Format of Power of Attorney

The format of Power of Attorney typically includes sections that identify the Principal and Agent, specify the powers granted, outline the duration of the POA, and contain places for signatures and notarization. It should be drafted in compliance with the legal requirements of the jurisdiction where it will be used.General Power of Attorney Format

To obtain the General Power of Attorney Format in Word and PDF formats, click the below button.Download Power of Attorney Format

You can also download the power of attorney format in the following formats.Key Considerations for Drafting a Power of Attorney

- Choose a trusted Agent: The Agent should be someone reliable and capable of handling the responsibilities you're assigning, whether they are financial, legal, or medical decisions. Be specific: Clearly outline the powers you are granting to your Agent. Specify this in the document if you only want them to handle certain transactions or decisions.

- Understand the type of POA needed: Choose the type that best suits your needs, whether it's a General, Durable, Special, Medical, or Springing POA. Legal requirements: Ensure the POA form complies with your state's laws. Requirements vary by state, including how the document must be signed, witnessed, and notarized.

- Revoke if necessary: You can revoke a POA as long as you are mentally competent. Revocation should be done in writing and communicated to the Agent and any institutions or parties informed of the original POA.

Conclusion

In conclusion, creating a Power of Attorney is a significant legal process that grants one or more individuals the authority to act on behalf of the grantor in various matters, as outlined in the Power of Attorney format. Whether opting for a General Power of Attorney format or a Special Power of Attorney, it's crucial to understand the responsibilities and powers conferred to the attorney. The document must be meticulously crafted, considering all legal requirements, including stamp duty, registration fees, and adherence to the Powers of Attorney Act of 1888. For those looking for ease of use, IndiaFilings offers various templates, including the Power of Attorney format in Word & PDF to help you start the process.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...