Last updated: August 29th, 2024 3:50 PM

Last updated: August 29th, 2024 3:50 PM

Pre-validation of Bank Account for Income Tax Refund

Pre-Validation of Bank Account is mandatory for claiming the income tax refund. If the taxpayer has miscalculated income tax and paid in excess or have an excess tax deducted at source (TDS), such excess amount can be obtained by claiming a refund at the time of filing income tax returns. The income tax department will verify the returns and process the refund. This refund will only be transferred electronically to the bank account that is linked with the PAN. Hence, the taxpayer must pre-validate the bank account on the income tax e-filing portal at the time of return filing. The current article explains the procedure for Pre-validation of Bank Account in detail.Pre-validation of Bank Account

As per the Income Tax Department notification, the taxpayer will have to make sure that they have pre-validated the bank account in which they wish to receive the income tax refund once the income tax return is successfully filed or when filing the return. Apart from pre-validating the bank account, the taxpayers are also required to link the PAN with the bank account. If the PAN is not linked with the bank account, then the taxpayer will not be able to get the income tax refund in the bank account. Know more about Linking PAN with Bank AccountsProcedure to Pre-validate Bank Account

The taxpayer needs to access the official website of Income-Tax e-filing portal and click on the ‘Login’ option and furnish the login credentials. The taxpayers are requested to use PAN as the User ID. [caption id="attachment_108066" align="aligncenter" width="590"] Pre-validation of Bank Account for Income Tax Refund - Home Page

Upon successful login to the portal, the user needs to click on the ‘Profile Settings’ tab and choose ‘Pre-validate Your Bank Account’ option.

[caption id="attachment_108067" align="aligncenter" width="586"]

Pre-validation of Bank Account for Income Tax Refund - Home Page

Upon successful login to the portal, the user needs to click on the ‘Profile Settings’ tab and choose ‘Pre-validate Your Bank Account’ option.

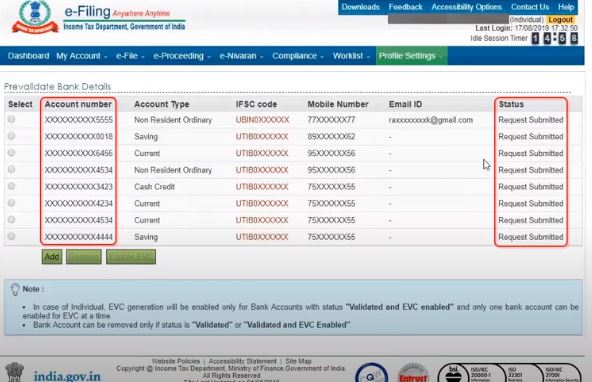

[caption id="attachment_108067" align="aligncenter" width="586"] Pre-validation of Bank Account for Income Tax Refund - Application Page

If any of the bank accounts are already pre-validated, it will be displayed on the screen. If the taxpayer doesn’t have a pre-validated account or the taxpayer wish to receive the income tax refund in a different bank account, then click on 'Add option'.

[caption id="attachment_108068" align="aligncenter" width="592"]

Pre-validation of Bank Account for Income Tax Refund - Application Page

If any of the bank accounts are already pre-validated, it will be displayed on the screen. If the taxpayer doesn’t have a pre-validated account or the taxpayer wish to receive the income tax refund in a different bank account, then click on 'Add option'.

[caption id="attachment_108068" align="aligncenter" width="592"] Pre-validation of Bank Account for Income Tax Refund - Application Page2

A new page will open, the taxpayer needs to provide the bank account details such as account number, IFSC, bank name, and contact details such as the mobile number and mail ID. The PAN, name, mobile number, and email address provided here must match with bank account records to pre-validate successfully.

[caption id="attachment_108069" align="aligncenter" width="587"]

Pre-validation of Bank Account for Income Tax Refund - Application Page2

A new page will open, the taxpayer needs to provide the bank account details such as account number, IFSC, bank name, and contact details such as the mobile number and mail ID. The PAN, name, mobile number, and email address provided here must match with bank account records to pre-validate successfully.

[caption id="attachment_108069" align="aligncenter" width="587"] Pre-validation of Bank Account for Income Tax Refund - Application Page3

Note: It is essential to link or update the PAN with the bank before pre-validating your bank account details under the e-filing portal.

After providing the details, click on 'Pre-validate' option. Once clicked, a message will appear on the screen as "Your request for a pre-validating bank account is submitted “ and “Status of your request will be sent to your registered email id and the mobile number"

[caption id="attachment_108070" align="aligncenter" width="591"]

Pre-validation of Bank Account for Income Tax Refund - Application Page3

Note: It is essential to link or update the PAN with the bank before pre-validating your bank account details under the e-filing portal.

After providing the details, click on 'Pre-validate' option. Once clicked, a message will appear on the screen as "Your request for a pre-validating bank account is submitted “ and “Status of your request will be sent to your registered email id and the mobile number"

[caption id="attachment_108070" align="aligncenter" width="591"] Pre-validation of Bank Account for Income Tax Refund - Application Page4

Pre-validation of Bank Account for Income Tax Refund - Application Page4

Check the status of Request

The taxpayer can check the status of the request in the following ways:- As mentioned above, Status of the Revalidation of Bank Account request will be updated through the registered email ID and mobile number

- By visiting the income tax e-filing website again and log in to the portal. Click the ‘Pre-validate Your Bank Account’ option under the ‘Profile Settings’ tab. The status of the request will be displayed.

Procedure to remove a bank account from the e-filing account

If the taxpayer wishes to remove a particular bank account from the e-filing account, the taxpayer needs to select the 'Pre-validate your bank account' option from the 'Profile Settings' tab, select the account wishes to remove and click on 'Remove' option.View the list of Bank Accounts

If the taxpayer wants to view the list of bank accounts where pre-validation has failed, then do the same by clicking, 'View Failed/removed bank accounts'. The screen will display all the details of the bank account and the reason for rejection or removal.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...