Updated on: December 27th, 2018 2:16 AM

Updated on: December 27th, 2018 2:16 AM

Preparing TRAN-1 using Offline Tool

TRAN-1 must be filed by a taxpayer who is have Input Tax Credit (ITC) on closing stock and have migrated to GST from any of the previous tax systems. To help taxpayers prepare and file TRAN-1, Goods and Service Tax Network (GSTN) has provided the TRAN-1 Offline Utility. All the information can be added in offline mode and later uploaded on GST portal to file TRAN-1. In this article, we look at the procedure for preparing and filing TRAN-1 using Offline Tool in detail.Features of TRAN-1 Offline Tool

The Key Features of TRAN-1 Offline Tool is explained in detail below:- The TRAN-1 records related to certain tables can be prepared offline

- Most of the data entries and business validations are inbuilt in the TRAN-1 offline tool reducing errors upon upload to GST Portal.

- Basic System Configurations

- To use TRAN-1 Offline Tool efficiently, ensure that the system has following basic configuration.

- System Requirement: The TRAN-1 Offline Tool functions work best on Windows 7 and above, the TRAN-1 Offline Tool does not work on Linux and Mac.

- MS Excel – Microsoft Excel 2007 and above is needed for running TRAN-1 Offline Tool. On the other hand, for any below version, the TRAN-1 Offline Tool will open in the default browser.

Download TRAN-1 Offline Tool from the GST Portal

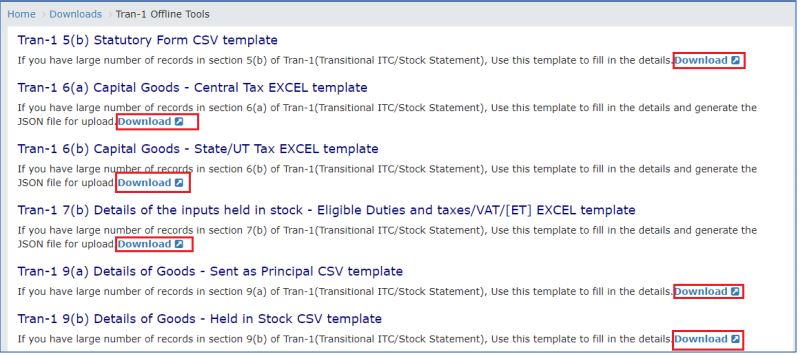

Downloading the TRAN-1 Offline Tool is a one-time activity; however, it may need an update in future if the GSTN updates the TRAN-1 Offline Tool. Note: The taxpayer needs to check the version of the TRAN-1 Offline Tool used by her/him with the one available in the GST Portal at regular intervals. You can follow the steps by step guidelines given here to download and install TRAN-1 Offline Tool Note: The taxpayer can download the TRAN-1 Offline Tool from the GST Portal without login to the Portal. Step 1: The taxpayer need to access the main page of Goods and Service Tax (GST) web portal. Step 2: From the GST home page, select the TRAN-1 Offline Tool option from the list of offline tools. Image 1 Preparing TRAN-1 using Offline Tool

Step 3: Click on the Download link for the section to be downloaded.

Image 1 Preparing TRAN-1 using Offline Tool

Step 3: Click on the Download link for the section to be downloaded.

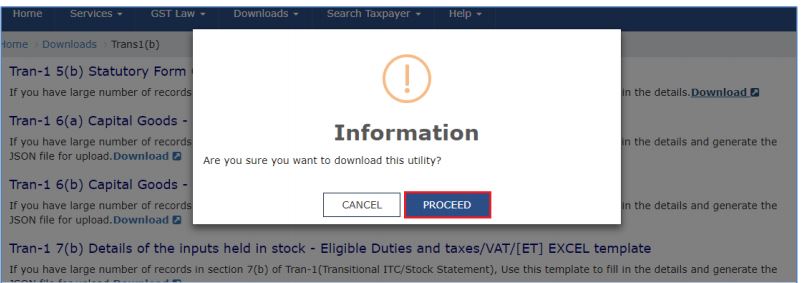

Image 2 Preparing TRAN-1 using Offline Tool

Step 4: A confirmation message appears. Click on the PROCEED button to download the TRAN-1 Offline Tool from the GST Portal.

Image 2 Preparing TRAN-1 using Offline Tool

Step 4: A confirmation message appears. Click on the PROCEED button to download the TRAN-1 Offline Tool from the GST Portal.

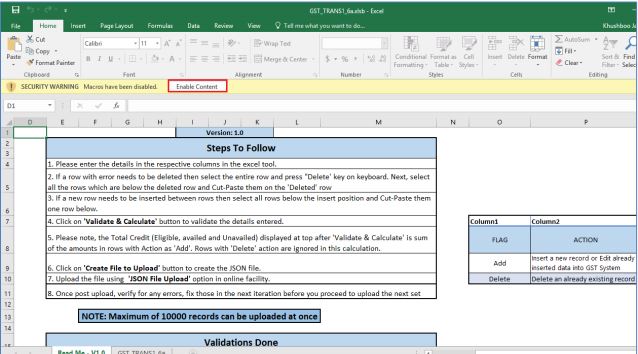

Image 3 Preparing TRAN-1 using Offline Tool

Step 5: The TRAN-1 Offline Tool will be downloaded in the Downloads folder.

Image 3 Preparing TRAN-1 using Offline Tool

Step 5: The TRAN-1 Offline Tool will be downloaded in the Downloads folder.

TRAN-1 Offline Tool Installation Procedure

Once the TRAN-1 Offline Tool is downloaded in the computer, you need to unzip these downloaded files prepare return offline. The procedure to install the TRAN-1 Offline Tool is explained in detail below: Step 1: Unzip the downloaded files and extract the files from the downloaded zip folder TRAN-1 Offline Tool. Zip folder will contain the CSV and excel file. Image 6 Preparing TRAN-1 using Offline Tool

Step 2: You need to double click on the Excel or CSV file. Once the excel file is opened, click the Enable Content button.

[caption id="attachment_70419" align="aligncenter" width="638"]

Image 6 Preparing TRAN-1 using Offline Tool

Step 2: You need to double click on the Excel or CSV file. Once the excel file is opened, click the Enable Content button.

[caption id="attachment_70419" align="aligncenter" width="638"] Image Preparing TRAN-1 using Offline Tool

Image Preparing TRAN-1 using Offline Tool

Templates in TRAN-1 Offline Tool

TRAN-1 Offline Tool has six downloadable templates as described below:Tran-1 5(b) Statutory Form CSV template

If the taxpayer has a large number of records in section 5(b) of Tran-1, transitional ITC or Stock Statement, the taxpayer can use this template to provide detailsTran-1 6(a) Capital Goods & Central Tax excel template

If the taxpayer has a large number of records in section 6(a) of Tran-1(Transitional ITC or Stock Statement), you can use this template to fill the details and generate the JSON file for uploadTran-1 6(b) Capital Goods & State,UT Tax excel template

If you have many records in section 6(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template to provide details and generate the JSON file for uploadTran-1 7(b) Information of the inputs held in stock - Eligible Duties and taxes/VAT/[ET] EXCEL template

For a large number of records in section 7(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template to furnish details and generate the JSON file for upload.Tran-1 9(a) details of goods - sent as the principal CSV template

If the taxpayer has a large number of records in section 9(a) of Tran-1(Transitional ITC/Stock Statement), he can use this template to fill the details.Tran-1 9(b) Details of goods - held in stock CSV template

If you have information in section 9(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template for providing detailsPrepare details using TRAN-1 Offline Tool

The procedure to provide details using the TRAN -1 offline tool is explained in detail below:Upload Details using the CSV Template

The following CSV templates are available to upload data for below section of TRAN-1:- Tran-1 5(b) Statutory Form CSV template

- Tran-1 9(a) Details of Goods - Sent as Principal CSV template

- Tran-1 9(b) Details of Goods - Held in Stock CSV template

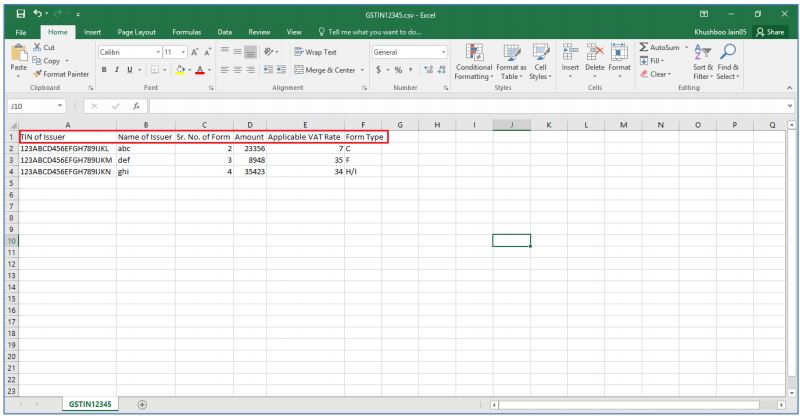

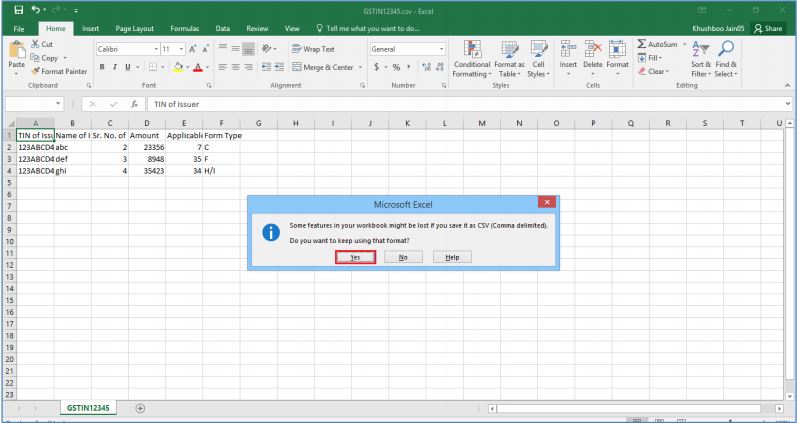

Image 7 Preparing TRAN-1 using Offline Tool

Step 2: Provide details in the excel sheet under respective columns.

Step 3: After providing the details, click on the SAVE button. The CSV file will be saved.

Image 7 Preparing TRAN-1 using Offline Tool

Step 2: Provide details in the excel sheet under respective columns.

Step 3: After providing the details, click on the SAVE button. The CSV file will be saved.

Image 8 Preparing TRAN-1 using Offline Tool

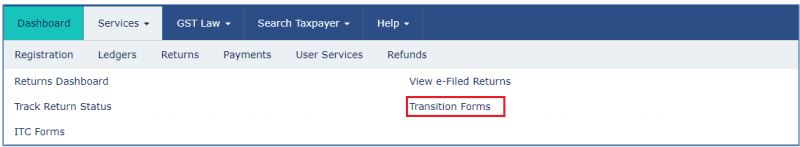

Step 4: Access the home page of GST, Click the Services option and then select the returns option. By clicking on Transition Forms, the TRAN - 1 - Transitional ITC / Stock Statement page will be displayed.

Image 8 Preparing TRAN-1 using Offline Tool

Step 4: Access the home page of GST, Click the Services option and then select the returns option. By clicking on Transition Forms, the TRAN - 1 - Transitional ITC / Stock Statement page will be displayed.

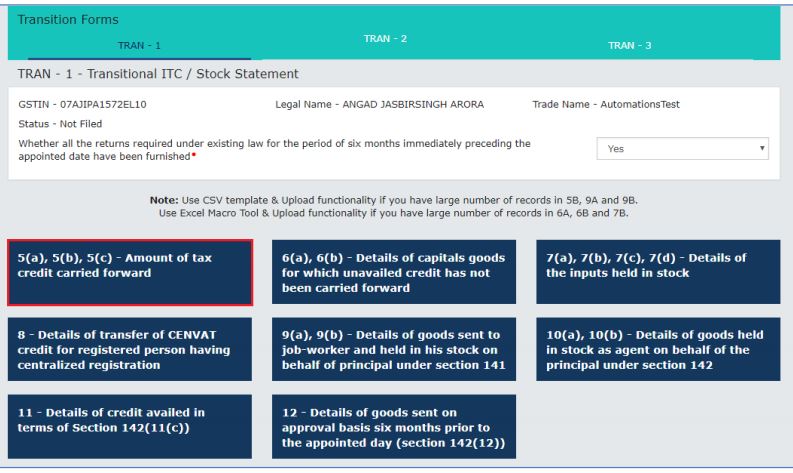

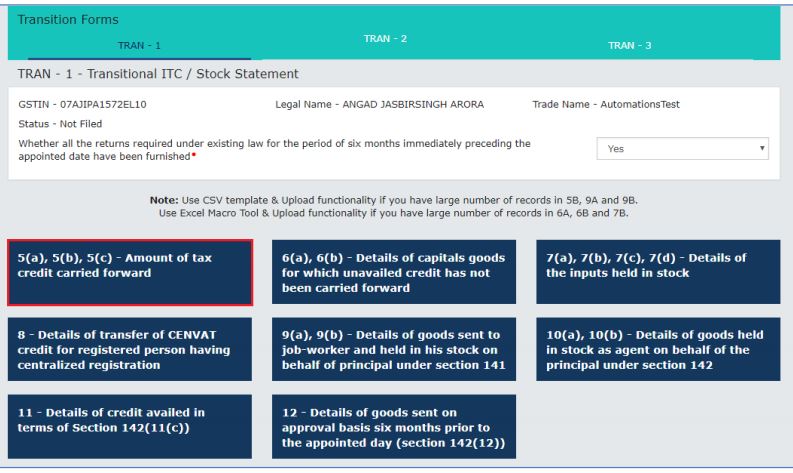

Image 9 Preparing TRAN-1 using Offline Tool

Step 5: Click on the 5(a), 5(b), 5(c) - Amount of tax credit carried forward tile.

Image 9 Preparing TRAN-1 using Offline Tool

Step 5: Click on the 5(a), 5(b), 5(c) - Amount of tax credit carried forward tile.

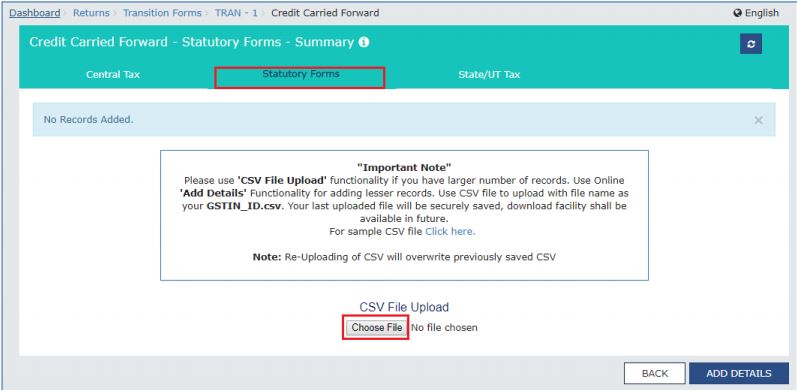

Image 10 Preparing TRAN-1 using Offline Tool

Step 6: In the new window, select the legal forms tab and then click on Choose file option.

Image 10 Preparing TRAN-1 using Offline Tool

Step 6: In the new window, select the legal forms tab and then click on Choose file option.

Image 10 Preparing TRAN-1 using Offline Tool

Image 10 Preparing TRAN-1 using Offline Tool

Image 11 Preparing TRAN-1 using Offline Tool

Step 7: Browse and navigate the CSV file to be uploaded from the computer. Click on the Open button.

Image 11 Preparing TRAN-1 using Offline Tool

Step 7: Browse and navigate the CSV file to be uploaded from the computer. Click on the Open button.

Image 12 Preparing TRAN-1 using Offline Tool

A success message will be displayed. The uploaded CSV file will be validated and processed. If the validation is failure upon processing; errors if any will be shown on the GST Portal.

Similarly, you can upload data for Tran-1 9(a) Details of Goods - Sent as Principal CSV template and Tran-1 9(b) Details of Goods - Held in Stock CSV template

Image 12 Preparing TRAN-1 using Offline Tool

A success message will be displayed. The uploaded CSV file will be validated and processed. If the validation is failure upon processing; errors if any will be shown on the GST Portal.

Similarly, you can upload data for Tran-1 9(a) Details of Goods - Sent as Principal CSV template and Tran-1 9(b) Details of Goods - Held in Stock CSV template

Upload Details using the Excel Template

The following Excel Template is available to upload data for below section of TRAN-1:- Tran-1 6(a) Capital Goods: Central Tax EXCEL template

- Tran-1 6(b) Capital Goods : State/UT Tax EXCEL template

- Tran-1 7(b) Details of the records held in stock - Eligible Duty and taxes/VAT/[ET] EXCEL template

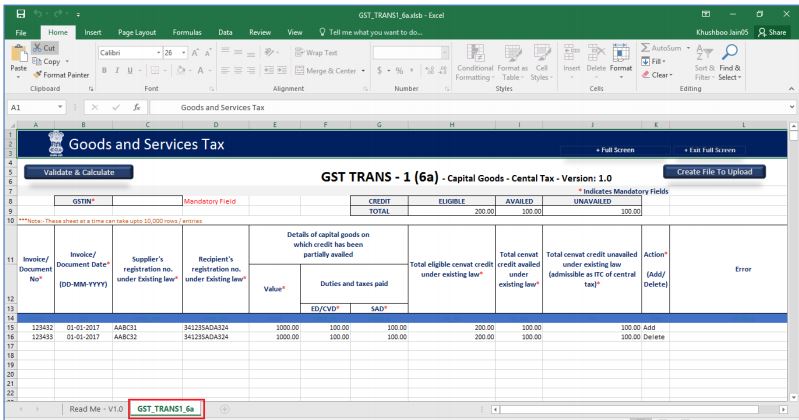

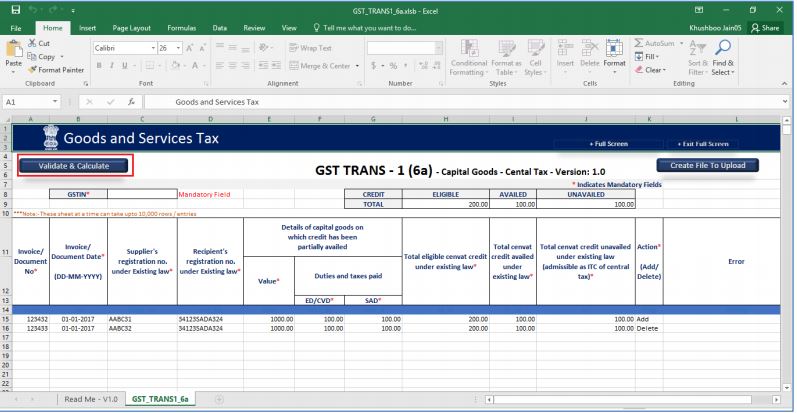

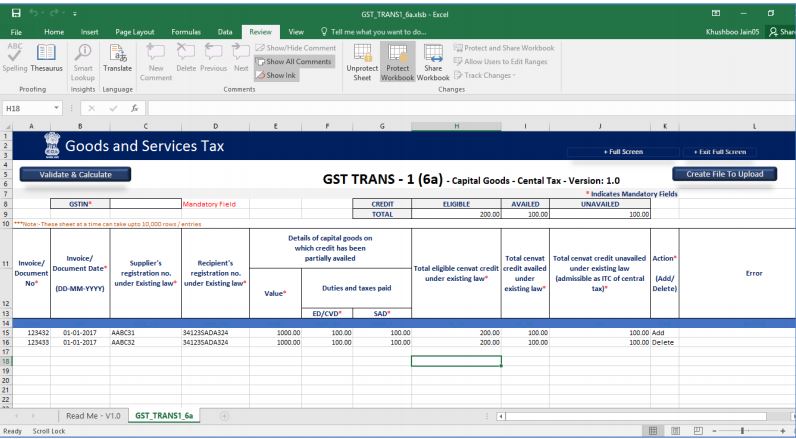

Image 13 Preparing TRAN-1 using Offline Tool

Step 2: You need to navigate to worksheet GST_TRANS1_6a.

Image 13 Preparing TRAN-1 using Offline Tool

Step 2: You need to navigate to worksheet GST_TRANS1_6a.

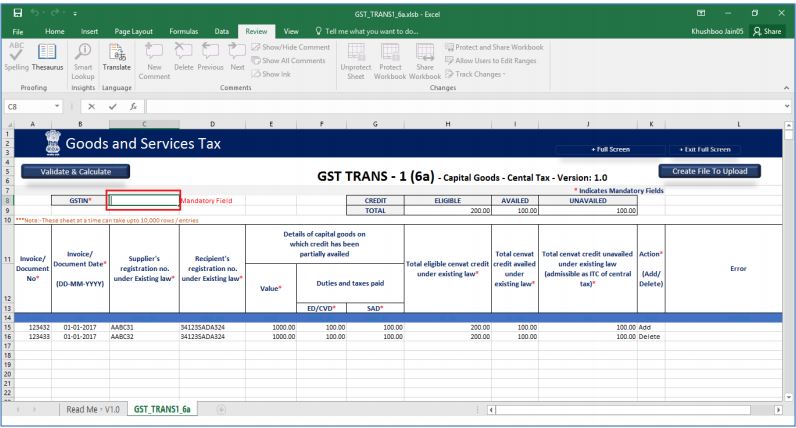

Image 14 Preparing TRAN-1 using Offline Tool

Step 3: In the GSTIN field, provide the GSTIN.

Image 14 Preparing TRAN-1 using Offline Tool

Step 3: In the GSTIN field, provide the GSTIN.

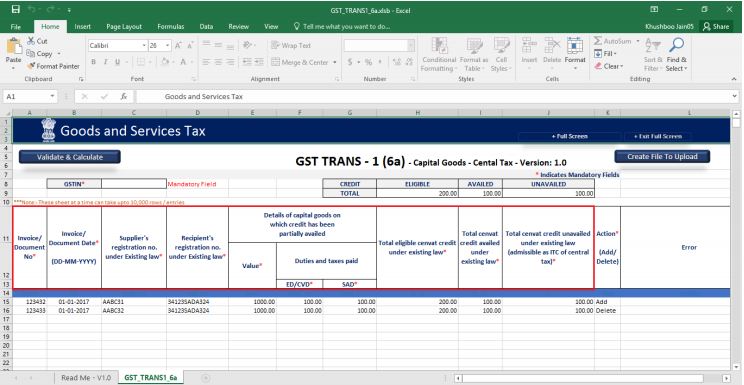

Image 15 Preparing TRAN-1 using Offline Tool

Step 4: Provide details in the respective columns of the excel tool

Note: Recipient's registration number should be a valid registration number available in Amendments of Registration Non-Core Fields in Registration Service under any Central Tax Registration Number category.

Image 15 Preparing TRAN-1 using Offline Tool

Step 4: Provide details in the respective columns of the excel tool

Note: Recipient's registration number should be a valid registration number available in Amendments of Registration Non-Core Fields in Registration Service under any Central Tax Registration Number category.

- You can use add an option to insert a new record or Edit already inserted data into GST System

- Using the delete option, you can delete an already existing record.

- If the taxpayer wants to insert a new row between rows, then select all rows below the insert position and Cut-Paste them one row below

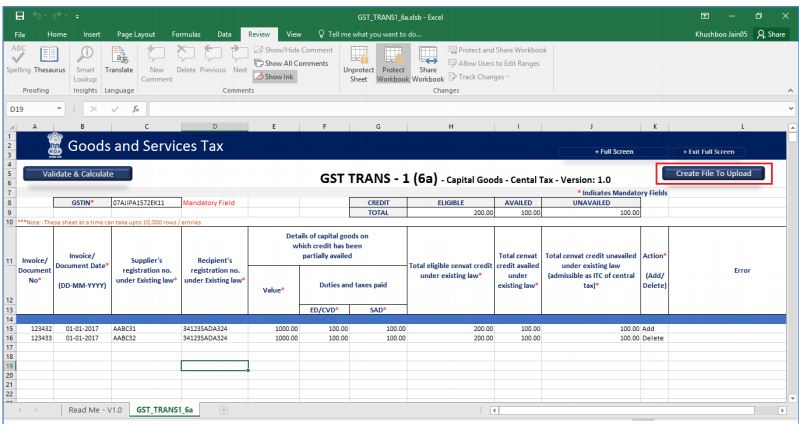

Image 16 Preparing TRAN-1 using Offline Tool

Step 5: Once all details are provided, click on the Validate and Calculate Sheet button to validate the worksheet.

The total un-availed credit will be calculated on clicking the 'Validate & Calculate' Button. The values will be calculated as Total Un-availed Credit = Total Available Credit - Total Availed Credit. The value should not be less than zero and greater than the calculated value.

Image 16 Preparing TRAN-1 using Offline Tool

Step 5: Once all details are provided, click on the Validate and Calculate Sheet button to validate the worksheet.

The total un-availed credit will be calculated on clicking the 'Validate & Calculate' Button. The values will be calculated as Total Un-availed Credit = Total Available Credit - Total Availed Credit. The value should not be less than zero and greater than the calculated value.

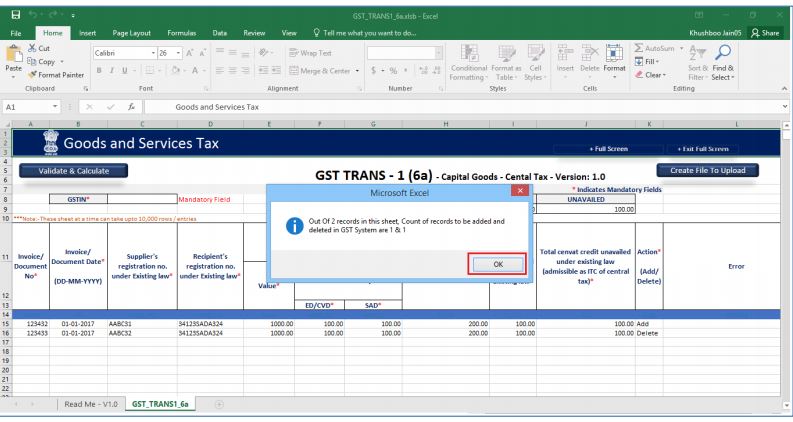

Image 17 Preparing TRAN-1 using Offline Tool

Image 17 Preparing TRAN-1 using Offline Tool

For successful validation

Step 6: In case of successful validation, a message will be displayed with a count of records to be added and deleted in the GST Portal. Click on the OK button. Image 18 Preparing TRAN-1 using Offline Tool

Note: If you want to delete the row with error, then select the entire row and press "Delete' key on the keyboard. Next, select all the rows, which are below the deleted row and Cut-Paste them on the 'Deleted' row.

Image 18 Preparing TRAN-1 using Offline Tool

Note: If you want to delete the row with error, then select the entire row and press "Delete' key on the keyboard. Next, select all the rows, which are below the deleted row and Cut-Paste them on the 'Deleted' row.

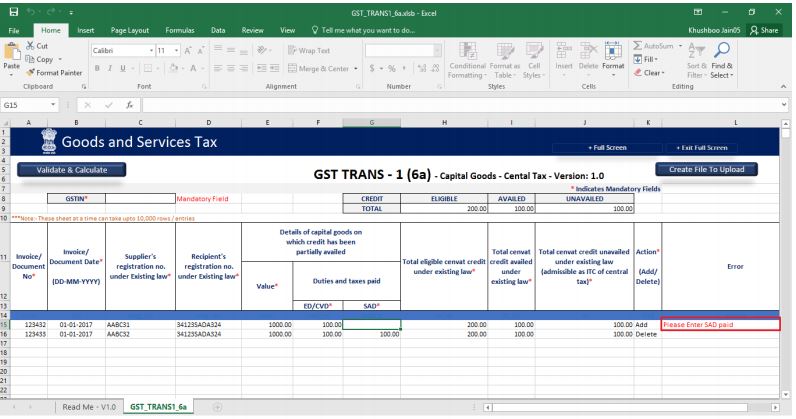

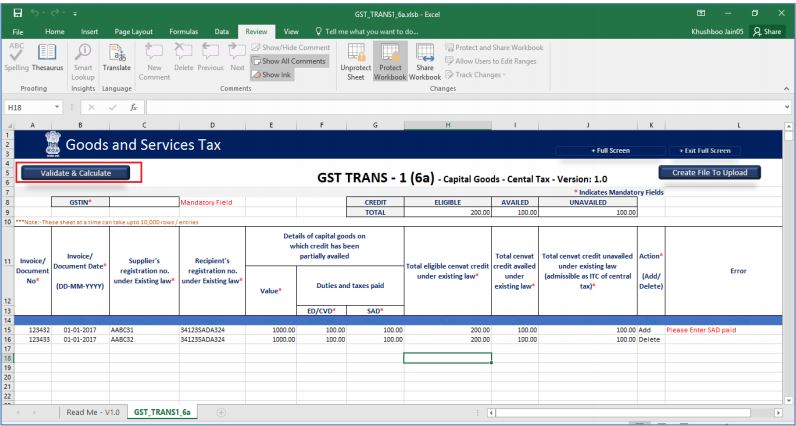

For unsuccessful validation

Step 7: In case of an unsuccessful validation, errors will be shown in the Error Colum. Image 19 Preparing TRAN-1 using Offline Tool

Step 8: Once all errors are rectified, click on the Validate & Calculate Sheet button to validate the worksheet.

Image 19 Preparing TRAN-1 using Offline Tool

Step 8: Once all errors are rectified, click on the Validate & Calculate Sheet button to validate the worksheet.

Image 20 Preparing TRAN-1 using Offline Tool

The error column will be blank showing the row is validated.

Image 20 Preparing TRAN-1 using Offline Tool

The error column will be blank showing the row is validated.

Generate JSON file

The procedure to generate JSON file using ‘Generate File to Upload’ button is described here: Step 1: Click on the Generate File to Upload button to generate JSON for upload on GST Portal. Image 21 Preparing TRAN-1 using Offline Tool

Step 2: Select the folder where you want to save the JSON file. Enter the file name and click on the SAVE button.

Image 21 Preparing TRAN-1 using Offline Tool

Step 2: Select the folder where you want to save the JSON file. Enter the file name and click on the SAVE button.

Image 22 Preparing TRAN-1 using Offline Tool

Step 3: A confirmation message will be displayed that the JSON file is created. Click on the OK button.

Image 22 Preparing TRAN-1 using Offline Tool

Step 3: A confirmation message will be displayed that the JSON file is created. Click on the OK button.

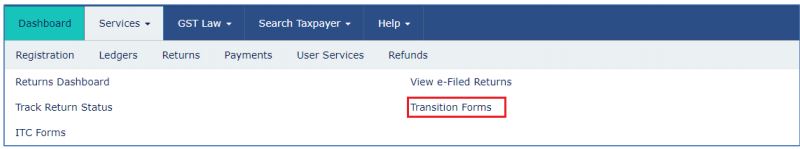

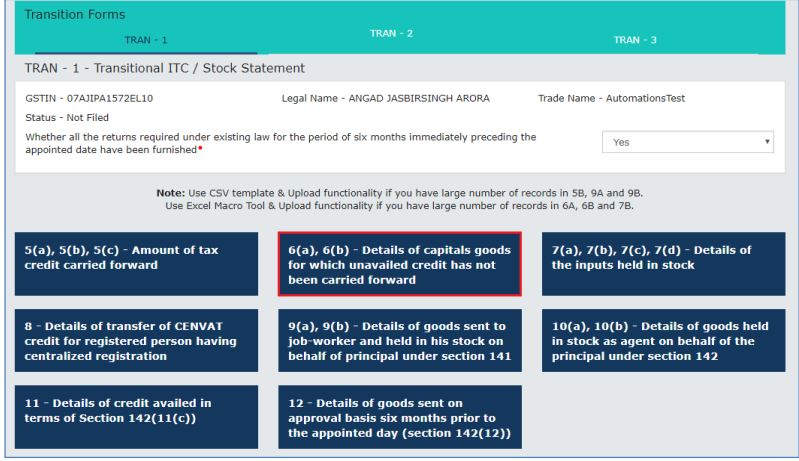

Upload the generated JSON File on GST Portal

The procedure to upload JSON file on GST Portal is explained in detail below: Step 1: For uploading Generated JSON file on GST web portal, the taxpayer has to visit the Goods and Service Tax home page. Step 2: From the home page, select the Service option and then select returns option. Now, the taxpayer needs to select the Transition Forms command option. Image 25 Preparing TRAN-1 using Offline Tool

Step 3: The TRAN - 1 - Transitional ITC / Stock Statement page will be displayed. Select the “6(a), 6(b) - Details of capitals goods for which un-availed credit has not been carried forward” tile.

Image 25 Preparing TRAN-1 using Offline Tool

Step 3: The TRAN - 1 - Transitional ITC / Stock Statement page will be displayed. Select the “6(a), 6(b) - Details of capitals goods for which un-availed credit has not been carried forward” tile.

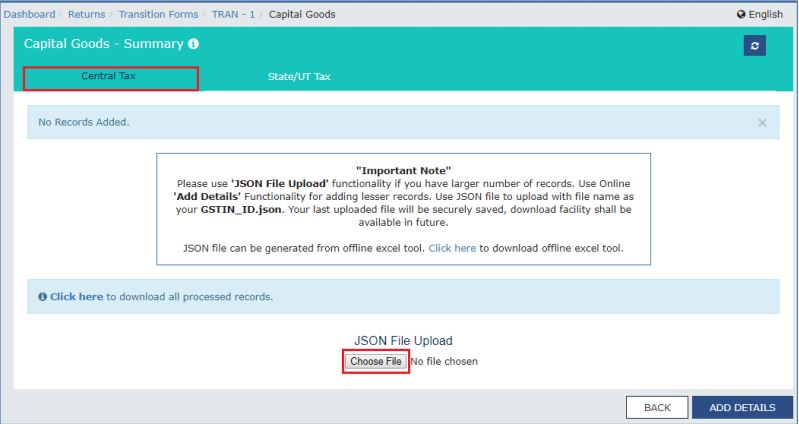

Image 26 Preparing TRAN-1 using Offline Tool

Step 4: Select the Central Tax Tab and then click on the Choose File button.

Image 26 Preparing TRAN-1 using Offline Tool

Step 4: Select the Central Tax Tab and then click on the Choose File button.

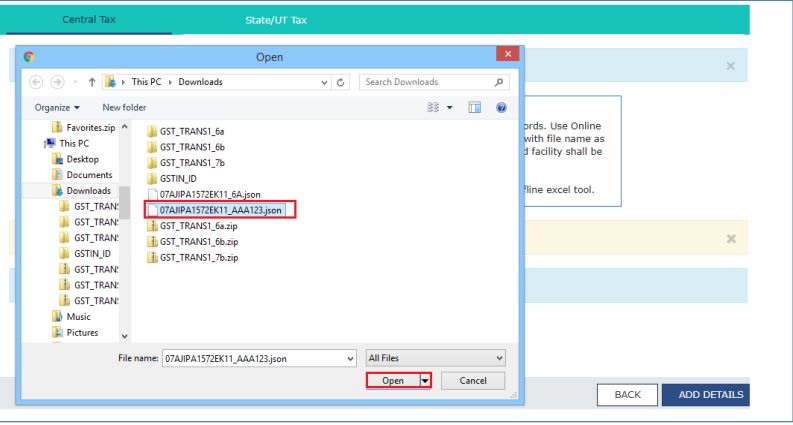

Image 27 Preparing TRAN-1 using Offline Tool

Step 5: Browse and navigate the JSON file to upload from the computer. Click on the Open button.

Image 27 Preparing TRAN-1 using Offline Tool

Step 5: Browse and navigate the JSON file to upload from the computer. Click on the Open button.

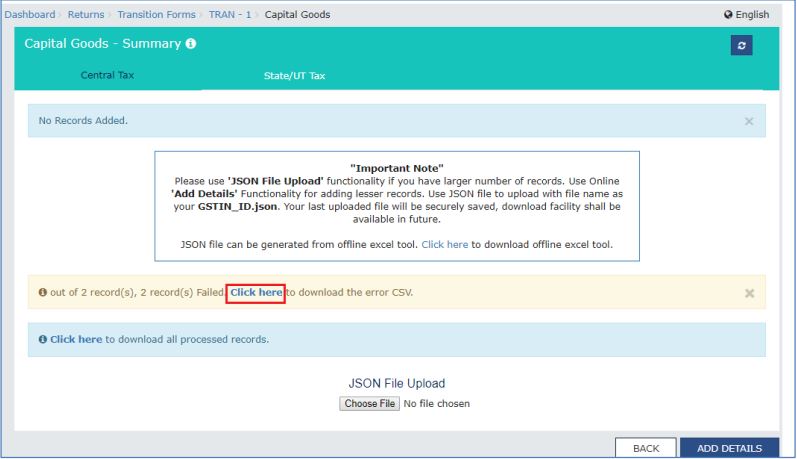

Image 28 Preparing TRAN-1 using Offline Tool

Step 6: The uploaded CSV file will be validated and processed. If the validation failure upon processing; errors if any can be downloaded from the GST Portal.

Image 28 Preparing TRAN-1 using Offline Tool

Step 6: The uploaded CSV file will be validated and processed. If the validation failure upon processing; errors if any can be downloaded from the GST Portal.

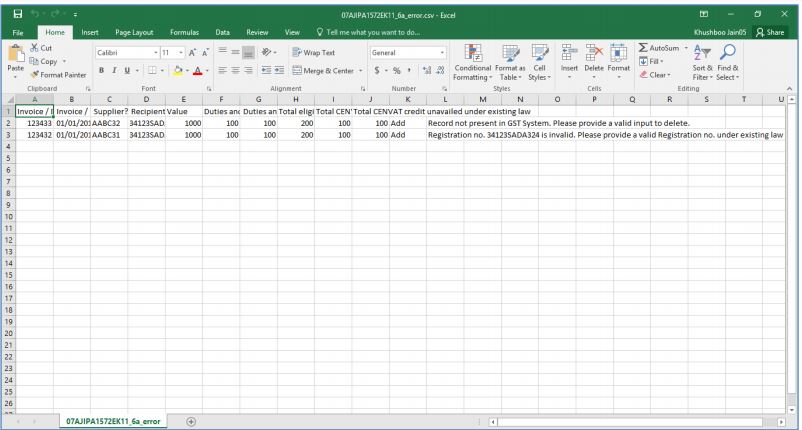

Image 29 Preparing TRAN-1 using Offline Tool

Step 7: The error will be shown after downloading the error file. You need to rectify the errors in the JSON file and upload again on the GST Portal.

Image 29 Preparing TRAN-1 using Offline Tool

Step 7: The error will be shown after downloading the error file. You need to rectify the errors in the JSON file and upload again on the GST Portal.

Image 30 Preparing TRAN-1 using Offline Tool

Similarly, you can upload data for Tran-1 6(b) Capital Goods - State/UT Tax EXCEL template and Tran-1 7(b) Details of the inputs held in stock - Eligible Duties and taxes/VAT/[ET] EXCEL template.

Image 30 Preparing TRAN-1 using Offline Tool

Similarly, you can upload data for Tran-1 6(b) Capital Goods - State/UT Tax EXCEL template and Tran-1 7(b) Details of the inputs held in stock - Eligible Duties and taxes/VAT/[ET] EXCEL template.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...