Updated on: December 17th, 2019 3:40 PM

Updated on: December 17th, 2019 3:40 PM

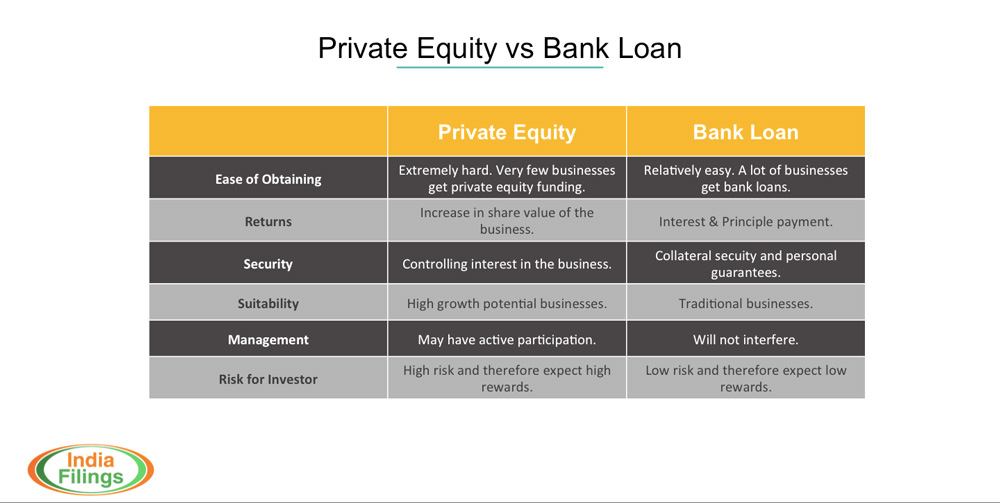

Private Equity vs Bank Loan

Starting a business and growing requires money, and raising the right kind of capital is essential. Bank loans have helped build many of the traditional businesses in India. Private equity and venture capital are today becoming increasing popular and are helping build many of the high-growth potential companies. Based on the vision the promoter has for the company, choosing the right kind of capital is essential. In this article we compare Private Equity vs Bank Loan in India.What is Private Equity?

Private equity is investment of equity capital by financial investors over the medium or long term - to non-quoted high growth potential companies. Private equity firms seek out companies with high growth potential and aim to put in place the capital, talent and strategy needed to permanently strengthen the company and raise its value. Private equity and venture capital are similar; however, strictly speaking, venture capital refers to equity investment made for launch and early development, whereas private equity refers to development stages of the business life cycle.

What is Bank Loan?

Bank loan is capital in the form of debt from financial institutions. Bank loan is available for businesses in all stages of the business life cycle. Bank loan for business is typically provided as term loans (for funding capital assets) and/or working capital (for funding inventory). Bank loan is one of the easiest forms of capital that can be obtained by the promoter to kick start a business. If certain criteria in terms of financial strength, collateral and margin are fulfilled, bank loan can be obtained easily. Bank loan is a very viable funding option for many of the startups in India, to know more read the article on "Bank loan for Startups".

What capital is right for my business?

Each business has its own aspirations, abilities, needs and team. Private equity may not be ideal for all businesses and private equity investors are also very selective when it comes to investing in companies. If the answer for majority of the following questions is yes, then private equity may be right for your business:

- Does your business operate in a high growth market?

- Is your company's development prospects sufficiently ambitious?

- Does your company have certain technological or competitive advantage that can be developed or exploited?

- Are your prepared to share strategic decisions with shareholders?

- Is there a realistic exit strategy for all the shareholders?

On the other hand, debt capital is suitable for most of the traditional businesses. It is also easier to obtain debt financing as there are plenty of Banks available to fund businesses that satisfy certain basic criteria. Debt funding may be ideal for your business, if the answer for majority of the following questions is yes:

- Does your business require investment in capital assets (Machinery) and/or working capital (inventory)?

- Can you afford to provide any property as collateral security for the debt funding?

- Do you have margin money for the debt funding?

Private Equity vs Bank Loan

[caption id="attachment_2525" align="aligncenter" width="887"] Private equity and Bank Loan differences

Private equity and Bank Loan differences

To sanction bank loan, lenders usually demand guarantees in the form of collateral security and personal guarantee - both personal and from the company. Therefore, first generation Entrepreneurs with few or no assets, might find it hard or even impossible to provide these collateral securities. However, bank loans do not have any impact on the share structure of the company and the banker will not intervene in the operations of the company.

Private equity investors bring equity capital for the company and do not require interest or principle payments. Private equity investors are like any other shareholder and will only profit if the company grows. Therefore, private equity investors look for a long-term partnership to help the company with the next growth stages of the business life cycle. However, private equity investors may request for specific controlling rights over how the company is managed and may play a active part.

To know more about Private Equity or Bank Loan, visit IndiaFilings.com

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...