Last updated: November 14th, 2024 9:47 AM

Last updated: November 14th, 2024 9:47 AM

Private Limited Company Tax Rate

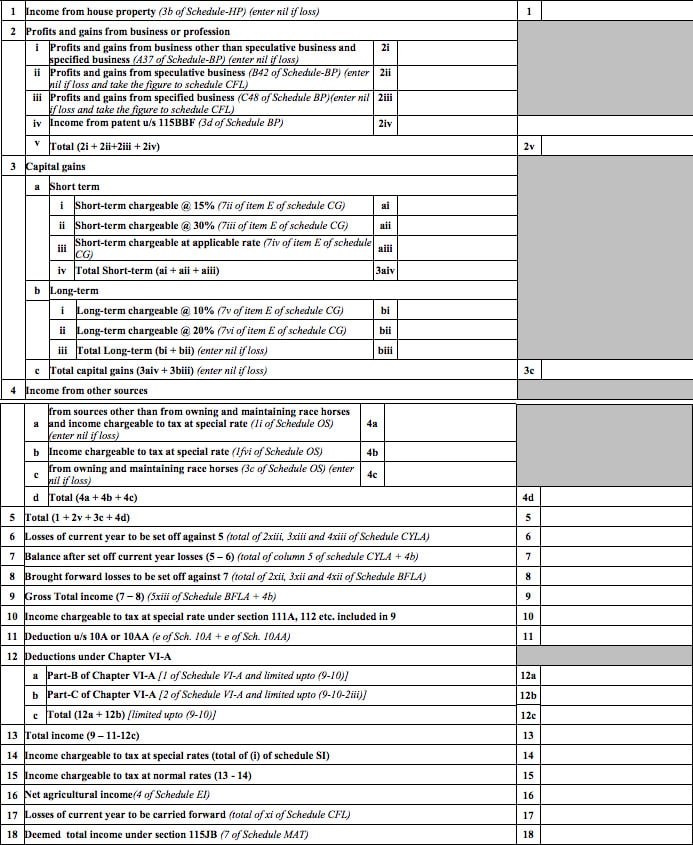

A private limited company is the most preferred type of business entity in India. Each year nearly a lakh companies are incorporated in India. All private limited companies registered in India are required to file income tax returns in ITR-6 return filing or ITR 7 each year mandatorily, irrespective of turnover or profitability. Hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. In this article, we look at the private limited company tax rate and the Pvt Ltd company tax slab during the assessment AY 2022-2023 and 2024 as we.How to calculate total income for a Company?

Income tax is levied on the total income of the company computed as per the Income Tax Act. The total income of a company is closely related to the profit of the company. Hence, income tax would be applicable only if the company has total income. A company would not be required to pay income tax if total income is negative i.e., the company has incurred losses during a year. Private Limited Company Tax Rate 2022

Private Limited Company Tax Rate 2022

Click here to get Income Tax Calculator

Income Tax for Private Limited Companies

A Private Limited Company falls under two different categories one is a domestic company in which there are no forging investments and another is a Foreign Company means a company in which foreign investments are involved. As mentioned above; the tax on private limited company and filing of Income-tax returns is mandatory, which means irrespective of turnover, profit & loss ITR needs to be filed and ROC compliances need to be carried out.Returns Applicable for Domestic Company

Form ITR-6

Form ITR-6 is Applicable for Companies other than those claiming exemption under section 11 of the Income Tax Act:| Indian Company | Body corporate incorporated by or under the laws of a country outside India | Any institution, association, or body, whether incorporated or not and whether Indian or Non-Indian which is declared by general or special order of the Board, to be Company, etc. |

Form ITR-7

Applicable for Persons including Companies who are required to furnish returns under Section 139 (4A) or Section 139 (4B) or Section 139 (4C) or Section 139 (4D)- Section 139(4A) – Income derived from Property held under Trust wholly / in part for charitable or religious purposes

- Section 139(4B) – Chief Executive Officer of every Political Party

- Section 139(4C) – Various entities like Research Association, News Agency, etc. mentioned in Section 10

- Section 139(4D) – University, College, or other institution referred to in Section 35

Corporate Income Tax Rate for AY 2022-23.

Below are details of the Corporate Income Tax Rate in India slab-wise for FY 2021-22 or AY 2022-23. This also corresponds to private limited company tax slab.The tax rate for Company If Turnover > Rs. 400 Crore.

| Income Slab | % of Tax |

| Upto 1 Crore | 30% |

| Above 1 Crore but upto 10 Crore | 3,00,000 + 30% |

| Above 10 Crore | 3,00,00,000 + 30% |

The tax rate for Company If Turnover < Rs. 400 Crore.

| Net Income Slab (Gross Taxable Income – deductions) | Income Tax Rate | Rebate u/s 87A (FY 2021-22) |

| Upto 1 crore | 25% | Nil |

| Above 1 crore but upto 10 crore | 25,00,000+ 25% | Nil |

| Above 10 crore | 2,50,00,000+ 25% | Nil |

Income Tax Surcharge

An income tax surcharge is an additional charge payable on income tax. It is an added tax on the taxpayers having a higher income inflow during a particular financial year. Income tax surcharge is applicable only for private limited companies having a total income of more than Rs.1 crore.- If a private limited company has a total income of Rs.1 crore to Rs.10 crore, a surcharge at the rate of 7% would be applicable on the income tax payable.

- In the case of private limited companies having a total income of more than Rs.10 crores, a 12% surcharge would be applicable to the income tax payable.

Budget 2022 update

In Budget 2022, FM proposes to restrict the surcharge for Association of Persons (AOPs) having only companies as its members to 15%. It is applicable to AOPs whose total income during the financial year exceeds Rs 2 Crores. Also, the surcharge on long-term capital gains ( LTCG) on listed equity shares, units, etc., has been capped at 15%.Education Cess for Company

Private limited companies are liable to pay education cess at the rate of 4% of the amount of income tax as increased by the applicable surcharge. Refer to the table for a better understanding of the details of the Corporate Income Tax Rate in India slab-wise for FY 2021-22 or AY 2022-23.| Net Income Slab (Gross Taxable Income – deductions) | Income Tax Rate for Company if Turnover < Rs. 400 Crore | Income Tax Rate for Company if Turnover > Rs. 400 Crore | Surcharge | Health & Education Cess |

| Upto 1 crore | 25% | 30% | Nil | 4%l |

| Above 1 crore but upto 10 crore | 25,00,000+ 25% | 3,00,000 + 30% | 7% | 4% |

| Above 10 crore | 2,50,00,000+ 25% | 3,00,00,000 + 30% | 12% | 4% |

Income Tax Rate for Domestic Manufacturing Companies for AY 2022-23

The private limited company Tax rate on Income of certain Domestic Manufacturing Companies for A.Y 2022-2023 is tabulated here:| Domestic Manufacturing Companies | Particulars | Rate | Surcharge | Health and Education Cess |

| Certain Domestic Manufacturing Companies (w.e.f. 2017-18) | Where it opted for section 115BA | 25% | - | - |

| For All Existing Domestic Companies (irrespective of their date of incorporation or nature of activity) | Where it opted for section 115BAA | 22% | 10% of taxable income if net income exceeds 1 crore | 4% of Income Tax plus Surcharge |

| For all new manufacturing domestic companies | Where it opted for section 115BAB | 15% | 10% of taxable income if net income exceeds 1 crore. | % of Income Tax plus Surcharge |

Income Tax Rate for Foreign Company

- Tax rate for Foreign Company is @ 40% fixed and Cess @ 4% on total income tax + surcharge

- A surcharge will be 2% if the Net income exceeds Rs.1 Crore but doesn’t exceed Rs. 10 Crores and 5% if the Net income exceeds Rs.10 Crores

Minimum Alternate Tax for Company

Companies can reduce their tax liability through various provisions of the Income-Tax Act, such as exemptions, deductions, depreciation, etc. There have been instances of some companies even managing to show nil taxable income despite making substantial profits and paying out dividends. Minimum Alternate Tax (MAT) was created to bring these ‘zero-tax paying companies’ within the ambit of income tax and make them pay a minimum amount in tax to the government. Minimum Alternate Tax (MAT) will be levied at a rate of @15% on Book profit in A.Y 2022-23.Domestic Company Tax Slab for AY 2024-25

For the Assessment Year (AY) 2024-25, the income tax rate for domestic companies is determined based on the turnover or gross receipts during the previous financial year (FY 2020-21) and the specific sections under which the company opts for taxation. The tax rates are as follows:|

Condition |

Income Tax Rate (excluding surcharge and cess) |

|---|---|

|

Total Turnover or Gross Receipts during FY 2020-21 does not exceed ₹400 crores |

25% |

|

If opted for Section 115BA |

25% |

|

If opted for Section 115BAA |

22% |

|

If opted for Section 115BAB |

15% |

| Any other Domestic Company |

30% |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...