Last updated: August 10th, 2021 5:33 PM

Last updated: August 10th, 2021 5:33 PM

Procedure for Furnishing and Uploading Form No. 34BB

Central Board Direct Taxes has issued the procedure furnishing and uploading Form No. 34BB. The signed copy of Form No. 34BB shall be uploaded on the new e-filing Portal of the Income Tax Department along with basic details for the assessee intending to exercise the option under sub-section (1) of section 245M. Online submission of Form No. 34BB shall be treated as a submission to the Assessing Officer as per sub-section (1) of section 245M of the Income Tax Act.Form No. 34BB

As per the Income Tax Rules, the assessee can exercise the option to withdraw his application filed to the Income Tax Settlement Commission (ITSC) if such application is pending. To exercise this option, the taxpayer has to furnish and upload Form No. 34BB in the manner as prescribed in Rule 44DA of the income tax.Procedure for Furnishing Details in Form No. 34BB

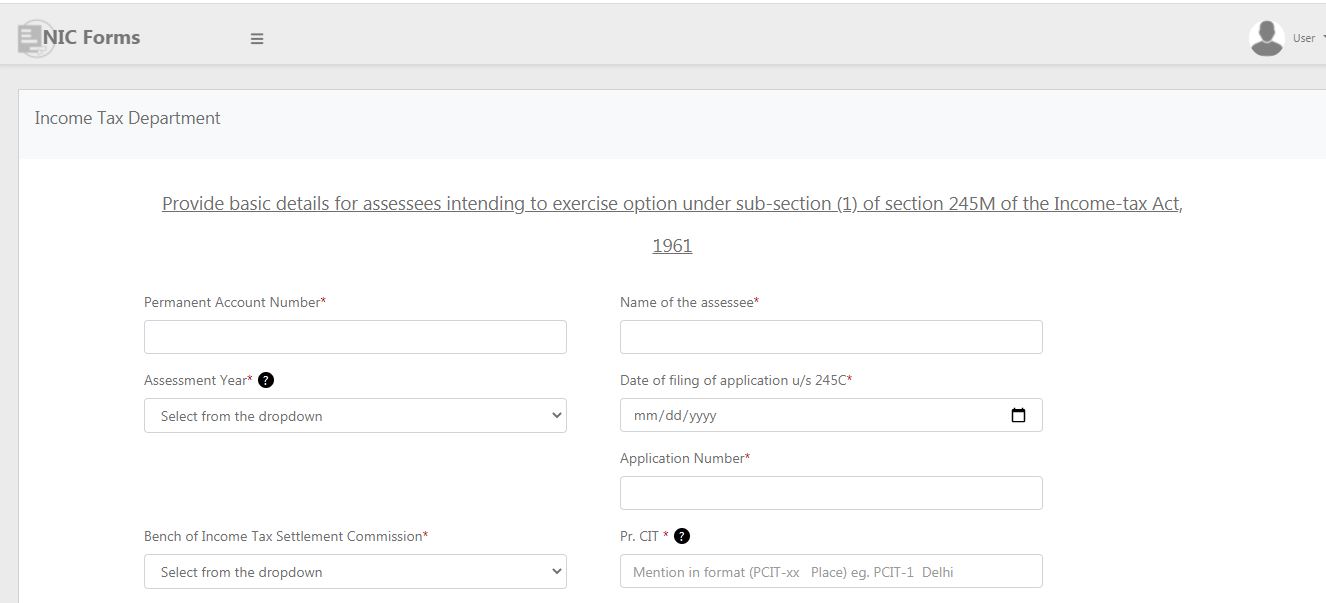

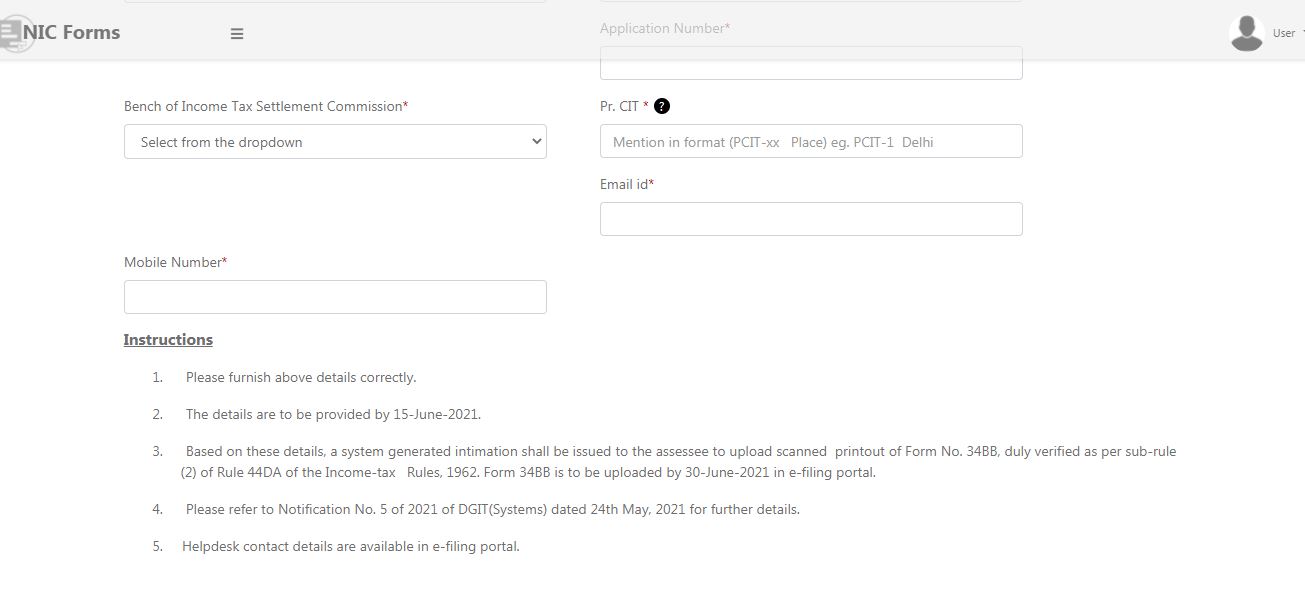

The assessee who wishes to exercise the option for withdrawal application filed under Section 245C and such application is pending, shall first provide the basic details in the following format on the form placed at NIC. Procedure for furnishing and uploading Form No. 34BB

Procedure for furnishing and uploading Form No. 34BB

Procedure for furnishing and uploading Form No. 34BB2

Note: The details of the link has also been made available on the new e-Filing portal of the Department

The taxpayer has to furnish the following basic information:

Procedure for furnishing and uploading Form No. 34BB2

Note: The details of the link has also been made available on the new e-Filing portal of the Department

The taxpayer has to furnish the following basic information:

- PAN

- Name of the assessee

- Assessment year

- Date of filing of the application under section 245C

- Application number

- The bench of the Settlement Commission

- PCIT (in the format PCIT-xx, Place)

- Email ID

- Mobile number

Upload of a signed copy of Form No. 34BB

Based on the above details, the taxpayer will receive intimation to this e-filing account requiring him to print, sign and upload the scanned copy of Form No. 34BB.- The taxpayer needs to log in to the income tax e-filing portal. After logging in to the portal, select ‘Furnishing of Form 34BB’ under the e-proceedings tab, uploads the signed printout of the form, and submit.

- The taxpayer must upload the signed printout of the form within the date specified under the provisions of the Income Tax Act

- The date of uploading such a signed form will be considered the date of withdrawal of the application.

Viewing submitted Forms

The submitted Form can be viewed and downloaded by login into the income tax portal using the User name and password. Select e-proceedings Tab and click on Furnishing of Form 34BB. By clicking on View submission, the details will be displayed.Submission to the Assessing Officer

Online submission of Form No. 3488 in the manner prescribed in this article would be treated as a submission to the Assessing Officer as per sub-section (1) of section 245M of the Income Tax ActPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...