Last updated: December 2nd, 2024 8:02 PM

Last updated: December 2nd, 2024 8:02 PM

Procedure for Online Withdrawal of Pending Application by Form 34BB

The Directorate of Income Tax (Systems) vides a Notification No. 5/2021 dated 24.05.2021 has notified the online procedure to exercise the option by an assessee to withdraw his pending application under sub-section (1) of section 245M by Form No. 34BB on e-filing portal. The current article briefs the procedure for Online Withdrawal of Pending Application by Form 34BBRule 44DA and Form 34BB

Earlier, CBDT vide Notification No. 40/2021 dated April 30, 2021, notified new Rule 44DA and Form No. 34BB to prescribe the manner for making an application to withdraw pending application filed before the Income-tax Settlement Commission (ITSC).- The Finance Act, 2021 has discontinued the Income-tax Settlement Commission with effect from 1st February 2021 and no application for settlement will be accepted from that date.

- The assessee has an option to withdraw any pending application filed before the Settlement Commission within 3 months from the date of commencement of the Finance Act, 2021

Rule 44DA of Income Tax Rules, 1962

Rule 44DA of Income Tax Rules, 1962 has been inserted to prescribe the manner of intimation by the assessee to the Assessing Officer, for exercising the option to withdraw the pending application for settlement of cases under Section 245M (1) of the Income-tax Act, 1961.Form 34BB

For this purpose, Form No. 34BB has been inserted in the Income-tax Rules to exercise the option of withdrawing the pending application for settlement of cases.Procedure for Filing of Form No. 34BB

The procedure for Furnishing Form No. 34BB to exercise option under sub-section (1) of section 245M is as follows:Provide Basic Details of Assessee

The assessee who wishes to exercise the option for withdrawal application filed under section 245C and such application is pending, shall first provide the basic details in the following format on the form placed at the official web portal of the NIC Procedure for Online Withdrawal of Pending Application by Form 34BB - NIC FORM

Procedure for Online Withdrawal of Pending Application by Form 34BB - NIC FORM

Procedure for Online Withdrawal of Pending Application by Form 34BB - NIC FORM2

Note: The details of the link has also been made available on the new E-Filing portal of the Income-tax Department with effect from 7th June 2021

Procedure for Online Withdrawal of Pending Application by Form 34BB - NIC FORM2

Note: The details of the link has also been made available on the new E-Filing portal of the Income-tax Department with effect from 7th June 2021

Details Required

The assessee is required to provide the following details to furnish Form No. 34BB to exercise option under sub-section (1) of section 245M:- Permanent Account Number

- Name of the assessee

- Assessment Year

- Date of filing of the application under section 245C of Income Tax Act

- The bench of Income Tax Settlement Commission

- Principal Commissioner of Income Tax (Pr. CIT)

- Contact Details

Prescribed Date to file Form 34BB

The details shall be provided by 15-June-2021.Upload of the signed copy of Form No. 34BB on E-filing Portal of the Department

- The assessee, to whom intimation to upload Form No. 34BB is generated, shall upload scanned printout of Form No. 34BB, duly verified as per sub-rule (2) of Rule 44DA of the Rules, online on the Income Tax Department e-Filing Portal.

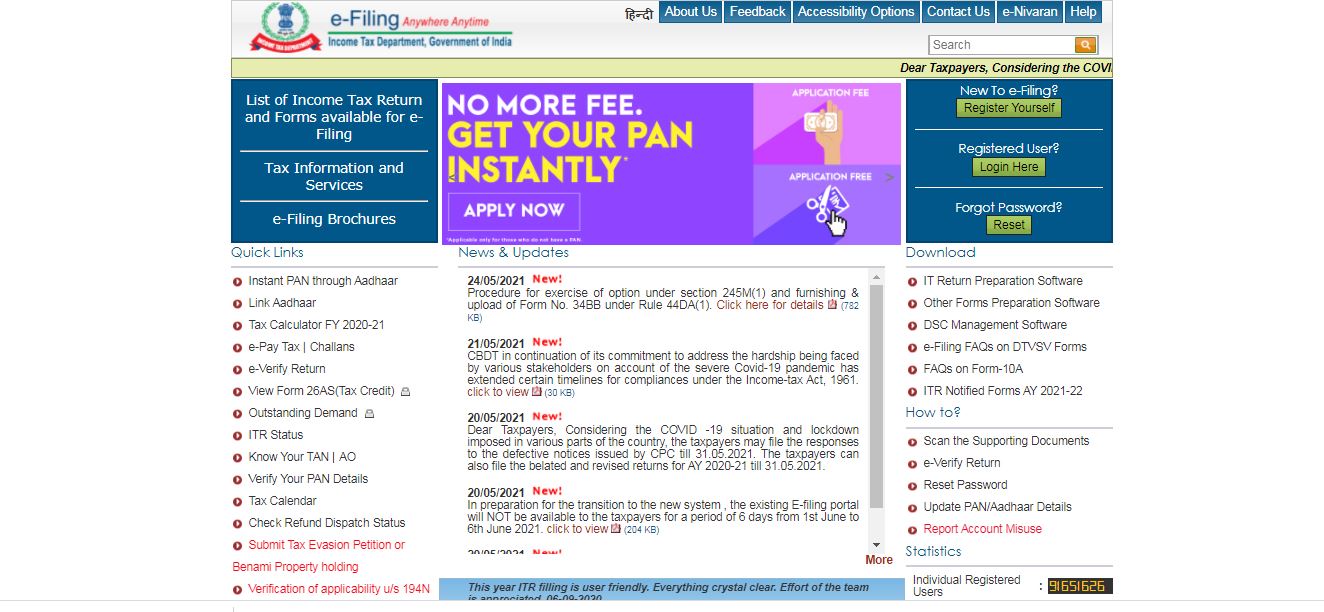

Procedure for Online Withdrawal of Pending Application by Form 34BB - IncomeTax eFiling

Procedure for Online Withdrawal of Pending Application by Form 34BB - IncomeTax eFiling

- The assessee is required to login into the e-Filing portal of Income Tax using their valid credentials.

Procedure for Online Withdrawal of Pending Application by Form 34BB - NIC FORM2

Procedure for Online Withdrawal of Pending Application by Form 34BB - NIC FORM2

- After to the portal, select the e-proceedings Tab and Select 'Furnishing of Form 34BB', and upload a scanned printout of the Form. The form can be submitted by clicking on the "Submit" button

Prescribed Date for Uploading Form

The assessee shall upload a signed printout of the form within the date specified under sub-section (1) of section 245M. The date of upload of signed printout of the Form shall be the date on which such application is withdrawnSubmission to the Assessing Officer

Online submission of Form No. 34BB in the manner prescribed herein would be treated as a submission to the Assessing Officer as per sub-section (1) of section 245M of the Act.View submitted Form

The submitted Form No. 34BB would be available for view and download. After login to the portal, Select e-proceedings Tab and click on 'Furnishing of Form 34BB. By clicking on the Select View submission option, the submitted Form would be available for view and download. The official notification pertaining to Procedure for Online Withdrawal of Pending Application by Form 34BB is as follows:Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...