Last updated: November 2nd, 2022 12:34 PM

Last updated: November 2nd, 2022 12:34 PM

Procedure to File Form 10A on New E-Filing Portal

Central Board of Direct Taxes (CBDT) mandated all the trust/societies/ institutions/ fund/ hospitals registered under Section 12A and Section 80G or Section 12AA of the Income Tax Act to obtain fresh registration in the prescribed format under Section 10(23C) of the Income Tax Act. The applicant needs to make an application in Form 10A with the Principal Commissioner or Commissioner authorized by the CBDT on or before the due date. The filing procedure of Form 10A is now enabled on the new e-filing portal. The current article briefs the Procedure to File Form 10A on New E-Filing Portal.

Form 10A of Income Tax Act

Form 10A was notified by the CBDT to enable trusts/NGOs to apply for migration of its registration to the new registration scheme as per section 12AB. Any application for registration of trust needs to be filed in form 10A. Form 10A is used for the following purposes:- For existing trusts or institutions which are already registered under section 12A or section 12AA before 1-4-2021

- For newly established trusts or institutions that are applying for provisional registration under section 12AB

Due Date for Filing Form 10A

CBDT vide Circular No. 12/2021 dated 25th June 2021 extended the date for furnishing Form 10A from 30th June 2021 to 31st August 2021. This has been done due to the fact the new income-tax portal which was launched on 7th June 2021 could not make Form 10A operational. This form was not available on the e-filing portal till 23rd July 2021. The filing procedure of Form 10A is now enabled on the new e-filing portal.Purpose of Form 10A

The purpose of Form 10A is explained in detail below:- As mentioned above, Form 10A is used for re-registration under section 12AB for trusts or institutions which are already registered or approved under these provisions before 1-4-2021.

- New Form 10A is also used by trusts or institutions which are newly established and are applying for registration under section 12A for the first time.

- Further, a trust or institution which is in existence for many years but is never registered under section 12A is also required to use the new Form No. 10A.

Eligible Applicants to file Form 10A

The following organizations are required to file Form No. 10A for registration under section 12A of the Income Tax Act:- Existing Registered Organizations: Organizations that are already registered under any of the erstwhile section 12A or section 12AA before 1-4-2021 shall apply for re-registration under section 12AB in Form No. 10A.

- Existing Unregistered Organizations: Organizations that have already commenced charitable activities but are not registered with income-tax authority under any of the erstwhile section 12A or section 12AA before 1-4-2021 shall apply for new registration under section 12AB in Form No. 10A. Such organizations will be given provisional registration for a maximum period of three years.

- Newly Established Organizations: New Organizations which wish to get themselves registered with the income tax authority for availing exemption under sections 11 and 12 of the Income-tax Act are required to apply for provisional registration in Form No. 10A

Prescribed date to File Form No. 10A

Form No. 10A for re-registration under section 12AB is required to be made within 30.06.2021. Existing Unregistered Organizations or New Organizations seeking fresh registration need to file Form 10A within one month before the commencement of the previous year from which such exemption is to be claimed.Documents Required

The documents required for filing Form 10A are as follows:- The document evidencing the creation or establishment of the trusts/NGOs

- Registration certificate with Registrar of Companies or Registrar of Firms and Societies or Registrar of Public Trusts

- Registration certificate under Foreign Contribution (Regulation) Act, 2010(42 of 2010), if the applicant is registered under such Act

- Existing order granting registration under section 12A or section 12AA or section 12AB of Income Tax Act

- Order of rejection of application for grant of registration under section 12A or section 12AA or section 12AB

- The annual accounts of the applicant relating to the prior year for which such accounts have been made up

- Self-certified copy of the report of audit as per the provisions of section 44AB The documents evidencing adoption or modification of the object

Procedure to File Form 10A on New E-Filing Portal

Procedure to online file Form 10A on the new e-filing income-tax portal is as follows: The trust/NGO is required to access the new e-filing portal and log in to the portal by entering the user ID and password. Procedure to File Form 10A on New E-Filing Portal - Homepage

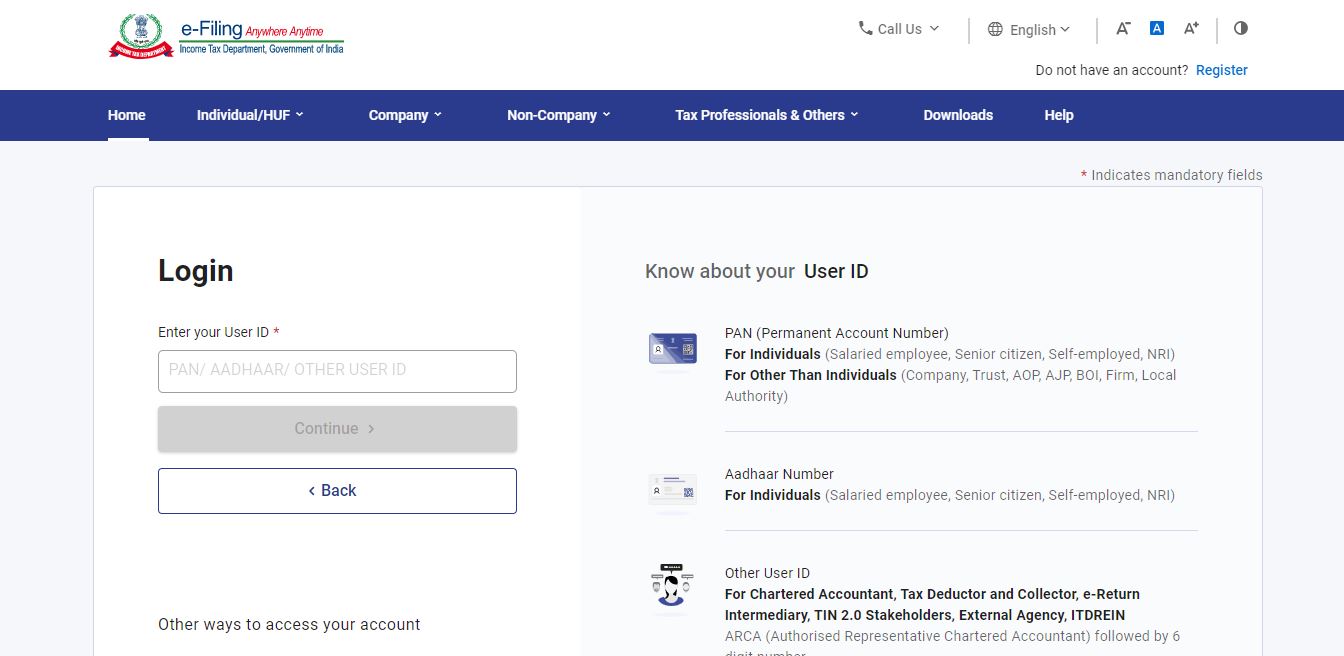

The user can apply Form 10A only after successful logging.

Procedure to File Form 10A on New E-Filing Portal - Homepage

The user can apply Form 10A only after successful logging.

Procedure to File Form 10A on New E-Filing Portal - Login

Procedure to File Form 10A on New E-Filing Portal - Login

- Click on the menu titled ‘file and then select ‘File Income Tax Forms’.

- Go to Tab titled ‘Persons not dependent on any Source of Income (Source of Income not relevant)’. Select ‘Form 10A - Application for registration or provisional registration or intimation’.

- The PAN and submission mode ‘Online’ will be prefilled and cannot be edited. Provide the value in the field ‘Assessment Year’ as 2022-2023

- Click on ‘Continue’ and then click on ‘Let’s Get Started’ to proceed further. The application form 10A will be displayed. Provide the following mandatory details:

- Incorporation/constitution details

- Other registrations details

- Details of Key Persons

- Details of Assets and Liabilities

- Income Details

- Religious activities details

- At last, the form is required to be verified by DSC or EVC as per Rule 17A(3)/(4). The name, father’s name, nature of the constitution, as well as capacity, will be prefilled. After providing the details, click on attach button to upload all documents.

- Once the information/data are filled in, click on the ‘Save’ button. After all the sections are filled in, each of them will be green-ticked and the status will be shown as ‘completed.

Circular No. 22/2022 dated November 1, 2022

The CBDT has condoned the delay up to 25-11-2022 in the filing of Form no. 10A, which was required to be filed electronically on or before 31-03-2022. The Form 10A must be filed for re-registration of existing trust registered under section 12A/12AA, for re-approval of existing trust or institution approved under section 10(23C)/80G, and for filing of intimation by a research association or institution under section 35.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...