Last updated: March 12th, 2020 4:17 PM

Last updated: March 12th, 2020 4:17 PM

Puducherry Property Registration

Registration of property in India is mandatory as per the provisions of Indian Registration Act, 1908. The transfer of immovable property has to be registered to obtain the rights of the property on the execution date of the deed. The Department of Registration and Stamp is liable for property registration in the State of Puducherry. In this article, we look at the procedure for Puducherry property registration.Section 25 of the Puducherry Registration Act

As per Section 25 of the Registration Act, 1969, all documents required for registering the deed has to be submitted within four months from the date of property registration to the concerned Registrar officer. In case of any violations on above, a fine amounting to 10 times of the amount of property registration fee has to be remitted in such case of property registration.Reasons for Property Registration

The following benefits can be obtained by registering the property deed.- To provide an absolute guarantee of the genuineness of the document.

- To afford publicity for transactions.

- To ensure prevention of frauds, conservation of evidence, the transfer of title to the owner.

- To maintain an up to day public record by registering a property.

- To afford the facility of determining whether the property has already been sold.

- To provide security of title deeds and to prove titles in case the original deeds are lost or destroyed.

Documents Required

The required documents are to be furnished along with the application form to register a property in the state of Puducherry.- P.A.N. card or adequately filled Form 60 together with identity proof and residence proof of the parties.

- Identity proof such as Aadhaar card/voter card/PAN card/passport/driving licence etc. of the participants.

- Principal documents when the present report is supplementary to such primary documents.

- Copy of Encumbrance certificate.

- Passport size photographs of the parties.

- Details of stamp duty and registration payment fee.

Stamp Duty and Registration Fee In Puducherry

The stamp duty is the percentage of the transaction value levied by the state government, on every registered sale. Stamp duty rates and Registration Fee for various transactions in Puducherry are given below.| S.No | Categories of Documents | Stamp Duty | Registration Fee |

| 1. | Conveyance (Sale) | 10% on the sale value of the property or the G.L.R. value whichever is higher | 0.5% on the sale value of property mentioned in the document or G.L.R. rate whichever is higher. |

| 2. | Gift | 0% on the sale value of the property or the G.L.R. value whichever is higher. | 0.5% on the sale value of property mentioned in the document or G.L.R. rate whichever is higher. |

| 3. | Agreement to Sale | Rs. 20 | 0.5% of the Advance Amount |

| 4. | Indemnity Bond | Rs. 22.50 | 0.5% of the Bond Value |

| 5. | Adoption deed | Rs. 33.75 | Rs. 20 |

| 6. | Power of Attorney | Rs. 20,000 (In case of Power issued to Non-Blood Relation) Rs.5,000 (In case of Power issued to Blood Relation) Rs.100 (In case of Non-Schedule Power) | Rs. 50 |

| 7. | Simple Mortgage (without possession) | 1% (on the loan amount) subject to a maximum of Rs. 25,000 | 0.5% on loan amount subject to a maximum of Rs. 5,101 |

| 8. | Mortgage with possession | 1% (on the loan amount) subject to a maximum of Rs. 25,000 | 0.5% subject to a maximum of Rs. 5,000 |

| 9. | Partition | 1% on the market value of the property but not exceeding Rs. 5000 | 0.5% on the value of property mentioned in the document or G.L.R. value whichever is higher. |

| 10. | Declaration of Trust (if the property is there, it would be considered as the sale) | Rs. 70 | Rs. 100 |

| 11. | Will | No stamp duty | Rs. 30 |

| 12. | Will Cancellation | Rs. 50 | Rs. 20 |

Online Stamp Duty Fee Calculator

You can calculate stamp duty for a property transaction on the portal of the Puducherry Registration Department by following the steps below:- To view, the applicable stamp duties visit the stamp duty page of the Registration department web portal.

- Select your type of deed from the drop-down list.

- Enter the details like Area, G.L.R. value and Click on "Result" button to calculate your stamp duty value.

Procedure for Registering a Deed Without E-Appointment

To register for property in Puducherry without e-Appointment, follow the steps below:Approach Sub-Registrar Office

Step 1: The applicant has to approach the Sub-Registrar office to collect the application form for property registration. Step 2: Now fill the application form with the appropriate details without any errors.Collect Application Form

Step 3: After filling the application form, submit the presentation of documents for registration along with the filled up application form to the concerned Sub-Registrar office. Step 4: Then, the verification process will be done by the Sub-Registrar. Step 5: Then, the applicant has to make payment of registration fees in the cash counter.Make Payment

Step 6: After payment, the applicant can collect the e-Stamp. Step 7: Next will be the capturing of the photo and fingerprint of the applicant. Step 8: The concerned authority of the Sub-Registrar will issue the registration number as the confirmation. Step 9: Then, the registration deed will be affixed with seals and signature of the sub-registrar. Step 10: Then, the registered documents will be scanned, and finally, the recorded documents will be issued by the concerned authority of the Sub-Registrar office.Procedure for Registering a Deed With E-Appointment

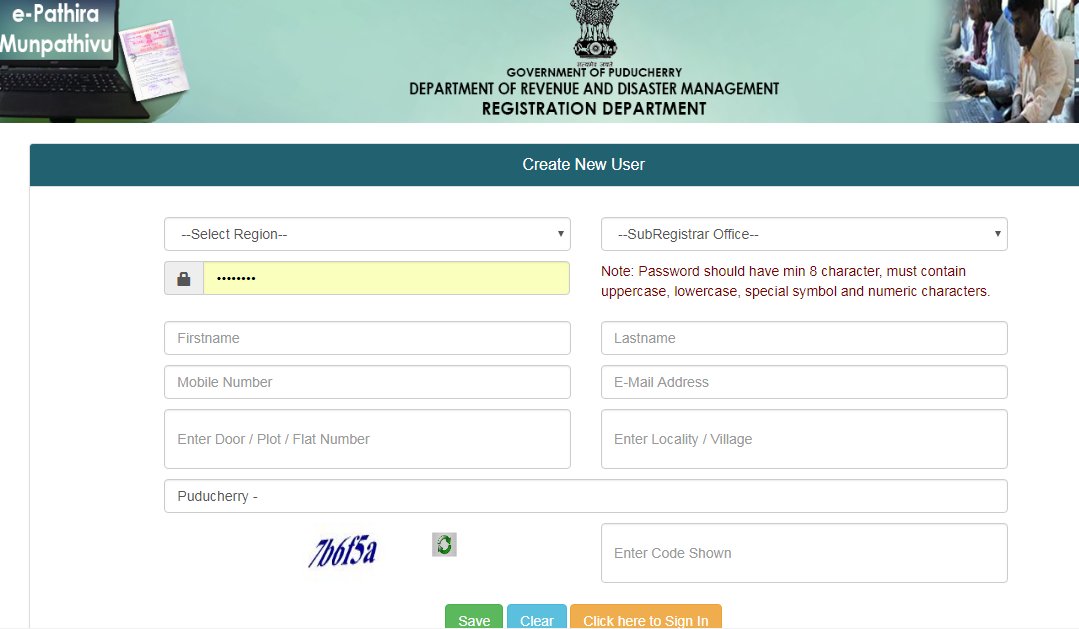

To apply for a property in Puducherry with e-Appointment, follow the steps explained here: Step 1: Visit the official website of Puducherry Department of Revenue and Disaster Management.User Registration

Step 2: Click on "Create user" which is visible on the homepage of the portal. Step 3: The user is supposed to give details like- Username

- Address

- Mobile number

- Email ID

Puducherry-Property-Registration-User-Details

Step 4: Then the user will be redirected to the sign page where one needs to give username and password and click on the "Login" icon.

Puducherry-Property-Registration-User-Details

Step 4: Then the user will be redirected to the sign page where one needs to give username and password and click on the "Login" icon.

Application Form for Property Registration

Step 5: Then, the application form for property registration will open up on the next screen. Step 6: Fill the application form and attach the documents required along with it.e-Appointment System

Step 7: After the registration of property, the user needs to take an e- appointment. Step 8: Now, the user has to enter the relevant information regarding appointment booking for visiting Sub-Registrar office. Step 9: Then the user has to appear before the Sub-Registrar office in the booked appointment time along with the printout of generated report and appointment slip.Purchase e-Stamp

Step 10: The user can collect the e-stamp from the Sub-Registrar office after remitting the fee of stamp duty and registration fee. Step 11: After verification of your documents, the registered deed will be delivered to the applicant. Note: After registration of the deed, one has to apply for Municipal Authority seeking mutation for the title of the property.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...