Last updated: December 17th, 2019 5:44 PM

Last updated: December 17th, 2019 5:44 PM

Puducherry Property Tax

Property tax is a prime source of revenue for the Puducherry Municipal Corporation. This form of tax is to be paid annually by the property owners to the municipal corporation of the jurisdiction in which the property/ land is located. The system of taxation has been made mandatory by the Government for anybody who owns property in Puducherry. In this article, we review the aspects of Puducherry property tax in detail.Puducherry Municipalities Act, 1973

The regulations under this act apply to serves the assessment of tax collected from the Municipal Corporation. Taxes would be payable in according to the rates fixed under Section 148 of the Act on the basis of annual value. According to this Act, the taxes are payable with the rates fixed under section 148 of the Act based on the yearly amount. Rebates shall be admissible in annual value and payable taxes in according with the provisions prescribed in the Act. Following the provisions in this Act, the deductions shall be admissible in annual value and payable taxes.Eligibility Criteria

The eligibility criteria for the property tax are as follows:- A person’s age is above 18 years of age.

- An individual who is a permanent resident in the state of Puducherry.

- Any person who owns a property in Puducherry is entitled to pay a property tax.

Calculation of Property Tax

Property taxes are determined from a percentage of the assessed value of the property. Property taxes are calculated using the amount and location of the property or land by a local government. The tax assessors will value the property or land and charge an appropriate rate from the landowners using the standards set by the government authorities.Documents Required

The applicant will have to submit a copy of the assessment order or receipt of the latest property tax paid payment while making the payment of property tax.Charges Applicable

The following charges apply for the Puducherry property tax is tabulated below:| S. No. | Payment Method | Fees (Excluding Applicable Taxes) |

| 1. | Payment via Internet |

|

| 2. | Payment via Debit Card |

|

| 3. | Payment via Credit Card | 1% of the transaction amount. |

| 4. | Cash-card/Prepaid/Wallets | Rs. 10 or 1.5% of the transaction amount whichever is lower |

| 5. | IMPS |

|

| 6. | NEFT/RTGS | Rs. 5 per payment for any transaction |

Procedure for Paying Property Tax – Online Method

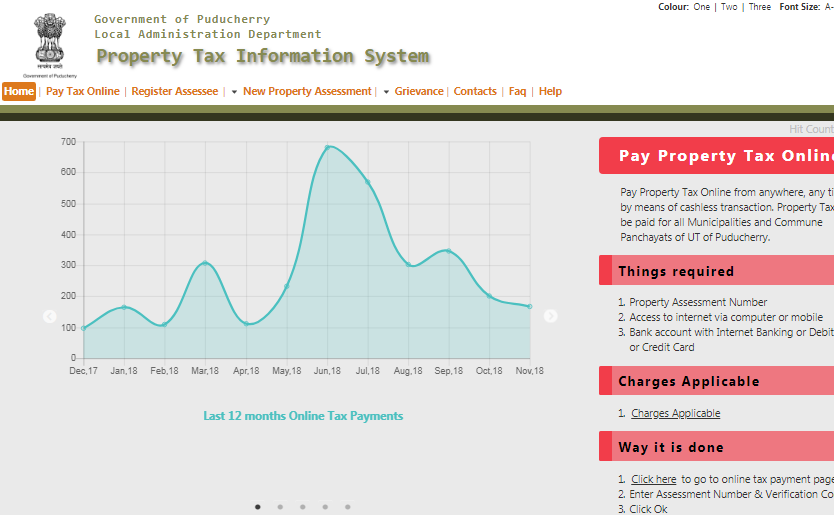

The applicants of Puducherry must follow the below steps to make the Property Tax payment online. Visit the Property Tax Portal Step 1: The applicant must visit the official website of property tax portal of Puducherry Municipal Corporation to make the property tax payment. [caption id="attachment_68210" align="aligncenter" width="834"] Step 1 - Puducherry Property Tax

Step 2: Then you have click on the ”Pay Tax Online” tab that is visible on the menu bar.

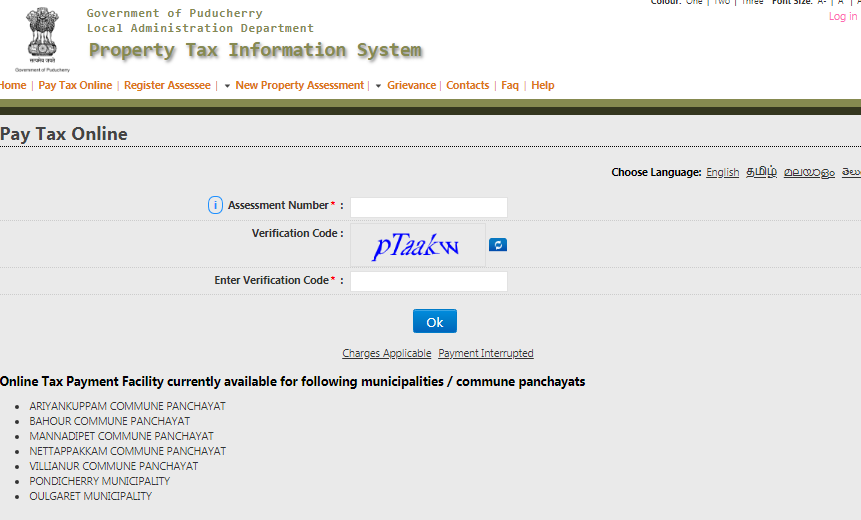

Step 3: Now you will be directed to the pay tax online page where you have to enter the Assessment Number and Verification Code.

[caption id="attachment_68213" align="aligncenter" width="861"]

Step 1 - Puducherry Property Tax

Step 2: Then you have click on the ”Pay Tax Online” tab that is visible on the menu bar.

Step 3: Now you will be directed to the pay tax online page where you have to enter the Assessment Number and Verification Code.

[caption id="attachment_68213" align="aligncenter" width="861"] Step 3 - Puducherry Property Tax

Step 4: Then you have to click on the OK button.

Step 5: You will be taken to the new page where you need to select the number of terms to be paid.

Provide Right Credentials

Step 6: You have to enter the payer name and their registered mobile number.

Step 7: Then you have to click on the OK button.

Step 8: You can also review the details and have to click on the Ok button and wait for the bank site to load.

Step 9: You will be taken to the payment gateway where you have to make the prescribed payment as per the charges specified above.

Make Payment

Step 10: Now, check the checkbox against the arrear bill for which the payment can be made. Then you need to click on the “Pay Now” button.

The money can be redeemed in three ways:

Step 3 - Puducherry Property Tax

Step 4: Then you have to click on the OK button.

Step 5: You will be taken to the new page where you need to select the number of terms to be paid.

Provide Right Credentials

Step 6: You have to enter the payer name and their registered mobile number.

Step 7: Then you have to click on the OK button.

Step 8: You can also review the details and have to click on the Ok button and wait for the bank site to load.

Step 9: You will be taken to the payment gateway where you have to make the prescribed payment as per the charges specified above.

Make Payment

Step 10: Now, check the checkbox against the arrear bill for which the payment can be made. Then you need to click on the “Pay Now” button.

The money can be redeemed in three ways:

- Full Payment: In total, it is deposited in one whole year.

- Partially Payment: This can be tested in the cart – Half-an-a-half.

- Advance Payment: It can be credited to the student in his or her second language.

- UBL name

- Collection date

- Collection centre

- Payment mode

- Bank details

Procedure for Paying Property Tax – Offline Method

In Puducherry, the applicants must follow the following steps to pay their property tax by submitting the application form in the concerned authority. Approach the Municipal Cooperation Step 1: Firstly, the applicant has to visit the municipalities/commune panchayats of UT of Puducherry. Step 2: Select any of the options from Pay By Challan at Bank, Pay by Challan at ULB, Pay at ULB Counter. If Pay By Challan at Bank tab is selected, then click on the Bank Name. Note: You can also download the Self-Assessment of Property Tax application form the official web portal of Puducherry Property Tax. The property tax application form is reproduced below for your ready reference. Step 3: In drop-down list names of those banks are available where the user can visit and make the payment. (Bank decided by Corporation/Council/Panchayat). Fill out the right credentials Step 4: You have to fill the application form with appropriate details without any errors. Provide the given information in the application form. Step 5: Print the Challan and visit your respective Corporation/Council/Panchayat or Bank with the Challan to make the payment. Step 6: The hard copies of the scanned documents should be submitted at the specified counters of Corporation/Council/Panchayat.Check/ Track Status of Application

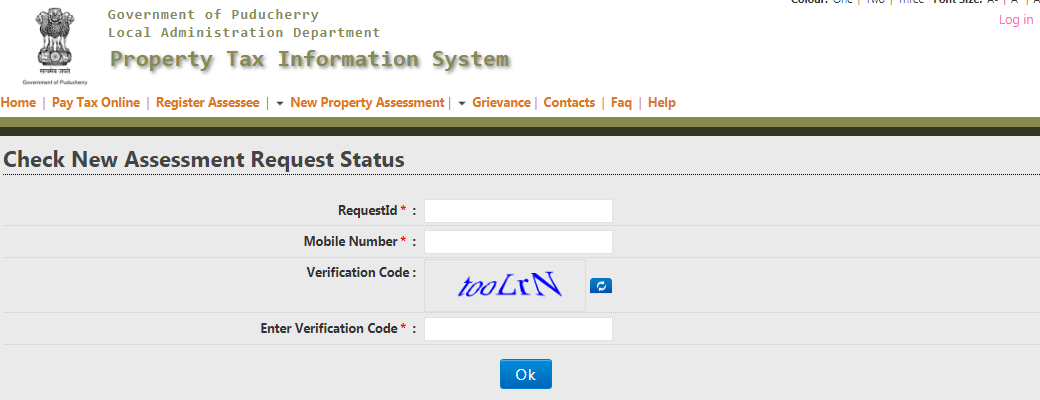

To know/verify the status of your application, go to the official portal. You have to select the Application Status tab available on the site. Enter your request id, mobile number and verification code. Click on the OK button to verify the status of your property tax application. [caption id="attachment_68215" align="aligncenter" width="1040"] Status of Application - Puducherry Property Tax

Status of Application - Puducherry Property Tax

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...