Last updated: August 29th, 2024 3:51 PM

Last updated: August 29th, 2024 3:51 PM

Pune Property Tax

Property tax is a tax levied by the Government on the value of a property or real estate. It is a prime source of revenue for the Pune Municipal Corporation (PMC). The Revenue Department of the Municipal body is responsible for the administration of the property taxation for the respective urban local bodies. Property tax applies to all vacant lands and properties within Municipal corporation limits. The taxation system has been made mandatory by the Government for anybody who owns property in Pune. In this article, we look at the aspects of Pune property tax in detail.Purpose of Property Tax

The urban local body will assess the land and collects the property tax. The collected taxes will be for the jurisdiction department in which the property is situated. The services for which the collected money are used for facilities such as education, library construction, sewer improvements, road and highway constructions, repairing roads, fire service and other services that highly benefit the concerned jurisdiction.Eligibility Criteria

The eligibility criteria for the property tax are as follows:- A person’s age is above 18 years of age

- A person who is a permanent resident in the Pune state.

- Any person who owns a property or land in Pune Municipal Area is entitled to pay a property tax.

Calculation of Property Tax

Property taxes are computed from a percentage of the assessed value of the property. Property taxes are calculated using the value and location of the property or land. The tax assessors will value the property/ land and charge an appropriate rate from the property owners using the standards set by the government authorities. Pune Municipal Corporation (PMC) allows its users to calculate property tax online by entering the area, locality, usage, type, total plinth area and age of the property. Property tax rates of PMC can be accessed using this link.Documents Required

The applicant has to submit a copy of the assessment order or the receipt of the updated property tax paid payment while making the property tax payment.Procedure for Paying Property Tax – Online Mode

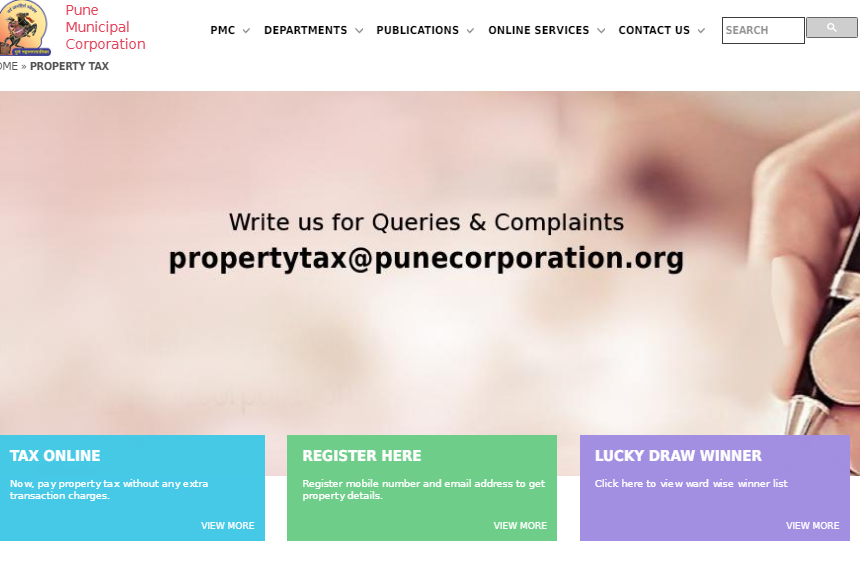

The applicants in Pune must follow the below steps to make the Property Tax payment online. Visit the PMC Portal Step 1: The applicant will have to visit the official Pune Municipal Corporation (PMC) portal of Pune to make the property tax payment. [caption id="attachment_68453" align="aligncenter" width="860"] step 1 - Pune Property Tax

Step 2: Then you have click on the ”Online Services” tab that is visible on the menu bar.

[caption id="attachment_68455" align="aligncenter" width="1100"]

step 1 - Pune Property Tax

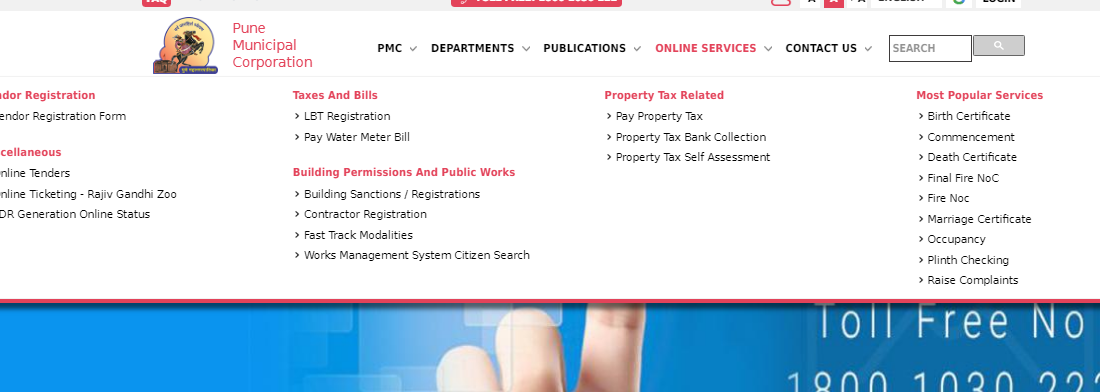

Step 2: Then you have click on the ”Online Services” tab that is visible on the menu bar.

[caption id="attachment_68455" align="aligncenter" width="1100"] Step 2 - Pune Property Tax

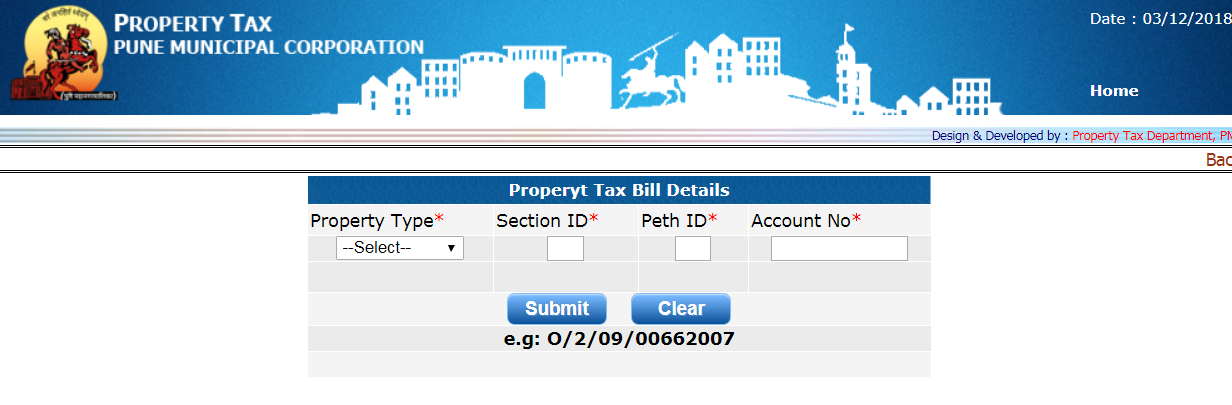

Step 3: Now you will be directed to the pay tax online page where you have to fill in all the requested details such as:

Step 2 - Pune Property Tax

Step 3: Now you will be directed to the pay tax online page where you have to fill in all the requested details such as:

- Property Type

- Section ID

- Peth ID

- Account No

Step 3 - Pune Property Tax

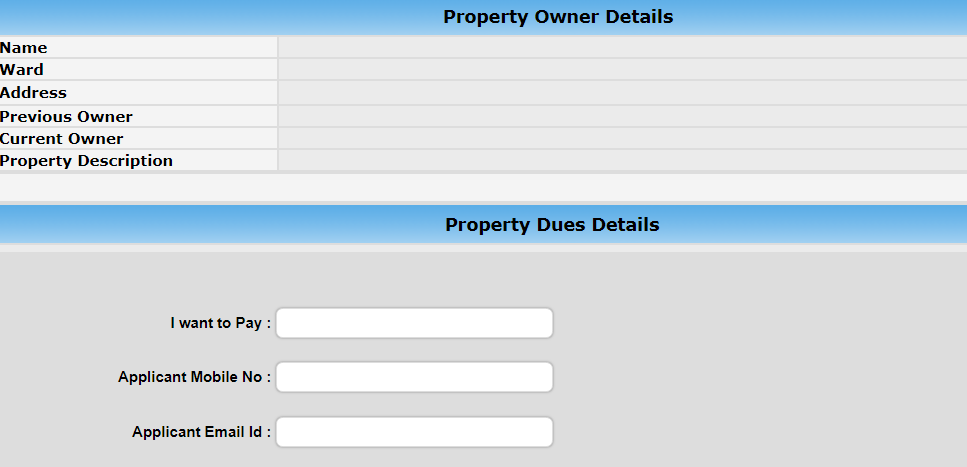

Step 4: Then you have to fill the Property Owner Details that includes Name, Ward, Address, Previous Owner, Current Owner, and Property Description.

Step 5: After filling the property owner details, you will have to fill the Property Dues Details like the amount of payment, verify the applicant’s mobile number and e-mail address.

[caption id="attachment_68457" align="aligncenter" width="967"]

Step 3 - Pune Property Tax

Step 4: Then you have to fill the Property Owner Details that includes Name, Ward, Address, Previous Owner, Current Owner, and Property Description.

Step 5: After filling the property owner details, you will have to fill the Property Dues Details like the amount of payment, verify the applicant’s mobile number and e-mail address.

[caption id="attachment_68457" align="aligncenter" width="967"] Step 5 - Pune Property Tax

Make Payment

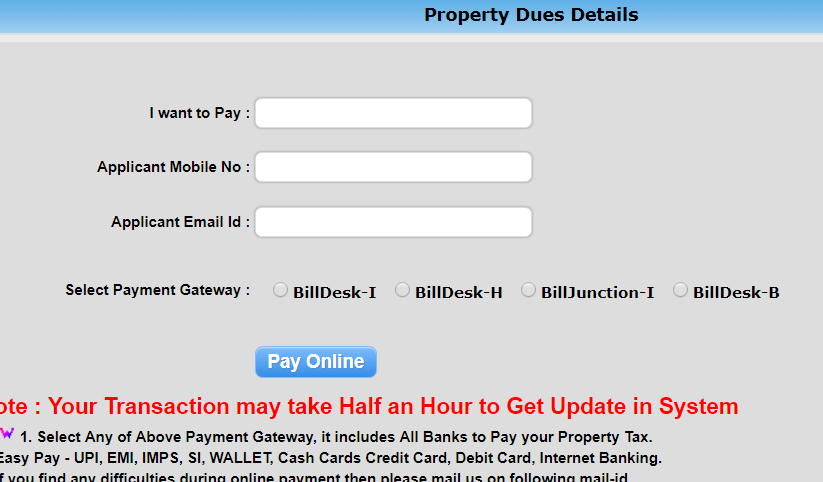

Step 6: Now, check the checkbox against the arrear bill for which the payment has to be made. Then have to click on the “Pay Now” button.

The money can be redeemed in 3 ways:

Step 5 - Pune Property Tax

Make Payment

Step 6: Now, check the checkbox against the arrear bill for which the payment has to be made. Then have to click on the “Pay Now” button.

The money can be redeemed in 3 ways:

- Full Payment: In total, it is deposited for one whole year.

- Partially Payment: It will be tested in the cart – Half-an-a-half.

- Advance Payment: It can be credited to the student in their second language.

Step 7 - Pune Property Tax

Step 8: The following details to must be filled before making the payment.

Step 7 - Pune Property Tax

Step 8: The following details to must be filled before making the payment.

- UBL name

- Collection date

- Collection centre

- Payment mode

- Bank details

Step 12 - Pune Property Tax

Step 13: Then you have to click on the submit button.

Step 14: The challan number column shows all the Challans of paid property tax that you paid.

Step 15: After that, you can click on the Challan number for which you need a printout.

Step 12 - Pune Property Tax

Step 13: Then you have to click on the submit button.

Step 14: The challan number column shows all the Challans of paid property tax that you paid.

Step 15: After that, you can click on the Challan number for which you need a printout.

Offline Payment

A taxpayer can alternatively pay tax offline by approaching any cosmos and bank cash counters in Pune. Once the payment is completed, the applicant receives a receipt that contains the property tax ID.Penalty for Non-Payment of Property Tax

Non-payment of property tax can incur a hefty penalty in the hands of the landowner. Late payments towards property tax may attract interest at the rate of 5 to 20 per cent on the payable sum, depending upon the relevant policies.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...