Last updated: December 17th, 2019 6:06 PM

Last updated: December 17th, 2019 6:06 PM

Punjab eStamp Paper

To register property in India, the buyer has to pay charges in the form of stamp duty for registration. Formerly, stamp duties were paid by purchasing stamp papers from approved stamp vendors or Government treasury at the time of deed registration. The Department of Revenue, Government of Punjab, has now facilitated the payment of Stamp Duty through the purchase of Punjab eStamp paper. In this article, we look at the procedure for purchasing Punjab eStam paper in detail. Know more about TDS on Property PurchaseStamp Duty

Stamp duty is a kind of tax that needs to be paid at the time of Punjab deed registration. This legal tax requires to be paid as proof for any purchase of immovable property or land or registration of deed. Stamp Duty is calculated on market value or a considerable amount of the property, whichever is higher. The stamp duty for Punjab Property registration is five rupees for every hundred on the market value of land. You can also obtain stamp duty value online through Kaveri portal. Note: Consideration amount is the total value of funds involved in any purchase or sale transaction entered between two or more parties.Stamp Paper

Stamp paper is one of the traditional ways of paying stamp duty and property registration charges. The owner of a property needs to purchase non-judicial stamp paper from an authorised vendor or Treasury in Punjab. Once the non-judicial stamp paper is purchased, the property transaction details will be written or typed on that.Punjab eStamp Certificate

Punjab eStamp Certificate is a computer-generated alternative for conventional stamp papers. To avoid counterfeit stamp papers and to make Punjab property registration easy, the Government of Punjab introduced e stamping. As per The Punjab Stamp Act, 1957 Act, transaction above Rs. 1 lakh should be paid only with Punjab e-stamp.Benefits of Punjab e-Stamp Paper

Punjab e-Stamping Certificate can be used regarding all instruments on which stamp duty is payable. Such instrument includes all transfer documents such as sale deed, mortgage deed, exchange deed, gift deed, conveyance deed, and power of attorney, deed of partition, lease deeds, agreement of tenancy, leave and license agreement. The benefits of using Punjab e-Stamping Certificate is explained in detail below:- Punjab e-Stamping Certificate is a convenient method for tax at the time of property registration

- Usage of Punjab e-Stamping Certificate eliminates the need of non-judicial stamp papers for deed registration

- All details of property registration stamp duty can be obtained from a single online portal

- Punjab e-Stamping Certificate online purchase makes the property registration process quick

- Punjab e-Stamping Certificate is tamper proof

- Validation is very easy with Punjab e-Stamping Certificate

Attribute in Punjab e-Stamp Paper

The Punjab e-Stamp certificate will contain below-mentioned details.- Name of payee

- e-Stamping Certificate Serial number

- Government Receipt Number (GRN)

- Payment Date and Time

- Nature of property or land

- Department Reference Numbers

- Value of immovable property or land

- Amount of stamp duty paid

Licensing Authority

The Stock Holding Corporation of India Limited is appointed as the Central Record Keeping Agency for issuing Punjab eStamp paper.Procedure to Purchase Punjab e-Stamping Certificate

Procedure to purchase Punjab e-Stamp paper is explained in step-by-step guidelines here: Step 1: You have to ascertain the Punjab property registration reference number and the amount of stamp duty payable from the concerned Registration office.Submit an Application

Step 2: Approach the nearest counter of CRA in Registration office or CRA branch office or Authorized collection centres (ACC) and fill up the Punjab e-Stamping Certificate application form. We have here with attached the Punjab e-Stamping Certificate: Step 3: After providing details in e-Stamping Certificate such as property/land details, first party information, Second party information, the rate of stamp duty payment furnish the application form at the counter.Make Payment

Step 4: Applicant can make the payment through any of the following ways to get Punjab e-Stamping Certificate:- Cash

- Cheque

- Demand Draft

- Pay Order

- RTGS

- NEFT

- Account to Account transfer

Get Punjab e-Stamping Certificate

Step 5: Once the payment for stamp duty is made, the Punjab e-Stamping Certificate will be generated and issued to the applicant. Step 6: In the case, the payment made through Cheque or Demand Draft, the applicant will be provided with a receipt from the counter. Upon crediting the charge to the CRA account, the applicant can get the Punjab e-Stamping Certificate from the concerned counter. Step 7: After obtaining the debit confirmation from the concerned bank, visit the nearest counter; furnish the transaction reference issued by the bank along with duly filled the e-Stamp Application Form to get the e-Stamping Certificate. Step 8: For registering property in Punjab, visit the concerned registration office with the Punjab e-Stamping Certificate along with the deed.Verify Punjab e-Stamping Certificate

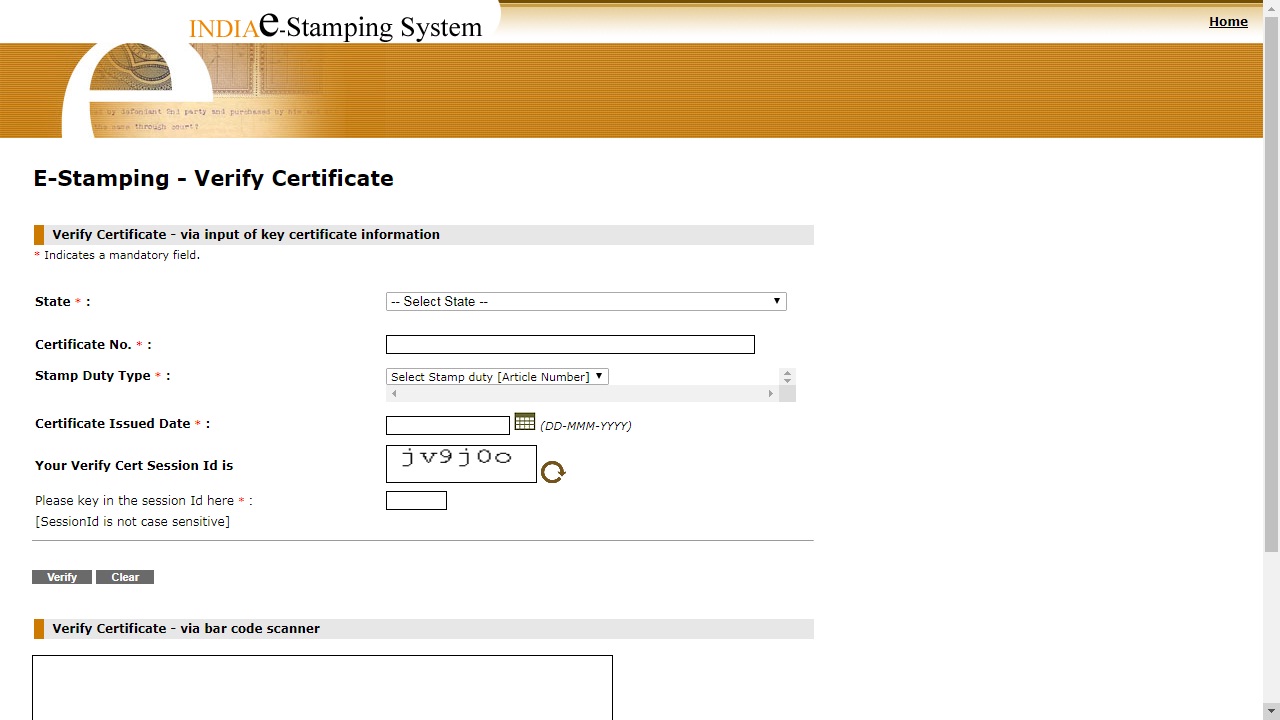

For verifying Punjab e-Stamping Certificate, you need to access the home page of the CRA web page. From the main page click on the verify e-Stamp certificate option. The link will redirect to new page. Image 1 Punjab e-Stamping Certificate

From the new page, select the state as Punjab from the drop-down menu and provide following details for verification.

Image 1 Punjab e-Stamping Certificate

From the new page, select the state as Punjab from the drop-down menu and provide following details for verification.

- Certificate Number

- Stamp Duty Type

- Certificate Issued Date

Image 2 Punjab e-Stamping Certificate

On clicking the verify button, details of e-Stamping Certificate will be displayed.

You can also Verify Certificate using the barcode scanner. Enter the given alphanumeric string for verification. On clicking the verify button, details of e-Stamping Certificate will be shown.

Note: The existing mode for payment of stamp duty and registration by stamp papers through treasury or stamp vendors will also be available. The payment of stamp duty using franking will also be available.

Image 2 Punjab e-Stamping Certificate

On clicking the verify button, details of e-Stamping Certificate will be displayed.

You can also Verify Certificate using the barcode scanner. Enter the given alphanumeric string for verification. On clicking the verify button, details of e-Stamping Certificate will be shown.

Note: The existing mode for payment of stamp duty and registration by stamp papers through treasury or stamp vendors will also be available. The payment of stamp duty using franking will also be available.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...