Last updated: December 17th, 2019 6:06 PM

Last updated: December 17th, 2019 6:06 PM

Punjab Road Tax

Road tax also known as vehicle tax is a taxation system that is applicable to all vehicle owners in the country. This tax is levied by the Central and State Government and the fund collected from the vehicle owners are used to enhance transportation facilities for the commuters within the country. In this article, we look at the various aspects of Punjab road tax in detail.Punjab Road Tax

The Punjab Transportation Department headed by the State Transport Commissioner, who is assisted by two additional State Transport Commissioner, One Joint State Transport Commissioner, Deputy Controller (F&A), Deputy State Transport Commissioner, Punjab, Service Engineer, Automobile Engineer and Assistant Transport Commissioner (Tech) in the Head Office. The provisions relating to Punjab Road Tax are provided in Section 213 of Motor Vehicles Act 1988.Road Tax for Two-Wheeled Vehicles

The Motor Vehicles Act, 1988 authorizes the regulations for calculating, executing and collection of Road Taxes. Provision 213 illustrates the rules that have to be followed for calculating Punjab Road Tax and for issuing registration certificates and fitness certificates for vehicles, permits required for opening driving schools for necessary training and safe driving. The payment of vehicle taxes can be made through a single payment. Failing to pay this amount leads to a penalty of Rs. 1,000 to Rs. 5,000. According to the Punjab Motor Vehicles Taxation Act, 1924, the rates of Punjab road tax are as follows.- Motorcycles up to 50 CC - 1.5% of the total cost of the vehicle.

- Motorcycles more than 50 CC - 3% of the total cost of the vehicle.

- Four wheelers that are used for personal reasons - 2% of the total cost of the vehicle.

- Two wheeler vehicles that are not more than 91 kg unladen weight - Rs. 120 has to be paid as a single payment.

- Two wheeler vehicles that are more than 91 kg unladen weight - Rs. 400 has to be paid as a single payment.

- Two wheeler vehicles that are not more than 91 kg unladen weight - Rs. 90 has to be paid as a single payment.

- Two wheeler vehicles that are more than 91 kg unladen weight - Rs. 300 has to be paid as a single payment.

- Two wheeler vehicles that are not more than 91 kg unladen weight - Rs. 60 has to be paid as a single payment.

- Two wheeler vehicles that are more than 91 kg unladen weight 0 Rs. 200 has to be paid as a single payment.

- Two wheeler vehicles that are not more than 91 kg unladen weight - Rs. 30 has to be paid as a single payment.

- Two wheeler vehicles that are more than 91 kg unladen weight - Rs. 100 has to be paid as a single payment.

Road Tax for Four-Wheeled Vehicles

The Punjab Road Taxes for four wheeler vehicles are provided in the Punjab Motor Vehicle Act, 1924. Vehicles less than 3 years of age- Four wheeler vehicles that are up to 4 seats - Rs. 1,800 has to be paid as a single payment.

- Four wheeler vehicles that are up to 5 seats - Rs. 2,100 has to be paid as a single payment.

- Four wheeler vehicles that are up to 6 seats - Rs. 2,400 has to be paid as a single payment.

- Four wheeler vehicles that are up to 4 seats - Rs. 1,500 has to be paid as a single payment.

- Four wheeler vehicles that are up to 5 seats - Rs. 2,100 has to be paid as a single payment.

- Four wheeler vehicles that are up to 6 seats - Rs. 2,400 has to be paid as a single payment.

- Four wheeler vehicles that are up to 4 seats - Rs. 1,200 has to be paid as a single payment.

- Four wheeler vehicles that are up to 5 seats - Rs. 1,200 has to be paid as a single payment.

- Four wheeler vehicles that are up to 6 seats - Rs. 1,200 has to be paid as a single payment.

- Four wheeler vehicles that are up to 4 seats - Rs. 900 has to be paid as a single payment.

- Four wheeler vehicles that are up to 5 seats - Rs. 750 has to be paid as a single payment.

- Four wheeler vehicles that are up to 6 seats - Rs. 7,500 has to be paid as a single payment.

Payment Procedure for Punjab Road Tax

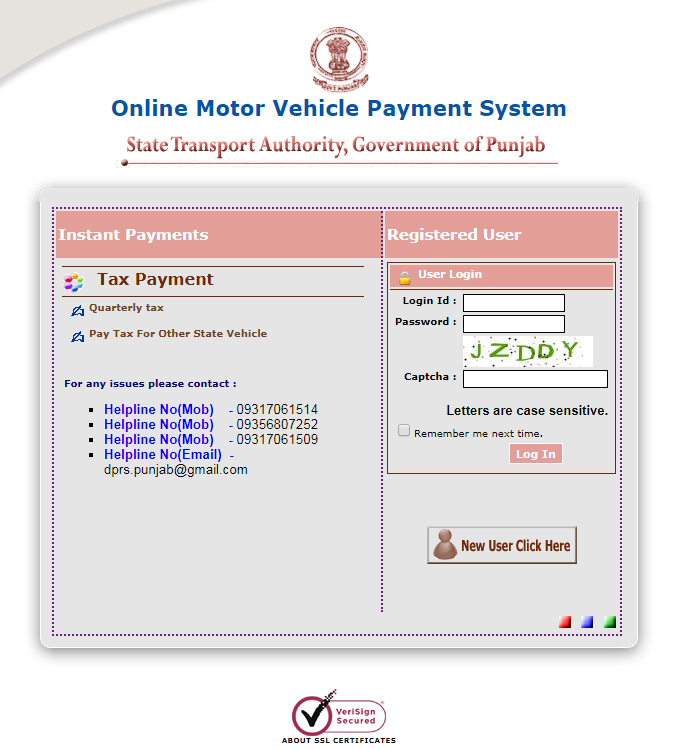

Vehicle owners in Punjab can pay taxes online through the official website. However, the taxpayer has to have a bank account in the State Bank of India for net banking. Here are the steps to pay road taxes in Punjab. Step 1: Login to the Portal The taxpayer has to login to the official portal. [caption id="attachment_70742" align="aligncenter" width="700"] Punjab Road Tax

Step 2: Online Motor Vehicle Payment System

The taxpayer has to access the page for Online Motor Vehicle Payment System.

Step 3: Enter the Credentials

The taxpayer has to enter the Login ID and Password to login to the portal. Following this, the taxpayer has to clear the Captcha Code.

Step 4: Click Log In

Once all the details are entered, the taxpayer has to click on the 'Log In' button where the taxpayer can make the payment.

Punjab Road Tax

Step 2: Online Motor Vehicle Payment System

The taxpayer has to access the page for Online Motor Vehicle Payment System.

Step 3: Enter the Credentials

The taxpayer has to enter the Login ID and Password to login to the portal. Following this, the taxpayer has to clear the Captcha Code.

Step 4: Click Log In

Once all the details are entered, the taxpayer has to click on the 'Log In' button where the taxpayer can make the payment.

Registering in the Portal

Here are for an individual to register in the portal. Step 1: Login to the Portal The taxpayer has to login to the official portal. Step 2: New User Click Here The taxpayer has to click 'New User Click Here' option. Step 3: Enter the Details Following details have to be entered.- Username

- Login ID

- Email ID

- Address

- Phone Number

- Mobile Number

- Registered DTO

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...