Last updated: November 15th, 2024 2:45 PM

Last updated: November 15th, 2024 2:45 PM

Rajasthan Land Conversion

Land conversion is a process of converting agricultural land to non-agricultural land. As per conversion of agricultural land for non-agricultural purposes in Rural Areas Rules, 1992, agricultural land in Rajasthan can be converted for residential, commercial purposes such as trade or commerce or business purposes only by taking earlier permission from the competent authority in the state. This article examines the procedure for Rajasthan Land Conversion in detail.Purpose of Land Conversion

According to the Urban Land Ceiling and Regulation Act, 1976, agriculture land in Rajasthan can be converted for the following purposes:- Residential

- Commercial

- Industrial area

- Medical facilities

- Salt manufacturing

- Public utility

Lands Not Covered Under Land Conversion Rules

No permission is granted for conversion of the following lands in Rajasthan:- No permission will be given for conversion of land which is under acquisition under the Land Acquisition Act, 1894

- If the land is falling within the boundary limit of any railway line, state highway, national highway or any other road maintained by the Central or State Government, such land cannot be converted

- Lands falling within the radius of 1 km of the outer limit of abadi of the village for an industrial unit or lime kiln or an industrial area cannot be converted

- Land used as catchment areas of a tank, village pond, land used as a pathway to any cremation or burial ground, village pond, even if not so recorded in the village revenue map or revenue record

Fee for Rajasthan Land Conversion

The fee payable for the conversion of agricultural land for non-agricultural purposes in Rajasthan is tabulated here:| S.No | Purposes | Fee |

|

1 |

Residential purpose - For a village having a population of fewer than 5000 persons | Rs.1 per sq. m for an area up to 2000 square meter. Rs.2 per sq m for area excess 2000 square meter. |

| 2 | Residential purpose - For a village having a population of more than 5000 persons. | Rs.2 per sq. m for an area up to 2000 square meter. Rs.4 per sq m for area excess 2000 square meter. |

| 3 | Commercial purposes | Rs.4 per sq. m for a land area up to 200 sq. meter Rs.8 per sq m for land area excess 200 sq. meter |

| 4 | The industrial purpose or industrial area | Rs. 1 per square meter |

| 5 | Salt manufacturing purpose | Rs. 1000 for every hectare of land |

| 6 | Medical facility for advanced medical services or super speciality as per the plan approved by the State Government. | Rs.1 per square meter |

| 7 | Charitable institutions | Rs.1 per square meter |

| 8 | Nursing homes, hospitals, diagnostic centres, clinics and dispensaries run on commercial lands and not covered by other categories | Rs.3 per square meter |

Exemption of Fee

A Khatedar tenant can convert his agricultural holding for construction of a dwelling house or cattle shed or storehouse on an area not exceeding 500 square meters without any fee payable. The area so converted will continue to be in his khatedari tenant. No fee will be payable by any department of State Government or a local authority for the conversion of agricultural land for any official use.Prescribed Authority for Land Conversion in Rajasthan

Prescribed authority for the conversion of agriculture land into non-agriculture purpose in Rajasthan is explained as follows:

Purpose |

Prescribed Authority |

|

Residential purposes |

|

|

Commercial purpose |

|

|

Salt manufacturing purposes |

|

|

The industrial purpose or industrial area |

|

| Public Utility Purpose |

|

| Medical facilities |

|

Documents Required for Rajasthan Land Conversion

- Self-attested copy of Jamabandi

- Self-attested copy of Revenue map showing the land sought to be converted in the red link

- In case of a residential colony or industrial area, layout plan to be submitted

- Details of tress in proposed land – How many trees standing and how many of trees likely to be removed

- Self-affidavit stating that ready for planting three trees instead of one tree

- Copy of challan

- Details regarding the purpose of conversion

Land Conversion Application Form

A khatedar tenant (applicant), who seeking permission for conversion of agricultural land for any non-agricultural purpose needs to submit an application form along with the all required documents to the prescribed authority (refer above). Once the application is accepted, the land conversion order will be issued.Apply online for Land Conversion

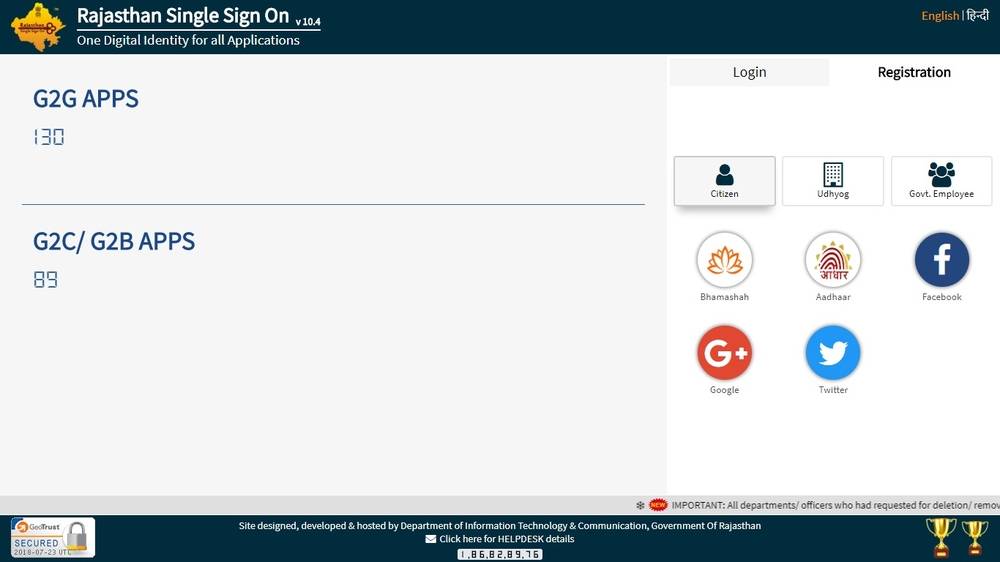

Step 1: Visit Rajasthan single-window clearance system (SWCS) official webpage. Step 2: Click on sign in or sign up tap from home page. Home screen Rajasthan Land Conversion

Home screen Rajasthan Land Conversion

User Registration

Step 3: If the applicant is a new user of SWCS then fill up the details of Entrepreneur, Investor, and Individual Registration (One-Time) to login to the dashboard page. Login Rajasthan Land Conversion

Login Rajasthan Land Conversion

Login to the Portal

Step 4: Enter the SSOID and password for login to the portal. Login Password Rajasthan Land Conversion

Step 5: On the dashboard, click on the hyperlink (I want to submit a new application) select the appropriate option from the menu.

Step 6: Click on Conversion of Land from Agriculture to Non-Agriculture in Urban Area under Rajasthan Land Revenue Rules under Sec 90A, 2012.

Login Password Rajasthan Land Conversion

Step 5: On the dashboard, click on the hyperlink (I want to submit a new application) select the appropriate option from the menu.

Step 6: Click on Conversion of Land from Agriculture to Non-Agriculture in Urban Area under Rajasthan Land Revenue Rules under Sec 90A, 2012.

Complete Application Form

Step 7: Fill all the mandatory information in the application form and upload all documents as prescribed above.- Name of Tenant

- Aadhaar number

- Bhamashah number

- Father or Husband’s number

- Email ID

- Address of the land

- Khasara number of the land

Make Payment

Step 8: Make payment by clicking on Pay Now. Only internet banking facility is available for land conversion in SWCS. Step 9: Once the applicant has applied, it will be forwarded to the concerned approving agency for the approval process.Download Land Conversion Order

Step 10: The applicant can track the application by merely visiting SWCS. Steps 11: Once the application has approved logon to the portal again to download the conversion order.Converting Land For Non-Agricultural Purpose

After receiving the conversion order, khatedar tenant will be entitled to convert agricultural land for non-agricultural purposes. Converted land can’t be transferred for two years, after two years such land may be transferred without payment of fee and obtaining permission from the prescribed authority.Entry in Revenue Records

After the issue of conversion order, the Tahsildar will reduce the area of Khatedari land by making necessary entries in the revenue records.Penaltyyour

If a person has used his Khatedari land for any non-agricultural purpose, without obtaining prior permission of the prescribed authority, such person shall be liable to a penalty equal to 25% of the amount of premium (fee), in addition to the premium payable.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...