Last updated: December 19th, 2024 10:33 AM

Last updated: December 19th, 2024 10:33 AM

Refund of Input Tax Credit under GST

Under GST, the taxpayer registered with GST can claim the refund for any tax and interest paid or any other amount of GST by making an application for GST refund before 2 years from the relevant date. In this article, we look at the procedure for obtaining GST refund and refund of unutilised input tax credit under GST in detail.Refund of Unutilised Input Tax Credit

Input tax credit mechanism in GST ensures that GST liability is ultimately passed on to the end consumer of goods or service. However, throughout the value chain, every person should pay GST and then claim the input tax credit on GST paid to reduce GST liability. In such a scenario, the possibility may arise for some taxpayers to accumulate input tax credit that cannot be set off against GST liability. Hence, the GST Act provides a procedure for applying for a refund of the unutilised input tax credit. According to the GST Act, the eligibility for refund shall apply to the following of underutilized input tax credit:- Zero rated supplies made without payment of tax;

- Input tax credit has accumulated on account of the rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies).

GST Refund for Zero Rated Supply

The following formula shall apply for calculating the refund of the input tax credit, in case of zero rated supply without payment of tax under bond or letter of undertaking:Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC ÷Adjusted Total Turnover

"Refund amount" means the maximum refund that is admissible. "Net ITC" means input tax credit availed on inputs and input services during the relevant period. "Turnover of zero-rated supply of goods" means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking. "Turnover of zero-rated supply of services" means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking. "Adjusted Total turnover" means the turnover in a State or a Union territory, as defined under sub-section (112) of section 2, excluding the value of exempt supplies other than zero-rated supplies, during the relevant period. “Relevant period” refers to the period for which the claim filed by the concerned individual. Also read: Zero Rated Supply under GSTGST Refund Due to Inverted Duty Structure

In the case of refund on account of inverted duty structure, refund of unutlised input tax credit is granted based on the following formula:Maximum Refund Amount = {(Turnover of inverted rated supply of goods) x Net ITC ÷ Adjusted Total Turnover} - tax payable on such inverted rated supply of goods

Applying for Refund of Unutilised Input Tax Credit

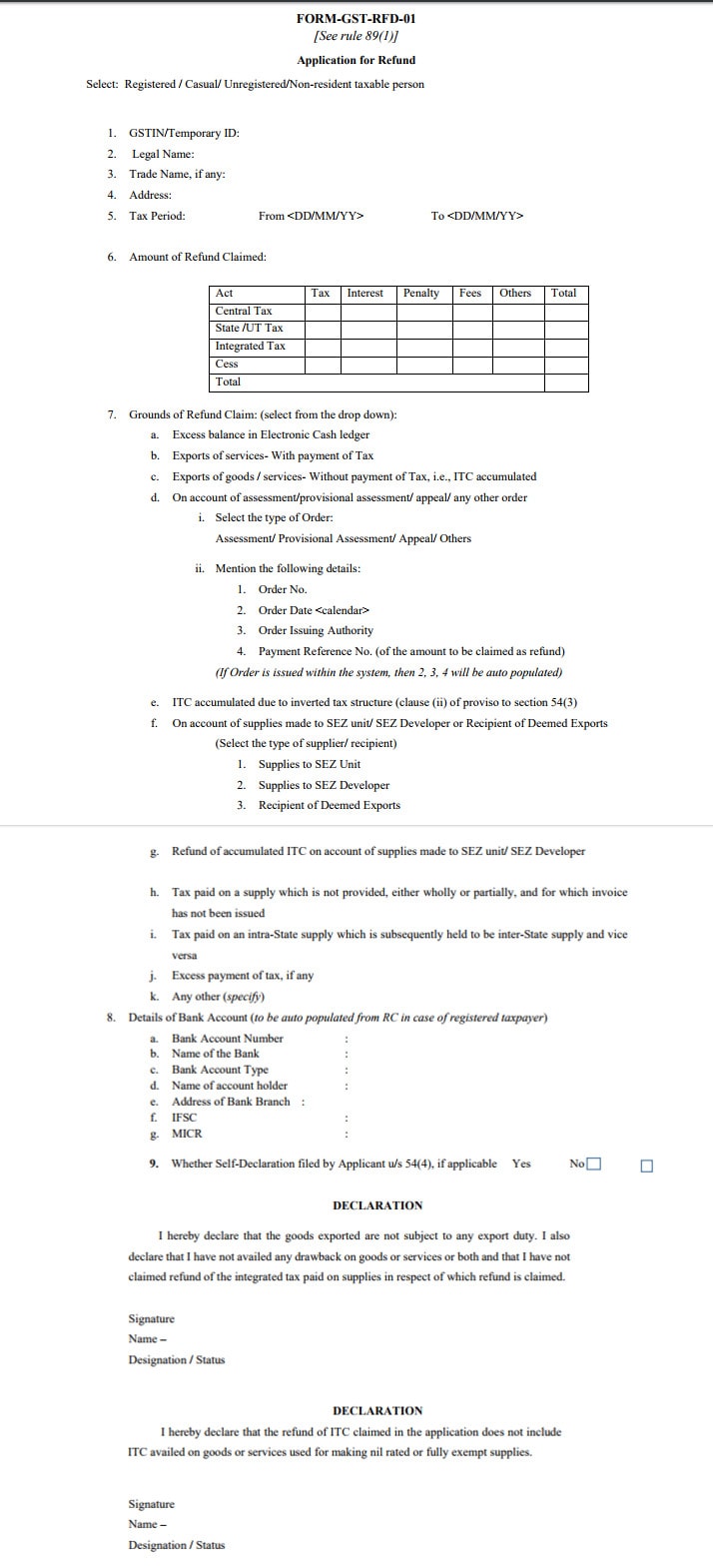

An application for refund of unutlised input tax credit must be submitted in Form GST RFD-01 as shown below: [caption id="attachment_33353" align="aligncenter" width="714"] GST Refund Application Form

Along with the GST refund application form, the taxpayer must submit documentary evidence supporting the GST refund. In case the GST refund claimed is less than Rs.2 lakhs, then the taxpayer can submit a declaration instead of submitting documentary evidence.

If the GST refund claimed is over Rs.2 lakhs, then documentary evidence must be submitted mandatorily. Based on the type of GST refund claim, one or more fo the following documents must be submitted as evidence.

GST Refund Application Form

Along with the GST refund application form, the taxpayer must submit documentary evidence supporting the GST refund. In case the GST refund claimed is less than Rs.2 lakhs, then the taxpayer can submit a declaration instead of submitting documentary evidence.

If the GST refund claimed is over Rs.2 lakhs, then documentary evidence must be submitted mandatorily. Based on the type of GST refund claim, one or more fo the following documents must be submitted as evidence.

- Reference number of the order and a copy of the order passed by the proper officer or an appellate authority or Appellate Tribunal or court resulting in such refund or reference number of the payment of the amount specified in sub-section (6) of section 107 and sub-section (8) of section 112 claimed as refund.

- Statement containing the number and date of shipping bills or bills of export and the number and the date of the relevant export invoices, in a case where the refund is on account of export of goods.

- Statement containing the number and date of invoices and the relevant Bank Realisation Certificates or Foreign Inward Remittance Certificates, as the case may be, in a case where the refund is on account of the export of services.

- Statement containing the number and date of invoices as provided in rule 46 along with the evidence regarding the endorsement specified in the second proviso to sub-rule (1) in the case of the supply of goods made to a Special Economic Zone unit or a Special Economic Zone developer.

- Statement containing the number and date of invoices, the evidence regarding the endorsement specified in the second proviso to sub-rule (1) and the details of payment, along with the proof thereof, made by the recipient to the supplier for authorised operations as defined under the Special Economic Zone Act, 2005, in a case where the refund reflects on account of supply of services made to a Special Economic Zone unit or a Special Economic Zone developer.

- Declaration to the effect that the Special Economic Zone unit or the Special Economic Zone developer yet to avail the input tax credit of the tax paid by the supplier of goods or services or both, in a case where the refund reflects on account of supply of goods or services made to a Special Economic Zone unit or a Special Economic Zone developer;

- Statement containing the number and date of invoices along with such other evidence as may be notified in this behalf, in a case where the refund is on account of deemed exports.

- Statement containing the number and the date of the invoices received and issued during a tax period in a case where the claim pertains to refund of any unutilised input tax credit under sub-section (3) of section 54 where the credit accumulated on account of the rate of tax on the inputs reflects higher than the rate of tax on output supplies, other than nil-rated or fully exempt supplies;

- Reference number of the final assessment order and a copy of the said order in a case where the refund arises on account of the finalisation of provisional assessment.

- Statement showing the details of transactions considered as intra-State supply but subsequently held as inter-State supply.

- Statement showing the details of the amount of claim on account of excess payment of tax.

- Declaration to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed does not exceed two lakh rupees.

- Certificate in Annexure 2 of FORM GST RFD-01 issued by a chartered accountant or a cost accountant to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed exceeds two lakh rupees.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...