Last updated: August 29th, 2024 3:58 PM

Last updated: August 29th, 2024 3:58 PM

Income Tax Refund

Assessees who have paid a higher tax to the government than their actual tax liability in the previous financial year, are required to file their income tax return (ITR) to claim the eligible amount of income tax refund. The higher tax is usually paid by way of an advance tax paid by an individual during the financial year or self-assessment or tax deducted at source (TDS). Refund is necessary when the tax liability is lesser than the sum of TDS credit available and self-assessment tax paid. In this article, we briefly discuss the procedure for applying for an income tax refund.What is Income Tax Refund?

A refund occurs when a taxpayer files the tax return with a tax liability which is less than the taxes paid. The Income Tax Department issues a refund, which is credited to the bank account mentioned while filing the Income Tax Return or a cheque is sent to the mailing address.Refund Banker Scheme

The Refund Banker Scheme is operational for taxpayers assessed all over India (except at Large Taxpayer Units) and for returns processed at CPC (Centralized Processing Centre). In the Refund Banker Scheme, the refunds generated on the processing of Income-tax Returns by the Assessing officers/CPC-Bangalore are transmitted to State Bank of India, CMP branch, Mumbai (Refund Banker) on the next day of processing for further distribution to taxpayers.Modes of Issuing Refunds

The assessee who files their Income-tax Return online gets their refund cheque issued by Centralized Processing Centre (CPC) of Income Tax Department at Bangalore. Refunds are being sent to the assessee in the following two modes:- RTGS / NECS: The refund amount will be credited to the assessee’s bank account if he has given the correct bank account details in Income tax Return Filed by him.

- Paper Cheque: Income Tax Refund Cheque would be sent to the assessee if he failed to give correct bank account details in Income tax Return Filed by him.

Online Procedure to Apply for a Refund Reissue

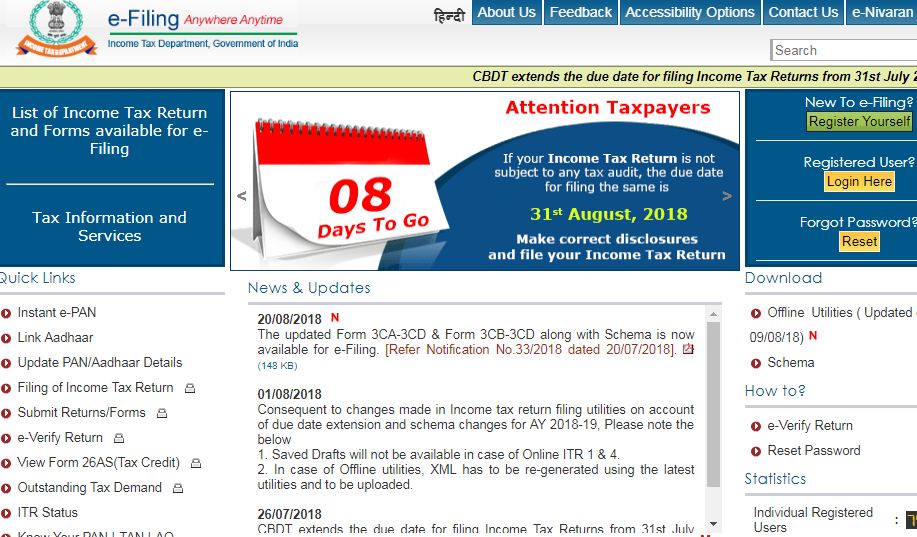

In case of the refund reissue, the taxpayer will have to submit a refund reissue request from the Income-tax Department’s official website. To raise a claim for Refund Reissue online, please follow the below-given steps: Step 1: Visit the official ‘e-Filing’ portal. [caption id="attachment_56832" align="aligncenter" width="917"] Step 1-Income Tax Refund Reissue

Step 2: In the case of a new user, the Taxpayer has to register on the official web portal by following the steps given below,

Step 1-Income Tax Refund Reissue

Step 2: In the case of a new user, the Taxpayer has to register on the official web portal by following the steps given below,

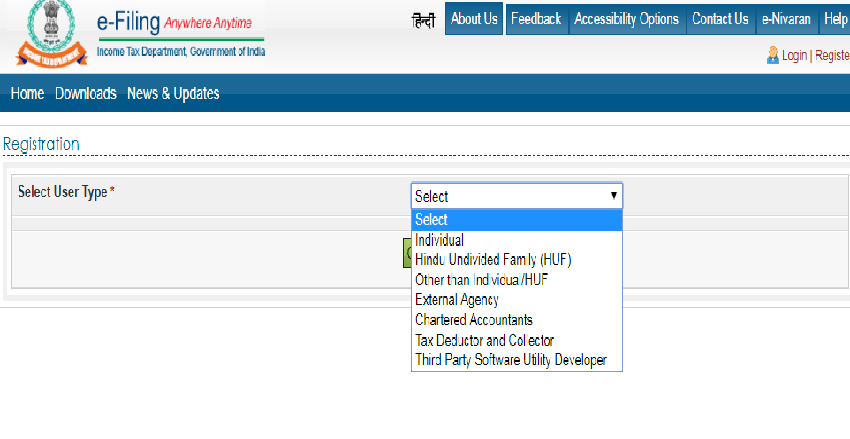

Registration Process

Step 3: Go to the ‘e-Filing’ Portal. Step 4: Click on "Register Yourself" in the menu bar. Step 5: Select the user type as Individual or HUF or Other than Individual and HUF and click on the "Continue" button. [caption id="attachment_56833" align="aligncenter" width="850"] Step 5-Income Tax Refund Reissue

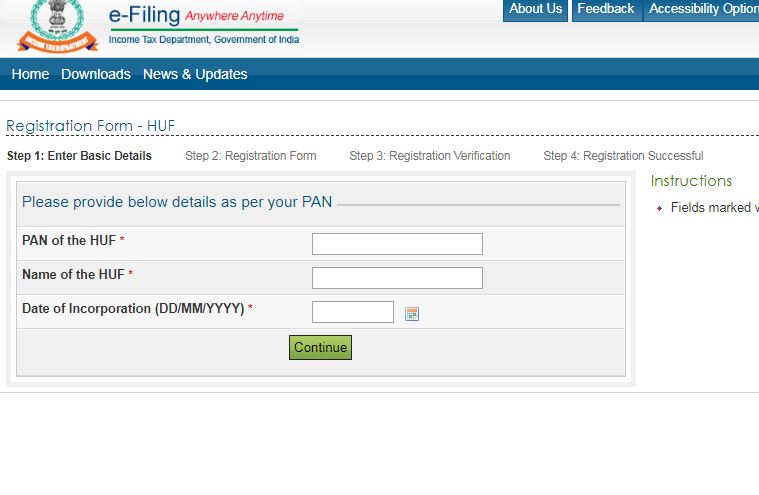

Step 6: Then give all the required details and click on continue.

[caption id="attachment_56834" align="aligncenter" width="759"]

Step 5-Income Tax Refund Reissue

Step 6: Then give all the required details and click on continue.

[caption id="attachment_56834" align="aligncenter" width="759"] Step 6-Income Tax Refund Reissue

Step 7: After registration, an OTP will be sent to their registered mobile number.

Step 8: Now enter the OTP for the successful registration.

Step 6-Income Tax Refund Reissue

Step 7: After registration, an OTP will be sent to their registered mobile number.

Step 8: Now enter the OTP for the successful registration.

Provide Details

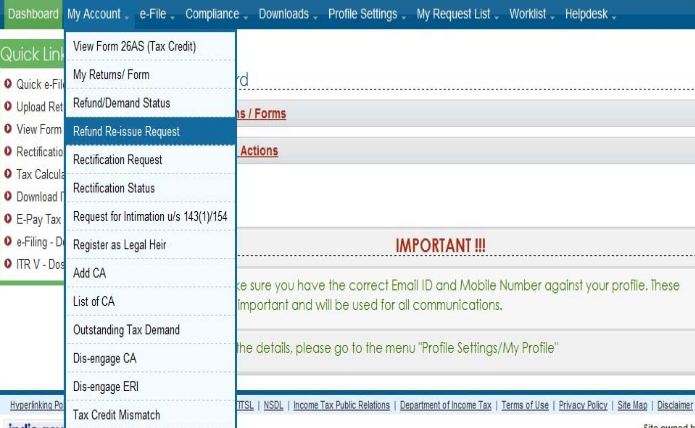

Step 10: Once login to the web page, click on the "My Account" option in the menu bar and click on “Refund Re-issue Request”. [caption id="attachment_56835" align="aligncenter" width="695"] Step 10-Income Tax Refund Reissue

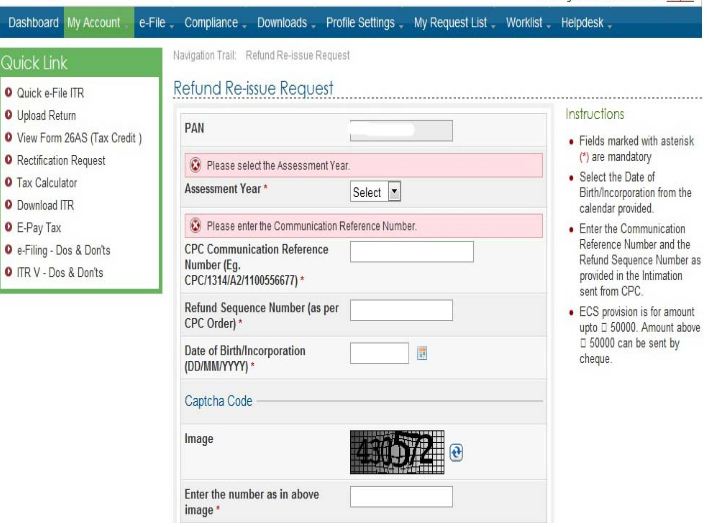

Step 11: Then enter all the required details such as PAN, Assessment Year, CPC Communication Reference Number, Refund Sequence Number and Click on the ‘Validate’ button.

[caption id="attachment_56836" align="aligncenter" width="713"]

Step 10-Income Tax Refund Reissue

Step 11: Then enter all the required details such as PAN, Assessment Year, CPC Communication Reference Number, Refund Sequence Number and Click on the ‘Validate’ button.

[caption id="attachment_56836" align="aligncenter" width="713"] Step 11-Income Tax Refund Reissue

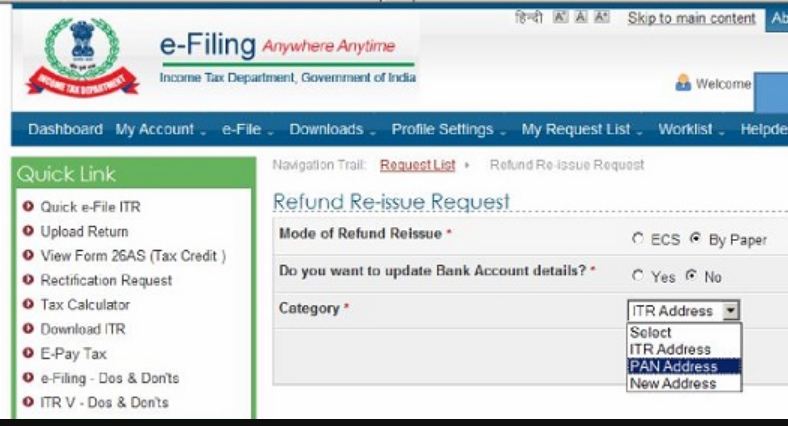

Step 12: After validation, select the mode of Refund Reissue from the options. The two modes of Refund Reissue are,

Step 11-Income Tax Refund Reissue

Step 12: After validation, select the mode of Refund Reissue from the options. The two modes of Refund Reissue are,

- By ECS

- By Paper (Cheque)

Step 12-Income Tax Refund Reissue

ECS Mode: Select mode of Refund reissue and Bank Account Details that can be changed, if required, category and click submit.

Paper Mode: If applied for refund reissue through Paper mode. This option envisages getting a refund through cheque to the address selected by the assessee.

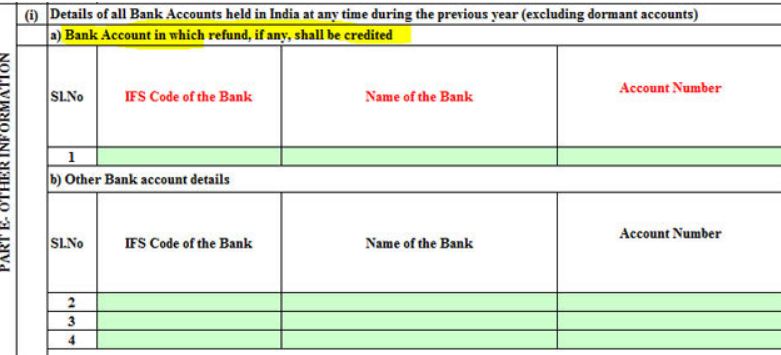

Step 13: Now give all the required Bank Account details from the options.

[caption id="attachment_56837" align="aligncenter" width="781"]

Step 12-Income Tax Refund Reissue

ECS Mode: Select mode of Refund reissue and Bank Account Details that can be changed, if required, category and click submit.

Paper Mode: If applied for refund reissue through Paper mode. This option envisages getting a refund through cheque to the address selected by the assessee.

Step 13: Now give all the required Bank Account details from the options.

[caption id="attachment_56837" align="aligncenter" width="781"] Step 13-Income Tax Refund Reissue

Step 14: Then give the correct address to which the cheque has to be sent from the drop-down given.

Step 15: Now click on the "Submit" button to validate the details.

Step 16: After the validation, the success message will be generated.

Step 17: Now, the user will have to undergo a verification process using an electronic verification code (EVC) or a digital signature certificate (DSC) to complete the process.

Step 13-Income Tax Refund Reissue

Step 14: Then give the correct address to which the cheque has to be sent from the drop-down given.

Step 15: Now click on the "Submit" button to validate the details.

Step 16: After the validation, the success message will be generated.

Step 17: Now, the user will have to undergo a verification process using an electronic verification code (EVC) or a digital signature certificate (DSC) to complete the process.

Track Refund Status

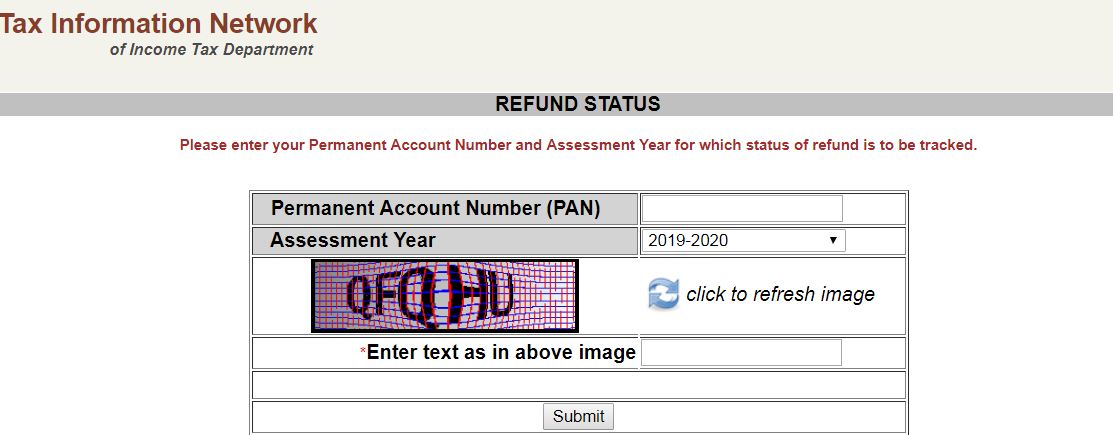

One can verify the status of the income tax refund on the TIN NSDL official website as well. Refund status is available on the website for 10 days after the department has sent the refund to the bank. To view the Refund/Demand Status, please follow the below-given steps: Step 1: Log in to e-Filing website with a User ID, Password, Date of Birth /Date of Incorporation and Captcha. Step 2: Go to My Account and click on “Refund/Demand Status”. [caption id="attachment_56840" align="aligncenter" width="912"] Refund Status

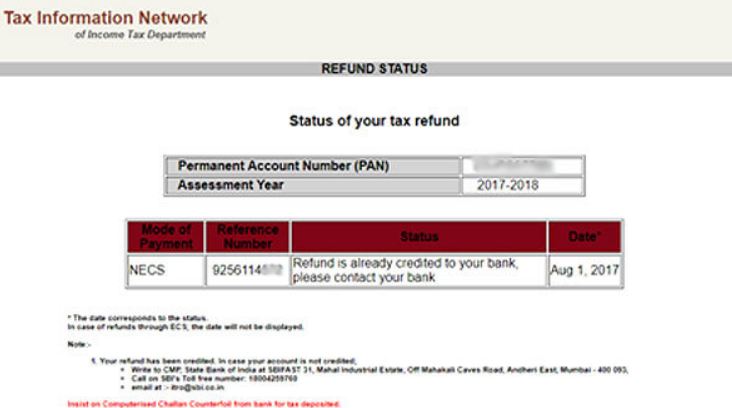

Step 3: The user can view the Refund/demand Status along with the following details below:

Refund Status

Step 3: The user can view the Refund/demand Status along with the following details below:

- Assessment Year

- Status

- Reason (For Refund Failure if any)

- Mode of Payment is displayed.

Refund Status

Refund Status

Refund Status and Resolution

The user will be notified depending on the refund status. The Refund messages displayed are tabulated below for the references:| S.No. | Refund Status | Resolution |

| 1. |

Refund Status - Expired: This implies that the refund cheque received was not deposited in the bank within the specified period. The validity for refunds of a cheque is 90 days during which the taxpayer has to submit the cheque to receive the payment from the bank. If this period expires, it is marked as expired and cancelled. |

In such a case, a taxpayer is required to submit 'refund re-issue request' on the e-filing portal. |

| 2. |

Refund Status - Refund Returned: It means that refund sent to the user via ECS (electronic clearing service) has returned undelivered. This happens when the user have given the wrong bank account details or wrong delivery address. |

If the user paper-filed their return, then they should contact the concerned Assessing Officer. |

| 3. |

Refund Status - Processed through direct credit but failed: This status appears if a refund for the credit to an account maintained with SBI had failed. |

If the user paper-filed their return, then they need to provide the correct account number and IFSC/MICR code to the concerned Assessing Officer. Once this information is updated, Assessing Officer will reinitiate their refund. |

| 4. | Refund Status - Refund processed through NEFT/NECS but failed: It means that the refund processed through NECS/NEFT mode had failed. | In this case, a taxpayer should verify the account number, account description, MICR/IFSC code given at the time of filing of the return. |

Reasons for Not Receiving Income Tax Refund

There are many reasons or not getting an income tax refund in time but the possible reasons for not getting the Income-tax Refund are listed below:- If the taxpayer has given his wrong bank details such as account number and IFSC code.

- If the communication address mentioned by the taxpayer is not correct.

- If there happens a mismatch between Form 26AS and tax details while filing Income Tax Return.

- If the details such as BSR code, date of payment and challan numbers are not correct.

- ITR V has not been received at CPC Bangalore office.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...