Last updated: March 19th, 2020 10:18 AM

Last updated: March 19th, 2020 10:18 AM

Section 194IB - TDS on Rent of Property

Section 194IB of the Income Tax Act is a provision which is enacted to ensure that TDS or Tax Deducted at Source is withheld on rental payments. As per the Finance Act, 2017, “TDS on Rent” under Section194IB is liable to be deducted by Individuals or HUFs (Hindu Undivided Family). After section 194IA, Government of India has inserted Section 194IB. The key objective of inserting this section is to curb tax evasion by landlords. In this article, we briefly discuss Section 194 IB of the Income Tax Act.Rent as per section 194-IB

Rent according to Section 194-IB refers to any payment under any tenancy, lease, sub-lease or any other arrangement for the below-mentioned uses:- Building including factory building

- Land

- Land appurtenant to a structure including factory building

- Machinery

- Plant

- Furniture

- Equipment

- Fittings

Person responsible to deduct TDS

All individuals or HUFs (except those liable to audit under clause a and b of Section 44AB) paying monthly rent to a resident more than Rs. 50,000 are liable to deduct TDS under Section 194-IB. Taxpayers should note that as per Clause a and b of Section 44AB, if the total sales, gross receipts or turnover from the business or profession of a HUF or an Individual exceed the monetary limits specified during the financial year immediately preceding the current financial year, the business establishment is liable to audit.Rate of TDS

Section 194-IB provides that for all the transactions with effect from June 1, 2017, tax at a rate of 5% should be deducted by the Tenant, Payer or Lessee at the time of making payment of rent to Lessor, Landlord or Payee. The tax deducted should be deposited to the Government Account through online by any of the authorised bank branches.Responsibility of Tenant

As stated above, all eligible individuals or HUFs paying monthly rent to a Landlord more than Rs. 50000 are liable to deduct TDS under section 194-IB. The rate of deduction is 5 % of the rent payment made to the resident. The following steps describe the procedure for making a TDS withholding on rent:- Collect the Permanent Account Number (PAN) of the resident and verify the details with the Original PAN card.

- PAN of the Landlord and Tenant should be mandatorily submitted in the online Form for furnishing information regarding the rent.

- Do not commit any mistake in quoting the PAN or other details in the online form. However, for rectifying the information furnished, the assessee is expected to contact the Income Tax Department.

- Download and provide TDS certificate in Form 16C from TRACES and issue to the Payee within 15 days from the due date of submitting of the challan-cum-statement in Form 26QC.

- If the Payee is a non-resident, the liability to deduct TDS arises under section 195 of the Income-tax Act, 1961.

Responsibilities of Landlord

- Provide PAN to the Tenant for furnishing information regarding TDS to the Income Tax Department.

- Verify deposit of taxes deducted by the Tenant in your Form 26AS Annual Tax Statement.

- Insist on obtaining Form 16C from the tenant who has been downloaded from TRACES website only.

Form 26QC

Form 26QC is the challan cum statement for reporting the transactions liable to TDS on rent under section 194-IB of the Income-tax Act.Filing form 26QC

As per rule, Taxpayer has to furnish Form 26QC in following scenarios:- The taxpayer has to mandatorily submit the Form at the end of each Financial Year in case the agreement period contains more than one Financial Year and rent has been paid during the year

- In case the agreement period falls in the same financial year, the taxpayer has to mandatorily submit the form in the month when the premise is vacated or when the termination of the agreement.

Due date for payment of TDS on rent

As per Section 194IB, the due date for payment of TDS on rent should be reckoned at 30 days from the end of the month in which the rent is paid. For example, if the taxpayer has made a deduction of rent in December, then the applicable TDS has to be deposited on or before thirty days, that is January 30th.Procedure to pay TDS

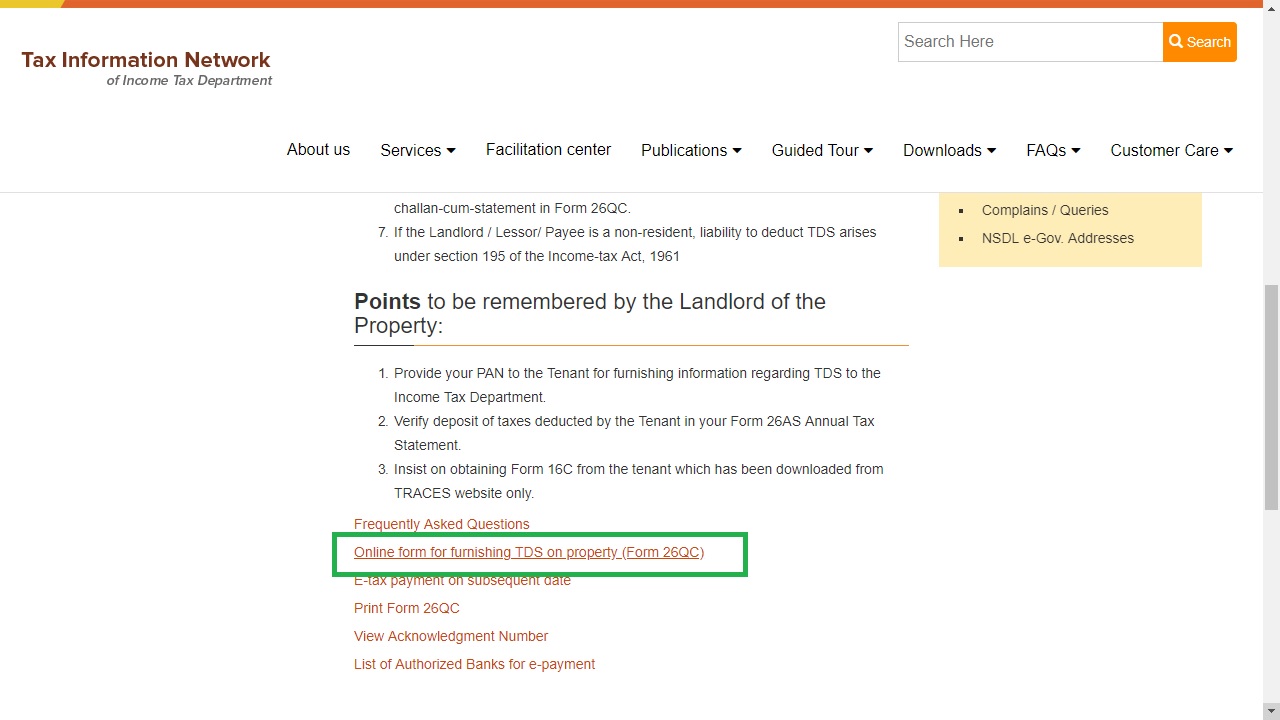

The tenant of the property has to provide information regarding the transaction, online through the TIN website. Step 1: Access home page of Tax Information Network. Step 2: Select the online form for furnishing TDS on the property (Form 26QC) for providing details in form 26QC. Image 1 Section 194 IB - TDS on Rent of Property

Step 3: Upon clicking on this, you will be redirected to e-Payment page, select Form 26QC.

Image 1 Section 194 IB - TDS on Rent of Property

Step 3: Upon clicking on this, you will be redirected to e-Payment page, select Form 26QC.

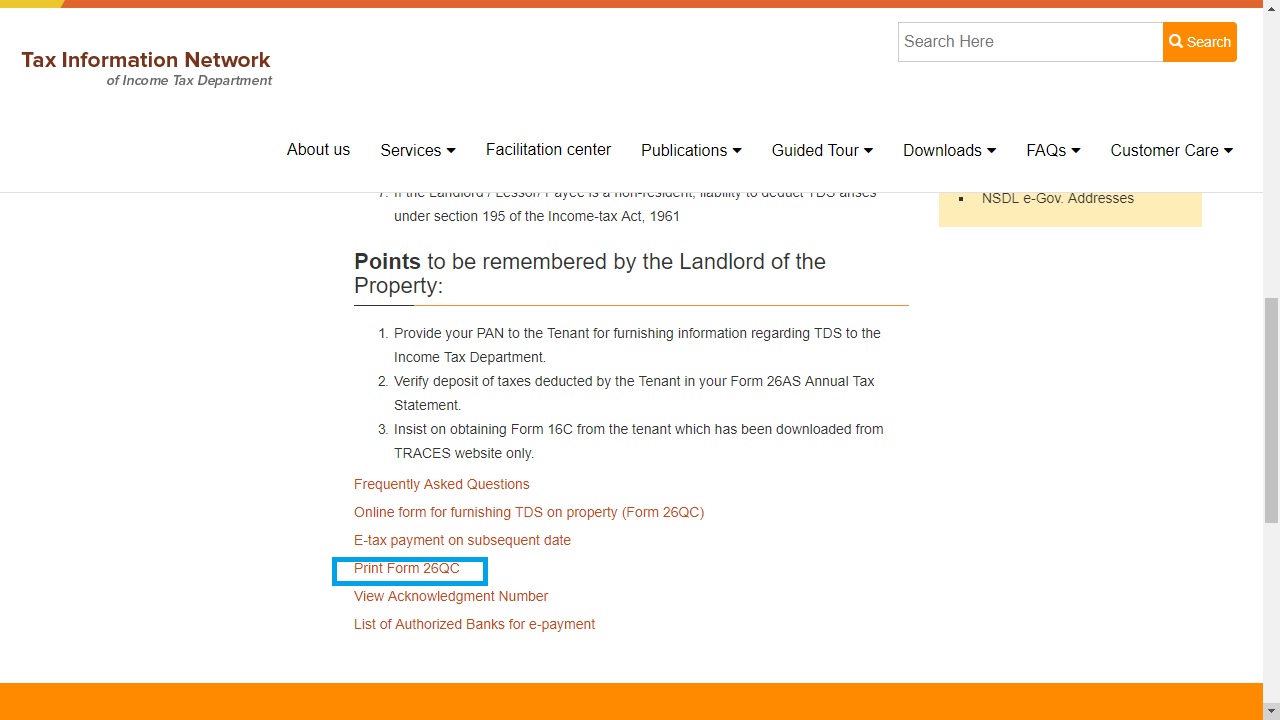

Image 2 Section 194 IB - TDS on Rent of Property

Step 4: You have to provide the following details in Form – 26QC.

Image 2 Section 194 IB - TDS on Rent of Property

Step 4: You have to provide the following details in Form – 26QC.

- Corporation Tax (Companies)

- Income Tax (Other than Companies)

- Status of the Landlord/Lessor/Payee

- PAN Details of Landlord/Lessor/Payee

- Address of the Tenant/Lessee/Payer

- Property Detail

- Amount Paid/Credited

- Tax Deposit Details

- Date of Tax Deduction

Download Form 26QC

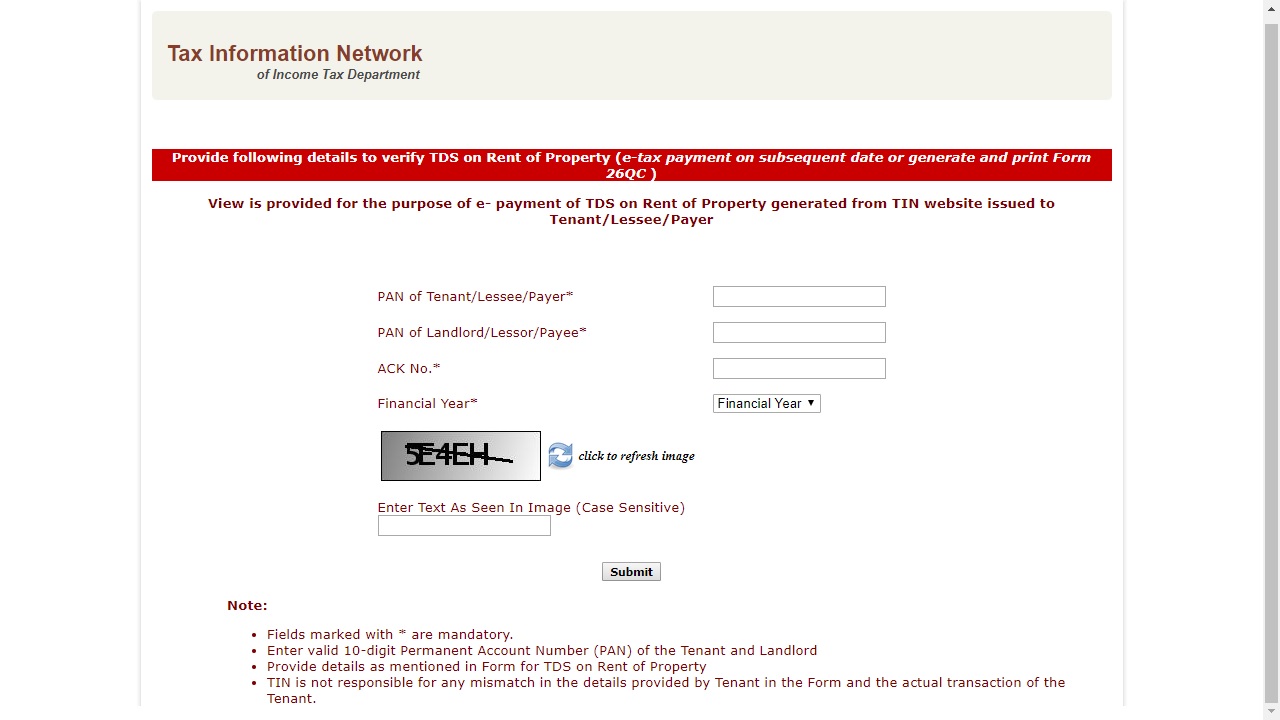

The tenant may be able to print the form 26QC after payment from TIN website. Image 4 Section 194 IB - TDS on Rent of Property

Provide details such as PAN of Tenant, PAN of Landlord, Acknowledge Number and Financial Year.

Image 4 Section 194 IB - TDS on Rent of Property

Provide details such as PAN of Tenant, PAN of Landlord, Acknowledge Number and Financial Year.

Image 5 Section 194 IB - TDS on Rent of Property

After entering the details click on submit. You can print Form 26QC.

Image 5 Section 194 IB - TDS on Rent of Property

After entering the details click on submit. You can print Form 26QC.

Form 16C

As per Section 194IB, Form 16C is the TDS certificate to be issued by the Tenant of property to the landlord of a property with respect to the tax deducted and deposited as TDS on rent of property under section 194-IB of the Income-tax Act.Penalties for Non-compliance

As per Section 234E of the Income-tax Act, 1961 read with Rule 31A (4B) of Income-tax Rules, 1962, failure on the part of the tenant to furnish details in Form No. 26QC online within 30 days from the end of the month in which the tax payment is made will attract levy of fee at the rate of Rs.200 for every day to be paid by the tenant.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...