Last updated: April 2nd, 2024 10:26 AM

Last updated: April 2nd, 2024 10:26 AM

Section 80QQB Deduction of Income Tax Act

Section 80QQB is a facility introduced in the Income Tax Act for providing a tax-incentive to Indian authors. The section permits taxpayers to claim tax deductions on royalty earned from the sale of books. Only resident Indian authors are eligible to claim a deduction under Section 80QQB. A maximum limit of Rs.3 lakhs is applicable for claiming a deduction under the section. Royalty in literary, artistic and scientific books is eligible for a tax deduction. However, royalties from textbooks, journals and diaries do not qualify for any tax deduction. If an author obtains royalties from abroad, the royalty should be brought into the country within a specified period to avail of tax benefits.Who can avail of section 80QQB tax deduction?

Section 80QQB tax deduction can be availed by authors in India earning royalty income. To claim deduction under Section 80QQB, the following two conditions must be satisfied:- The taxpayer should be an individual who is a resident of India.

- The taxpayer should be an author or joint-author of a book which is a work of literary, artistic or scientific nature.

Amount of Deduction under Section 80QQB

Under section 80QQB, authors can claim an income tax deduction of up to Rs.3 lakhs or the amount of royalty income received, whichever is lower.Conditions to Avail of a Deduction

- To avail of section 80QQB deduction, the taxpayer must be an individual resident or resident but not ordinarily resident in India. However, the assessee may be an Indian citizen or a foreign citizen. The taxpayer must have authored or co-authored a book that falls under the literary, artistic or scientific work category.

- Authors of books do not include brochures, commentaries, diaries, guides, journals, magazines, newspapers, pamphlets, school textbooks, and other similar publications.

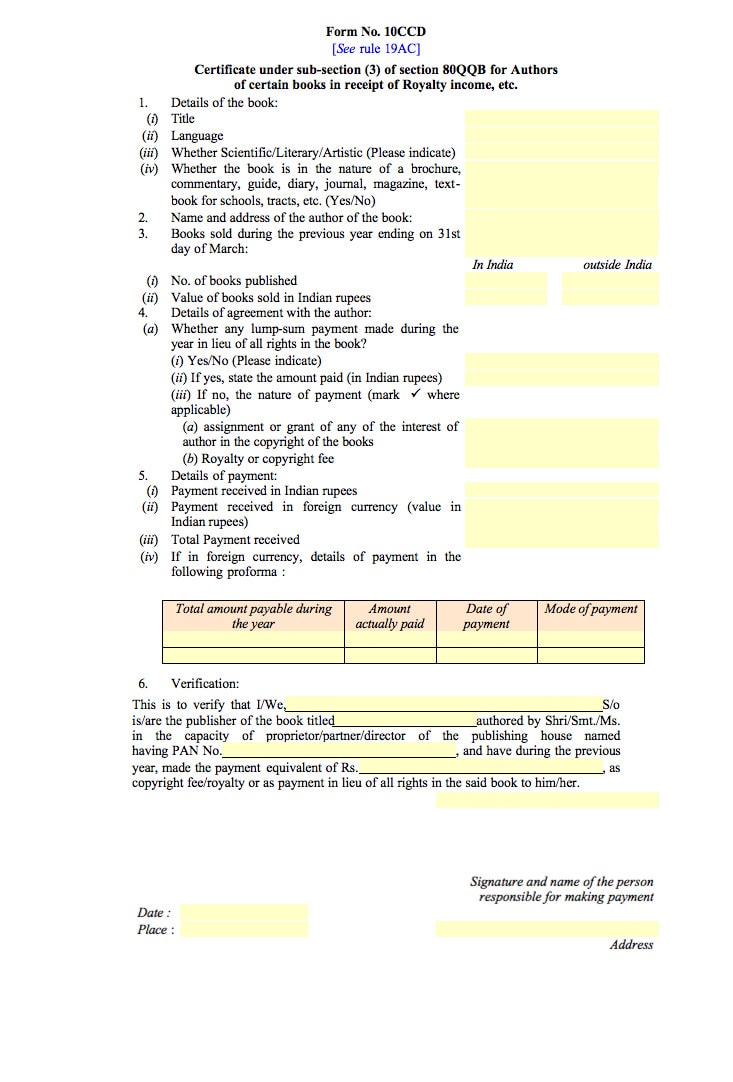

- The taxpayer must file an income tax return to claim the deduction and obtain Form 10CCD from the person/entity making the royalty payment. Form 10CCD need not be attached to the income tax return. However, it must be maintained along with the assessee's books of accounts and produced if requested by an Assessing Officer along with the tax audit report.

- If the author's income is not a lump sum payment, then 15% of the value of books sold in the year (before allowing any expenses) should be ignored. Additionally, suppose the income is earned outside India. In that case, the deduction is allowed on income when brought to India within 6 months from the end of the year or within the period defined by the Reserve Bank of India (RBI).

Form 10CCD Format

Form 10CCD format must be obtained by the taxpayer for availing deduction under section 80QQB. Form 10CCD needs to be completed and signed by the person or entity making the royalty payment to the taxpayer. The following Form 10CCD format can be used for claiming deduction under this section. [caption id="attachment_33495" align="aligncenter" width="733"] Form 10CCD Format

Form 10CCD Format

Click here to download Form 10CCD format in editable pdf format.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...