Last updated: December 23rd, 2022 1:56 PM

Last updated: December 23rd, 2022 1:56 PM

Service Exports from India Scheme (SEIS)

Service Exports from India Scheme (SEIS) aims to promote the export of services from India by providing duty scrip credit for eligible exports. Under the Scheme, service providers located in India would be rewarded under the SEIS scheme for all eligible export of services from India. This article looks at the Service Exports from India Scheme in detail. Service Exports from India Scheme was earlier termed Served from India Scheme (SFIS).Service Exports from India Scheme (SEIS)

Under the Foreign Trade Policy 2015-20, SEIS Scheme provides a mechanism under which service providers who had provided any of the eligibles notified services [as in Appendix 3D] in a financial year are entitled to certain benefits. Benefits are like duty-free credit scrip, which can be used for payment of essential customs duty and specific other duties. These scrips are also freely transferable.Duty Credit Scrip under SEIS

Under the framework of the SEIS scheme, service exporters for eligible service categories are granted benefits like transferable Duty Scrips as a percentage of Net foreign earned on the export of the qualified services in a financial year.Rate of Reward

As mentioned above, Under SEIS Scheme, Exporters of selected Services are entitled to a 3% / 5% / 7% incentive on the Net Foreign exchange earned in the form of Duty Credit Scrips. These SEIS scrips can be used to pay Import duty or encashed by selling them to any Importer. Therefore, it is as good as a cash Incentive Scheme. Net foreign exchange earnings for the SEIS scheme are calculated as follows: Net Foreign Exchange = Gross Earnings of Foreign Exchange – Total Expenses or payment or remittances of Foreign Exchange. To get the SEIS Rates, click hereService Eligible for SEIS

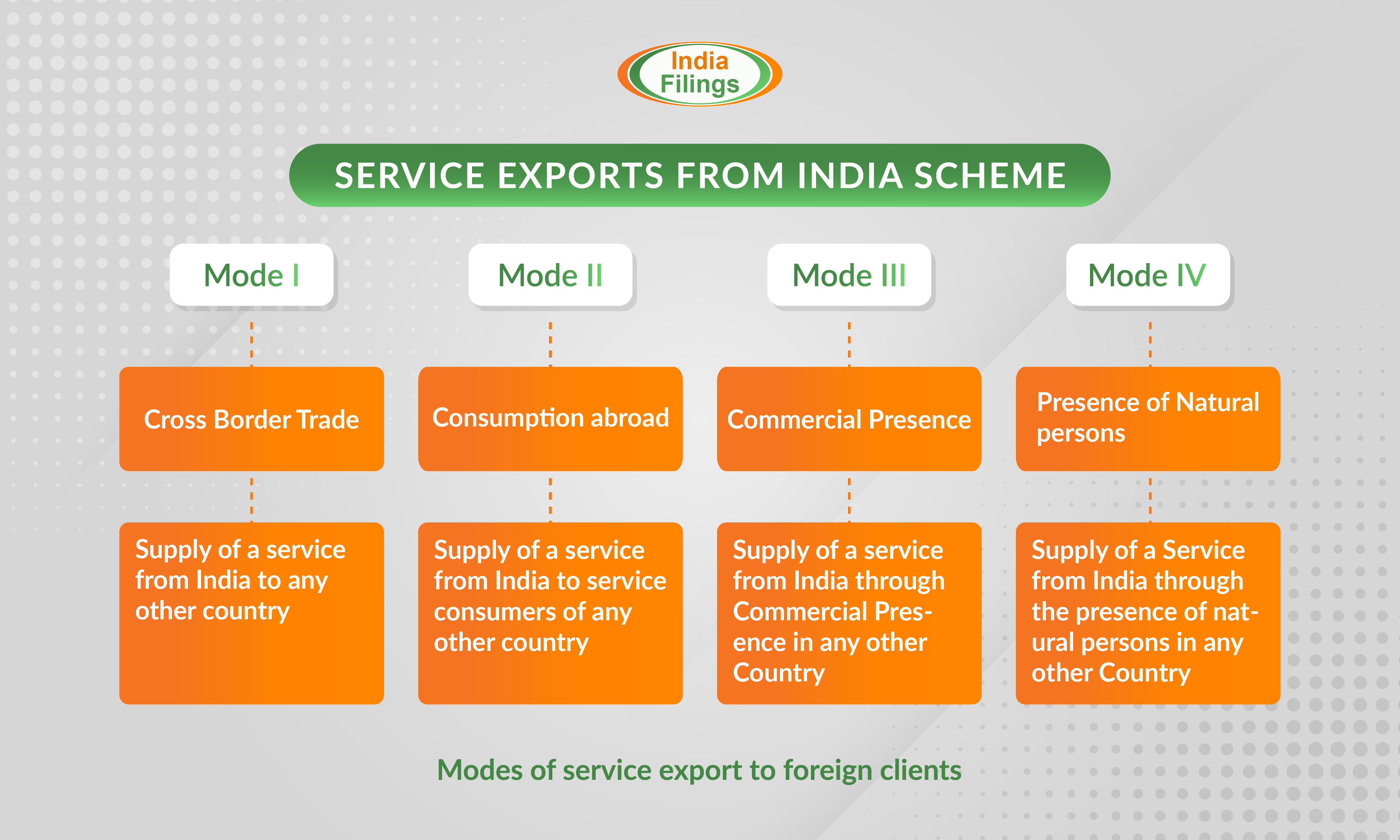

Only Services rendered under the Service Exports from India Scheme (SEIS):- Mode I: Cross Border Trade, i.e., Supply of assistance from India to any other country

- Mode II: Consumption abroad, i.e., Supply of service from India to service consumers of any other country. Benefits not Eligible: Supply of a Service through

- Mode III: Commercial Presence, i.e., Supply of service from India through Commercial Presence in any other Country

- Mode IV: The presence of Natural persons in any other country is not eligible for a reward under this Scheme. Different categories of ineligible services may be found in Public notice 45 dated 05.12.2017.

Service Eligible for SEIS

Service Eligible for SEIS

Eligibility Criteria for SEIS

The eligibility Criteria for Service Exports from India Scheme (SEIS) are as follows:- To be eligible under this Scheme, the service provider shall have minimum net free foreign exchange earnings of $15,000 in the preceding financial year.

- For Individual Service Providers and Sole Proprietorships, the minimum net free foreign exchange earnings criteria are $10,000 in the preceding financial year.

- To claim the incentives, the service provider is required to have an active IEC Code at the time of rendering such services.

- Suppose the IEC holder is a manufacturer of goods and service provider. In that case, the foreign exchange earnings and Total Expenses/ payment/ remittances are to be considered for the service provider only.

Pre-requisites for Applying for SEIS Scheme

The pre-requisites for Applying for Service Exports from India Scheme (SEIS) is as listed as follows:- The exporter should have an active IEC at the time of rendering services

- The exporter should have certain minimum earnings

- The exporter Should have exported eligible services as notified in Appendix 3D/3E/3X (Appendix 3X will be applicable on a claim for FY 2019-20, and Appendix 3D/3E will be suitable for another year claim)

- The services do not fall under ineligible categories as in Public notice 45 dated 05.12.2017

- Services provided under Modes 1 and 2 only are allowed for claims for eligible services

- Negative Net Foreign Exchange earnings (NFE) make the entitlement under zero for the financial year

Application Procedure - SEIS

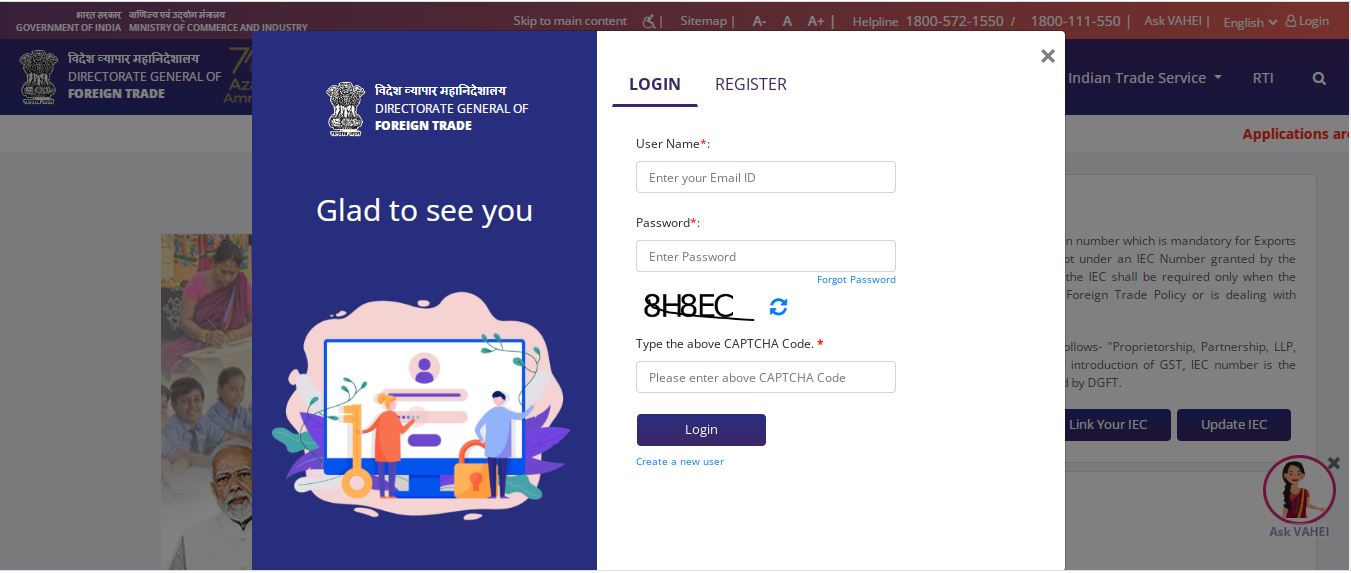

- Visit the DGFT website and proceed with Login by entering the User ID, Password and captcha, then click on the login button to log in to the system.

Service Exports from India Scheme (SEIS) - DGFT Login

Service Exports from India Scheme (SEIS) - DGFT Login

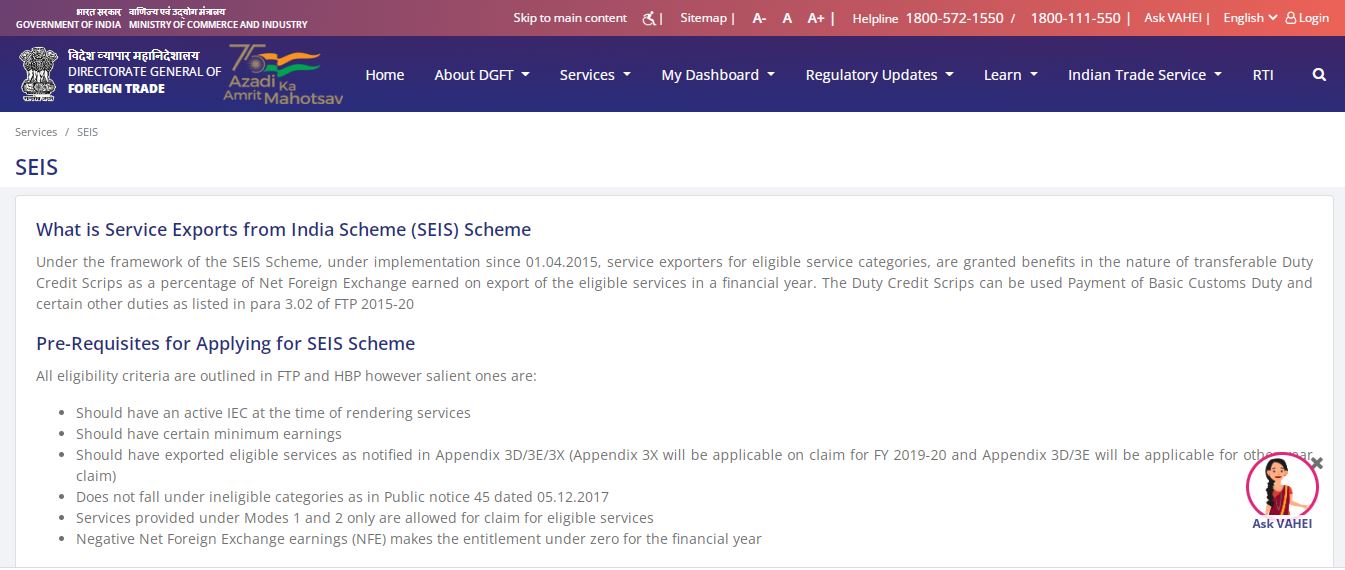

- Click on the service option at the top of the screen and select the SEIS option from the menu; the user will be redirected to the SEIS page.

Service Exports from India Scheme (SEIS) - SEIS Application

Service Exports from India Scheme (SEIS) - SEIS Application

- Scroll down to find the Apply for SEIS node and click on explore button on the SEIS node; you will be redirected to the Apply for SEIS application page.

- To create a new application, click on the Start Fresh Application. Fill in the required fields in the applicant details section.

- In the PRC section, if PRC is not approved, click on ‘NO’ for ‘Is PRC Approved?’ Note: if PRC is not endorsed, then the ‘year of rendering exports for which SEIS claimed’ dropdown will display the current year and last two years or as per notification by DGFT.

- If PRC is approved, then enter the PRC reference number and upload the PRC document.

- Select the ‘year of rendering services exports for which SEIS claimed’ and click on the Save & Next button in the applicant details screen, to land on the RCMC details screen.

- Select the RCMC details and click on the save & following buttons.

- In the ‘invoice wise details of new foreign exchange earned screen,’ click on ‘download sample excel’ to download the sample excel of invoice details. In the downloaded excel, make changes and save the excel sheet.

- Click on the bulk upload button in the invoice details section. Now click on ‘choose the file to upload.

- Enter all the mandatory details on the screen and click on the ‘save & next button to reach the other details page

- In the other details screen, click on ‘do you want to split scrip?’ if you want to split the scrip. In case of split requested maximum value for each scrip is Rs 5,00,0

- Upload the CA/CS as an attachment by selecting the attachment type and clicking on the ‘upload attachment button.

- The user has to upload CA/CS attachment or add CA/CS details to CA/CS annexure details section to proceed further.

- On the declaration page, click on yes to add penalty details. Enter the place and sign the declaration by clicking the box.

- Click on the print summary to print the outline of the application.

- To proceed with payment, click on proceed with a payment button. After successful payment, the e-receipt will be generated.

Viewing and printing the SEIS scrip

There are two ways to view the SEIS scrip. After login to the DGFT website, follow the below-mentioned steps:- Viewing SEIS scrip from view and print SEIS Node (Services -> SEIS -> View and print Node)

- Viewing SEIS scrip from My Authorization section (My Dashboard -> My Authorizations)

Foreign Exchange or Remittance Ineligible under SEIS Scheme

Foreign exchange remittances other than those earned for rendering notified services would not be counted for entitlement. Thus, other sources of foreign exchange earnings, such as equity or debt participation, donations, receipts of repayment of loans, etc., and any additional inflow of foreign exchange unrelated to rendering of service, would be ineligible. As mentioned above, the service provider should have an active Import Export Code (IE Code) when rendering such services for which rewards are claimed. IndiaFilings can help you obtain the Import Export Code (IE Code).Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...