Updated on: February 26th, 2020 5:39 PM

Updated on: February 26th, 2020 5:39 PM

Service Tax Payment Due Dates

Persons and businesses that provide taxable services are required to collect and remit service tax to the Government at the service tax rate specified in the Act. Service tax registration is mandatory for any person or businesses that provides taxable services in excess of Rs.9 lakhs per year. Currently, service tax is levied at 14% and those persons or businesses that provide taxable services of less than Rs.10 lakhs are exempted from collecting and paying service tax dues. In this article, we mainly look at service tax payment due dates and procedure for making service tax payment in India.

Service Tax Payment Due Dates

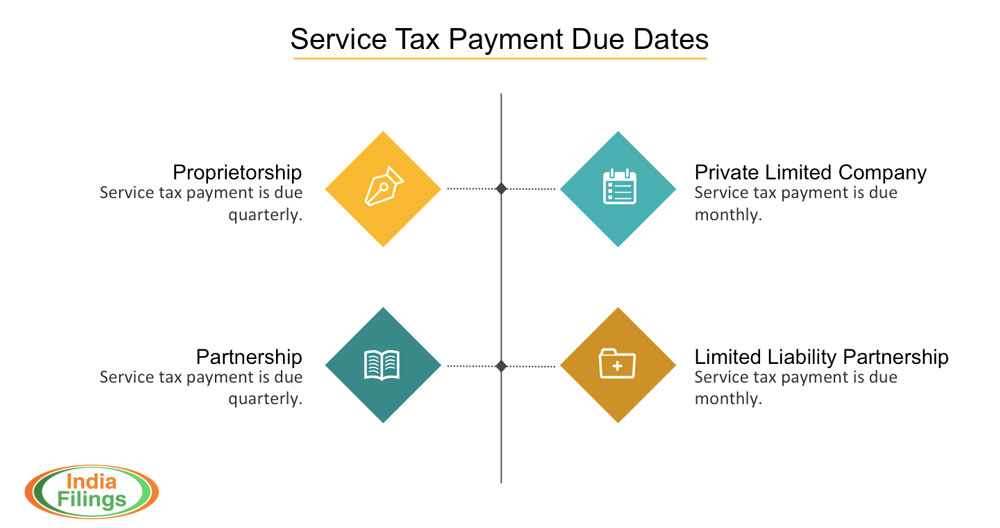

Service tax payment due dates could either be quarterly or monthly. The following is the service tax payment due dates for different types of entities in India:

[caption id="attachment_2464" align="aligncenter" width="824"] Service Tax Payment Due Dates Chart

Service Tax Payment Due Dates Chart

Individual Service Tax Payment Due Dates - Quarterly Payment

For individuals providing taxable services, service tax payments are due quarterly. If the service tax payment is paid electronically through internet banking, then service tax payments are due on the 6th of July, 6th of October, 6th of January and 31st of March. If service tax payment is paid by any other manner, then service tax payments are due on the 5th of July, 5th of October, 5th of January and 31st of March for individuals.

Proprietorship Service Tax Payment Due Dates - Quarterly Payment

For proprietorships providing taxable services, service tax payments are due quarterly. If the service tax payment is paid electronically through internet banking, then service tax payments are due on the 6th of July, 6th of October, 6th of January and 31st of March. If service tax payment is paid by any other manner, then service tax payments are due on the 5th of July, 5th of October, 5th of January and 31st of March for proprietorships.

Partnership Service Tax Payment Due Dates - Quarterly Payment

For partnership firms providing taxable services, service tax payments are due quarterly. If the service tax payment is paid electronically through internet banking, then service tax payments are due on the 6th of July, 6th of October, 6th of January and 31st of March. If service tax payment is paid by any other manner, then service tax payments are due on the 5th of July, 5th of October, 5th of January and 31st of March for partnership firms.

Private Limited Company Service Tax Payment Due Dates - Quarterly Payment

For private limited company providing taxable services, service tax payments are due quarterly. The due date for payment of service tax is the 5th of the month immediately following the respective quarter (in case of e-payment, by 6th of the month immediately following the respective quarter). The quarters are: April to June, July to September, October to December and January to March.

Limited Liability Partnership (LLP) Service Tax Payment Due Dates - Quarterly Payment

For Limited Liability Partnership (LLP) providing taxable services, service tax payments are due quarterly. The due date for payment of service tax is the 5th of the month immediately following the respective quarter (in case of e-payment, by 6th of the month immediately following the respective quarter). The quarters are: April to June, July to September, October to December and January to March

One Person Company Service Tax Payment Due Dates - Monthly Payment

For One Person Company (OPC) providing taxable services, service tax payments are due monthly. If the service tax payment is paid electronically through internet banking, then service tax payments are due on the 6th of every month and 31st of March. If service tax payment is paid by any other manner, then service tax payments are due on the 5th of every month and 31st of March for One Person Company (OPC).

Service Tax Return Due Date

All persons or entities liable to pay service tax or having service tax registration must file service tax returns. Entities having service tax registration are mandatorily required to file service tax returns. Service tax return must now be e filed. Service tax returns are due on 25th of April and 25th of October, each year. IndiaFilings can help you file Service Tax Return. Know more about Service Tax Return Filing on IndiaFilings.com.

Procedure for Making Service Tax Payment

Service tax payment must be made through GAR-7 challan. In case service tax payment is made through cheque, then the service tax payment date is the date of presentation of cheque in Bank - subject to realization. Service tax payment must be electronically for most service tax Assessees. If the Assessee has paid a total service tax of Rs.1 lakh or more including the amount paid by utilization of CENVAT credit, in the preceding financial year, then service tax payment must be made mandatorily through internet banking.

Penalty for Making Late Service Tax Payment

If service tax payment is not paid within the service tax payment due date, then a penalty is payable. Currently, late service tax payment must be paid as per below table:

| S.No. | Under Section | Offence | Details |

| 1 | 76 | Failure to pay service tax | In addition to the service tax and interest, a penalty not less than Rs.100 for every day during which failure continues, or @ 1% of such tax per month, whichever is higher but shall not exceed 50% of service tax due. |

| 2 | 77 | General penalty for contravention of any provisions of chapter V of Finance Act, 1994 or rules made thereunder for which no penalty is provided | 1. Failure to take registration in accordance with Section 69 or rules made thereunder - Rs.10000 or Rs.200 per day during which failure continues, whichever is higher. 2. Failure to keep, maintain or retain records - Up to Rs.10000 3. Failure to furnish information, to produce documents called for by Central Excise Officer or to appear before the Central Excise Officer - Upto Rs.10000 or Rs.200 per day during which failure continues. 4. Failure to pay tax electronically by the person required to pay tax electronically - upto Rs.10000 5. Failure to issue the correct invoice with complete details and account for the invoice in his books of accounts - Upto Rs.10000 For contravention of any other provisions of the Act where no separate penalty is provided - upto Rs.10000 |

| 3 | 78 | Service tax not been levied or paid or been short-levied or short-paid or erroneously refunded by reason of fraud or collusion or willful misstatement or suppression of facts or contravention of any of the provisions of chapter V of Finance Act, 1994 or of the rules made thereunder with intent to evade payment of service tax | Shall in addition to the Service Tax and interest thereon, if any payable, be the amount equal to the amount of Service tax not levied or paid or short levied or short paid or erroneously refunded. But where true accounts are available in specified records, the penalty is reduced to 50%. Where the service tax and interest are paid within 30 days, from the date of communication of the order the penalty is 25%. The reduced penalty is available only if the penalty is paid within 30 days of the date of communication of the order. |

| 4 | 70(1) & Rule 7C | Late filing of returns | Late fee upto Rs.20000 a) Delay up to 15 days - Rs.500 b) Delay beyond 15 days and upto 30 days - Rs.1000 c) Delay beyond 30 days - Rs.1000 plus Rs.100 per day of delay beyond 30 days Provided the total amount payable in terms of this rule shall not exceed the amount specified in Section 70 of the Act. |

Fore more information about Service Tax Registration or Service Tax Filing, visit IndiaFilings.com.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...