Updated on: May 28th, 2021 5:21 PM

Updated on: May 28th, 2021 5:21 PM

Shelf Prospectus

A shelf prospectus is a type of prospectus issued by companies making multiple issues of bonds for raising funds. A prospectus is a notice, advertisement or any other document inviting the public to subscribe for securities. It is compulsory for public limited companies to issue a prospectus before issuing securities. A shelf prospectus can be issued by any public limited company raising funds through multiple issues of bonds. Companies which issue a shelf prospectus should file an Information Memorandum in Form PAS-2. The advantage of a shelf prospectus is that a new prospectus need not be issued every time the company issues securities. A maximum of four issues of securities can be made using a shelf prospectus. A shelf prospectus should be used within a maximum of one year. A shelf prospectus can be filed only by companies issuing non-convertible debt bonds (these are bonds which cannot later be converted into share capital). The procedure for raising funds using a shelf prospectus is the same as for raising debt funds. The only additional requirement is to file an Information Memorandum. A substantial amount of public money is involved when a company goes in for a public issue of bonds. Therefore, any public issue is governed by the rules and regulations developed by the Securities and Exchange Board of India (SEBI).Applicability

The following kinds of companies are eligible to issue a shelf prospectus:- Public Financial Institutions (PFIs) (PFIs are companies whose paid-up share capital is held by the Central Government to the extent of more than 51 per cent. Examples are the Life Insurance Corporation of India, Infrastructure Development Finance Company Limited, Industrial Credit and Investment Corporation of India Limited, Industrial Finance Corporation of India, and Industrial Development Bank of India.)

- Public sector banks

- Non-banking Finance Companies

- Listed companies [A listed company has its securities listed with the Bombay Stock Exchange (BSE), National Stock Exchange (NSE) or Calcutta Stock Exchange (CSE)]

Conditions

These are the conditions that should be followed by a company opting to issue a shelf prospectus:- The company’s net-worth should be more than Rs.500 crores.

- The company should have had distributable profit during the preceding three years.

- An arrangement should be made for dematerialisation of securities. The arrangement must be made with a depository registered with the SEBI.

- A merchant banker should be appointed for the issue. The merchant banker must be registered with the SEBI.

- In case debentures are issued, a debenture trustee should be appointed.

- Credit rating should be obtained. The securities issued should have a credit rating of AA- or more (Credit ratings are accepted only from credit rating agencies registered with the SEBI).

- The company’s directors or promoters should not have been faced with any regulatory action.

- The company should not have defaulted in repayment of deposits during the preceding three years.

- The company should have honoured its listing agreement during the preceding three years.

Information Memorandum

Meaning

Changes may take place in the financial position of the company after the shelf prospectus is filed. These changes should be intimated to the Registrar of Companies (ROC). For this purpose, an Information Memorandum should be filed in Form PAS-2. Form PAS-2 should be filed with the ROC, the SEBI and the NSE or BSE.Applicability

An Information Memorandum should be filed on the second, third and fourth issue of securities made under the shelf prospectus.Time Limit

One month before the issue.Fees Payable

The fees payable is Rs.200 according to the relevant MCA Notification.Option for Withdrawal

In case the company had accepted money from the public before changes were made to its financial structure, the applicants should be informed of the changes. After receiving this information, the applicants may want their money to be refunded. In those cases, the company should make the refund within fifteen days.Procedure to Fill Form PAS-2

- Download Form PAS-2.

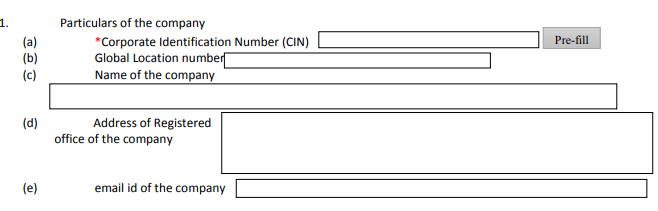

- Open the PDF file and enter the CIN in field 1.(a), and click ‘Pre-Fill’. A dialogue box appears with the message, ‘Allow this PDF document to connect with mca.gov.in?’. Click ‘Yes’.

Basic details about the company

Basic details about the company

- Fill the form with relevant details

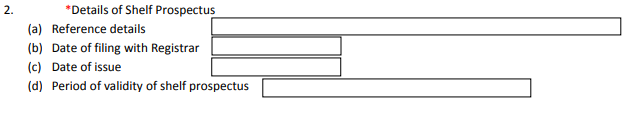

Details about shelf prospectus

Details about shelf prospectus

- The subsequent fields relate to changes in the company's financial position. They should be filled based on recommendations given by the company's Financial Executive.

- Attachments are optional for this form. In case there are any attachments they should be appended to the PDF file.

- In the ‘Declaration’ field, enter the board resolution number and date. The board resolution should relate to the board meeting held for authorising the person filing the form.

Declaration of authorisation

Declaration of authorisation

- Give the name and designation of the person filing the form. The designation refers to whether the person filing the form is the manager, director, secretary, or the authorised representative of the company. Affix the digital signature of the person filing the form.

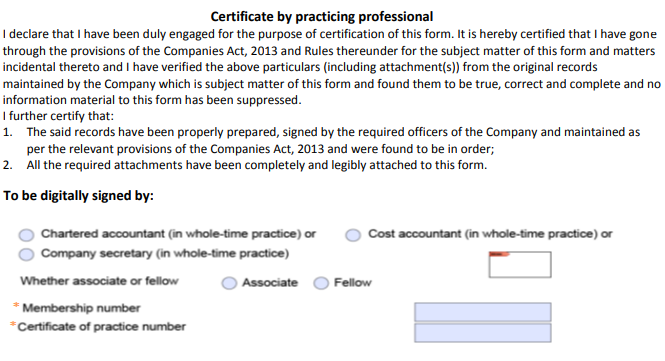

- Under the ‘Certificate by practising professional’ field, choose whether the form is certified by CA, CWA or CS. Choose whether the professional is an associate (five years or less than five years of practice) or fellow (more than five years of practice).

Certificate by practising professional

Certificate by practising professional

- Enter Membership number and Certificate of practice [COP] number of the professional and also affix the digital signature of the professional.

- Click ‘Prescrutiny’ and make the necessary corrections and additions, if any. Save the PDF file.

Procedure to Upload Form PAS-2

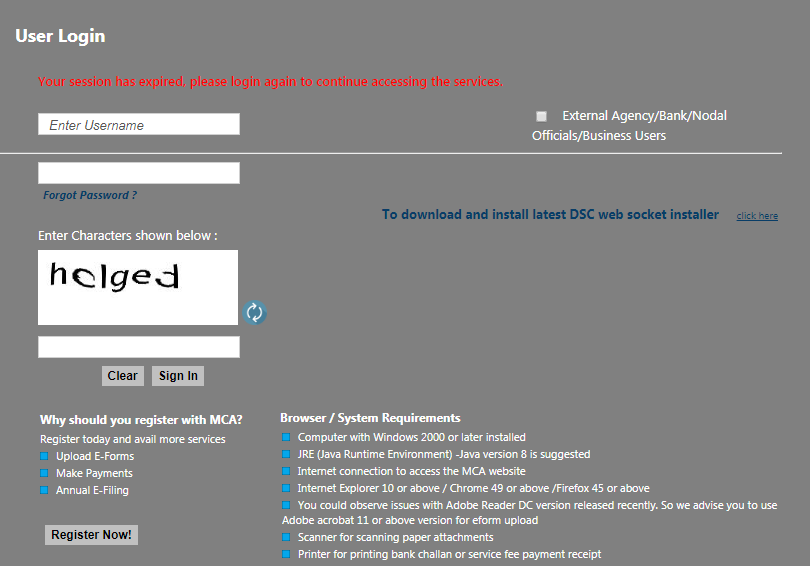

- Access the MCA website.

- Complete the captcha procedure and click ‘Sign In’.

MCA portal login page

MCA portal login page

- Enter the CIN of the company and details of jurisdiction, and from the drop-down menu, choose the option ‘PAS-2’.

- Click ‘Attach’, choose the saved PDF file and click ‘Open’. Then click ‘Submit’.

- Pay the applicable fees of Rs.200.

- A challan is generated once the payment has been completed through the electronic mode. A copy of the challan should be saved for future reference.

- Click ‘Finish’. A Service Request Number (SRN) will be generated. This should be noted down for future filing of forms with the MCA.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...