Updated on: August 19th, 2021 10:32 AM

Updated on: August 19th, 2021 10:32 AM

SIDBI Assistance to Healthcare Sector In War Against Second Wave Of COVID19 (SHWAS Scheme)

Stepping up the fight against COVID -19 and helping Micro and Small Enterprises (MSEs) battle the prevailing situation, the Small Industries Development Bank of India has launched SIDBI Assistance to Healthcare Sector in War against Second Wave of COVID 19 SHWAS Scheme. As part of this financial scheme, assistance is provided for MSEs which are involved in the manufacturing of medical oxygen or providing services related to oxygen. The main objective of the scheme is to support and encourage those MSEs who are helping the nation fight against the novel Corona Virus. SIDBI provides loans to MSEs at a low rate of interest of 4.5% to 5% within 48 hours, making it easier for them to facilitate tasks that can help tackle the pandemic.The objective of the SHWAS scheme

As mentioned above, the key objective of the SHWAS scheme is to provide financial support to the Healthcare Sector which is evolved in the manufacturing of medical oxygen products related to fighting against the novel Coronavirus. SIDBI also aims to provide loan to MSEs which are providing services related to COVID-19Key Features of the SHWAS scheme

The key features of the SIDBI Assistance to Healthcare Sector in War against Second Wave of COVID19 (SHWAS Scheme) are as follows:- Small Industries Development Bank of India is offering 100% finance under this financial scheme

- SIDBI also offers the very low collateral option to borrowers

- The eligible Healthcare Sector unit is not required to pay any processing fee to avail of the loan

- SHWAS scheme provides Attractive Interest Rates, SIDBI provides loans to MSEs at a low rate of interest of 4.5% to 5%

- Credit Guarantee option also available to MSE (Charges to be borne by SIDBI)

Purpose of Loan under SHWAS scheme

Small Industries Development Bank of India is providing the loan to the healthcare unit to fight against the second wave of COVID-19.- The MSE unit can use the loan available under the SHWAS scheme to purchase any equipment or assets for manufacturing or delivery of services related to medical oxygen

- The loan availed under the SHWAS scheme can be used for the purchase of raw material for the production of medical oxygen

Eligible Entity for SHWAS scheme

SIDBI Assistance to Healthcare Sector in War against Second Wave Of COVID19 (SHWAS Scheme) is applicable for all existing MSEs that manufacturing the following products.- Micro and Small Enterprises (MSEs) engaged in manufacturing of oxygen cylinders, oxy-generators, oxygen concentrators, liquid oxygen

- Micro and Small Enterprises (MSEs) provide services in transportation, storage, and refilling to supply the above-mentioned items.

- The Existing Customers of SIDBI need to furnish the Cash profit in the last audited balance sheet (i.e. FY 2020)

- New customers to SIDBI need to furnish the Cash profit in the last two years.

- The MSE should have a Satisfactory Credit track record with existing Bankers / Financial Institutions.

SHWAS Scheme Loan Details

SIDBI is providing Rs. 200 lakh for eligible entities under the SIDBI Assistance to Healthcare Sector in War against Second Wave of COVID19 (SHWAS Scheme). This scheme offers loans either in the form of the Term Loan or Working Capital Term- Term Loan is provided for acquiring equipment/machines

- Working Capital Term Loan can be availed for purchasing the raw materials or executing confirmed orders

Rate of Interest

The SIDBI has fixed the rates of Interest for 4.5% to 5% per annum on reducing balance.Security Details

For Existing customers: SIDBI will extend the existing securities or any other security to meet asset coverage For New customers: Credit guarantee cover will be offered at no cost or any other security offered by the borrower to meet asset coverage normsRepayment Details

The maximum repayment period for the term is 60 months including a 1-year moratorium and Working Capital Term Loan that need to be repaid within 18 months including a suitable moratorium.Documentation for SHWAS Scheme

SIDBI offers a simple one-page application and built-in checklist for SIDBI Assistance to Healthcare Sector in War against Second Wave Of COVID19 (SHWAS Scheme). The Standard KYC checks and due diligence are also available for the SHWAS application.SHWAS Scheme Application

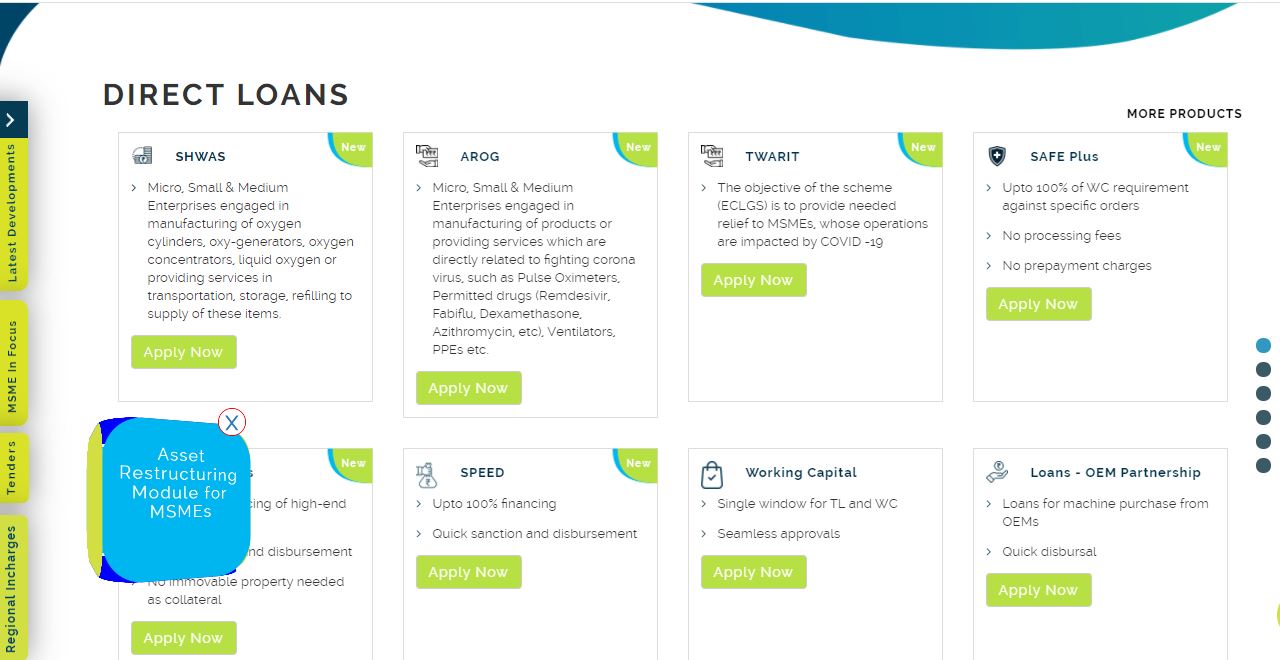

The eligible MSME needs to access the SIDBI’s online application page to apply the scheme. SHWAS Scheme - Application Page

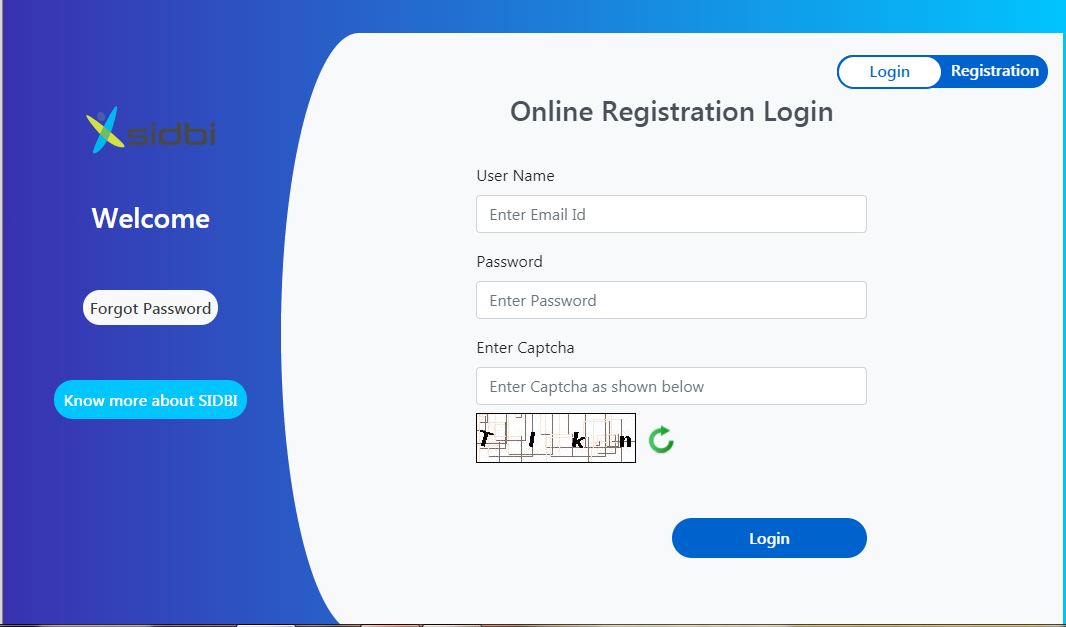

The online Registration Login page will display, by clicking on the Registration tab, a new user can register in SIDBI and avail of the loan.

SHWAS Scheme - Application Page

The online Registration Login page will display, by clicking on the Registration tab, a new user can register in SIDBI and avail of the loan.

SHWAS Scheme - User Registration Page

The applicant entity needs to provide the details of Enterprise Name, Phone number, Email, and Proposed Total Loan Requirement. On successful registration, the user name and password will be provided to the entity.

SHWAS Scheme - User Registration Page

The applicant entity needs to provide the details of Enterprise Name, Phone number, Email, and Proposed Total Loan Requirement. On successful registration, the user name and password will be provided to the entity.

SHWAS Scheme - User Login Page

After login into the portal, the applicant needs to fill in a simple one-page application and built-in checklist. After the Standard KYC checks and due diligence, the loan amount will be credited to the applicant’s account within 48 hours.

SHWAS Scheme - User Login Page

After login into the portal, the applicant needs to fill in a simple one-page application and built-in checklist. After the Standard KYC checks and due diligence, the loan amount will be credited to the applicant’s account within 48 hours.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...