Updated on: August 15th, 2021 10:21 AM

Updated on: August 15th, 2021 10:21 AM

SIDBI Assistance to MSMEs For Recovery & Organic Growth During Covid19 Pandemic (AROG Scheme)

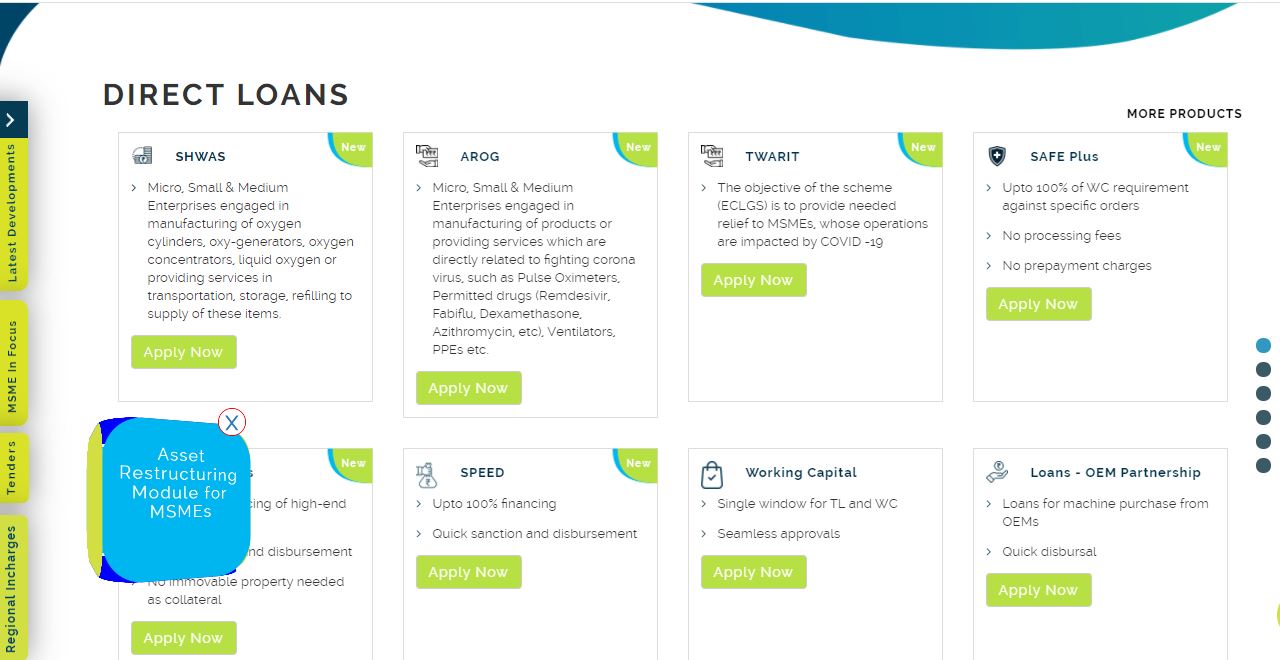

Stepping up the fight against COVID -19 and helping Micro and Small Enterprises (MSEs) battle the prevailing situation, the Small Industries Development Bank of India has launched SIDBI Assistance to MSMEs For Recovery & Organic Growth During Covid19 Pandemic – AROG Scheme. As part of this financial scheme, assistance is provided for MSEs which are involved in the manufacturing of medical products or services related to fighting COVID-19. The main objective of the scheme is to support and encourage those MSEs who are helping the nation fight against the novel Corona Virus. SIDBI provides loans to MSEs at a low rate of interest of 5.5% to 6% within 48 hours, making it easier for them to facilitate tasks that can help tackle the pandemic. Know more about SIDBI Assistance to Healthcare Sector In War Against Second Wave Of COVID19 (SHWAS Scheme)The objective of the AROG scheme

As mentioned above, the key objective of the AROG scheme is to provide financial support to MSEs which are involved in the manufacturing of products related to the fight against the novel Coronavirus. The SIDBI also aims to provide loans to MSEs which are providing services related to COVID-19.Key Features of the AROG scheme

The key features of the SIDBI Assistance to MSMEs For Recovery & Organic Growth During Covid19 Pandemic (AROG Scheme) are as follows:- Small Industries Development Bank of India is offering 100% finance under this financial scheme

- SIDBI also offers the very low collateral option to borrowers

- The eligible Healthcare Sector unit is not required to pay any processing fee to avail of the loan

- ROG scheme provides Attractive Interest Rates, SIDBI provides loans to MSEs at a low rate of interest of 4.5% to 5%

- Credit Guarantee option also available to MSE (Charges to be borne by SIDBI)

Purpose of Loan under AROG scheme

Small Industries Development Bank of India is providing the loan to the MSE to fight against the second wave of COVID-19.- The MSE unit can use the loan available under the AROG scheme is to purchase any equipment or assets for manufacturing or delivery of services

- The loan can also be used for the purchase of raw material or consumables for the production of items that are used for the fight against the second wave of COVID-19.

Eligible Entity for AROG scheme

SIDBI Assistance to MSMEs For Recovery & Organic Growth During Covid19 Pandemic (AROG Scheme) is applicable for all existing MSEs that manufacturing the following products. Micro and Small Enterprises (MSEs) engaged in manufacturing of products or services which are directly related to fighting coronavirus such as;- Pulse Oximeters

- Permitted drugs (Remedesivir, Fabiflu, Dexamethasone, Azithromycin, Zincovit, Limcee, Ivermectin, Paracip, Azax, Betadine

- Ventilators and PPEs

- Inhalation Masks

- IV fluid – DNS/Dextrose

- IV Sets and IV Cannula

- ICU Beds

- Cardiac Monitors

- Syringe pumps

- Portable X-ray machines

- Endotracheal tube

- Suction tube

- The Existing Customers of SIDBI need to furnish the Cash profit in the last audited balance sheet (i.e. FY 2020)

- New customers to SIDBI need to furnish the Cash profit in the last two years.

- The MSE should have a Satisfactory Credit track record with existing Bankers / Financial Institutions.

AROG scheme Loan Details

SIDBI is providing Rs. 200 lakh for eligible entities under the SIDBI Assistance to MSMEs For Recovery & Organic Growth During Covid19 Pandemic (AROG Scheme). This scheme offers loans either in the form of the Term Loan or Working Capital Term- Term Loan is provided for acquiring equipment/machines

- Working Capital Term Loan can be availed for purchasing the raw materials or executing confirmed orders

Rate of Interest

The SIDBI has fixed the rates of Interest for 5.5% to 6% per annum on reducing balance.Security Details

- For Existing customers: SIDBI will extend the existing securities or any other security to meet asset coverage

- For New customers: Credit guarantee cover will be offered at no cost or any other security offered by the borrower to meet asset coverage norms

Repayment Details

The maximum repayment period for the term is 60 months including a 1-year moratorium and Working Capital Term Loan that need to be repaid within 18 months including a suitable moratorium.Documentation for AROG Scheme

SIDBI offers a simple one-page application and built-in checklist for SIDBI Assistance to MSMEs for Recovery & Organic Growth during Covid19 Pandemic (AROG Scheme). The Standard KYC checks and due diligence are also available for the AROG application.AROG Scheme Application Procedure

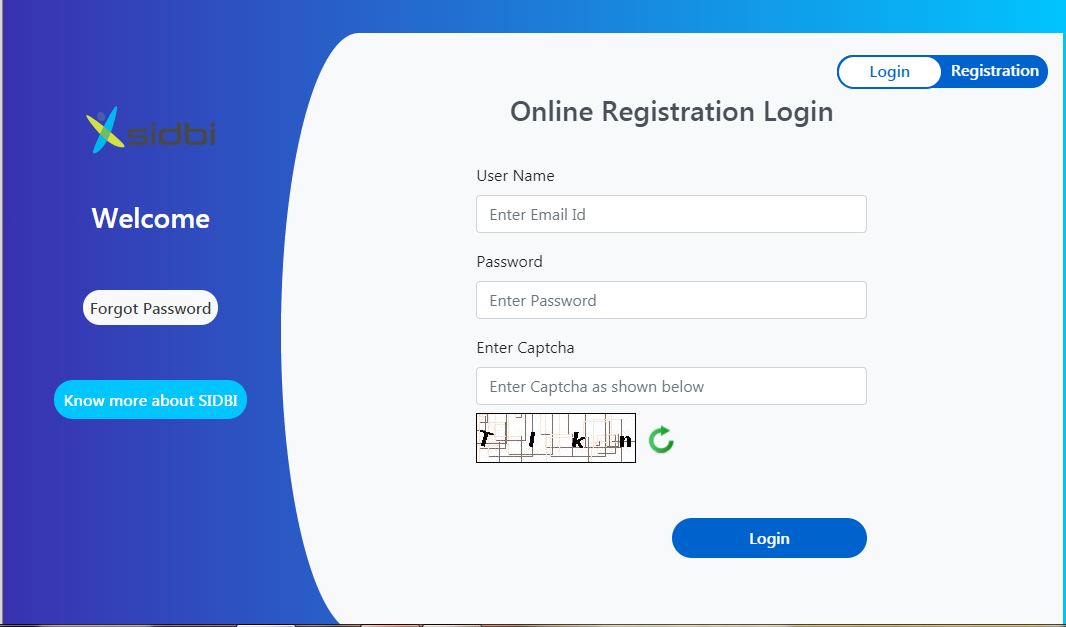

The eligible MSME needs to access the SIDBI’s online application page to apply the scheme. The online Registration Login page will display, by clicking on the Registration tab, a new user can register in SIDBI and avail of the loan. AROG Scheme - Application

The applicant entity needs to provide the details of Enterprise Name, Phone number, Email, and Proposed Total Loan Requirement. On successful registration, the user name and password will be provided to the entity.

AROG Scheme - Application

The applicant entity needs to provide the details of Enterprise Name, Phone number, Email, and Proposed Total Loan Requirement. On successful registration, the user name and password will be provided to the entity.

AROG Scheme - User Registration Page

After login into the portal, the applicant needs to fill in a simple one-page application and built-in checklist. After the Standard KYC checks and due diligence, the loan amount will be credited to the applicant’s account within 48 hours.

AROG Scheme - User Registration Page

After login into the portal, the applicant needs to fill in a simple one-page application and built-in checklist. After the Standard KYC checks and due diligence, the loan amount will be credited to the applicant’s account within 48 hours.

AROG Scheme - User Login Page

AROG Scheme - User Login Page

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...