Last updated: May 23rd, 2024 5:30 PM

Last updated: May 23rd, 2024 5:30 PM

SIDBI Secured Business Loan

SIDBI is a primary financial institution which promotes, develops and finances the Micro and Small Medium Enterprises (MSME) through various schemes. One such scheme is Secured Business Loan which was developed to provide faster dispensation of credit to MSMEs, particularly in the manufacturing segment and service sector. The scheme offers financial assistance for business-related expenses, depending upon the strength of the collateral security and the repayment capacity of the MSME. In this article, we look at the SIDBI Secured Business Loan in detail.Objective of the Scheme

The primary objective of the Secured Business Loan scheme is to facilitate the MSME units by providing adequate and need-based credit facility.Eligibility Criteria

The following are the eligibility criteria for availing secured business loans from the SIDBI:- Micro, Small or Medium Enterprises (MSME) in the manufacturing or service sector.

- The MSME unit must be in existence and operation for the past two financial years to apply for the secured business loan.

- The net worth of the MSME units should be positive and no cumulative losses.

- The SIDBI provides secured business loan only for those existing MSME units, which earned a net profit for the last two financial years.

- The borrower should not be the defaulter of any loans obtained from the banks or financial institutions.

Nature of Assistance

The nature of assistance will be open term loan and other forms of assistance such as working capital term loan, etc.Quantum of Loan

The maximum quantum of assistance under the secured business loan scheme will be up to Rs.10 crore for the eligible MSME units. Note: Also, the assistance provided will be linked to gross cash accruals and collateral security value.Rate of interest

SIDBI secured business loan will hold a fixed rate of interest linked to PLR as per credit rating.Repayment of Loan

A maximum repayment tenor is for 10 years that includes the moratorium period.Foreign Currency Assistance

Foreign currency assistance can be obtained under the scheme towards the creation of tangible assets subject to natural hedge and other terms and conditions.Documents Required

The documents required for SIDBI secured business loan scheme is explained in detail below:For MSME loans up to Rs.10 crore

- Proof of Identity: Passport, Driving License, Voter’s ID Card, PAN Card and Signature identification from present bankers of the proprietor, partner or director

- Proof of residence: Recent telephone bills, property tax receipt, electricity bill, Voter’s ID Card of Proprietor, partner of Director (if a company)

- Proof of business Address: As per SIDBI’s KYC application form for Non-Individuals

- MOA (Memorandum and articles of association) of the firm and Partnership Deed of partners etc.

- Biodata of promoters/Guarantors

- Net Worth Statement of borrowers and guarantors along with latest income tax returns.

- Rent Agreement and clearance from the pollution control board if applicable

- Udyog Aadhar memorandum (UAM) registration

- Projected balance sheets of the next two years if the working capital limits and for the period of the loan in terms of the term loan

- Photocopies of lease deeds and title deeds of all the properties being offered as primary and collateral securities

- Bank Account details in case of any existing outstanding loans or limits

- Certificate of incorporation from the ROC in case of the company

- Profile of the unit

- Copy of last three years balance sheets of the company and associate

- Project report

- Manufacturing process details

- GSTN number ( if applicable)

- Credit rating details and report (if applicable)

- ZED rating (if applicable)

Application Procedure

Online Application

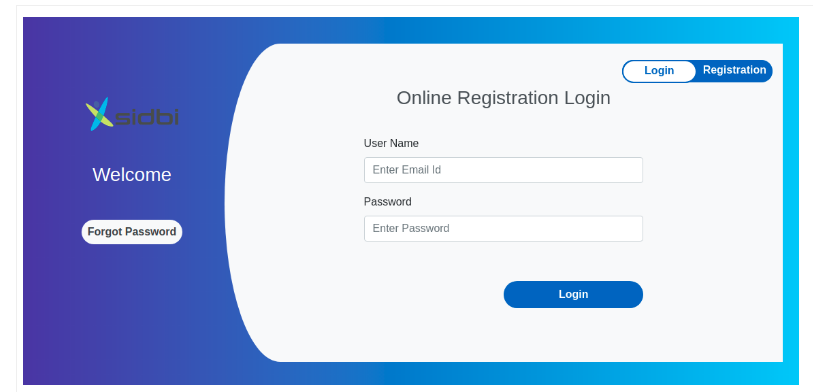

The application procedure for SIDBI Secured Business Loan scheme is explained in detail below:Step 1: The eligible MSME enterprise needs to approach the SIDBI official website for applying for a loan.

Step 2: Click on “Borrower’s Corner” link, which is present on the home page of the portal.

Step 3: On the next page, choose the option “Online loan application” tab under borrower’s corner.

Step 4: In case of an existing user, the user can log in directly into the portal with the login credentials such as mail id and password and click on the “Login” button.

Step 5: In case of the new user, the user needs to create new user registration with the mandatory details such as enterprise name, phone number, password, email id, proposed loan requirement details and after entering the details click on “Register” button.

Step 6: Once all the details are entered, you can validate the page and apply for the respective loan scheme, which is applicable according to your financial profile.

Step 7: If the application is approved after verification of details, the SIDBI will approve the loan amount will be credited to the beneficiary’s accounts.

Offline Application

To apply for SIDBI secured business loan, the borrower has to visit the nearest SIDBI office to collect the application form. After completing the application form with all details, the application can be submitted with the required documents at the same SIDBI office.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...