Last updated: May 23rd, 2024 5:51 PM

Last updated: May 23rd, 2024 5:51 PM

SIDBI Trader Finance Scheme (STFS)

The Small Industries and Development Bank of India (SIDBI) is a developed financial institution which mainly focuses on the development of the micro, small and medium enterprises (MSME) sector. The primary objective of SIDBI is to strengthen the MSME sector by providing them with financial assistance. Under SIDBI, Trader Finance Scheme was launched to support the financial need of MSME Retailers/Wholesalers involved in the selling of goods and service. In this article, we look at the SIDBI Trader Finance Scheme (STFS) in detail. To apply for Trade License, visit indiafilings.comPurpose of the Scheme

The SIDBI Trader Finance Scheme is designed to meet working capital requirements of traders including stockists, super-stockists, distributors, dealers and organized retailers like supermarkets, malls, departmental stores, retail chains, etc.Features of the SIDBI Trader Finance Scheme

The features of the SIDBI Trader Finance Scheme are given below:- An individual is eligible to avail a maximum amount of Rs.1 crore.

- The borrowers are granted with hassle-free and quick loan sanctions with attractive interest rates on the term loan and working capital loan.

- Under STFS, no collateral security is required to obtain a loan from SIDBI.

- SIDBI offers attractive interest rates and lower promoter’s contribution to capital expenditure.

Eligibility Criteria

The trader should satisfy the below criteria to apply for the SIDBI Trader Finance Scheme.- Any MSME Retails or Wholesalers who are in existence for at least 3 years with a satisfactory financial position.

- The MSME Retails/Wholesalers which have already availed loans from any other banks related to working capital assistance are not eligible to participate under SIDBI Trader Finance Scheme.

Eligible Expenditure

Any business related expenditure like a working capital requirement and need-based capital expenditure (including renovation of existing owned shops) is eligible to avail credit under STFS.Quantum of Assistance

The minimum quantum of assistance will be Rs.10 lakhs, and the maximum quantum of the assistance of Rs. 1 crore can be obtained to meet the working capital requirements.Rate of Interest

SIDBI offers an attractive interest rate on this product along with flexible repayment options. The sanctioning branch will provide the details once the loan is approved.Repayment of Loan

The tenure depends on the loan amount and the maximum repayment tenure is up to 5 years, including moratorium period.Nature of Assistance

The nature of assistance is in the form of open term loan and working capital term loan, etc.Collateral Security

No collateral security will be obtained for SIDBI Trader Finance Scheme (STFS).Documents Required

The documents required for SIDBI Trader Finance Scheme are provided below:- Proof of Identity: Passport, Driving License, Voter’s ID Card, PAN Card and Signature identification from present bankers of the proprietor, partner or director

- Proof of residence: Recent telephone bills, property tax receipt, electricity bill, Voter’s ID Card of Proprietor, partner of Director (if a company)

- Proof of business Address: KYC application form for Non-Individuals has to be enclosed.

- Memorandum and articles of association of the firm and Partnership Deed of partners etc.

- Biodata of promoters/Guarantors

- Net Worth Statement of borrowers and guarantors along with latest income tax returns.

- Agreement of rent and clearance from the pollution control board

- Udyog Aadhar memorandum (UAM) registration

- Projected balance sheets of the next two years if the working capital limits and for the period of the loan in terms of the term loan

- Photocopies of lease deeds and title deeds of all the properties being offered as primary and collateral securities

- Bank Account details in case of any existing outstanding loans or limits

- Certificate of incorporation from the ROC in case of the company

- Profile of the unit

- Copy of three years balance sheets of the company and associate

- Project report

- Manufacturing process details

- GSTN number ( if required)

- Credit rating details and report (if required)

- ZED rating (if required)

Procedure for SIDBI Trader Finance Scheme

Online Application

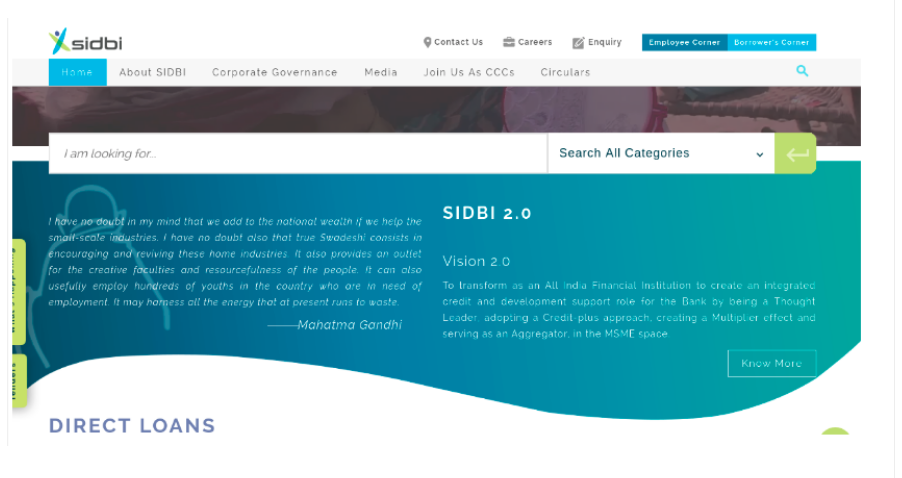

The application procedure for SIDBI Trader Finance Scheme is explained as below:Step 1: The MSME enterprise needs to refer to the official website of SIDBI

Step 2: Click on “Borrower’s Corner” link, which is present on the home page of the portal.

[caption id="attachment_84234" align="aligncenter" width="477"] SIDBI Trader Finance Scheme - Image 1

SIDBI Trader Finance Scheme - Image 1

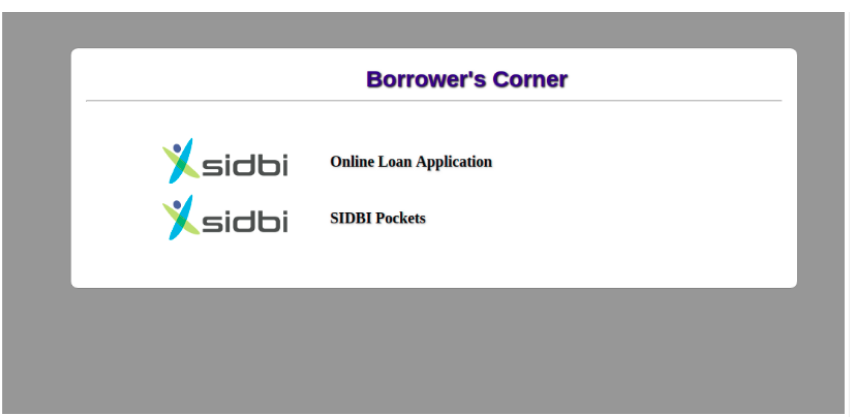

Step 3: Choose the option “Online loan application”.

[caption id="attachment_84235" align="aligncenter" width="472"] SIDBI Trader Finance Scheme - Image 2

SIDBI Trader Finance Scheme - Image 2

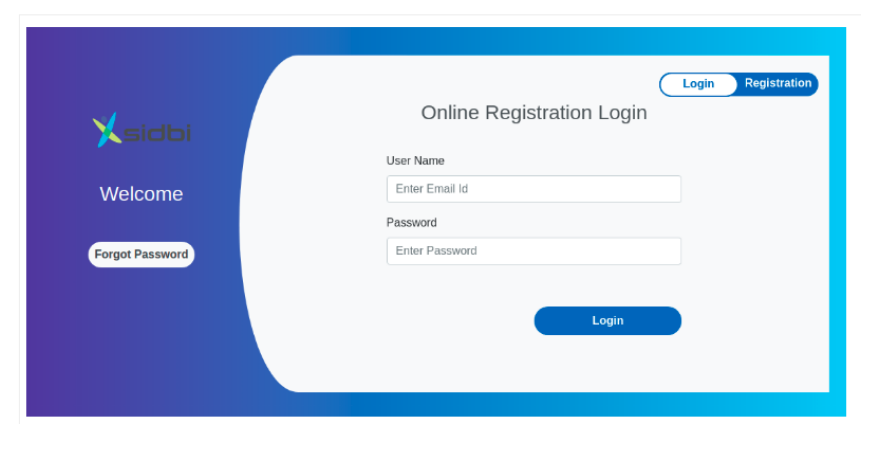

Step 4: The user can access the webpage if the credentials are available already.

[caption id="attachment_84236" align="aligncenter" width="484"] SIDBI Trader Finance Scheme - Image 3

SIDBI Trader Finance Scheme - Image 3

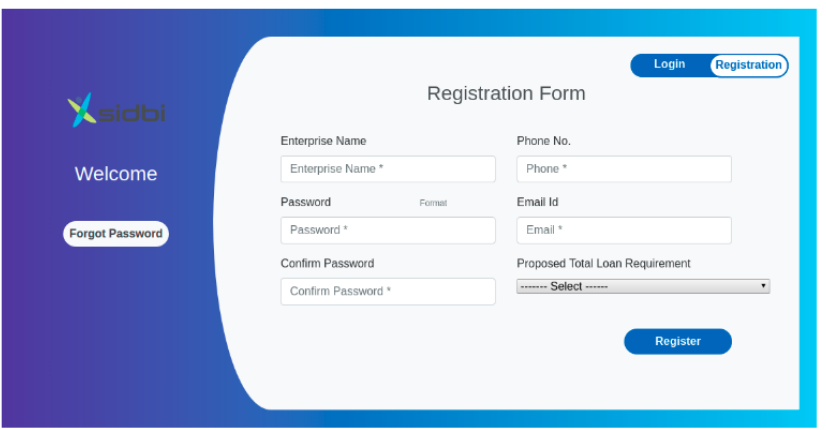

Step 5: For new user, create new user registration with the mandatory details such as enterprise name, phone number, password, email id, proposed loan requisite details and after entering the details click on “Register” button.

[caption id="attachment_84237" align="aligncenter" width="484"] SIDBI Trader Finance Scheme - Image 4

SIDBI Trader Finance Scheme - Image 4

Step 6: Once all the details are entered, you can validate the page and apply for the respective loan scheme, which is applicable according to your financial profile.

Step 7: After submitting your application, the acknowledgement number will be received to your registered mobile number for further reference.

Note: If the application is approved after verification of details, the SIDBI will approve the loan amount will be credited to the beneficiary’s accounts.Offline Application

To apply for SIDBI Trader Finance Scheme, the borrower has to visit the nearest SIDBI office to collect the application form. After completing the application form with all details, the application can be submitted along with the required documents at the same SIDBI office for processing the loan. The application form for SIDBI Trader Finance Scheme is reproduced below for quick reference: [pdf-embedder url="https://www.indiafilings.com/learn/wp-content/uploads/2019/06/STFS-Loan-Application.pdf" title="STFS Loan Application"]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...