Updated on: December 13th, 2022 11:50 AM

Updated on: December 13th, 2022 11:50 AM

Single Window Project

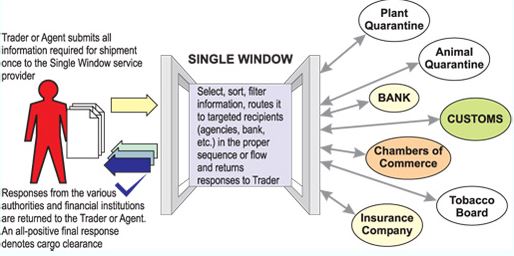

The Single Window Interface for Facilitating Trade was implemented on 01.04.2016 by Indian Customs to establish a better way of doing business. Under this project, the importers electronically lodge Integrated Declaration at a single point with the Customs. The required permission from other regulatory agencies can be obtained online without the importer/ exporter having to approach these agencies separately. Know more about the Importer Exporter Code (IEC)Benefits of the Scheme

The following are the benefits of the scheme.- Reduced cost of doing business

- Enhanced transparency

- Reduced duplicity and cost of compliance

- Optimal utilization of manpower

Message Exchange with FSSAI/ DDPQ and S

Circular No. 09/2015, dated 31-03-2015, mandates implementing a system of online message exchange between the Customs and other regulatory agencies as per the 'Indian Customs Single Window Project.' The online messaging can be operated between Customs and the Department of Plant Protection, Quarantine and Storage (DPPQ and S) and the Food Safety Standards Authority of India (FSSAI). This came into force from 01-04-2015 at JNPT (Nhava Sheva) ICD, Tughlakabad, and ICD, Patparganj, on a pilot basis. The online message exchange is now extended to imports at the Air Cargo Complex, Sahar, and Delhi Air Cargo. The scheme will gradually be implemented in all other locations where FSSAI, DPPQ, and S systems are operational. [caption id="attachment_68859" align="aligncenter" width="514"] Single Window Project

Single Window Project

No Objection Certificate on ICES

The Board has decided to establish a system of online granting called as 'No Objection Certificate' under the ICES for imported goods that come under the purview of the following agencies:- Drug Controller

- Animal Quarantine

- Wild Life Crime Control Bureau.

Documents Required

To obtain NOC from the agencies, the Customs Broker or the importer has to furnish hard copies of checklists, import licenses, and other certificates and documents that the agency requires, with a copy of the Bill of Entry. Depending on the Bill of Entry Number, the agency's officer recovers the Bill of Entry online in ICES, verifies the documents, and records the decision online. The Agency office may carry out any one of the following actions.- Release - No Objection Certificate

- Out of Scope - The item does not require the agency's NOC

- Reject - If the item is not permitted for clearance for home consumption. Agency's office takes a suitable recommendation for the item, such as re-export or destruction. The agency records the remark online. However, Customs takes further necessary action on the Bill of Entry.

- Withhold NOC - NOC will be temporarily withheld for documentation and/or testing after entering suitable remarks in the system by the agency. The Agency's office can recover such Bill of Entries for a further decision after receiving the information.

- Provisional NOC - NOC is granted subject to the production of Letters of Guarantee and the carrying out of testing samples as required by the agency. Customs release goods after a Bond or Letter of Guarantee has been accepted for the Bill oF Entry and the required samples are drawn.

Lab Module in ICES

A new feature called 'Lab Module' has been introduced in ICES to bring the online method of referring consignment samples for testing and analysis. This facility was launched at a few locations to execute the process of referring samples drawn from consignments for testing facilities at the Central Revenues Control Laboratories (CRCL). This module has been developed to extend it for testing the consignments by laboratories/ referral agencies under the Textile Committees and to other agencies to whom Customs may refer samples and documentation for testing or NOC.Rights of Customs Officers

According to the 'Lab module,' the customs officer responsible for examining goods and samples generates Test Memos online, records the details of the samples drawn online, and prints test memos. Customs will duly dispatch the samples drawn from the consignment to the concerned laboratory and referral agency. With the receipt of the samples, the laboratories can access the Test Memo details online. The laboratory/ referral agency records the results and findings when the test and analysis are carried out. These results/recommendations can be viewed by Customs immediately, upon which it can take the necessary action on the consignment without waiting for the hard copy of the test results and recommendation.Reference of the Customs Officer

The Lab Module will be utilized when a reference is required by a Customs Officer online toward another Government Agency for NOC/ clearance at the examination stage, after which a reference will be made using the Lab Module. The necessary directories have to be updated for sending a sample to a laboratory or making a reference to an agency through the Lab Module, by which the Customs locations and Customs tariff heads may be notified to the Laboratories and Agencies. DG (systems) makes the required arrangements so that the Local Systems Manager authorizes these directories.Maintenance of Liaison

The Board desires that the Customs maintain a close liaison with these laboratories/ referral agencies to ensure that their responses are received without delay and that required actions are taken for the clearance of goods.Mapping of Local System Managers

The Local System Managers of ICES map the roles in ICES to officers from Labs/ referral agencies that are a part of the Textile Committee and the Wild Life Crime Control Bureau. These roles have been defined as a part of the Lab Module and are outlined in the user manual developed by DG (systems).Declarations and Undertakings

Besides incorporating the specified forms, the Integrated Declaration also includes various declarations, undertakings, and letters of guarantee that are presently required to be submitted on company letterheads. The Integrated Declaration captures the text of the undertakings, declarations, letters of guarantee, etc., in the form of statements. The given statements have been standardized and codified so that while submitting the Integrated Declaration, the importer specifies the statement codes and the printed copies of the Bills of Entry containing the corresponding standardized texts.Supporting Documents

The Integrated Declaration has a separate decision on the supporting documents that must be provided with the Bill of Entry. The Importer or the Customs Brokers can also provide details of the supporting documents. CBEC is in the process of acquiring IT infrastructure to capture digitally signed copies of the supporting documents. After its implementation, there will be no requirement to provide hard copies of the supporting documents.Processing of Bill of Entry under Integrated Declaration

By filing the Integrated Declaration, the Bill of Entry will automatically be referred to the concerned agency based on the scope of risk. The system has been altered to enable simultaneous processing of the Bill of Entry by PGA and Customs.Uploading Supporting Documents

The following steps have to be followed to upload supporting documents on ICEGATE. Step 1: Log in to the Portal To start with, the authorized people must log in to the ICEGATE portal. Step 2: Enter the Credentials The individual must enter the username and password to log in to the portal. Step 3: Enter the Captcha Code After entering the password, the appropriate captcha code must be entered from the depicted image. Step 4: Click e-SANCHIT The 'e-SANCHIT' option has to be clicked. Suppose the authorized people wish to provide a document after generating the Bill of Entry number. In that case, the individual has to first upload the document on ICEGATE, obtain a unique ID Image Reference Number (IRN) for the document and link the document with the corresponding Bill of Entry by submitting an amendment at the Service Centre. This also applies to those submitting a document in response to a query that Customs raise for a Bill of Entry.Assessment and Document Verification

Once the Bill of Entry has been filed, the Customs officers can access the uploaded electronic versions of supporting documents even while viewing or assessing the Bill of Entry on ICES. During the assessment, ICES provides a query that has to be raised to call for additional documents or information. In response to the query, the supporting documents can also be uploaded online. All the documents that are required for assessment purposes are viewed online. Gradually, this facility will be extended to the Participating Government Agencies (PGAs) officers. The Post Clearance Compliance Verification (PCCV) will be carried out based on the electronic versions of the supporting documents instead of hard copy dockets of the Bills of Entry.Manifest Closure

After submitting the supporting documents online, the manifest of the closure department of the Custom House will not receive hard copies of the dockets. Officers rely on the electronic records maintained on ICES to carry out activities about manifest closure.Other Features to be Pilot-Tested

The following features will be taken up for pilot testing in consulting with the stakeholders.- Uploading the supporting documents for Bills of Entry filed through the Service Centers.

- On a test basis, the handheld services would be used by examining officers and Shed Superintendents to record inspection and examination reports on the spot.

- The electronic copies of Put-of-Charge orders and assessed copies of Bills of Entry are delivered online to the Custodians and authorized people. After the pilot testing, digital signatures will be applied to these messages instead of copies of Bills of Entry.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...