Last updated: October 30th, 2024 3:39 PM

Last updated: October 30th, 2024 3:39 PM

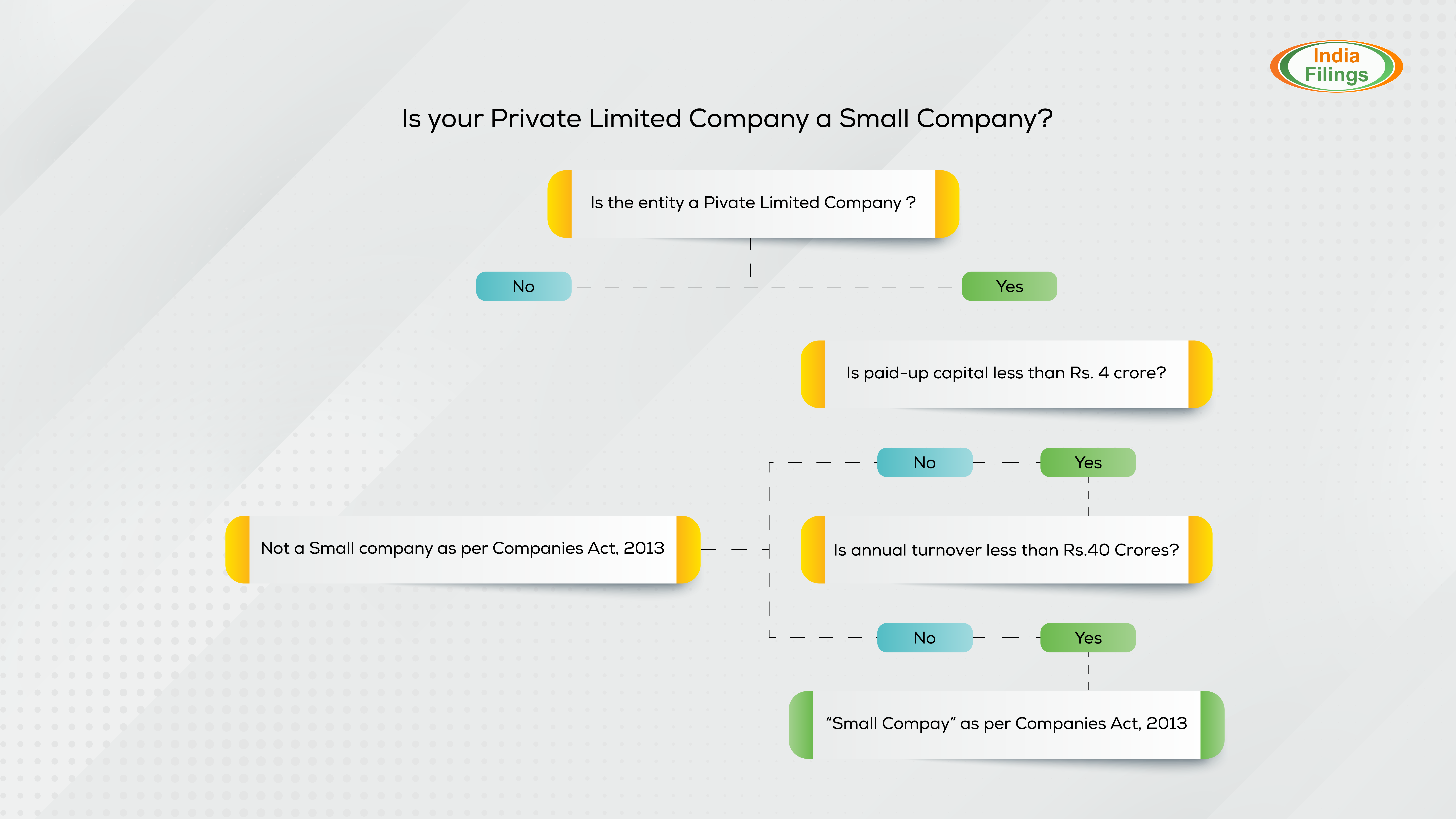

Small Company Definition in India

The Ministry of Corporate Affairs (MCA), on September 15th, 2022, introduced the Companies (Specification of Definitions Details) Amendment Rules, 2022, revising the Small Company definition. A Small Company is now classified as a non-public entity with a paid-up capital not exceeding Rs. 10 crores and a turnover of up to Rs. 100 crores. These changes aim to reduce compliance burdens for private limited companies, which are crucial in generating profits and employment, particularly in a developing country like India. This article provides information regarding the definition of small company, its characteristics, its benefits, and more. Get your Company registered effortlessly with IndiaFilings experts!! [shortcode_1]What are Small Companies?

To provide advantages to small businesses operating as private limited companies, the Companies Act 2013 introduced the concept of small companies. The annual revenue of small companies is lower than that of regular-sized companies. India's small companies are crucial to generating profits and creating jobs. Consequently, they are the economy's backbone. In accordance with the small company as per Companies Act, small businesses need not follow a separate company registration procedure, and they are registered as private limited companies. However, the Act differentiates a private company from a small company based on its smaller amounts of investment and Turnover.The New Definition of Small Company

According to Section 2(85) of the Companies Act 2013, a small company definition meets the following conditions:- Condition 1: Paid-up capital of the company should not exceed INR 4 Crores, or such a higher amount specified should not exceed INR 10 Crores.

- Condition 2: Turnover of the company should not exceed INR 40 Crores, or such a higher amount specified should not exceed INR 100 Crores.

- A public company

- A holding company

- A subsidiary company

- Company registered under section 8

- A company that is governed by any particular act

The new definition of Small Company

The new definition of Small Company

Earlier Definition of Small Companies 2021

The Ministry of Corporate Affairs (MCA) had earlier, vide the Companies (Specification of Definition details) Amendment Rules 2021, revised the definition of small companies by increasing their thresholds for paid up Capital from not exceeding INR 50 lakh to not exceeding INR 2 crore and Turnover from not exceeding INR 2 crore to not exceeding INR 20 crores. This definition of small companies has now been further revised by increasing such thresholds for paid-up Capital from "not exceeding Rs. 2 crores" to "not exceeding Rs. 4 crores" and Turnover from "not exceeding Rs. 20 crores" to "not exceeding Rs. 40 crores".Comparison of Small Company New Definition with Old Definitions

The amendment proposed in the Companies (Specification of Definition details) Amendment Rules 2022 to the definition of small company increased the maximum limit of Turnover and paid-up Capital. The boundaries were expanded so that more firms could be covered within the ambit of small companies, making them eligible to get more benefits than small companies provided under the Companies Act 2013. A simple comparison of the old and new small company definition MCA is explained hereunder:| Criteria | Old Definition | Old Definition 2021 | New Definition 2022 |

| Paid-up share capital | Maximum paid-up share capital of Rs.50 lakh | Maximum paid-up share capital of Rs.2 Crores | Maximum paid-up share capital of Rs.4 Crores |

| Turnover | Maximum turnover of Rs.2 crore | Maximum turnover of Rs.20 Crores | Maximum turnover of Rs.40 Crores |

Benefits of Revised Small Company Definition

- Small companies are exempted from the essential to prepare cash flow statements as part of financial statements.

- Advantages of preparing and filing an Abridged Annual Return.

- The small company will not be required to have the compulsory rotation of auditors.

- An Auditor of a company does not need to report on the adequacy of the internal financial controls and its operating effectiveness in the auditor's report.

- The company can hold only two board meetings in a year.

- The company secretary can sign annual company returns or, where there is no company secretary, by a company director.

- In addition, small companies are subject to fewer penalties.

Characteristics of a Small Company in India

Small companies in India are typically characterised by their limited size, resources, and scope of operations. Key characteristics include:- Ownership Structure: A small company can either be a private company or a public company with fewer shareholders and less capital investment compared to larger corporations

- Board Structure: Typically, small companies have a simpler board structure and fewer officers than larger corporations. They may require only two directors for operation.

- Fewer Compliance: Small companies enjoy various statutory benefits and exemptions under the Companies Act, such as fewer compliance burdens, lesser penalties, and simpler annual return filing requirements.

- Auditing Requirements: Small companies may have less stringent audit requirements than larger ones, which helps reduce administrative burdens and costs.

- Restrictions: Small companies cannot be holding companies or subsidiary companies of a public company, nor can they be a Section 8 company (a company formed for charitable purposes).

- Lower Revenue and Profits: Small companies often generate lower revenue and profit margins than medium and large enterprises. This can be attributed to smaller customer bases, limited market reach, and lower economies of scale. However, it's important to note that profitability is not solely determined by revenue, as efficiency and cost management also play crucial roles.

- Fewer Employees: Given their smaller scale, small companies generally employ fewer staff members than larger corporations. Sometimes, they may even be operated by a single individual or a small team. This can lead to a more streamlined and agile business structure.

- Smaller Market Area: Small companies often serve a limited geographic area, such as a local community or region. This can be exemplified by convenience stores in rural townships or specialised businesses catering to niche markets.

- Limited Locations: Unlike larger companies with multiple branches or international operations, small businesses typically have a single location or a limited number of outlets. This can restrict their geographic reach and market penetration.

How to Register a Small Company as per the Companies Act 2013?

Typically, the below steps are followed to register a small company under the Companies Act 2013 in India. You can choose the preferred business structure for your small company, like a Private limited company, OPC, or LLP.- Obtain Digital Signature Certificates (DSCs): All proposed directors and subscribers of the company must have DSCs to file forms electronically on the Ministry of Corporate Affairs (MCA) website.

- Reserve the Company Name: Submit a Part-A of the SPICe+ form to reserve a unique and appropriate company name. The ROC will review the application and either approve or reject it within 20 days.

- File the SPICe+ Form: Submit Part-B of the SPICe+ form along with the following documents:

-

- Memorandum of Association (MOA): Outlines the company's objectives, scope, and powers.

- Articles of Association (AOA): Specifies the internal rules and regulations governing the company's management and administration.

- Professional Declaration: A declaration by a qualified professional confirming compliance with all legal requirements.

- Affidavits: Affidavits from subscribers and directors stating no recent convictions or offences.

- Identity and Address Proofs: Documents verifying the identity and address of subscribers and directors.

- Correspondence Address: A temporary address for correspondence until the registered office is established.

- Pay Fees and Stamp Duty: Submit the prescribed fees and stamp duty for the SPICe+ form, MOA, and AOA.

- Obtain Certificate of Incorporation: The ROC will review the submitted documents and issue a Certificate of Incorporation if everything is in order. This certificate serves as conclusive proof of the company's existence and registration.

What are the Matters to be Included in the Board's Report for Small Company?

For a Small Company, the matters required in the Board’s Report closely mirror those for an OPC, reflecting its simplified reporting requirements. These include:- Web Address for Annual Return: Provide the web link to the annual return under Section 92(3), if available.

- Number of Board Meetings: State the number of Board meetings held throughout the year.

- Directors’ Responsibility Statement: Include the Directors' Responsibility Statement as per Section 134(5), confirming the Board’s responsibility in preparing the financial statements and adhering to legal requirements.

- Fraud Reporting: Detail any frauds reported by the auditor under Section 143(12), except those that must be reported to the Central Government.

- Explanations on Auditor’s Remarks: Offer explanations or comments from the Board on any qualifications, reservations, or adverse remarks in the auditor’s report.

- State of Company’s Affairs: Summarize the current affairs of the company, providing a business overview.

- Financial Summary/Highlights: Include a financial summary or highlight key financial information from the reporting period.

- Material Changes After Financial Year-End: Report any major changes in the nature of the business after the financial year-end and their impact on the company’s financial position.

- Changes in Directorship: Note any director appointments or resignations that occurred during the year.

- Significant Orders Affecting Future Operations: Include information on any significant legal or regulatory orders impacting the company's going concern status or operations in the future.

Synopsis of MCA Notification on Companies (Specification of Definition details) Amendment Rules 2022

The following amendment has been made in the Companies (Specification of Definition details) Amendment Rules 2022:- A new clause 2(1)(t) has been substituted in Rule 2, which specifies the Definitions of Small Companies.

- As mentioned above, the definition of a Small Company under the Companies Act, 2013 has now been revised by increasing the thresholds for Paid-up capital and Turnover.

- The said amendment is made effective from September 15th, 2022.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...