Last updated: December 23rd, 2022 8:13 PM

Last updated: December 23rd, 2022 8:13 PM

eWay Bill Generation on Mobile through SMS

The GST e-way bill is an electronic paperwork for tracking all interstate movement of goods. All suppliers and transporting the goods should carry GST E-way bill. The registered person can generate the GST e-way bill through various modes such as in the E-Way Bill portal, Goods and Services Tax Suvidha Provider, Android App, and including SMS. The Ministry of Finance introduced SMS facility mainly for the small taxpayer, who are unable to set up technological equipment. In this article, we look at the procedure for generating e-way bill through SMS. Government website for generating e-way bill:https://ewaybill.nic.in/SMS eWay bill Generation

Mobile e-way bill is a simple SMS based waybill generation facility using any cell phone. This type of e-way bill generation is usually carried out by small taxpayers who might not be equipped with a computer and internet connectoin. SMS e-way bill generation is ideal for entities with limited transactions, as it would be prudent to use other methods in case of higher volume. SMS e-way bill generation facility can also be used by taxpayers in case o emergencies such as during the night or while involved in travelling in a vehicle. 3 major activities related to e-way bill operation through SMS mode are as follows:- Generate the e-way bill

- Update the vehicle details

- Cancellation of the e-way bill

Enabling SMS E-Way Bill Generate Facility

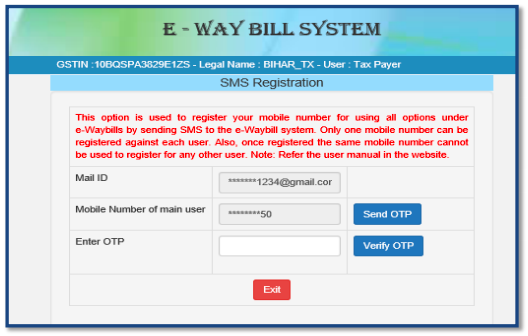

Before starting to transact, the taxpayer must first register his/her mobile number on the GST e-way bill portal. The system only enables and responds to mobile number registered on the portal for a particular GSTIN. Once user selects option ‘for SMS’ under main option ‘Registration’, following screen is displayed. E-way Bill SMS Registration

The user must enter the mobile number and complete the OTP to register the mobile number.

E-way Bill SMS Registration

The user must enter the mobile number and complete the OTP to register the mobile number.

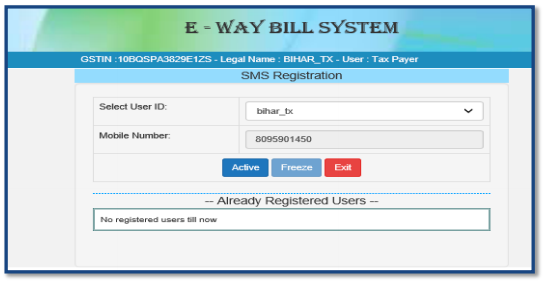

E-way Bill SMS Activation

In the next screen the mobile number registered with the GSTIN is displayed. The user can use this screen for delinking or changing the mobile number, if required.

E-way Bill SMS Activation

In the next screen the mobile number registered with the GSTIN is displayed. The user can use this screen for delinking or changing the mobile number, if required.

Step 1: Access to Portal

The taxpayer or the transporter must open the e-way bill portal and log in using his/her credentials.Step 2: Register Mobile Number

Enable the SMS eWay bill generation in Mobile by following the below shown above. Once validation is complete and the mobile number is registered, you are ready to generate e-way bill using SMS.Mobile Number for SMS E-Way Bill - 77382 99899

The mobile number to send SMS to e-way bill generation on mobile is 77382 99899. There must be a space beside each parameter. The SMS format is as follows.SMS format for eWay Bill Generation

Each of the above parameters in the SMS format must be filled with the appropriate information as per the table below:EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

| EWBG | e-Way Bill Generate Key Word denotes the act. |

| TranType | Transaction Type must be referred to the Code list. |

| RecGSTIN | Recipient’s GSTIN (GST Identification Number). |

| DelPinCode | PIN Code of Place of Delivery. |

| InvNo | GST Invoice or Bill Number of the document of supplier. |

| InvDate | Invoice or Bill Date of the document of supplier. |

| TotalValue | Total Value of goods as per Invoice/Bill document in Rupees. |

| HSNCode | HSN Code of the first Commodity. |

| ApprDist | Distance in kms from the consignor to the consignee. |

| Vehicle | Vehicle Number in which the goods are being transported. |

SMS Format - Vehicle Details Update

The details of the vehicle can only be updated by the taxpayer or transporter who has generated the e-waybill. Further, vehicle details may be updated within the validity period as per the distance mentioned in e-Way Bill. To update details of the vehicle used for carrying the consignment, the following SMS format must be used.EWBV EWBNO Vehicle ReasCode

| EWBV | e-Way Bill Vehicle Updating Key Word. |

| EWBNo | 12 digits E-Way Bill number for which the new vehicle has to be added |

| Vehicle | Vehicle number for the movement of goods |

| ReasCode | Reason Code to indicate why the vehicle number is being added. |

SMS Format - Cancellation of E-Way Bill

An e-way bill can be terminated within 24 hours of generating an e-way bill and a verified e-waybill cannot be terminated. The SMS format can be used to cancel an e-way bill:EWBC EWBNO

| EWBC | E-Way Bill Cancellation Key Word |

| EWBNo | 12 digits E-Way Bill Number, which has to be cancelled |

Validation

On sending the SMS, the automated system would validate the bill before processing the request. If the validations fail, the system sends an error message to the registered mobile number. The invalidation of an e-way bill is limited to the generator of the e-Way Bill. Also, the taxpayer must be very careful while transacting through SMS mode because the SMS must retain the prescribed format without any data entry errors. Incorrect data entry or format could lead to failure or incorrect e-way bill generation.Signup for LEDGERS GST Software to Issue and Track E-way Bill.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...