Updated on: October 5th, 2021 5:54 PM

Updated on: October 5th, 2021 5:54 PM

Soft Loan Scheme for Women Entrepreneurs

The Government of Kerala has initiated various schemes for the welfare of women and their development. A significant concern has been to make them self-reliant by empowering them in business, for which the Kerala Startup Mission (KSUM) has implemented the Soft Loan Scheme for Women entrepreneurs. Under this scheme, loans will be provided as working capital for implementing works and projects received from the Government departments and the Public Sector Undertakings in Kerala.Kerala Startup Mission (KSUM)

The Government of Kerala launched the Kerala Startup Mission (KSUM) for entrepreneurship development and incubation activities in Kerala. The government initiated the startup movement through KSUM by forging and implementing forward-looking policies for creating a vibrant startup ecosystem in the state primarily to foster the growth of innovation lead technology entrepreneurship. Kerala Startup Mission (KSUM) supports women startups with a soft loan scheme for an amount limited to Rs.15 Lakhs as working capital for implementing works and projects received from the Government departments and the Public Sector Undertakings in Kerala.Objectives of Soft Loan Scheme

The prime objective of the Kerala Startup Mission is to employ this scheme to assist women to be self-reliant by undertaking the businesses and micro-enterprises and prevent them from borrowing money at high-interest rates from the moneylenders for the sameBenefits of the Scheme

The Benefits of the Soft Loan Scheme for Women entrepreneurs are listed below:- The scheme helps in motivating women entrepreneurship of the country by financially supporting them

- Soft Loan Scheme enables women to elevate their status by participating in businesses and building micro-enterprises.

- The Scheme not only enhances the income of an individual or family but also contributes to the overall growth of the country by initiating an economic boom.

- This loan scheme provides social and financial security to the women in the state.

Eligibility Criteria for Soft Loan Scheme

The eligibility criteria to apply for the Soft Loan Scheme for Women entrepreneurs are given below:- The Startup should be approved by Department for Promotion of Industry and Internal Trade and have the Unique ID issued by the Kerala Startup Mission.

- The women co-founder should have a majority stake in the startup.

- The Startup should be registered in Kerala.

- The client needs to be a Government Department or Public Sector Undertaking

Quantum of Assistance

As mentioned above, Under the Soft Loan Scheme, all the eligible women entrepreneurs will get Rs.15 Lakhs as working capital for implementing works and projects received from the Government departments and the Public Sector Undertakings in Kerala.Pattern of Financing

The amount of loan is limited to 80% of the Purchase order and disbursement is as an advance against the milestone payment agreed by the client.Rate of Interest

The soft loan will have 6% simple interest and must be repaid in 1 year or on completion of the project with the full settlement, whichever is earlier.Repayment of Loan

The repayment period of the loan is 1 year or completion of the project with the full settlement, whichever is earlier.Other Conditions

The Startup should ensure the proper delivery of the product service specified in the purchase order and the disbursement from the second installment will be based on satisfactory completion of a milestone as certified by the client.Documents Required

The documents required to apply for the Soft Loan Scheme for Women entrepreneurs are as follows;- MOA (Memorandum of Association)

- AOA (Article of Association)

Soft Loan Scheme for Women entrepreneurs – Application Procedure

The procedure for applying for Soft Loan Scheme is explained below:- The Women entrepreneurs need to access the home page of Startup Mission, Kerala web portal.

Soft Loan Scheme for Women Entrepreneurs-KSUM Home Page

Soft Loan Scheme for Women Entrepreneurs-KSUM Home Page

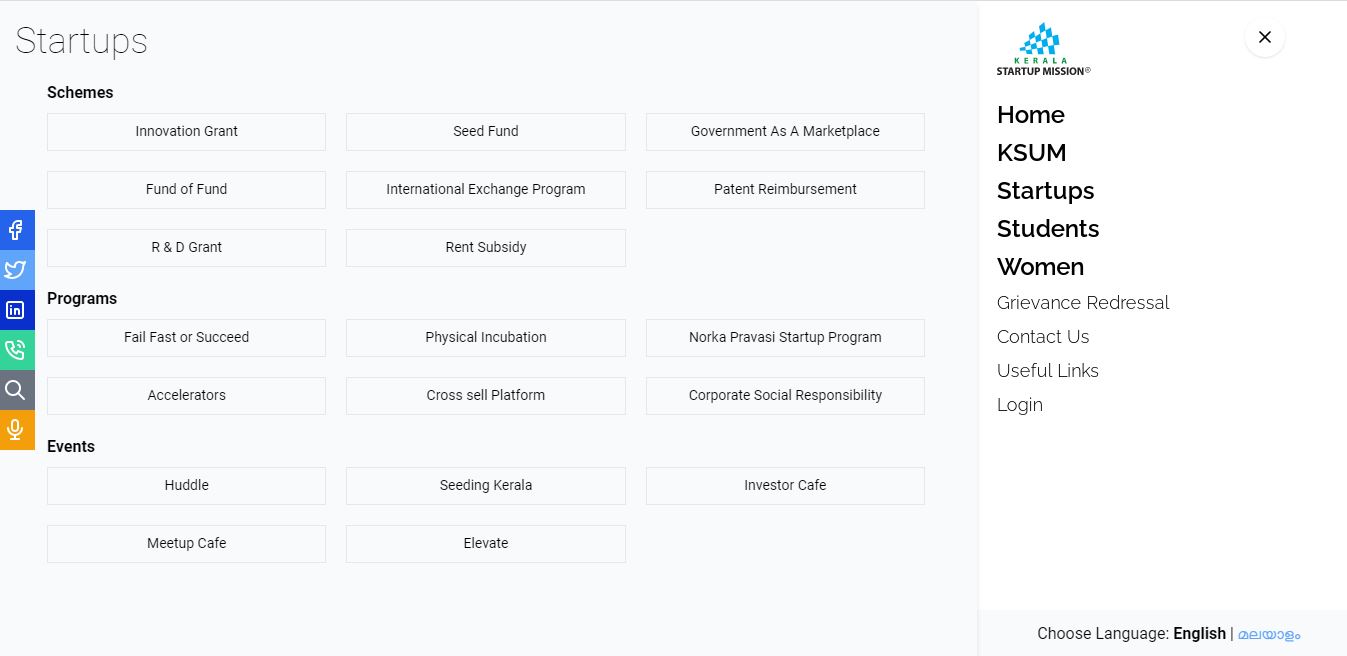

- From the homepage, click on the Navigation Assistant option and then select the Women option.

Soft Loan Scheme for Women Entrepreneurs-KSUM Home Page2

Soft Loan Scheme for Women Entrepreneurs-KSUM Home Page2

- By clicking on the soft loan option, the link will redirect to the scheme page. Select the apply now option to proceed further with the application form. The application is a three-stage process.

Soft Loan Scheme for Women Entrepreneurs-Application

Company Information

The applicant needs to provide the following information on the first page of the application form:

Soft Loan Scheme for Women Entrepreneurs-Application

Company Information

The applicant needs to provide the following information on the first page of the application form:

-

- Name of Startups registered in Registrar of Companies

- Contact Number and Email ID

- KSUM Unique ID I

- Corporate Identity Number (CIN)

- Registered location as with MCA

- Status as per MCA Site

- INC 22A Compliance

- Udyog Aadhar Number

- PAN Number of the Company

- Director details

- Shareholder Details

- Authorized Capital (Rs.)

- Paid-up Capital

- Brief Profile of the company

- Key product/service offerings by the startup

- Name of the Department/ PSU (Client) procuring your solution

- Brief on the product/services offered to the Client organization with end deliverables

- Purchase Order Number

- Purchase Order Date

- Purchase Order Value

- Validity of the purchase order

- The due date for completion of the project

- The due date for completion of the project

- Amount Needed as Soft Loan

- Manager (Finance), Kerala Startup Mission

- AGM (Finance) / CFO – KFC/KSIDC/IT parks

- Secretary and Registrar, Kerala Startup Mission.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...