Last updated: February 3rd, 2020 11:54 AM

Last updated: February 3rd, 2020 11:54 AM

GST Provisional ID Not Generated or Not Working: Solved

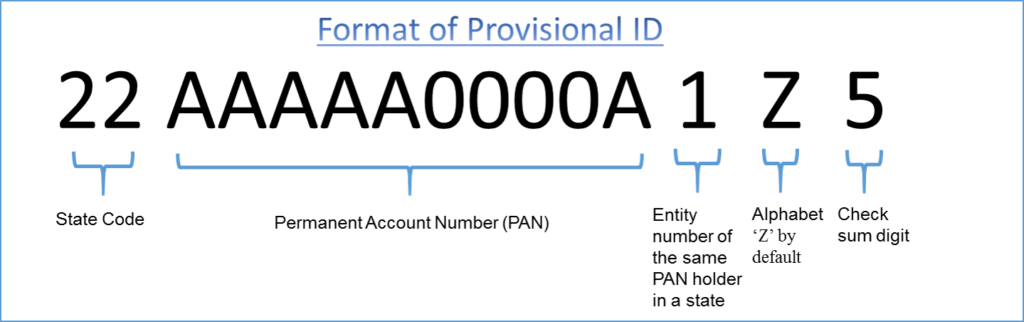

To migrate into GSTIN from VAT the taxpayers should procure GST Provisional ID. After successful verification for migration, the taxpayer shall use the Provisional ID as GSTIN. An existing taxpayer already registered under Central Excise, Service Tax, VAT, Entry Tax, Luxury Tax and also to Entertainment Tax migrates into the new GST Platform. The process has been termed as enrolment. Enrolment under GST refers to validating the data of existing taxpayers from the legacy system. Further, it updates the remaining key information under the new GST system by the taxpayer to prepare for the GST regime in India. In some cases, certain issues such as issues like GST Provisional ID might not get generated or stops working. This article illustrates the process and procedure to follow to solve such issues.GST Enrolment using Provisional ID

Existing taxpayers who are already registered under Central Excise, Service Tax, VAT, Entry Tax, Luxury Tax or Entertainment Tax are required to complete the GST enrolment process using a provision ID provided by the respective tax department. All existing taxpayers are required to be enrolled through the GST portal, as it is mandatory for complying under the GST regime by filing GST return, making GST payment, etc. To enroll under GST, a business must have the following information:- Provisional ID received from State/ Central Authorities

- Password received from the State/ Central Authorities

- Valid E-mail Address

- Valid Mobile Number

- Bank Account Number as well as

- Bank IFSC

In addition to having the above information handy, the following documents are also required:

In addition to having the above information handy, the following documents are also required:

- Proof of Business Incorporation, Registration or Constitution in PDF or JPEG format of less than 1MB size

- Partnership Deed for Partnership Firms

- Incorporation Certificate for LLP, Private Limited Company, One Person Company, Limited Company and other types of Companies and also

- Registration Certificate from Concerned Authority for other types of entities.

- Photograph of Promoters / Partners / Karta of Hindu Undivided Family (HUF)

- Proof of Appointment of Authorised Signatory

- Photograph of Authorised Signatory as well as

- Opening page of Bank Passbook or Statement with Bank Account Number, Address, Branch, and Few Transaction.

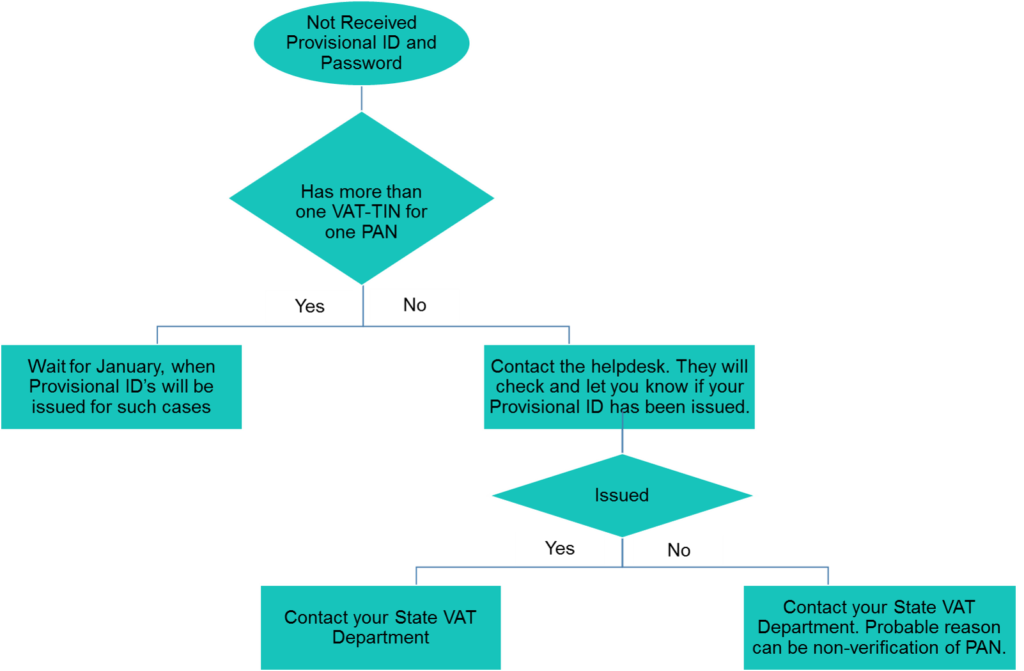

GST Provisional ID Not Generated

GST enrolment has been very successful and over 83 lakh businesses have already migrated to the new GST platform as of April 30th, 2017 as under:| S. No. | State | Start Date | Number of Taxpayers with validated PAN | User activated till date | Percentage of User Activated |

|---|---|---|---|---|---|

| 1 | Andhra Pradesh | 1/1/2017 | 229,493 | 203,330 | 88.60% |

| 2 | Arunachal Pradesh | 11/30/2016 | 5,476 | 1,539 | 28.10% |

| 3 | Assam | 11/30/2016 | 206,034 | 57,532 | 27.92% |

| 4 | Bihar | 11/30/2016 | 194,495 | 115,338 | 59.30% |

| 5 | Chandigarh | 12/16/2016 | 16,305 | 14,844 | 91.04% |

| 6 | Chhattisgarh | 11/14/2016 | 109,055 | 91,010 | 83.45% |

| 7 | Dadra and Nagar Haveli | 11/14/2016 | 4,389 | 3,031 | 69.06% |

| 8 | Daman and Diu | 11/14/2016 | 4,803 | 3,349 | 69.73% |

| 9 | Delhi | 12/16/2016 | 393,200 | 268,761 | 68.35% |

| 10 | Goa | 11/14/2016 | 25,016 | 15,742 | 62.93% |

| 11 | Gujarat | 11/15/2016 | 499,823 | 450,729 | 90.18% |

| 12 | Haryana | 12/16/2016 | 242,527 | 172,709 | 71.21% |

| 13 | Himachal Pradesh | 12/16/2016 | 66,165 | 34,056 | 51.47% |

| 14 | Jammu & Kashmir | 12/16/2016 | 58,208 | 2,866 | 4.92% |

| 15 | Jharkhand | 11/30/2016 | 92,627 | 57,344 | 61.91% |

| 16 | Karnataka | 1/1/2017 | 550,489 | 513,426 | 93.27% |

| 17 | Kerala | 1/1/2017 | 263,424 | 183,014 | 69.48% |

| 18 | Madhya Pradesh | 11/30/2016 | 301,997 | 251,988 | 83.44% |

| 19 | Maharashtra | 11/14/2016 | 803,261 | 705,235 | 87.80% |

| 20 | Manipur | 11/30/2016 | 3,940 | 1,789 | 45.41% |

| 21 | Meghalaya | 11/30/2016 | 24,296 | 4,711 | 19.39% |

| 22 | Mizoram | 11/30/2016 | 2,313 | 868 | 37.53% |

| 23 | Nagaland | 11/30/2016 | 4,847 | 2,829 | 58.37% |

| 24 | Odisha | 11/30/2016 | 175,463 | 89,870 | 51.22% |

| 25 | Puducherry | 11/8/2016 | 16,450 | 12,841 | 78.06% |

| 26 | Punjab | 12/16/2016 | 229,541 | 187,113 | 81.52% |

| 27 | Rajasthan | 12/16/2016 | 564,625 | 435,382 | 77.11% |

| 28 | Sikkim | 11/8/2016 | 3,119 | 1,952 | 62.58% |

| 29 | Tamilnadu | 1/1/2017 | 630,251 | 550,148 | 87.29% |

| 30 | Telangana | 1/1/2017 | 209,863 | 163,978 | 78.14% |

| 31 | Tripura | 11/30/2016 | 16,630 | 7,785 | 46.81% |

| 32 | Uttar Pradesh | 12/16/2016 | 812,129 | 596,283 | 73.42% |

| 33 | Uttarakhand | 12/16/2016 | 104,255 | 77,491 | 74.33% |

| 34 | West Bengal | 11/30/2016 | 273,823 | 210,228 | 76.78% |

| Total for State VAT Users | 7,138,332 | 5,489,111 | 76.90% | ||

| 35 | Taxpayers registered under Central Excise Act but not registered under State VAT | 1/7/2017 | 55,830 | 14,486 | 25.95% |

| 36 | Taxpayers registered under Service Tax Act but not registered under State VAT | 1/20/2017 | 1,156,337 | 546,580 | 47.27% |

| Total for CBEC Users | 1,212,167 | 561,066 | 46.29% | ||

| Grand Total | 8,350,499 | 6,050,177 | 72.45% |

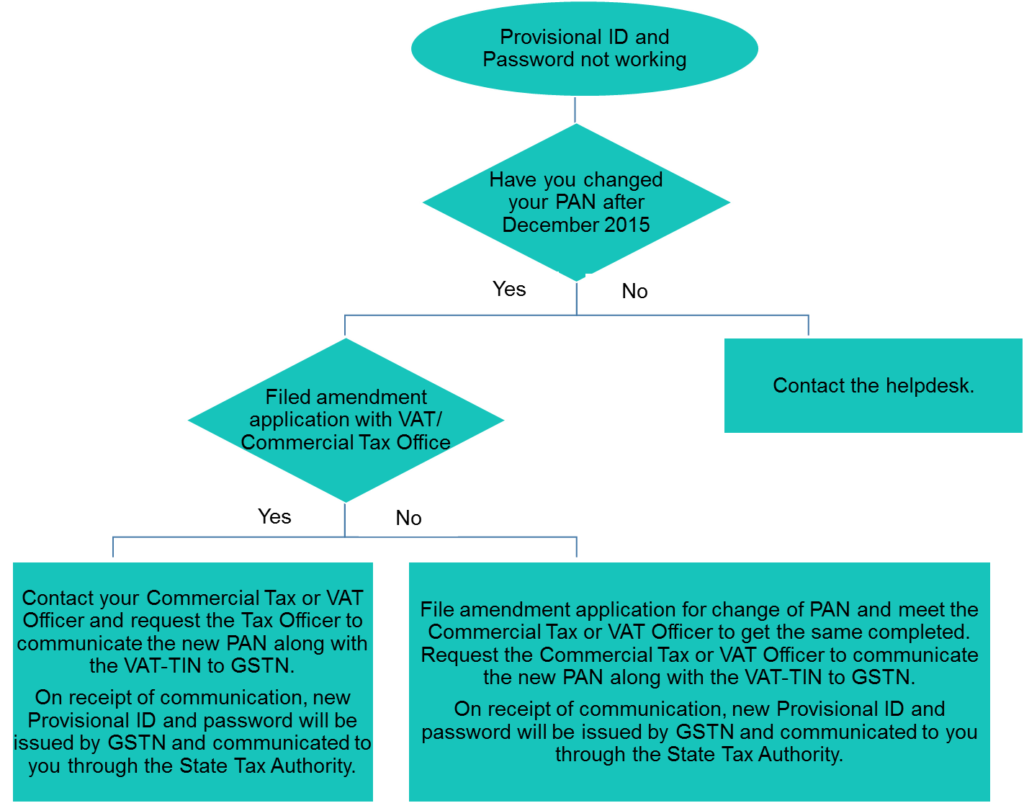

GST Provisional ID Not Working

In case the taxpayer obtained a GST provisional ID and the ID is not working during the enrolment process, then the concerned individual shall follow the following steps for troubleshooting: Check if a Provisional ID is issued for the PAN by using the Check Registration Status tool on the GST Portal. In case the GST provision ID is not working during the enrolment process, then the GST provisional ID could also be canceled, expired, or inactive. By using the Check Registration Status tool, the individual can check the following statues: Provisional: It indicates that Provisional ID is issued but Application for Enrolment of Existing Taxpayer is yet to be filed after attaching digital signatures. Pending for Verification: It indicates that the application submitted is successfully, however, validation by the system with external agencies is under processing. The status will get updated once verification is completed. Validation against Error: The PAN details entered do not match with the CBDT database. Kindly fill the details as per PAN details and resubmit the form. Migrated: The application has been successfully migrated under GST. No changes can be done to the Application now. The provisional registration certificate shall be made available at the portal after appointed date i.e. the date on which GST Act will come into force. Canceled: Existing Registration is canceled, therefore, Provisional ID stands canceled. The ‘Cancelled’ status indicates that Provisional ID was generated and issued but later on canceled. It could be due to the fact that the existing registration got canceled. In case, it is not correct. It is best to approach the respective Tax Department and check the reasons.GST Provisional Email ID and Password Not Working

In case the Provisional ID and the password are showing as a mismatch, then the following steps can be followed for solving the error. [caption id="attachment_30316" align="alignleft" width="583"] GST Password Not Working

Click here for assistance regarding the complete GST enrolment or contact an IndiaFilings GST Expert.

GST Password Not Working

Click here for assistance regarding the complete GST enrolment or contact an IndiaFilings GST Expert.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...