Last updated: December 17th, 2019 5:04 PM

Last updated: December 17th, 2019 5:04 PM

Star Startup Scheme

To build a strong ecosystem for the growth of startup businesses, to drive sustainable economic growth and to generate large scale employment opportunities, the Indian Government has come up with an initiative known as the “Star Startup Scheme”. Under this scheme, Bank of India (BOI) grants financial assistance to technically qualified, trained and experienced entrepreneurs for setting up new units. In this article, we will look at Star Startup Scheme.Startup under Star Startup Scheme

Startup means an entity, incorporated or registered in India not prior to five years, with an annual turnover not exceeding Rs.25 crore in any preceding fiscal year, working towards the innovation, development or commercialization of new processes, products or services driven by technology or intellectual property.- The entity/ unit should not be formed by splitting up or reconstruction of the business already in existence.

- The entity will be ceased to be a startup if its turnover for the previous financial year has exceeded Rs.25 crore or it has completed five years from the date of incorporation/registration.

- The startups will be eligible for tax benefits only after it has obtained certification from the inter-ministerial board set up for such purpose.

Objective of Star Startup Scheme

Under the Star Startup Scheme, Bank of India provides funding support to eligible startups recognised as per the Government policy.Eligibility Criteria for Startups

The eligibility criteria of the startups to obtain the Star Startup Scheme is explained in detail below:- The startups defined as per policy of the bank.

- The unit must be eligible and certified as a startup by the concerned Government authority as per the Startup India Scheme

- The constitution of the unit should be a private limited company (under the companies act 2013), Registered partnership firm (under the Partnership act 1932) and liability Partnership (under the limited liability partnership act 2008).

Eligibility Criteria for Entrepreneur

For existing businesses, the borrower should be GST, IT compliant and must have Six Months Bank Statement Facility. Entrepreneurs loan eligibility will be determined by the following:- Income/ Revenue

- Repayment Capacity

- Existing Credit Facilities

- Any other Factors as set by Lenders

Types of Financial Assistance

The nature of facilities under the Star Startup Scheme is explained in detail below:- Term loan

- Working capital

Purpose of Star Startup Scheme

To finance for innovation, development, deployment or commercialisation of the new product, process or services driven by technology or intellectual property as per the start-up scheme.Quantum of Finance

The quantum of finance will be assessed as per the project. Minimum of Rs.0.10 crore and Maximum Rs.5.00 crore.Margin

As per the startup scheme, the term loan is 25 %, and the working capital is 10%.Rate of Interest

The rate of interest will be fixed on the basis of Credit risk rating. 1% concession in applicable ROI, subject to minimum appropriate 1-year MCLR + BSS.Processing Charges

The processing charges are waived for Star Startup Scheme.Credit Risk Rating

The credit risk rating will be determined as per extant guidelines. Financing below entry level is not permitted.Security

Primary: All tangible assets created out of Bank’s finance will be charged in favour of the bank by way of Hypothecation/MortgageCollateral

The facility may be covered under the GCSE/Credit guarantee fund for startups for the limits for which coverage is available. Beyond the amount covered under the GCSE/Credit Guarantee Fund for Startups as mentioned above, collateral security may be insisted upon by the sanctioning authority.Guarantee Details

- Personal Guarantee of promoter directors, partners of the firm/company/major shareholders having sufficient worth and of all mortgagors of collateral security

- The facility should be covered under Credit Guarantee cover for Startups to be floated by NCGTC, upon implementation and if collateral security not obtained.

- The facility may also be covered under CGTMSE as per existing guideline of CGTMSE.

- The fees for the guarantee cover, if the borrower will bear any.

Repayment Details

Working Capital: Twelve months subject to annual renewal as per extant guidelines. For a term loan, the maximum door to door payment will be 120 months including moratorium period of maximum 24 months.Validity of the Scheme

Any startup will cease to be startup if it has completed 05 years from the date of incorporation/registration or if its annual turnover is more than 25 crores.Treatment of Seed Capital

Any seed capital/venture capital invested by Venture Capitalist/Angel funds will be treated as margin/equity for calculation of Detail Project Report.Documents Required

An Existing business wishing to make a loan application under the Star Startup Scheme requires the following:- Last 2 years audited balance sheets of the units along with the income tax/sales tax return etc.

- Projected balance sheets for 2 years in case of working capital limits and the period of the loan in case of the term loan.

- Sales achieved during the current financial year to the date of submission of application.

- Asset & Liability statement of proprietor/ Partners/ Directors.

- If funds proposed to be infused by the borrower, please specify Sources.

- Detailed Particulars of securities primary/collateral proposed

- Details of all liabilities of the enterprises including the liabilities owed to the State or Central Government and unsecured creditors

- A detailed note on the nature of stress faced by the Enterprise.

- GST Details: GST Identification Number (GSTIN), GST User Name and OTP

- Income Tax Details: Upload ITR in XML format

- Bank Statement: Upload Bank Statements for the last six months in PDF format Details of Directors/Partners/Proprietor

- Details related to Loan Required

Star Startup Scheme Offline Application Procedure

The entrepreneur needs to access the concerned branch of Bank of India. Submit an application for Star Startup Scheme; separate forms are available for startups depending on the loan amount. We have here with attached an application for Star Startup Scheme: Application for Rs.10 lakhs and upto to Rs.25 crore Application for Existing loan exposure up to Rs. 10 lakhsStar Startup Scheme Online Application Procedure

The procedure to apply for Star Startup Scheme is explained in detail below: Step 1: Access the official web site of Bank of India. From the main page, click on MSME. Image 1 Star Startup Scheme

By clicking on that, the link will redirect to the new page — Select Apply Online option.

Image 1 Star Startup Scheme

By clicking on that, the link will redirect to the new page — Select Apply Online option.

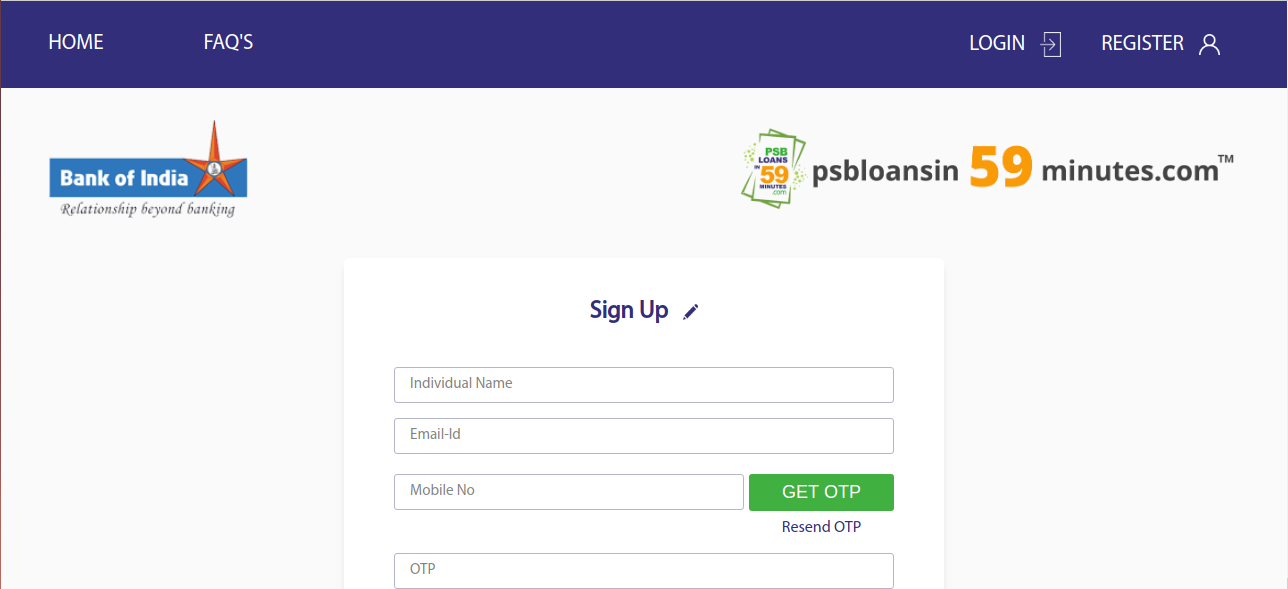

Image 2 Star Startup Scheme

Step 2: The member registration form will be displayed. Provide Name, Email ID, Mobile number.

Image 2 Star Startup Scheme

Step 2: The member registration form will be displayed. Provide Name, Email ID, Mobile number.

Image 3 Star Startup Scheme

Step 3: By clicking on getting OTP option, an OTP will be sent to the registered mail Id. After entering the details click on Proceed button.

Image 3 Star Startup Scheme

Step 3: By clicking on getting OTP option, an OTP will be sent to the registered mail Id. After entering the details click on Proceed button.

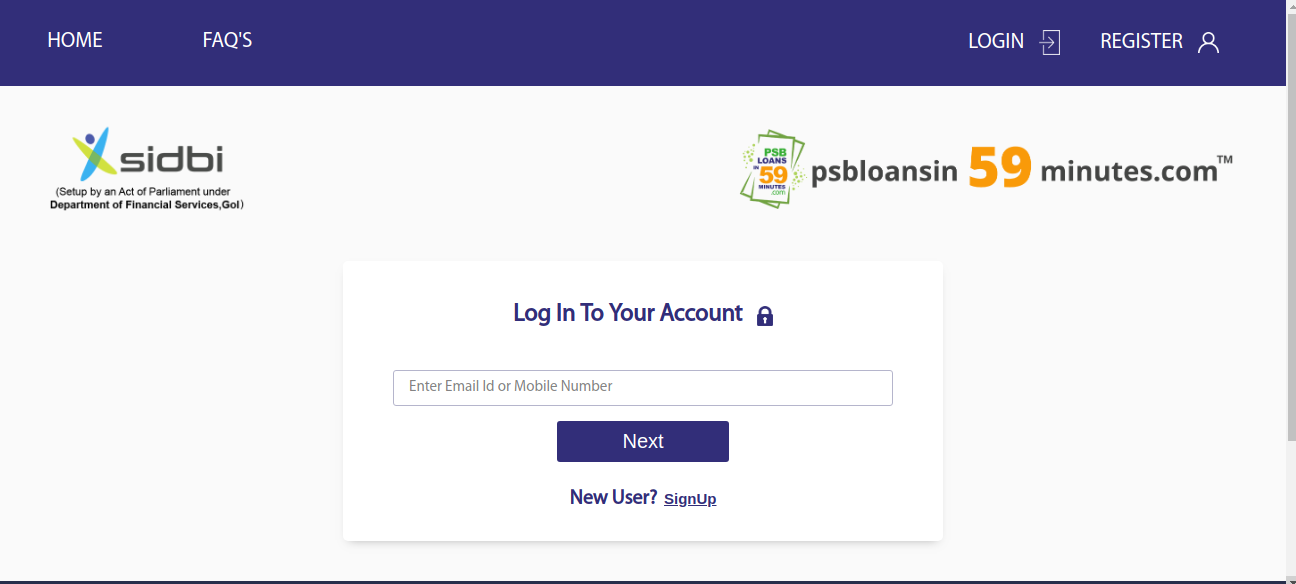

Image 4 Star Startup Scheme

Step 4: The entrepreneurs can now log in to the portal using the registered mail ID/ Phone number for proceeding with the application. The application form will be displayed. Provide details of the following:

Image 4 Star Startup Scheme

Step 4: The entrepreneurs can now log in to the portal using the registered mail ID/ Phone number for proceeding with the application. The application form will be displayed. Provide details of the following:

- Enterprise Details

- Details of Proprietor/ Partners/ Directors:

- Details of Associate Concern, Sister Concern, Group Companies

- Social Category

- Details of Existing Liabilities with the Bank:

- Details of Other Liabilities

- Financials

- Details of Existing Security

- Details of Proposed Additional Security

- Details of Existing Guarantors

- Details of Proposed Guarantors

Image 5 Star Startup Scheme

After furnishing the details, click on the submit button. The application will be forwarded to the concerned bank branch. On successful verification, the loan will be credited to the entrepreneur's account.

Image 5 Star Startup Scheme

After furnishing the details, click on the submit button. The application will be forwarded to the concerned bank branch. On successful verification, the loan will be credited to the entrepreneur's account.

Application Status

The post is receiving In-Principle Approval, you can check the status of your application on the psbloan59 minute's web portal by signing in with your registration details.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...